Are Online Insurance Quotes Accurate: Discover Now

The internet has completely changed the way we buy insurance. A growing number of Americans are now turning to online platforms to meet their insurance needs. But as with any other online business, the results can vary depending on your point of view.

Gone are the days when fair insurance rates were based solely on age and other factors. In the past, insurers used to calculate premiums manually using the rating booklets and asked a few questions before giving individual quotes themselves but this information was provisional and subject to change based on further certification.

The process is now automated. Agents enter your information into the software, and the computer generates quotes accordingly. The accuracy of online quotes depends largely on the information provided by the customer. Therefore, it is important to write accurate details to get an accurate quote.

What is an insurance quote?

An coverage quote serves as an preliminary estimate supplied through an insurance agency, outlining the predicted fee for a selected insurance policy. It’s corresponding to a rate tag within the insurance international, imparting prospective policyholders perception into the capacity fees related to buying insurance from that particular insurer.

Comparing Options

Individuals regularly seek coverage rates from more than one insurers to evaluate fees and coverage alternatives efficiently. By doing so, they can make informed selections based on their budget and precise insurance needs. Comparing prices enables purchasers to assess various insurers’ services comprehensively, ensuring they acquire the maximum suitable coverage at a competitive charge.

Factors Considered

Insurance fees recall numerous factors, inclusive of the extent of chance offered through the prospective insured and the favored insurance quantity. Additionally, the pricing model hired by the insurer, at the side of the advantages supplied, impacts the quoted value. Therefore, it’s essential for people to provide constant facts throughout all quote requests to facilitate accurate comparisons.

The Importance of Accuracy

Ensuring accuracy inside the records furnished to insurers is critical when inquiring for fees. Discrepancies or omissions in info, consisting of driving records or preceding claims, can result in tremendous differences in quoted costs. Despite variations within the records-gathering manner amongst brokers, maintaining consistency in the data submitted is essential for acquiring dependable costs.

Moving Beyond Quotes

Although coverage rates offer valuable insights into capacity charges and coverage options, they do not now represent binding insurance contracts. The final dedication of coverages, situations, and prices occurs throughout the evaluate manner through an coverage underwriter. After this evaluation, the underwriter provides the prospective policyholder with a professional insurance contract, outlining the agreed-upon phrases and conditions for popularity or rejection. Thus, while prices offer a starting point, it’s the underwriter’s assessment that finalizes the insurance agreement.

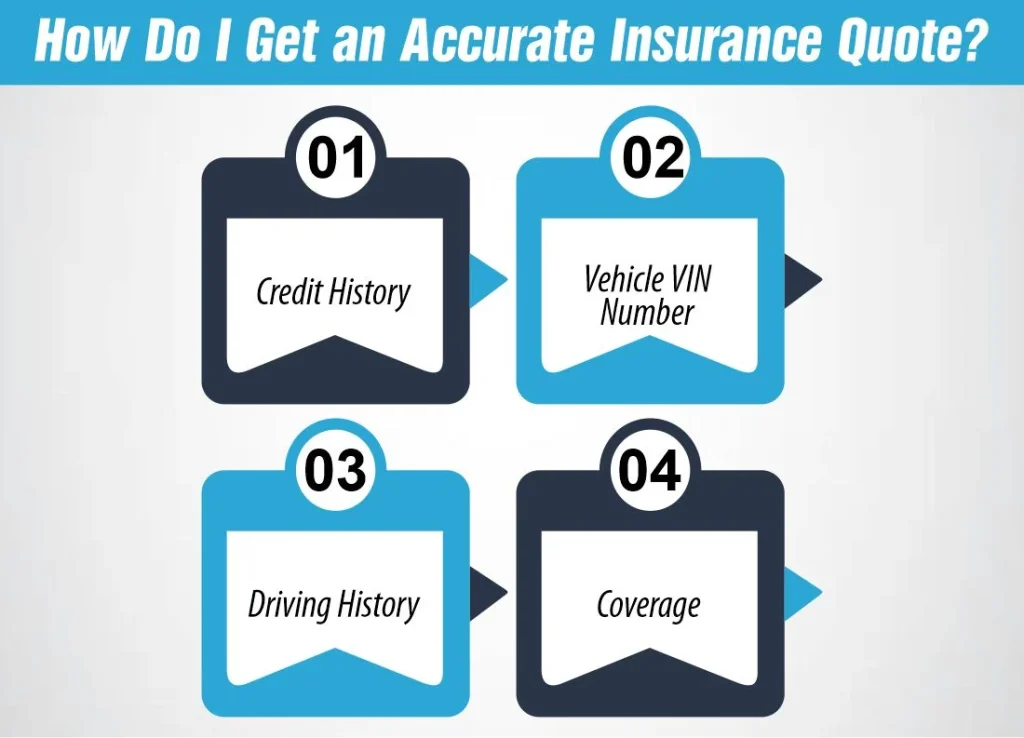

How Do I Get an Accurate Insurance Quote?

How Do I Get an Accurate Insurance Quote?

