Burial Insurance for Parents: A Complete Guide

Key Takeaways

- Affordable protection for funeral costs.

- Coverage available up to age 85.

- Peace of mind for families.

Planning for your parents’ final expenses can help reduce money worries during a sad and emotional time. Burial insurance for parents is a special type of life insurance policy that will help pay for funeral expenses, medical bills, or any debts after they pass away.

No matter if your parents are in their 50s or even over 85, there are plans available that give peace of mind and financial protection for your family.

In this article, we’ll explain everything you need to know about burial insurance for parents—like what ages can qualify, how much coverage you can get, how much it may cost, and simple tips to help you choose the right policy.

Table of Contents

ToggleWhat Is Burial Insurance for Parents?

Burial insurance that is also known as final expense insurance or funeral insurance, this is a small type of whole life insurance that will helo pay for end-of-life expenses. The plan will give you coverage that is usually between $2,000 and $50,000, which makes it less expensive than regular life insurance policies.

When you buy burial insurance for your parents, you are usually the policyholder. This means you pay the monthly premiums and name yourself or another family member as the beneficiary mean that the person who gets the money. When your parent passes away, the insurance company will give you money and will help pay for the funeral and other final expenses.

Why Do Parents Need Burial Insurance?

In the U.S., funeral expenses are usually between $7,000 and $12,000, and that’s not even counting extra bills like medical or legal expenses. If there’s no insurance policy, families have to pay all of this money themselves, which can be stressful.

Here’s why getting burial insurance for parents is a smart choice:

Affordable

The monthly premiums are usually lower than traditional life insurance.

Easy to qualify

Many plans don’t need a medical exam, so even older parents can get coverage.

Peace of mind

It gives your family financial help and removes the worry of sudden expenses.

How Much Does Life Isurance Cost?

Can I Buy Burial Insurance for My Parents?

Yes, you can. You can purchase the policy, but you have too pay the monthly premiums, and list yourself as the beneficiary means that the person who gets the money. But there are a few important rules to know, lets have a look what are they.

Your parents must agree

You cannot buy insurance for them without their knowledge or permission.

Age matters

Many companies sell burial insurance for parents over 50, 60, 70, and even up to 85. But the older they are, the fewer options you’ll find.

You pay the premiums

If you are the one who is buying the insurance plan, it’s your job to make sure that the monthly payments are made on time

Burial Insurance for Parents by Age

Burial Insurance for Parents Over 50

If your parents are in their 50s, they are usually healthy enough to get the lowest rates. Coverage is more affordable and there are plenty of plan choices.

Burial Insurance for Parents Over 60

For parents over 60, policies are still affordable, but premiums (monthly costs) are higher than in their 50s. Many plans at this age offer immediate coverage with no waiting period.

Best Burial Insurance for Parents Over 70

At 70+, coverage is still possible but there are fewer options. The best choice is usually guaranteed issue or simplified issue policies, which don’t require a medical exam.

Burial Insurance for Parents Over 80

For parents in their 80s, coverage is still available, but premiums increase a lot. Some companies will cover parents up to age 85, so it’s smart to apply quickly.

Burial Insurance for Parents Over 85

After 85, coverage is rare but still possible with a few insurers. These plans usually come with graded benefits, meaning the full payout starts only after a waiting period of about 2 years.

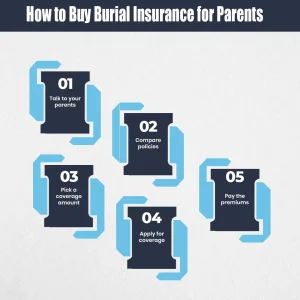

How to Buy Burial Insurance for Parents

If you’re wondering how to buy burial insurance for parents, here are the some steps you have to follow, lets have a look for the better understanding:

Talk to your parents

First you have to make sure that your parents agree and discuss how much coverage is needed.

Compare policies

Check different insurance companies to find the best price and benefits.

Pick a coverage amount

Decide how much money is needed to cover funeral costs and any debts.

Apply for coverage

The application is usually quick. Most companies only ask a few health questions and don’t require a medical exam.

Pay the premiums

After approval, keep the policy active by paying the monthly premiums on time.

Best Burial Insurance Options for Parents

When choosing the best burial insurance for your parents, there are a few main types to know about. There is a simplified issue life insurance plans that will only asks a few health questions and it also does not require a medical exam. Guaranteed issue life insurance has no health questions at all and everyone is accepted, but these policies usually come with a waiting period before full coverage starts. Another option is pre-need funeral insurance, which is bought through a funeral home and is used to cover specific funeral services directly.

Cost of Burial Insurance for Elderly Parents

Monthly premiums can be vary by age, health, coverage amount, and the type of policy chosen. Lets have a look at the average prices of the plans:

- Parents in their 50s have to pay $25–$50 per month.

- Parents in their 60s have to pay $40–$80 per month.

- Parents in their 70s have to pay $70–$150 per month.

- Parents in their 80s have to pay $150–$250+ per month.

Keep in mind that these prices are the estimated and you have to ask for the exact prices from the insurance company while buying the plan.

Pros and Cons of Buying Burial Insurance for Parents

| Pros | Cons |

| More affordable than traditional life insurance | Coverage amounts are limited |

| Helps pay funeral and end-of-life expenses | Premiums are higher for older parents |

| Many policies don’t require medical exams | Some plans include waiting periods before full benefits apply |

| Provides peace of mind for children and families | Coverage choices shrink as parents get older |

Final Thoughts

Getting burial insurance for your parents is one of the most important and the caring step you can take in your life. These insurance plans will pay for the funeral expenses as well as the unpaid loans. No matter if your parents are in their 50s or even over 85,but make sure to buy the right plan, there are plans available for different needs and budgets. The best step is to talk with your parents, compare different companies, and choose a plan early, before prices go up with age.

Protect Your Family Today

Don’t wait until it’s too late, get peace of mind knowing your parents’ final expenses are covered. At Insure Guardian, we help families find the most affordable burial insurance plans for parents of all ages.

Get Your Free Quote Today

Frequently Asked Questions

1. What is the best insurance for burial?

The best burial insurance is usually a whole life policy made just for funeral costs and final expenses. The right one depends on your parent’s age, health, and budget. Look for a policy with affordable premiums, no medical exam, and guaranteed coverage.

2. What is the death insurance for parents?

Death insurance usually means life insurance. For parents, the most common choice is burial (final expense) insurance, which helps pay for funeral costs, medical bills, or debts after they pass away.

3. Can I get death insurance on my parents?

Yes, you can. You can buy the policy, pay the monthly premiums, and list yourself as the beneficiary (the person who gets the money). But your parents must agree to it, and you’ll need their information to apply.

4. What’s the difference between life insurance and burial insurance?

- Life insurance

Can provide large amounts of coverage (like $100,000 or more) and is often used to replace income, pay off a mortgage, or leave money for the family.

- Burial insurance

A smaller type of life insurance (usually $2,000–$50,000) that is mainly for funeral costs and final expenses.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.