Americo Final Expense Review: Expert Insights & Analysis

Navigating through the maze of insurance options can feel like deciphering a cryptic code. But fear not! Imagine having a guiding compass through the complexities, especially when it comes to something as vital as Americo Final Expense Insurance. Picture this: a safety net ensuring your final journey is cushioned financially, sparing your loved ones from the weight of expenses during an emotionally challenging time.

Enter Americo Final Expense Insurance—a beacon of simplicity in a world of convoluted policies. It’s your ticket to peace of mind, designed to cover end-of-life expenses without the fuss of medical exams or bewildering paperwork.

Whether you’re considering securing your future or seeking clarity about this insurance, this comprehensive guide is your trusty map through the Americo Final Expense Insurance terrain. So, buckle up as we embark on a journey to unravel what this insurance entails, its quirks, benefits, and its suitability, especially for the seasoned souls among us.

What is Americo Final Expense Insurance?

Americo Final Expense Insurance is a type of life insurance explicitly tailored to cover end-of-life expenses, such as funeral costs, medical bills, and other outstanding debts. It serves as a financial safety net for families, ensuring that the burden of these expenses doesn’t fall upon loved ones during an emotionally challenging time.

This insurance policy is generally easier to qualify for, often available without the need for a medical exam. It’s intended for individuals who are seeking a simple and straightforward way to secure coverage for their final expenses.

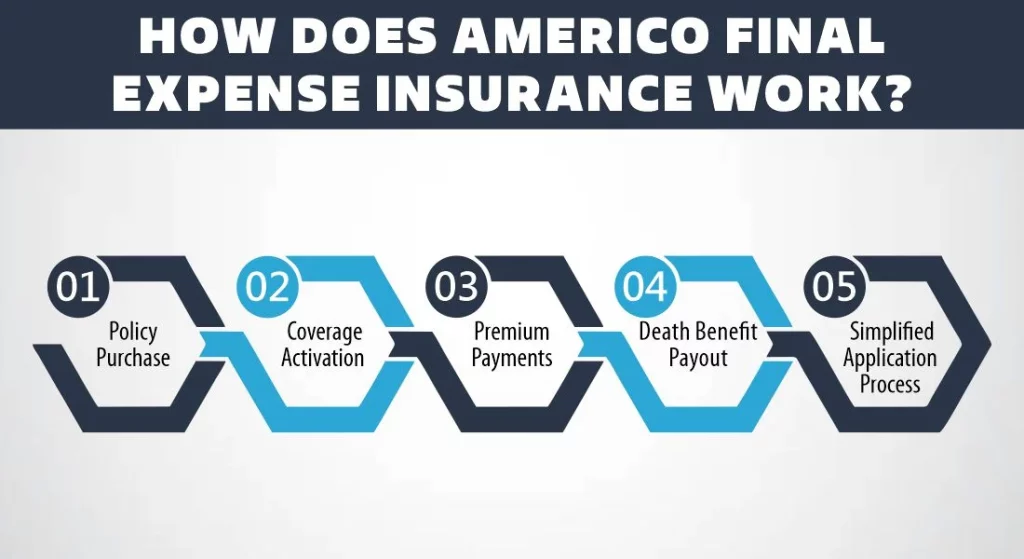

How Does Americo Final Expense Insurance Work?

Americo Final Expense Insurance operates on a straightforward principle, aiming to provide financial support for end-of-life expenses. Here’s how it works:

1- Policy Purchase

To initiate coverage, individuals purchase an Americo Final Expense Insurance policy. This involves choosing the desired coverage amount and paying regular premiums.

2- Coverage Activation

Once the policy is in effect, it provides coverage for the policyholder’s final expenses. These may include funeral costs, medical bills, outstanding debts, and other expenses associated with the end of life.

3- Premium Payments

Policyholders pay premiums on a regular basis—monthly, quarterly, semi-annually, or annually—based on the chosen payment frequency. These premiums ensure the policy remains active and coverage continues.

4- Death Benefit Payout

Upon the insured person’s passing, the policy pays out a lump sum, known as the death benefit, to the designated beneficiaries. Beneficiaries can use this sum to cover the expenses outlined in the policy, alleviating the financial burden on family members during a challenging time.

How Much Does Life Isurance Cost?

