Life Insurance for Kidney Transplant Patients: Secure Future

Have you ever thought about what happens after a kidney transplant, especially when it comes to life insurance? It might seem a big and complicated topic, but it’s important. People who have gone through a kidney transplant have already shown a lot of courage and strength. Now, they face a new challenge: figuring out life insurance.

The big question is, how can someone with a kidney transplant find life insurance that understands their unique situation and offers them the protection they need? Let’s dive into this topic and find out how life insurance for kidney transplant patients can work for those on such a challenging journey.

Life Insurance and Kidney Disease: An Overview

Kidney disease is a prevalent condition that impacts approximately 1 in 10 Canadians, with the prevalence increasing annually, as reported by the 2019 Canadian Organ Replacement Register Annual Statistics. This condition manifests in various forms, each with distinct causes and ranging in severity from mild to severe, potentially culminating in kidney failure, also known as end-stage kidney disease. One of the challenges with kidney disease is its tendency to develop silently, often remaining undetected for years due to the absence of clear symptoms.

Generally, kidney diseases are categorized into two primary types: chronic and acute. Infections commonly trigger acute kidney disease, whereas the leading causes of chronic kidney disease (CKD) include diabetes and high blood pressure. The term “chronic” applies when the kidneys are impaired for a period extending beyond three months. While many instances of acute kidney disease can be effectively addressed with treatment, chronic forms of the disease are more likely to influence life insurance premiums.

| Stages | Normal, Category 1 | Mild, Category 2 | Moderate, Category 3 | Severe, Category 4 | Kidney failure, Category 5 |

| Share of kidney function | More than 60% | 45%-59% | 30%-44% | 15%-29% | Less than 15% |

| Symptoms | No symptoms | No symptoms | Early symptoms may occur and could include tiredness, poor appetite, and itching | Tiredness, poor appetite, and itching may get worse. | Symptoms may include severe fatigue, nausea, difficulty breathing, and itchiness. |

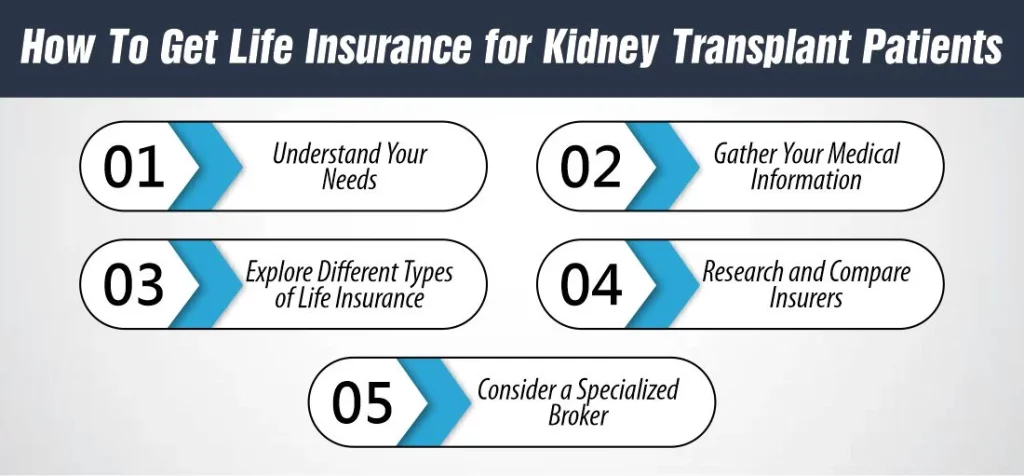

How To Get Life Insurance for Kidney Transplant Patients

Getting life insurance for kidney transplant patients can feel like navigating a maze. After all, undergoing a kidney transplant is a significant health event, and it can affect your eligibility for life insurance. But fear not! With the right approach and knowledge, it’s possible to secure life insurance. Here’s a simple guide on how to get life insurance for kidney transplant patients.

Understand Your Needs:

First, assess what you need from a life insurance policy. Are you looking to cover specific debts, provide for your family, or ensure your medical expenses are covered? Understanding your needs will help you determine the amount of coverage that is right for you.

Gather Your Medical Information:

Be prepared with detailed medical records regarding your kidney transplant, including the cause of your kidney failure, the date of the transplant, follow-up care, and any medications you’re taking. Insurers will review this information closely to assess your risk level.

Explore Different Types of Life Insurance:

Look into different types of life insurance policies. Understanding the differences between term, permanent, and guaranteed issue life insurance is crucial for kidney transplant patients.

- Term Life Insurance typically covers you for a set period, like 10, 20, or 30 years. It’s often less expensive than permanent life insurance but doesn’t offer cash value accumulation. For those who underwent a transplant, finding a term policy post-surgery may mean higher premiums due to the increased risk perceived by insurers.

- Whole Life Insurance includes types like whole life and universal life. These policies last a lifetime and usually have a cash value component, which can grow over time. While more expensive, they may be beneficial for younger kidney transplant patients who are looking for both insurance and investment components.

- Guaranteed Issue Life Insurance offers a way to bypass health screenings and medical exams. While accessible, it comes with higher premiums and typically offers lower coverage amounts. It might include a graded death benefit, which limits coverage for natural death in the initial years of the policy.

