Private Health Insurance for Travel Nurses: Find a Right Plan

Are you a travel nurse wondering about the best way to secure your health and well-being while on assignment? Private health insurance could be the answer you’re looking for. As a travel nurse, your work takes you to different locations, often far from home, making access to quality healthcare a top priority.But with so many insurance options available, how do you choose the right plan for your needs? In this guide, we’ll explore the importance of private health insurance for travel nurses and provide valuable insights into selecting the right plan. From understanding the key factors to consider and comparing different options to maximizing your coverage and ensuring peace of mind, we’ve got you covered.So, if you’re ready to find the perfect private health insurance plan for your travel nursing career, let’s dive in!

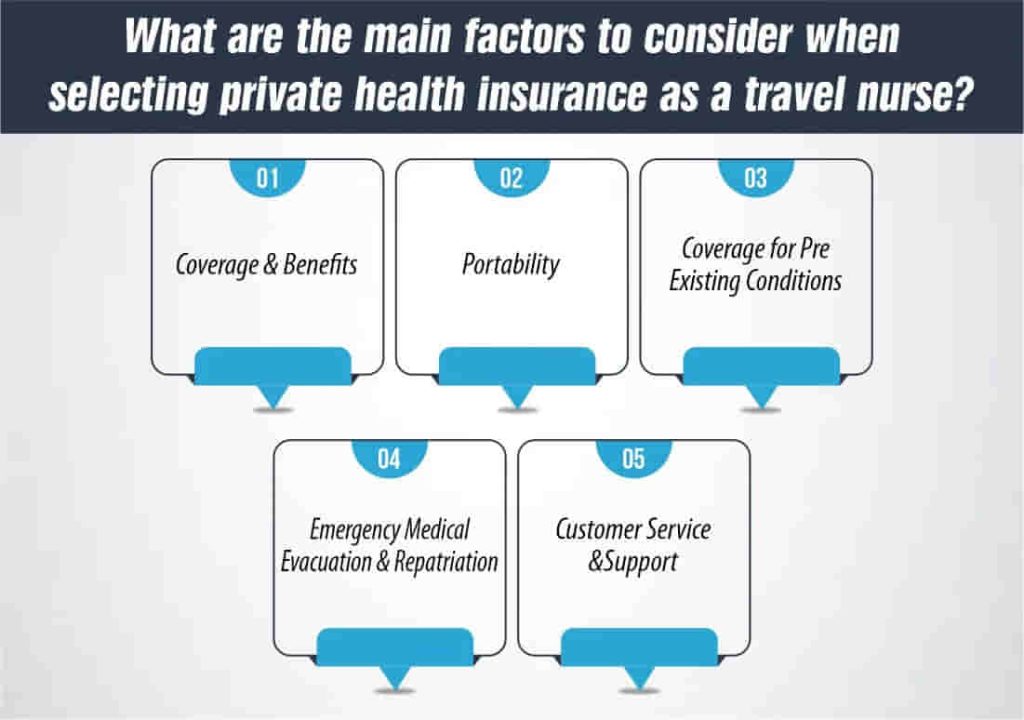

Traveling as a nurse on private pay comes with its own set of difficulties that you navigate around the different factors such as looking for the right health insurance plan that suits you. So, what are the main factors to keep in mind when selecting private health insurance for travel nursing?Here’s a breakdown:

Why is Private Health Insurance for Travel Nurses Essential?

Private health insurance is essential for travel nurses for several reasons. Firstly, it provides access to healthcare services wherever they are assigned, ensuring they can receive medical attention without worrying about network restrictions or coverage limitations. This is especially important for travel nurses who often work in different states or countries where their regular health insurance may not apply.Secondly, private health insurance for travel nurses offers peace of mind by covering unexpected medical expenses, including emergency medical evacuation and expulsion, which are crucial for travel nurses working in remote or unfamiliar locations.Additionally, private health insurance can provide coverage for pre-existing conditions, prescription drugs, and other healthcare needs that may not be covered by traditional plans, offering comprehensive protection for travel nurses throughout their assignments.How does Private Health Insurance for Travel Nurses differ from Traditional Plans?