5- Simplified Application Process

Notably, Americo Final Expense Insurance typically offers a simplified application process, often without the need for a medical exam. This makes it accessible to individuals who might have health issues or are of advanced age.

Coverage for Diseases

Here’s an example table detailing the coverage for certain diseases under Americo Final Expense Insurance:

| Covered Diseases | Coverage Details |

|---|---|

| Chronic Illnesses | Covered, subject to specific terms outlined in the policy |

| Terminal Diseases | Covered, ensuring financial support during end-of-life situations |

Explanation of Coverage:

Chronic Illnesses: Americo Final Expense Insurance often covers chronic illnesses, although the specific terms and conditions may vary depending on the policy. Certain chronic illnesses may have waiting periods or limitations outlined in the policy document. It’s crucial to review the policy details to understand the extent of coverage for chronic illnesses.

Terminal Diseases: This insurance generally covers terminal illnesses, ensuring that individuals diagnosed with a terminal illness receive financial support during their end-of-life phase. The policy typically provides benefits if the insured is diagnosed with a terminal illness that is expected to result in death within a specified period, as defined in the policy terms.

How Does Americo Final Expense Insurance Cost?

Below is an example table outlining factors affecting the cost of Americo Final Expense Insurance and their impact on premiums:

| Factors Affecting Cost | Impact on Premiums | Typical Range |

|---|---|---|

| Age | Older individuals may have higher premiums | $20 – $150 per month |

| Health Condition | Pre-existing conditions could affect premium rates | $30 – $200 per month |

| Coverage Amount | Higher coverage typically results in higher premiums | $10,000 – $30,000 |

| Payment Frequency | Monthly, quarterly, semi-annually, or annually payments | Varies based on choice |

Pro & Cons of Americo Final Expense Insurance

Let’s explore the pros and cons of Americo Final Expense Insurance:

Pros:

- Simplified Application Process: The application process for Americo Final Expense Insurance is generally straightforward, often requiring minimal underwriting. This makes it accessible for individuals who might have health issues or are older.

- Coverage for Final Expenses: It ensures that the insured person’s final expenses, such as funeral costs, medical bills, and debts, are covered. This alleviates the financial burden on family members during a difficult time.

- No Medical Exam: Many policies within Americo Final Expense Insurance don’t mandate a medical examination. This feature makes it more accessible to individuals with health concerns.

Cons:

- Higher Premiums for Some: Premiums might be higher for older individuals or those with pre-existing health conditions. This can make it comparatively expensive for certain demographics.

- Limited Coverage Amounts: Policies may have limitations on coverage amounts. Higher coverage may not be available or may come with higher premiums.

- No Cash Value Accumulation: Unlike some other life insurance policies, Americo Final Expense Insurance doesn’t accumulate cash value over time. This means the policyholder won’t receive any cash benefits during their lifetime, as the policy is mainly designed to cover final expenses.

What is the Background of Americo Final Expense Insurance?

Americo Final Expense Insurance is a part of Americo Life, Inc., a well-established insurance company founded in 1946 and headquartered in Kansas City, Missouri. Americo Life specializes in providing life insurance, annuities, and retirement planning products.

Over its extensive history, Americo Life has developed a strong reputation for reliability and customer service within the insurance industry. The company has focused on offering a range of insurance products designed to meet the diverse needs of individuals and families at various stages of life.

Americo Final Expense Insurance specifically caters to individuals looking for coverage that addresses end-of-life expenses. It is crafted to provide financial support to cover funeral costs, medical bills, and other outstanding debts that may arise after a policyholder’s passing. This type of insurance aims to ease the burden on family members during an emotionally challenging time by ensuring that these expenses are taken care of through the policy’s death benefit payout.

The background of Americo Final Expense Insurance is rooted in Americo Life’s commitment to providing accessible and straightforward insurance solutions, particularly tailored to help individuals and families prepare for the financial aspects of end-of-life circumstances. This insurance product is part of Americo Life’s portfolio, reflecting the company’s dedication to serving its customers’ needs with reliable and purpose-driven coverage options.

