Affordable Life Insurance Quotes For Whole Life Policy

Planning for your family’s financial security is very important for mental peace, and whole life insurance is a strong option to consider when you are planning to buy the life insurance policy. Many people get confused between term life and the whole life plan.

So the whole life plan is so different from the term life insurance, which only lasts for the second number of years, whole life insurance covers you for your entire life and even builds cash value that grows over time. But the question is how do you find the right insurance codes for a whole life policy? Let us help you with this guide. We will help you understand life insurance quotes for whole life policy, why getting quotes matter, and how to compare the best options available

Understanding Of Whole Life Insurance Policy

Whole life insurance policies are a type of life insurance policy that will last for your whole life as long as you keep paying your monthly premiums. This land does not end after some years. It also saves money for your future that is called the cash value and this amount gross overtime and you can use it whenever you want.

Table of Contents

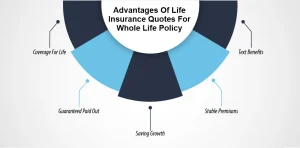

ToggleAdvantages Of Life Insurance Quotes For Whole Life Policy

Whole life insurance a special kind of insurance that protect you for your entire life it help to keep your family safe and also save money for you future

Coverage For Life

Your insurance stays active for your whole life as long as you are keeping your premiums it does not end like other plans that only last for few years

Guaranteed Paid Out.

When you pass away, your family will get the promised money. This money will help them with expenses and give them financial support.

Saving Growth

Your policy saves money that is called the cash radio this money will grow overtime and you can borrow or take out if you need it in future

Stable Premiums

The amount you pay for your insurance stays the same every year. It means that you will not have to worry about pricing going up.

Text Benefits

The money saving your policy grows without being text until you decide to take it out, which can save your money

Why Should You Get Multiple Life Insurance Quotes For a Whole Life Policy?

Comparing life insurance quotes for whole life policy is very easy and simple. It means that you have to look at different insurance plans to find out the one that fits your budgets and needs. Prices and benefits are different with each company so checking in many will help you avoid paying too much and get the best deal.

How Much Does Life Isurance Cost?

Benefits Of Shopping For Best Life Insurance Quotes For Whole Life Policy

- Look at the different prices and pick what you can afford.

- Check what each plan covers any extra benefits.

- Choose plans from companies you can trust

- Insurance that matches your money goals.

How To Find Life Insurance Quotes For Whole Life Policy Online

Today it is very simple to get life insurance quotes for whole life policy online by using the trusted websites that compare policies from many insurance providers. You just need to enter some basic details about yourself and the coverage you want. Let’s have a look at the same easy steps to get the best life insurance quotes for whole life policy online.

- Go to the trusted insurance comparison website

- Enter your basic details like age, your gender and your health.

- Select how much coverage you need.

- See many quotes right away.

- Compare prices benefits and complete reviews before choosing the plan

How To Compare An Affordable Life Insurance Quotes For Whole Life Policy

Price is important but don’t just choose the cheapest plan. It is important to look closely at what the plan actually offers for the money. Good coverage is always a protection wall for your family. When you are comparing the plan you have to check the total amount of the coverage, how much you pay each month or the year and is there any extra hidden fee that you have to pay later in future?

Also you have to make sure to see if the plan has any add ons, and how your cash value account is growing. These are the things that you have to look at before buying the whole life plan.

Tips To Find Affordable Life Insurance Quotes For Whole Life Policy

Whole life insurance usually costs more than term life insurance, but you can save money with these easy tips.

- Buy insurance when you are young because it will be cheaper

- Stay healthy, and don’t smoke so you have to pay less if you don’t smoke.

- Pick a coverage amount that you can afford

- Ask any insurance agent that will help you to find the best deals.

- Use online tools to check how much your insurance will cost you before you buy it.

What To Look For It In The Best Life Insurance Quotes For Whole Life Policy Providers

All the best life insurance companies out there are financially strong and stable so it means that they can pay your claims when needed. All these companies offer clear and easy to understand policies. So that is exactly what you are getting, these companies also provide flexible coverage options so that you can change them later in life when you want. Good customer service is important and top providers have friendly and reliable support to help you whatever you need. Lastly they have a solid track record of handling claims and fairly and quickly, giving you peace of mind for the long run.

What Are The Factors That Affect The Cost Of The Whole Life Insurance?

Let’s have a look at all those things that affect the price you pay for insurance, your age, health, gender, and how much coverage you want all affect the price you pay for insurance policy. If you add extra benefits that are called the riders they can also make your policy cost even higher.

It’s important to keep honest and complete information when you apply so you get the right and most accurate price for your policy.

Different Whole Life Insurance Options

There are different types of whole life insurance plans to choose from, depending on what suits you best

Standard Whole Life

You pay the same amount regularly, and your family get a guaranteed payout when you pass away.

Participating Whole Life

This plan can give you extra money that is called dividends, depending on how well the insurance company does.

Limited Pay Whole Life

You pay premiums for a certain number of years, but your coverage last year

Single Premium Whole Life

You pay just once in your coverage last for your entire life

Final Thoughts

Whole life insurance is the best way to protect your family and build savings over time. Make sure to take your time comparing life insurance quotes for whole life policy to find the best plan that fits your budget and needs. Online to make it easy to get multiple courses quickly and securely. Always check what each plan offers and choose a trusted insurance to make sure your family’s future is safe.

Get your free affordable life insurance quote for whole life policy today and make a smart choice for life protection

Ready To Protect Your Future?

Get your free life insurance quotes for whole life insurance policies today with insure guardian

It’s quick, easy and hundred percent secure. Compared to trusted providers, choose the best plan for your budget and give your family the lifelong protection they deserve.

FAQs

What are whole life insurance quotes?

Life insurance quotes for a whole life policy are price estimates that show how much you will pay for a whole life insurance plan. They help you see what the policy can cost.

How can I get a life insurance course for a whole life policy online?

You can visit a trusted insurance website, then you have to fill in your basic details like your age, gender, and health condition and see your courts in just a few minutes.

What factors affect whole life insurance policy dates?

Your age health gender how much coverage you want and any extra features like riders can change how much your plan cost

Are whole life insurance quotes more expensive than term life insurance?

Yes, whole life insurance usually costs you more as compared to the life insurance policy because whole life will cover you for your entire life but term life will cover you for a specific time and also hold life. Will give you a cash value that will grow overtime and you can take it whenever you want.

How do I compare your whole life insurance quotes from different providers?

To compare life insurance courses for whole life policy from the different insurance companies you simply have to look at the prices coverage amount benefit and if they provide some extra features that all then all these things will help you to pick the best plan from the best providers

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.