Does homeowners insurance cover hail damage to car

Experiencing a hailstorm can be incredibly stressful, as the pelting ice can wreak havoc on vehicles. If you’ve recently faced hail damage, you might be wondering about the extent of your insurance coverage. For cars, the answer hinges on your specific insurance plan. Those with full coverage, encompassing both collision and comprehensive parts, will find that the comprehensive coverage typically addresses hail damage. On the home front, most insurance policies do provide hail damage protection. However, it’s important to note that certain states or regions within the U.S. may have exclusions in their homeowners insurance policies, specifically excluding hail damage to homes or other buildings on the property.

Let’s examine: Does homeowners insurance cover hail damage to car? breaking it down into simple answers.

Understanding the Scope of Homeowners Insurance

Homeowners insurance is designed to protect your home and the property in it from unexpected events. This usually includes situations such as fire, theft, and certain natural disasters. However, when it comes to automobiles, homeowners insurance policies make a clear distinction because this form of insurance is not covered. This exclusion is universal and applies to all types of vehicle damage, including hail.

The Savior: Auto Insurance

For those who want it, Does homeowners insurance cover hail damage to car? Turning your attention to your car insurance policy is the way forward, especially for the general coverage section. Unlike liability insurance, which covers damage to other vehicles or property when you are at fault, comprehensive insurance is designed to protect your vehicle from collisions and this includes damage from theft, property damage, falling objects, and more importantly, weather events such as in hail.

Comprehensive Coverage: A Deep Dive

Opting for comprehensive coverage on Does homeowners insurance cover hail damage to car? It’s important to note that comprehensive coverage is optional, and its inclusion in your policy comes down to your choice. This coverage requires you to select a deductible, which is the amount you pay out of pocket before your insurance kicks in to cover the remaining repair costs.

How do I know whether homeowners insurance covers hail damage to car?

To decide if your owner of a house’s coverage covers hail damage, start with the aid of reviewing your coverage files closely. These files outline the specifics of what’s and isn’t protected under your coverage. Most homeowners insurance regulations cover hail harm to the shape of your house and personal property inside it, however it is critical to test for any exclusions or barriers. If the language on your coverage isn’t clean, or when you have unique questions on insurance, the excellent direction of motion is to touch your coverage agent or organization at once. They can offer particular statistics about your coverage, inclusive of any deductibles that can practice to hail harm claims. Understanding the nuances of your policy ensures you are thoroughly organized to have a hailstorm affect your property.

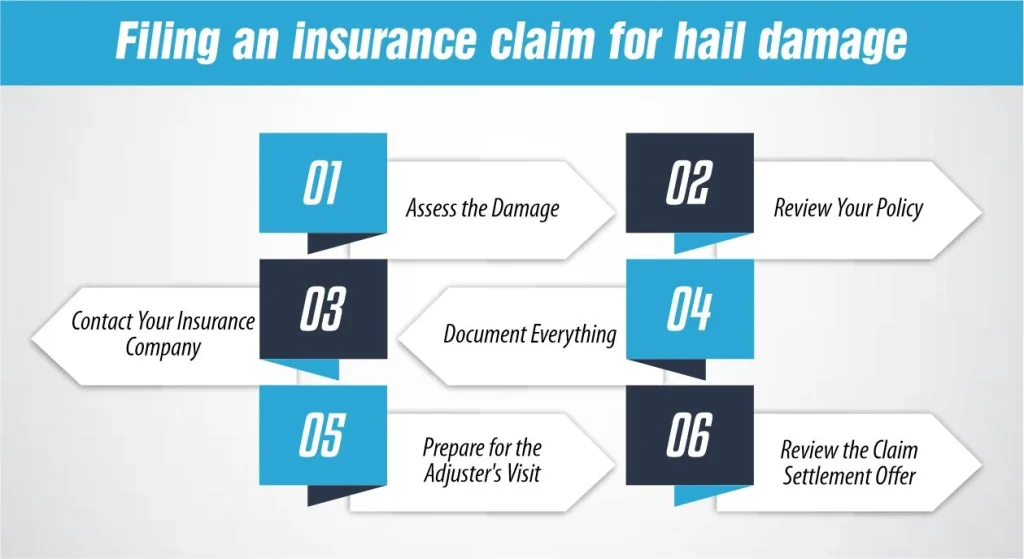

Filing an insurance claim for hail damage

Filing an insurance claim for hail damage

Filing an insurance declaration for hail harm may be straightforward in case you observe the proper steps. Whether your own home or automobile has been affected, the subsequent manual will assist you navigate the claims process correctly and efficiently.

Step 1: Assess the Damage

Immediately after the hailstorm, as soon as it’s secure, determine the extent of the harm. Take unique images of any visible harm to your property or car. This visible evidence can be vital in assisting your claim.

Step 2: Review Your Policy

Before submitting a claim, assess your coverage to understand your coverage for hail damage. Look for unique deductibles, coverage limits, and exclusions that could have an effect on your claim. Knowing your policy inside and out will prepare you for discussions with your coverage business enterprise.

Step 3: Contact Your Insurance Company

As soon as viable, contact your coverage business enterprise to file the hail harm. Most insurers offer a couple of channels for submitting claims, inclusive of online portals, cell apps, or over-the-cellphone services. Be prepared to offer your policy a wide variety and a brief description of the damage.