Private health insurance for travel nurses differ from traditional plans in several key ways:Flexibility

Private health insurance plans for travel nurses are designed to be more flexible, allowing for coverage across different states or countries. This flexibility is essential for travel nurses who frequently change assignments and locations.Coverage for Travel-related Issues

These plans often include coverage for travel-related health issues, such as emergency medical evacuation and repatriation, which are not typically covered by traditional plans.Network of Providers

Private health insurance plans for travel nurses may offer a broader network of healthcare providers across different locations, ensuring access to quality healthcare wherever they are assigned.Customization

These plans can be customized to meet the specific needs of travel nurses, including coverage for pre-existing conditions, prescription drugs, and other healthcare services that may be required while on assignment.Cost

While the cost of private health insurance plans for travel nurses may vary, they are often more expensive than traditional plans due to the added benefits and flexibility they offer.What are the key benefits of having tailored private health insurance as a travel nurse?

Are you thinking about what makes tailored private health insurance a game-changer for travel nurses? This health insurance offers a variety of benefits specifically designed to address the unique needs of travel nurses. Here are some key advantages:Worldwide Coverage

Tailored plans often provide coverage worldwide, ensuring travel nurses can access healthcare services wherever their assignments take them, without worrying about network restrictions.Flexibility

These plans are designed to be flexible, allowing travel nurses to receive healthcare services wherever they are assigned, without worrying about network restrictions or coverage limitations.Peace of Mind

With tailored private health insurance, travel nurses can have peace of mind knowing that they are protected against unexpected medical expenses while on assignment.Access to Quality Healthcare: Private health insurance often provides access to a network of quality healthcare providers, ensuring that travel nurses receive the care they need, even in remote or unfamiliar locations. What are the main factors to consider when selecting private health insurance for travel nurse?

What are the main factors to consider when selecting private health insurance for travel nurse?

Traveling as a nurse on private pay comes with its own set of difficulties that you navigate around the different factors such as looking for the right health insurance plan that suits you. So, what are the main factors to keep in mind when selecting private health insurance for travel nursing?Here’s a breakdown:Coverage and Benefits:

Look for a plan that offers comprehensive coverage for medical services, including emergency care, hospitalization, and prescription drugs. Consider additional benefits such as dental and vision coverage.Portability

Choose a plan that is portable and can be used across different states or countries, allowing you to maintain coverage while on assignment.Coverage for Pre-existing Conditions

If you have any pre-existing conditions, make sure the plan provides adequate coverage for these conditions.Emergency Medical Evacuation and Repatriation

Consider whether the plan includes coverage for emergency medical evacuation and repatriation, which are important for travel nurses working in remote or high-risk areas.Customer Service and Support

Look for a plan with good customer service and support, including assistance with claims and access to a 24/7 helpline.How can Travel Nurses compare different Private Health Insurance Plans effectively?

Are you overwhelmed by the multitude of private health insurance plans available for travel nurses? Comparing these plans effectively is crucial to finding the right coverage for your needs. Here’s how you can do it:Coverage Options: Compare the coverage options offered by different plans, including benefits, exclusions, and limitations. Look for plans that offer comprehensive coverage for medical services, prescription drugs, and other healthcare needs.Network of Providers: Consider the size and scope of each plan’s network of healthcare providers. A larger network can provide you with more choices and greater flexibility in choosing healthcare providers.Cost: Compare the cost of premiums, deductibles, copayments, and coinsurance rates for each plan. Consider your budget and how much you can afford to pay out-of-pocket for medical expenses.Portability: Check whether the plan is portable and can be used across different states or countries. This is important for travel nurses who may be assigned to different locations.Coverage for Pre-existing Conditions: If you have any pre-existing conditions, make sure the plan provides adequate coverage for these conditions. Some plans may exclude coverage for pre-existing conditions or impose waiting periods before coverage begins.By comparing these factors, you can effectively evaluate different private health insurance for travel nurses plans and choose the one that best meets your needs as a travel nurse.What Coverage Options should Travel Nurses explore when considering Private Health Insurance?