Some kidney transplant patients may find more success with a guaranteed issue life insurance policy, which does not require a medical exam. However, it may come with higher premiums and lower coverage limits. Term life insurance or whole life insurance might also be options, depending on your health and when you had your transplant.

Research and Compare Insurers

Not all insurance companies have the same policies regarding kidney transplant patients. Research insurers to find those with experience in covering high-risk individuals or those specializing in policies for people with pre-existing conditions. Comparing different companies can help you find the most favourable terms and rates.

How Much Does Life Isurance Cost?

Consider a Specialized Broker

A specialized insurance broker with experience in high-risk policies can be invaluable. They understand which insurers are more likely to provide coverage to kidney transplant patients and can guide you through the application process, increasing your chances of approval.

Why does a kidney transplant impact life insurance?

A kidney transplant significantly impacts life insurance for several reasons, mainly due to the increased health risks and potential complications associated with organ transplants. Here’s a deeper look into why a life insurance for kidney transplant patients premiums can be affected by this disease:

Increased Risk of Health Complications:

Kidney transplant recipients typically face a higher risk of health complications, both from the transplant surgery itself and from the lifelong need to take immunosuppressive medications to prevent organ rejection. These medications can increase susceptibility to infections and other health issues, raising the risk profile for insurers.

Potential for Organ Rejection:

Even with successful surgery, there’s always a risk that the recipient’s body will reject the new kidney. This risk persists throughout the life of the transplant, which can lead to additional surgeries, treatments, or even another transplant, further increasing the risk from an insurer’s perspective.

Underlying Health Conditions:

Individuals who require a kidney transplant often have underlying health conditions that led to kidney failure in the first place, such as diabetes or high blood pressure. These conditions can complicate the underwriting process, adding another risk layer for the life insurance company.

Long-term Survival Rates:

While kidney transplants can significantly improve quality of life and longevity, they also come with long-term health considerations that can impact life expectancy. Insurance companies consider these statistics when determining eligibility and pricing for life insurance policies.

Observation Period:

Many insurers require a waiting period after a transplant before considering offering coverage to ensure the transplant has been successful and the recipient’s health has stabilized. This period can vary but often lasts several years, during which the patient’s health and response to the transplant are closely monitored.

Varied Insurance Company Policies:

Different insurers have different policies and levels of comfort when insuring kidney transplant patients. Some may offer standard policies after a certain period post-transplant, while others might only offer policies with higher premiums or limited coverage options.

Given these factors, kidney transplant recipients looking for life insurance may face higher premiums, more restrictive policies, or difficulty obtaining coverage.

Can you get life insurance for kidney transplant patients:

Getting life insurance for kidney disease or as a dialysis patient is challenging but not impossible. Your options and the cost will significantly depend on your condition’s severity, overall health, and the type of insurance policy you’re considering.

For individuals with chronic kidney disease (CKD), term life insurance is a popular choice. It provides coverage for a specified period and typically offers higher death benefits at more affordable premiums than permanent life insurance options. Companies like Corebridge Financial (formerly AIG Life & Retirement) are highlighted for their competitive rates and favourable underwriting for people with conditions like heart disease and diabetes, making them a solid option for many life insurance shoppers, including those with kidney disease.

Insure Guardian is recommended for people on dialysis or with advanced kidney disease looking for guaranteed-issue policies. Guaranteed-issue policies do not require a medical exam for approval and offer smaller payouts than traditional term life policies. Still, they provide an option for those who might not otherwise be eligible for coverage.

The National Kidney Foundation suggests that insurance options may change as kidney disease progresses. For example, individuals who start dialysis or have a kidney transplant can apply for Medicare, which typically covers 80% of the cost of dialysis treatment and immunosuppressant medications after transplant.

Does Life Insurance Cover Kidney Failure?

Obtaining life insurance for kidney transplant patients can be challenging due to the increased health risks associated with the condition. Insurers often view applicants with kidney failure or chronic kidney disease (CKD) as high-risk, which can lead to higher premiums or denial of coverage under traditional term and permanent life insurance policies.

However, options like guaranteed issue life insurance may still be available, albeit at higher costs and with lower coverage amounts. These policies typically do not require a medical exam, making them more accessible to those with significant health issues, including kidney disease. When applying for life insurance, it’s crucial for individuals with kidney disease to fully disclose their health status and history, as this information will impact their eligibility and the terms of any coverage offered. Working with an insurance broker specializing in high-risk cases can help you navigate the complex landscape and find the most suitable coverage options.

Conclusion

Securing life insurance for kidney transplant patients symbolizes a step towards financial security and a testament to resilience and hope. Despite the complexities and potential challenges in obtaining coverage, the journey underscores the importance of advocating for one’s health and future.

It reminds us that everyone deserves the peace of mind that comes with knowing their loved ones are protected, regardless of their medical history. For kidney transplant patients, finding the right life insurance policy is more than a financial decision—it’s a declaration of strength, a commitment to life, and an embrace of the future with confidence and security.

FAQs

Can I get life insurance if I have a kidney transplant history?

Yes, obtaining life insurance with a kidney transplant history is possible, but it may involve thorough health assessments and potentially limited options. Insurers will consider your overall health and stability post-transplant when making their decision.

Will my kidney transplant history affect my life insurance premiums?

Yes, a history of kidney transplants can affect your life insurance premiums, often resulting in higher costs. Insurance companies view kidney transplants as an increased risk, which can influence the premium rates they offer.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.