Life Insurance Beneficiary Guide

Last Updated on: June 17th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

It’s an emotional and difficult time when one of your loved ones passes away, and a few days later, you discover that they had a life insurance policy. But there’s one big question that comes to your mind. Are you the beneficiary? And if so, what happens next?

Table of Contents

ToggleIn the world of life insurance, the word beneficiary is very important. It means the person who will get the money from the policy after the insured person passes away. But many people don’t really know what a beneficiary is, how to check if they are one, or what to do to get the money if they are named in the policy.

There is no need to worry if you don’t know anything. We will give you this easy and detailed guide. This will help you understand the meaning of insurance beneficiary, how to find out if you are the one, get ideas on how to make a claim, how to prove it, and how to choose the right person to name as a beneficiary.

Who Is a Life Insurance Beneficiary?

A life insurance beneficiary is the person who will get the money from a life insurance policy after the person who bought it passes away. This money is usually paid in one big amount and can help cover things like funeral costs, unpaid bills, or support for the family’s future needs.

There are generally two types of beneficiaries:

- Primary Beneficiary

The first in line to receive the insurance proceeds.

- Contingent (or Secondary) Beneficiary

This person will receive the benefits only if the primary beneficiary is deceased or cannot be located.

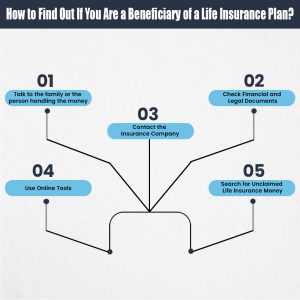

How to Find Out If You Are a Beneficiary of a Life Insurance Plan?

If you think that someone may have named you to get their life insurance money, and you don’t have an idea how to get but, here are some easy steps to help you find out:

How Much Does Life Isurance Cost?

1. Talk to the family or the person handling the money

The first thing you have to do is talk to the family or the person in charge of the person’s things. They might have the life insurance papers.

2. Check Financial and Legal Documents

The next thing to do is, check the person’s bank statements, emails, or important papers. Look for payments or letters from the insurance company.

3. Contact the Insurance Company

If you find the policy number or the name of the insurance company, next you have to call them directly. They might ask for a death certificate and your ID to help you.

4. Use Online Tools

You can also use online tools to take help. One good tool is the Life Insurance Policy Locator from the NAIC. It helps people find life insurance policies that are lost or forgotten.

5. Search for Unclaimed Life Insurance Money

If no one has claimed the life insurance money for a long time, the state might be holding it. You can check online at missingmoney.com or on your state’s unclaimed money website.

How to Make a Life Insurance Claim When You Are a Beneficiary

Once you know that and it is confirmed that you are a beneficiary of a life insurance policy, the next step is to claim the money. This means that you have to ask the insurance company to give you the money left to you. Here are the simple steps you need to follow to get the life insurance benefit:

1. Obtain the Death Certificate

The first step is that Insurance companies ask for an official copy of the death certificate as proof.

2. Call the Insurance Company

The second step is you have to call or contact the insurance company that is named in the policy. You will need to give them the policy number, the name of the person who passed away, and your ID.

3. Complete the Claim Form

The next step is that you have to fill out a claim form to ask for the money. Also, send any documents they ask for, like a copy of the death certificate.

4. Submit Supporting Documents

Along with the death certificate, you may also need to send a copy of your ID and something that shows how you were related to the person who passed away.

5. Choose Payout Option

You will have options for how you receive the money. You can get it all at once (a lump sum), in regular payments over time (an annuity), or through other ways the insurance company offers.

6. Receive the Death Benefit

Once the insurance company checks your documents and approves them, they will send you the money. Most claims are paid within 30 to 60 days after you submit your paperwork.

How to Prove That You Are a Beneficiary of a Policy

If you want to claim the insurance money, there is a must-thing that you have to show that you are the right person to receive it. Here’s what the insurance company usually needs from you:

- Your ID: A government ID with your photo to show who you are.

- Death Certificate: A certified copy to prove the person has passed away.

- Claim Form: A form you fill out to ask for the life insurance money.

- Policy Information: The policy number, the name of the person who had the insurance, or a copy of the policy.

- Proof of Relationship (if needed): Papers like a marriage or birth certificate to show how you were related to the person.

