Affordable Life Insurance for Veterans – Get Covered

Last Updated on: July 10th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Veterans are those superheroes who have made huge sacrifices while in the service to their country. The only thing that they deserve is the financial protection of their families in return. The one important component of that protection is life insurance for veterans. No matter if you just separated from the military or you are a long-time veteran, retired. You have to understand your options, which can help you secure peace of mind for the future. In this detailed article, we will explore everything you need to know about life insurance for veterans, including the things like it’s free or not, and also what the VA offers, how much it costs, and the best life insurance policies for former service members.

Table of Contents

ToggleHow Life Insurance for Veterans Works

Life insurance for veterans means that it is specially designed to support the unique needs of those who have served in the military. There is one common option that is Servicemembers’ Group Life Insurance (SGLI), but this is full-time coverage, and not everyone qualifies for this. Also, there are specific requirements set by the Department of Veterans Affairs VA, and you have to meet these requirements to be eligible for this insurance.

SGLI offers $500,000 in coverage, but some of veterans can find that private life insurance plans will provide better benefits and higher coverage limits.

Veterans’ Life Insurance Programs Offered by the VA

The Department of Veterans Affairs (VA) offers several life insurance programs that are specially designed for veterans, each designed to meet different needs and stages of life.

VA-Backed Life Insurance Programs

Veterans’ Group Life Insurance (VGLI)

After leaving their active duty, veterans can convert their Servicemembers’ Group Life Insurance (SGLI) into Veterans’ Group Life Insurance (VGLI). VGLI is the new term policy that does not require any medical exam if applied within the set time frame. The coverage for this policy ranges from $10,000 to $500,000, depending on your needs. The monthly premiums are based on your age and the amount of coverage you have selected. This option allows veterans to maintain life insurance protection after military service with flexible coverage choices.

Veterans Affairs Life Insurance (VALife)

Veterans Affairs Life Insurance VALife was introduced in 2023, and this insurance will provide guaranteed acceptance whole life insurance for veterans who are living with service-connected disabilities. This program always makes sure that eligible veterans can get the coverage without having to take a medical exam, which will make it easier for them to qualify. The maximum amount of coverage available through VALife is $40,000, and once this is approved, the policy will build cash value for you over time. This insurance is a hopeful option for veterans who are looking for permanent life insurance protection that is designed to protect their health and service history.

Service-Disabled Veterans Insurance (SDVI)

Service-Disabled Veterans Insurance (SDVI) is offering important life insurance protection. This program will give the basic coverage up to $10,000. Eligible veterans can also apply for the supplement coverage of up to $30,000, and this will make the total coverage amount $40,000. SDVI is designed to support those veterans who have been injured or disabled during service by offering affordable and accessible life insurance options.

How Much Does Life Isurance Cost?

Do Veterans Get Free Life Insurance?

There is a common question among veterans is “Is life insurance free for veterans?”The short answer is no, but there are some exceptions you have to know.

The active duty members receive free SGLI coverage up to $500,000, but this ends shortly after discharge.

Veterans must pay the premiums for coverage under programs like VGLI and VALife.

Some service-connected disabled veterans may qualify for free basic coverage under Service-Disabled Veterans Insurance (S-DVI).

So while most veterans don’t receive free life insurance, they do get access to exclusive and often affordable plans through the VA.

How Much Do Veterans Pay for Life Insurance?

The cost of life insurance for veterans depends on several factors:

- Age

- Type of coverage (term vs. whole life)

- Health condition

- Amount of coverage

VGLI Monthly Premiums (Sample Rates for $250,000 Coverage)

| Age Range | Monthly Premium |

| 30–34 | $17.50 |

| 40–44 | $32.50 |

| 50–54 | $97.50 |

| 60–64 | $97.50 |

Other private life insurance companies may offer lower or higher premiums based on your health, smoking status, and lifestyle.

What Is the Best Life Insurance for Veterans?