When considering private health insurance, travel nurses should explore various coverage options to ensure they have comprehensive coverage while on assignment. Here are some key coverage options to consider:Medical Services: Ensure the plan covers essential medical services, including doctor visits, hospital stays, emergency care, and laboratory tests.Prescription Drugs: Look for coverage for prescription drugs, including both generic and brand-name medications, to help manage your healthcare costs.Preventive Care: Check if the plan covers preventive care services, such as vaccinations, screenings, and annual check-ups, to help you stay healthy and prevent illness.Mental Health Services: Consider coverage for mental health services, including counseling and therapy, as mental health is an important aspect of overall well-being.Dental and Vision Care: Look for plans that offer coverage for dental and vision care, as these services are often not covered by traditional health insurance plans.Emergency Medical Evacuation and Repatriation: Consider plans that include coverage for emergency medical evacuation and repatriation, especially if you are working in remote or high-risk areas.Travel-related Health Issues: Look for coverage for travel-related health issues, such as treatment for illnesses or injuries that occur while traveling, as well as coverage for emergency medical evacuation and repatriation.What steps can be taken to maximize the coverage with private health insurance for travel nurses?

Travel nurses can take several steps to maximize their coverage with private health insurance:Understand Your Policy

Thoroughly review your insurance policy to understand what is covered and what is not. Pay attention to coverage limits, deductibles, and copayments.Stay In-Network

Whenever possible, use in-network healthcare providers to avoid higher out-of-pocket costs. Check with your insurance company to find in-network providers in your area.Utilize Preventive Care

Take advantage of preventive care services, such as annual check-ups and vaccinations, which most insurance plans often cover at no cost.Keep Records

Keep detailed records of your medical expenses, including bills, receipts, and explanations of benefits (EOBs). This will help you track your healthcare spending and ensure you are being billed correctly.Use Telemedicine Services

Consider using telemedicine services for non-emergency medical issues. Many insurance plans offer telemedicine services, which can be a convenient and cost-effective way to receive medical care.By following these steps, travel nurses can make the most of their private health insurance coverage, ensuring they have access to quality healthcare services wherever their assignments take them.Conclusion

Finally, private health insurance particularly matters for travel nurses, guaranteeing them an all-covering package and the required stability during the term. It is advisable to contemplate the mentioned factors and compare alternative solutions to choose the right private health insurance plan. A plan which takes into account and meets your particular needs and offers coverage that will help you stay healthy and safe during your travels.FAQs

1- Can travel nurses purchase private health insurance plans that cover them internationally?

Yes, many private health insurance plans for travel nurses offer coverage internationally. Travel nurses need to verify that the plan they choose provides coverage in the countries where they will be working.2- Are there any restrictions on the types of healthcare providers travel nurses can see with private health insurance?

Some private health insurance plans have networks of healthcare providers, and seeing providers outside of the network may result in higher out-of-pocket costs. Travel nurses should check the network requirements of their plan and choose providers accordingly.3- Does private health insurance for travel nurses typically include coverage for routine medical check-ups and preventive care?

Yes, many private health insurance plans for travel nurses include coverage for routine medical check-ups and preventive care services. These services are essential for maintaining overall health and well-being.4- What should travel nurses do if they need medical care while traveling internationally?

Travel nurses should contact their insurance company immediately if they need medical care while traveling internationally. The insurance company can guide how to access care and ensure that the costs are covered by the policy.5- Can travel nurses add dependents to their private health insurance plans?

Yes, many private health insurance plans for travel nurses allow them to add dependents, such as spouses or children, to their coverage. Travel nurses should check with their insurance provider for specific details and costs associated with adding dependents to their plan.References:

https://apollo-insurance.com/best-health-insurance-for-travel-nurses/https://www.linkedin.com/pulse/choosing-best-health-insurance-travel-nurses-josh-boddie

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

What are the main factors to consider when selecting private health insurance for travel nurse?

What are the main factors to consider when selecting private health insurance for travel nurse?