After you send these documents, the insurance company will check everything to make sure you are the right person. Then they will send you the money.

Who Can I Name to Receive My Life Insurance

The most important thing when you get the insurance policy is to decide who will take the money, and here are some of the common choices to think about when choosing the beneficiary

Spouse or Partner

This is the most common choice when you are choosing a person to take the money after your death. The money can help them pay bills, cover funeral costs, and maintain their way of living.

Children

You can name your children, but keep in mind that the kids who are minors will not be able to get the benefit directly. In such cases, appointing a trustee or setting up a trust is recommended.

Other Family Members

There is also an option to name the other family members to take the money. You might consider naming siblings, parents, or extended family if they depend on you financially.

Charity or Non-Profit

There are some people who choose to leave their life insurance money to a charity or nonprofit group they care about.

Trust

If your money and property plans are complicated, you can name a trust to decide how and when the money is given out.

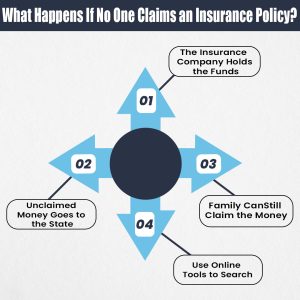

What Happens If No One Claims an Insurance Policy?

If you are thinking what will happen to the insurance money if no one claims it, here’s the answer: The money doesn’t just disappear. The insurance company won’t keep it forever. Here are some of the points that will happen

The Insurance Company Holds the Funds

The first thing the insurance company can do is wait for someone to claim the money. If no one asks for it and they can’t find the person who should get it, the money stays unclaimed with the company for a while.

Unclaimed Money Goes to the State

If the life insurance money is not claimed for a certain time, that is usually 3 to 5 years, the insurance company, after some time, sends the money to the state or government. This process is called escheatment. The state keeps the money safe until the right person comes to claim it.

Family Can Still Claim the Money

Even after the money is sent to the state, family members or beneficiaries can still ask for it. They will need to show proof of who they are and how they are related to the person who passed away

Use Online Tools to Search

Websites like missingmoney.com or the National Association of Unclaimed Property Administrators (NAUPA) can help you search for life insurance money that hasn’t been claimed yet.

How to Avoid Unclaimed Life Insurance Money:

- Keep your life insurance papers in a safe and easy-to-find place.

- Tell the people you choose as beneficiaries about your policy.

- Make sure the insurance company always has your current address and phone number.

Frequently Asked Questions (FAQs)

What happens if no one claims an insurance policy?

If no claim is made, the insurance company will hold the funds for a few years. Afterward, the funds are turned over to the state’s unclaimed property office. Beneficiaries can still claim them, but must go through the state’s verification process.

Can a minor be a life insurance beneficiary?

Yes, but they can’t legally receive the money until they turn 18 (or 21 in some states). A trust or guardian should be named to manage the benefit.

Can I change my life insurance beneficiary?

Yes. Most policies allow you to change your beneficiary at any time, unless the designation is irrevocable. Always notify the insurance company and complete the proper forms.

How long do I have to claim a life insurance benefit?

There’s no strict deadline, but the sooner the claim is filed, the better. Delayed claims may result in complications or escheatment to the state.

What is a contingent beneficiary?

A contingent (or secondary) beneficiary receives the payout if the primary beneficiary is unable or unwilling to do so.

Final Thoughts

If you’re mentioned as a life insurance beneficiary or you are planning to choose one, it’s a big way to look after the people you love. This step is more than the money, it’s about giving them security when you can’t be there. Knowing how to find out if you’re a beneficiary, how to claim the money, and making sure everything is done right can make a tough time a little easier for your family.

To make things easier later, keep your policy updated. Name your beneficiary, and make sure your contact information is correct. Whether you’re setting up your policy or trying to claim one for someone else, having the right information makes all the difference. It’s one simple step that brings peace of mind to you and security to those you love.

Ready to Secure Your Loved Ones’ Future?

Don’t wait until it’s too late! Make sure your life insurance policy is up-to-date and that you’ve chosen the right beneficiary. If you’re a beneficiary, take the steps today to claim what’s yours. Need help or have questions? Reach out to your insurance provider or a trusted financial advisor to get the guidance you need. Protect your family’s future with confidence!

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.