Choosing the best life insurance for veterans depends on several factors, including your personal needs, age, health status, and whether you prefer term life or whole life insurance

1. VGLI (Veterans’ Group Life Insurance)

Veteran’s Group Life Insurance is best for veterans who have recently separated from the military and want to continue their life insurance coverage without giving a medical exam. It offers a simple transition from SGLI, allowing veterans to maintain protection as long as they apply within the required time frame after leaving service. One of the main advantages of VGLI is that it’s renewable for life. However, premiums increase every five years, which can make it more expensive as you get older.

2. VALife (VA Life Insurance for Disabled Veterans)

This life is best for the veterans who have service-connected disabilities and are also looking for guaranteed life insurance coverage. One of the main benefits of VALife insurance is that there is no medical exam, and this will make it easier to qualify. Also, the policy offers fixed premiums, so your monthly payments will not increase over time. But there is a major limitation that coverage is capped at $40,000, which may not be enough for veterans seeking higher financial protection for their families.

3. USAA Life Insurance

Private life insurance is considered the best insurance for veterans who are in good health and they are also looking for a good rate but more coverage options. The insurance companies provide a wide range of policy types, including term, whole, and universal life insurance, allowing veterans to choose coverage that fits their financial goals. However, it might be possible that the medical exam is taken, and approval isn’t guaranteed if there are health concerns.

4. Navy Mutual

Navy Mutual is a good choice for veterans who want life insurance that lasts their whole life and doesn’t have rules that exclude war or flying accidents. It offers high amounts of coverage and steady payments that don’t go up. But, only military members and their families can get this insurance, so you need to be connected to the military to apply.

Is Life Insurance Free for Veterans with Disabilities?

If you have a service-connected disability, you will be able to get free or low-cost life insurance through special VA programs:

- The S-DVI program gives you free basic life insurance coverage of $10,000 if you apply within two years after getting your disability rating.

- Some veterans with total disability may not have to pay any premiums at all.

Even though the coverage amount is small, these plans can be a good starting point. You can add more insurance with private or group policies later.

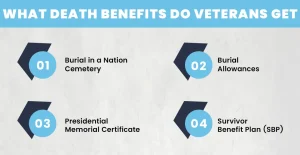

What Death Benefits Do Veterans Get?

Veterans and their families may be eligible for several death benefits in addition to life insurance:

VA-Provided Death Benefits:

-Burial in a National Cemetery

- Includes grave marker, opening/closing, and perpetual care.

- No cost to the family.

-Burial Allowances

- VA provides up to $2,000 toward burial expenses for service-connected deaths.

-Presidential Memorial Certificate

- Signed certificate honoring the veteran’s service.

-Survivor Benefit Plan (SBP)

- An optional military retirement benefit allows a portion of your pension to be passed to your spouse.

While these benefits are valuable, they do not replace life insurance, which offers flexible, immediate financial protection for loved ones.

Final Thoughts

Getting life insurance as a veteran is a very important way to protect your family and legacy. The VA is offering affordable life insurance choices. But if you want more coverage and low premiums, then private insurance can be a good option for you. Veterans usually do not get free life insurance. But with the right help, they can find a better plan that will help them to keep their loved one safe.

Ready to secure your family’s future with the right life insurance?

Don’t wait, explore your veteran life insurance options today and find the affordable coverage that fits your unique needs.

Contact us and get a licensed insurance agent now to get personalized advice and start your application!

FAQs

Do veterans get free life insurance?

No, most veterans don’t get free life insurance. Active duty soldiers get free coverage with SGLI, but it stops when they leave the military. Some veterans who are disabled may get free basic coverage from the VA’s Service-Disabled Veterans Insurance program.

What life insurance options does the VA offer for veterans?

The VA has different life insurance programs, like Veterans’ Group Life Insurance (VGLI), Veterans Affairs Life Insurance (VALife) for disabled veterans, and Service-Disabled Veterans Insurance (SDVI).

How much does life insurance for veterans cost?

The cost depends on your age, health, the kind of coverage, and how much coverage you want.

Can veterans get life insurance without a medical exam?

Yes, programs like VGLI (if applied within a certain time frame) and VALife for disabled veterans offer coverage without requiring a medical exam.

What is the best life insurance for veterans?

The best life insurance depends on what you need. VGLI is good if you just left the military. VALife is made for disabled veterans. Private companies like USAA or Navy Mutual offer other choices with different coverage and prices.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.