Making certain your coverage quote is accurate relies upon the statistics you offer. Here are some easy hints to help you get an correct quote:

Credit History:

- Your credit history, called an insurance rating, influences your final premium.

- Use your real information to keep away from getting an erroneous premium.

- If you’re snug, providing your social safety variety can assist get a greater correct quote. Just make certain you’re on a stable internet site.

Vehicle VIN Number:

- Providing appropriate details about your car, like its model and VIN number, ensures you get the proper top class.

- This prevents any surprises when you’re ready to shop for the policy.

Driving History:

- Insurers observe your driving record to set your fee.

- Be honest about any tickets or accidents you have had in the past 3 to five years. Leaving out facts can lead to surprises afterward.

- Don’t assume reviews are constantly ordered except you’re informed so. They price the insurer money and won’t be ordered until later inside the process.

Coverage:

- Make certain you realize what coverage you need before getting a quote.

- You can speak to a coverage agent or do some studies online to determine what’s exceptional for you.

- While getting the minimum coverage would possibly seem like a good idea for your finances, it could cause problems whilst you want to make a declaration afterward.

What factors determine your insurance quote?

When looking for insurance, there are several factors which are taken under consideration to decide the fee you are quoted. One of the most vital elements is assessing the level of danger you pose to the coverage business enterprise. They want to assess the chance of you submitting a declaration and the potential charges they’ll have to cover beneath your coverage. This evaluation includes analyzing diverse factors such as your driving report, the vicinity and circumstance of your property, and the chance of flooding to your place.

For instance, in case you are looking for automobile insurance, elements including your driving records, the kind of car you very own, and in which you reside can impact the quote you receive. Similarly, when seeking home coverage, the age and situation of your home, its region (especially in phrases of dangers like flooding or earthquakes), and the insurance options you choose all contribute to determining the quoted fee. Each sort of coverage has its personal specific set of chance factors that insurers take into consideration while calculating your quote. Therefore, having knowledge of these elements permits you to better comprehend why your coverage quote may also vary relying on the form of coverage you’re searching for.

How Much Does Life Isurance Cost?

How can I shop for insurance online?

When it comes to buying insurance online, there are two main options. The first way is to visit an insurance company’s website, where you enter your information and compare the plans offered by that particular company. Sometimes these companies may even present quotes from other high-priced insurers to confirm their competitive pricing.

Single Carries Websites:

- Compare plans: Go to the carrier’s website, enter your information, and compare the plans they offer.

- Potential bias: Some carriers may display quotes from other expensive suppliers to promote their competitive pricing.

Insuring Guardian Approach:

- Independent agents: Insurance Guardian works with independent insurance agents who have access to many leading insurance companies.

- Personal shopping: Agents shop on your behalf, ensuring you get the best deal at a competitive price.

Understanding Report Ordering Process:

- Explicit reporting: Do not assume that reporting is always ordered unless explicitly indicated.

- Cost Considerations: Reports incur costs to the insurance company and may not be ordered until later in the process to avoid unnecessary costs.

Determination of coverage requirements:

- Make coverage clear: Understand what coverage you need before you get a quote.

- Get advice: Consult with a broker or research online to find the best options.

- Beware of limited coverage: While not cash-free, limited coverage can cause complications when applying later.

How accurate is my insurance quote?

When looking for insurance online, there are generally two ways to get a quote: short forms or long forms. Short papers ask key questions and provide quick quotes, but may not be super accurate. Long letters dig deep with detailed questions, and they can be difficult, but they are very true.

At Insure Guardian Insurance, we combine both approaches with data to ensure accuracy. We start with basic information to give you an initial presentation. For life insurance, only your address gives you an instant quote! Then, our representatives contact you by email, phone, or text to prepare the process further.

We can’t provide life insurance information right away, but our online tool just asks a few questions. Our team then quickly shops your policy with top-rated carriers to find you the best coverage and rates. Making sure you always make great money.

Conclusion

In today’s digital age, the Internet has reshaped the sale of insurance, empowering consumers to generate online quotes. While the accuracy of online citations depends on the information provided, the format provides convenience and accessibility. By understanding the factors that affect quotes and ensuring accuracy of data entry, customers can effectively compare options and get the coverage protection they need at competitive prices.

FAQs

Are online insurance quotes legit?

exactly! Most major insurance companies provide you with online auto insurance quotes. For some, you may need to speak with an agent before finalizing your purchase. But many companies let you do it all online, from making money to buying your policy.

Is it better to buy insurance online or in person?

When searching for car insurance online, you can compare prices from different companies and find the best one that suits your needs. In addition, buying online can be cheaper because you won’t have to pay agent fees or other expenses that you might face when you actually get insurance.

Reference:

https://www.thetruthaboutinsurance.com/are-online-insurance-quotes-accurate/

https://www.insuranceopedia.com/definition/476/insurance-quote

https://tgsinsurance.com/are-online-insurance-quotes-accurate/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

How Do I Get an Accurate Insurance Quote?

How Do I Get an Accurate Insurance Quote?