Step 4: Document Everything

Keep distinctive records of all communications together with your insurance business enterprise, which include dates, names, and the specifics of what changed into mentioned. Also, shop all receipts related to the hail harm, along with those for temporary maintenance or shielding measures you’ve taken to save you in addition to harm.

How Much Does Life Isurance Cost?

Step 5: Prepare for the Adjuster’s Visit

Your coverage organization will ship an adjuster to look at the harm. Prepare for him or her to go by way of getting ready your listing of damages and repair estimates. The adjuster’s evaluation will play a crucial function in the approval and valuation of your declaration.

Step 6: Review the Claim Settlement Offer

Once the adjuster has evaluated the damage, your insurer will provide you with a claim agreement offer. Review this offer cautiously to ensure it covers the full extent of the damage and is in step with your policy terms. If the provide appears low or incomplete, don’t hesitate

Tips for a Smooth Claims Process:

Act Quickly:

The faster you record your declaration, the quicker the procedure can start. Delays can complicate the evaluation of harm.

Understand Your Coverage:

Know the specifics of your coverage, which includes what forms of damage are blanketed and the quantity of your deductible.

Keep Good Records:

Documentation is your satisfactory ally in a claims process. It presents a clean proof trail that can expedite your declaration.

Filing an insurance claim for hail harm can seem daunting, but with the aid of following these steps, you can navigate the method with confidence. Always communicate openly with your insurance provider and are seeking for clarification whilst needed to make certain that you acquire the coverage you deserve.

Wind and hail house owners coverage deductibles

The repayment for hail damage from your coverage provider could be decided by using their assessment of the harm and your policy’s insurance limits. However, filing a declaration commonly entails any other price – your deductible. This deductible is the portion of the repair costs which you’re chargeable for earlier than your insurance coverage kicks in.

For instance, if your coverage has a $1,000 deductible and also you record a declaration for $5,000 well worth of hail damage on your roof, you would owe the first $1,000, and your insurance would pay the ultimate $four,000.

It’s also essential to note that house owners’ coverage regulations in areas susceptible to hail and wind damage might have a specific deductible for these kinds of events. Unlike a popular deductible, this will be a fixed amount or, extra usually, a percentage of your total policy coverage for the assets. This special deductible applies completely to damage from wind or hail and may be higher than your coverage’s general deductible.

| Deductible type | Total property coverage | Your payment out of pocket |

| $1,000 flat deductible | $200,000 | $ 1,000 |

| 1% wind and hail deductible | $200,000 | $ 2,000 |

Will filing a claim for hail damage increase my insurance rates?

Filing a claim for hail harm may grow your coverage rates, but this outcome isn’t assured and varies by means of insurance enterprise and policy. Insurers keep in mind a selection of things whilst determining rates, such as the frequency of claims filed, the region’s hazard for hail, and even the person policyholder’s claims history. While an unmarried hail harm claim is much less likely to justify a sizable charge growth on its very own, more than one claim over a short length should signal to your insurer that you’re at a better danger for future claims.

Some regions liable to frequent hail would possibly see better rates across the board due to the expanded hazard. For specific recommendations and how a hail declaration may affect your fees, it’s good to speak directly together with your insurance provider.

Fortifying your roof to keep away from a hail insurance claim:

Fortifying your roof in opposition to hail harm is a proactive step that may save you from the trouble and capacity cost implications of filing an insurance claim. Start by means of choosing hail-resistant roofing substances; many are rated with the aid of the UL 2218 general, with Class four being the maximum resistant. Regular preservation is also key—inspect your roof periodically for any signs of wear and tear and tear and deal with these problems promptly. Installing effect-resistant shingles may be a game-changer, as they may be designed to resist extreme climate conditions. Additionally, take into account running with a roofing professional who can recommend high-quality substances and techniques to your unique geographic place. Taking those steps not only protects your home but can also cause lower coverage premiums, as some organizations provide discounts for homes which can be much less prone to hail harm.

The Bottom Line:

Coverage can seem intricate on the subject of Does homeowners insurance cover hail damage to cars. In phrases of automobile insurance, if you have a coverage that consists of complete insurance, your coverage corporation ought to cover hail harm for your car. However, with house owners coverage, coverage will depend upon any exclusions to your policy.

If you have got hail harm to the roof or some other part of your private home and the harm is greater than cosmetic, it should be included below your well-known house owners coverage. However, some groups write exclusions into policies in sure areas which are extra prone to hail.

Familiarize yourself together with your coverage to make sure your coverage enterprise does not exclude hail damage. If you don’t like your contemporary coverage policy, you can save on-line and evaluate insurance fees with several companies for your place. Comparing charges will let you see which company offers the insurance you need at a rate you could manage to pay for.

References:

https://www.usnews.com/insurance/homeowners-insurance/does-homeowners-insurance-cover-hail-damage

https://www.tdi.texas.gov/tips/after-hail-or-windstorms.html

https://www.valuepenguin.com/hail-damage-homeowners-insurance

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

Filing an insurance claim for hail damage

Filing an insurance claim for hail damage