Globe Life Insurance Guide – Quotes, Login & Reviews

Finding the right life insurance policy can feel a little confusing when every company promises to give you affordable protection. Among all of them globe life insurance stands out as the best and the most trusted insurance provider. This company is known for quick approval and no exam policies, but is it really the best choice for your needs? Let’s take a closer look at its coverage options, pricing, globe life insurance reviews and customer experience to help you decide

Who Owns Globe Life?

Globe life and accident insurance company is a long established insurance provider company and this company is the part of globe life Inc group. It has been offering life and accident coverage across the United States for so many years.

Globe life promises to provide affordable policies that are specially designed for both individuals and families. There are so many people who choose globe life insurance because it has the easy application process and paperless policy management through the globe life insurance login portal policy holders can pay their bills. They can also view their coverage and update information at any time. This will make it special and easy for those who prefer online management

Table of Contents

ToggleHow To Access Globe Life Online Account

Managing your life insurance has never been an easy thing to do. Globe lives online account system will allow you to handle your policy from anywhere.

Once you logged in, you can view your current policy details, you can check your payment history and also you can set up or manage automatic payments in addition to this you can also change your beneficiaries and after that you can download and print your policy document very easily

Ways To Pay Your Globe Life Premiums

You can’t pay your global life insurance premiums with a few easy fees. The first option is to pay online through the globe live website, which is quick and simple. You can also set up an auto pay option so that your payments are made automatically every month and your policy will stay active and never expire by mistake. If you prefer the old-fashioned way you can send your payment by mail or call on life globe life insurance phone number and talk to their billing department to pay over the phone. PC payment options make sure that your recovery stays active without any missed payment.

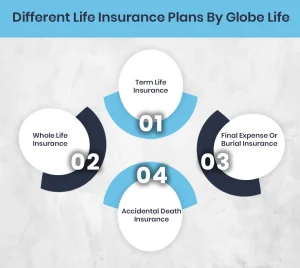

Different Life Insurance Plans By Globe Life

True life provides so many life insurance policies types that are specially made and designed for different financial goals and age groups. Here is an overview of the types of life insurance policies.

Term Life Insurance

A life insurance plan provides protection for a fixed number of years. You have an option to choose it for 10, 15 or 20 years. It totally depends on your preference and goals. If the policy holder passes away during this time period so that the person who is the mentioned as beneficiary will receive the death benefit

Whole Life Insurance

Whole life insurance gives coverage for your entire life, and it also includes a cash value account that grows over time.

Final Expense Or Burial Insurance

This plan is also called funeral insurance. The plan helps you to cover burial or end of life expenses. It is easy to qualify for, even for seniors and offers peace of mind for families.

How Much Does Life Isurance Cost?

Accidental Death Insurance

This plant provides financial protection in the event of injury or death caused by an accident. It can supplement your main policy for extra coverage.

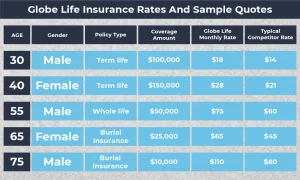

Globe Life Insurance Rates And Sample Quotes

True life rates are competitive especially for the applicants who are looking for good coverage without a medical exam. The sign of process is very easy and quick but not that new exam policies sometimes have a little higher premiums than the regular plans.

Let’s look at the sample quotes table

| Age | Gender | Policy Type | Coverage Amount | Globe Life Monthly Rate | Typical Competitor Rate |

| 30 | Male | Term life | $100,000 | $18 | $14 |

| 40 | Female | Term life | $150,000 | $28 | $21 |

| 55 | Male | Whole life | $50,000 | $75 | $60 |

| 65 | Female | Burial Insurance | $25,000 | $65 | $45 |

| 75 | Male | Burial Insurance | $10,000 | $110 | $80 |

Globe Life Insurance Cost For Seniors

Globe life is the most popular choice for seniors who want easy and guaranteed life insurance without taking a medical exam . For people between the ages of sixty five and eighty the monthly cost between $60 to $150. But it totally depends on the type of plan and how much coverage they choose. Many seniors get these insurance policies to help pay for funeral expenses, settling down their small loans, or leave some money for their families. Even though the prices may be a little higher. Than the other options, the quick approval and the simple process make globe life a convenient and stressful choice for older adult adults.

Viewing Your Policy Details

With a globe life online account. You can easily manage your insurance any time you want. You can also check your payment status, and also you can download important information forms, update your personal details and see your coverage information in one place. The online dashboard is very easy and simple to use, making it easy for you to take care of everything related to your policy without any hassle.

Globe Life Insurance Customer Support

If you need any help you can contact globe lives customer service Centre by calling on their number 13 will be there to help you with billing questions, policy updates and claims. You can also reach them through email or by using the contact form on their website however customer feedback is mixed. Some people say that service is very helpful and easy to use, while others mention that it takes a while to get a response or speak to a real agent.

Is Globe Life Insurance Legit

Yes, globe life insurance legit, financially strong and trusted company. It has received an A.M best which shows that it has good financial health and can pay claims reliability although the company has faced some criticism over things like data privacy and marketing issues it still serves millions of customers across the United States and continues to operate successfully.

What Do Customers Think About Globe Life Insurance?

Customer opinion about globe life are mixed

Many customers like;

- The fast approval process with no medical exam.

- The simple and easy to use online account.

- The flexible payment method that make managing policies easier

However, some customers complain about;

- Facing difficulty in cancelling the policies

- Delays in getting refunds.

- Limited choices when it comes to customising coverage options

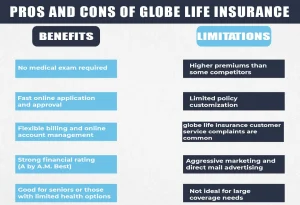

Pros And Cons Of Globe Life Insurance

| Benefits | Limitations |

| No medical exam required | Higher premiums than some competitors |

| Fast online application and approval | Limited policy customization |

| Flexible billing and online account management | globe life insurance customer service complaints are common |

| Strong financial rating (A by A.M. Best) | Aggressive marketing and direct mail advertising |

| Good for seniors or those with limited health options | Not ideal for large coverage needs |

Should You Choose Globe Life?

Globe life insurance can be a good option if you want fast coverage, minimal, and no health exams. It is especially practical for seniors or the people who value convenience over customisation.

Final Verdict

Globe life insurance company remains a reliable well established company that is offering quick and easy life insurance policies. It is ideal for customers looking for simple protection and seniors who prefer policies without the medical exam exams.

However, if you prioritise flexibility and the lowest possible monthly premiums you can have to compare rates from competitors before making your decisions.

If you are ready to explore affordable coverage that will fit your lifestyle then Insure guardian will help you compare the best term and whole life policies available.

Get a free coat today and secure your families financial future with insure guardian

Faqs

Is Globe Life insurance good or bad?

Yes, global life insurance is good for people who prefer simple quick easy approval coverage without a medical exam. However, some customers sometimes show that the service is slow and premiums are a bit higher.

What happened to Globe Life insurance?

Nothing happened to the globe life insurance it is still a top provider and offers a lot of insurance policies to their customers

How much is Globe Life insurance for seniors?

Seniors between the age of 65 and 80 years usually pay between $60 to $150 per month.

Can I view my Globe Life policy details online?

yes you can manage and view the globe life policy details online. You can log into your globe life account any time to review the coverage, pay the bills and update your details.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.