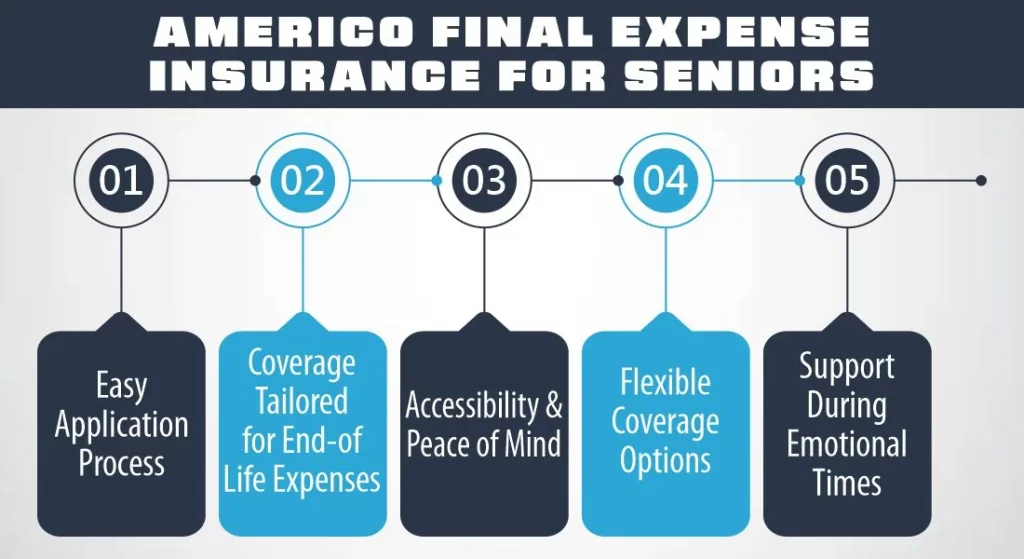

Americo Final Expense Insurance for Seniors

Americo Final Expense Insurance holds significant appeal for seniors, offering a simplified and accessible insurance option tailored to meet the specific needs of this demographic. Here’s why it’s particularly attractive for seniors:

Easy Application Process

Seniors often find Americo Final Expense Insurance appealing due to its simplified application process. The policy typically doesn’t require a medical exam, making it accessible to seniors who might have health issues or concerns.

Coverage Tailored for End-of-Life Expenses

This insurance product is designed explicitly to cover end-of-life expenses, such as funeral costs, medical bills, and debts. For seniors planning and preparing for their final arrangements, Americo Final Expense Insurance ensures that these financial aspects are taken care of, lessening the burden on their loved ones.

Accessibility and Peace of Mind

Seniors, especially those over 50 or 60 years old, may prefer this insurance for its straightforward nature and peace of mind. It offers a reliable way to secure coverage without complex procedures, ensuring that their families are financially protected during a difficult time.

Flexible Coverage Options

Americo Final Expense Insurance typically provides flexibility in choosing coverage amounts, allowing seniors to select an amount that suits their specific needs and budget.

Support During Emotional Times

By securing this insurance, seniors can feel confident that they have taken steps to alleviate the financial stress on their families after their passing. It provides a sense of security, knowing that their final expenses are accounted for.

Overall, Americo Final Expense Insurance serves as a practical and accessible option for seniors seeking a simple and purpose-driven way to ensure their final expenses are covered, allowing them to plan for their future and provide financial support to their loved ones.

Conclusion

Navigating Americo Final Expense Insurance involves understanding its purpose, coverage, costs, and suitability for your individual needs. It serves as a crucial financial tool to ensure that your loved ones aren’t left with the financial burden of your final expenses. With its simplified application process and focus on covering end-of-life costs, Americo Final Expense Insurance stands as a viable option for those seeking a straightforward solution.

FAQs (Frequently Asked Questions)

1- Is Americo Final Expense Insurance the same as traditional life insurance?

While both provide a death benefit, Americo Final Expense Insurance differs in its focus. It’s specifically designed to cover end-of-life expenses, such as funeral costs and medical bills, and is generally easier to qualify for compared to traditional life insurance.

2- Can I get Americo Final Expense Insurance if I have pre-existing health conditions?

Yes, in many cases. Americo Final Expense Insurance often doesn’t require a medical exam, making it accessible to individuals with health concerns. However, the premium rates might be affected based on the severity of the conditions.

3- Are there limitations on how the death benefit can be used?

The death benefit from Americo Final Expense Insurance can generally be used at the beneficiaries’ discretion. It’s often utilized to cover funeral expenses, outstanding debts, and other end-of-life costs. However, it’s advisable to review the policy terms to understand any specific limitations.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.