Last Updated on: June 26th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Dermatology is playing a very useful role in treating and diagnosing the issues related to skin, hair, and nails. Unexpected rashes and active acne to some of the serious concerns like skin cancer, dermatological issues can affect anyone at any time. But most people are not sure that if their insurance policy will cover dermatology or not. It depends on a few things, like what kind of treatment you need and your health insurance plan.

Table of Contents

ToggleIn this easy guide, we’ll explain everything you should know about how insurance can help pay for skin care, which insurance plans are best for seeing dermatologists, and how to understand insurance rules so you don’t get unexpected bills.

Medical vs. Cosmetic Dermatology: What’s Covered by Insurance?

Before understanding what dermatology services are covered by insurance policies, it’s important to understand the difference between medical dermatology and cosmetic dermatology. This will play a big role in whether your treatment will be paid by insurance or you have to pay it of your pocket.

Medical Dermatology

Medical dermatology is usually covered by insurance and treats problems with your skin, hair, or nails that can affect your health. These are medically necessary conditions, so insurance usually helps pay for them, at least some of the cost. Here are some common examples:

- Acne

Because acne is a medical skin condition, insurance covers visits to diagnose and treat it. However, coverage can change depending on the condition. But it would be better to review your insurance policy to see what is included.

- Eczema

This is a skin condition generally covered by insurance because it causes itching, redness, and dryness.

- Psoriasis

A disease that causes thick, scaly skin patches. Insurance usually covers the treatment.

- Skin infections

Caused by bacteria, viruses, or fungi. Insurance usually covers the treatment.

- Rashes and allergic reactions

Skin irritation from allergies or other triggers. Insurance often covers diagnosis and treatment.

- Suspicious moles or possible skin cancer

Unusual spots that may need testing or removal. Insurance typically covers this.

How Much Does Life Isurance Cost?

- Hair loss

If linked to a medical condition like thyroid issues, insurance may cover the evaluation and treatment.

- Nail infections

Infections that make nails thick, discolored, or painful. Insurance usually covers the treatment.

Cosmetic Dermatology

Cosmetic dermatology is all about improving yourself. It’s not related to the health problems. The cosmetic treatments are considered optional, so insurance doesn’t pay for them. Here are some of the common cosmetic treatments;

- Botox

- Fillers

- Laser hair removal

- Skin tag or mole removal

- Chemical peels

Best Insurance for Dermatologist Visits: Top Providers

If the dermatologist visit is important for you, then you have to choose the right insurance plan that will give you benefits. Good insurance plans will let you visit a skin doctor without needing a referral and include many certified dermatologists in their network. They also help keep costs low with affordable copays and deductibles, and they cover both regular checkups and ongoing care for skin problems.

Here are some top insurance companies that offer excellent dermatology coverage:

Cigna: Covers many different skin treatments.

Blue Cross Blue Shield: Blue Cross Blue Shield has many doctors and hospitals to choose from. They also have good coverage for specialists who treat specific health problems.

UnitedHealthcare: Best for families who need skin doctors for both kids and adults.

Aetna: Known for low fees when you visit and easy access to specialists.

Kaiser Permanente: Has its skin doctors available at many places.

Types of Dermatology Treatments Covered by Insurance

Here are common types of dermatology treatments covered by insurance, assuming medical necessity:

| Treatment | Usually Covered by Insurance? |

| Skin biopsies | Yes |

| Acne treatment (moderate to severe) | Yes |

| Psoriasis and eczema management | Yes |

| Skin cancer surgery | Yes |

| Cosmetic Botox | No |

| Laser hair removal | No |

| Chemical peels (for acne scars) | Maybe (if medically necessary) |

| Wart removal | Yes (if painful/infected) |

| Mole removal | Yes (if suspicious or changing) |

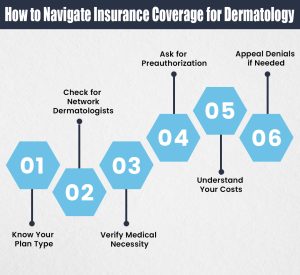

How to Navigate Insurance Coverage for Dermatology

You have to know about the dermatology benefits when getting the insurance, but sometimes it is confusing for you. But with simple steps, it will be much easier. Here you can understand how to use your insurance for skin care.

1. Know Your Plan Type

First thing, it is important to know what kind of health insurance you have. Different health insurance plans work in different ways when you see a skin doctor:

- HMO (Health Maintenance Organization): You need to get a note (referral) from your main doctor. You also have to see skin doctors who are part of your insurance plan.

- PPO (Preferred Provider Organization): This plan gives you more choices. You don’t need a note to see a skin doctor, and you can go to doctors outside the plan, but it might cost more.

- EPO or POS: These plans may have a mix of rules from both HMO and PPO types. It’s important to read the details of your specific plan.

2. Check for Network Dermatologists

Always use in-network providers to avoid out-of-pocket costs. Use your insurance portal to locate a dermatologist nearby.

3. Verify Medical Necessity

Have your primary care doctor or dermatologist provide documentation showing that the treatment is medically required.

4. Ask for Preauthorization

Some procedures require prior approval. Always check before scheduling to avoid denied claims.

5. Understand Your Costs

Learn about:

- Copays

- Deductibles

- Out-of-pocket maximums

This helps you estimate the cost of a dermatologist visit.

6. Appeal Denials if Needed

If your insurance denies coverage, you can file an appeal. Provide supporting documentation from your dermatologist.

Cost of Visiting a Dermatologist When You Don’t Have Insurance

Seeing a dermatologist without insurance will not be as expensive as you think. The cost can vary depending on the doctor, the location of the clinic, and why you’re going in. It’s a good idea to call the clinic before going and ask them about the prices.

You might also have to pay extra for things like:

- Lab tests or biopsies

- Prescription medications

- Treatments done in the office (like freezing a wart or injecting a cyst)

If you don’t have insurance, ask them if they offer a discount for paying yourself. Some clinics also have special rates or payment plans that don’t involve insurance.

Conclusion

Understanding insurance for skin doctors can be tricky, but knowing what is covered helps a lot. Most insurance pays for visits when you have a medical skin problem, but not for beauty treatments. Always check with your insurance to see what they pay for. You may need a referral or permission before seeing a specialist. It’s best to go to doctors in your insurance network. Good insurance helps when you have acne, need skin checks, or have long-term skin issues.

Need Dermatology Coverage?

Insure Guardian works with top insurers to get you the best plan for your skin health.

Get Your Free Dermatology Insurance Quote Now

FAQs

1. Is acne treatment covered by health insurance?

Yes, if your acne is severe and can cause physical or emotional distress, insurance will cover the acne treatment.

2. Are cosmetic dermatology procedures ever covered?

Yes, only if there is a medical reason, like removing a mole because it might be cancerous.

3. Do I need a referral to see a dermatologist?

Generally, with PPO plans, you don’t need a referral, but with an HMO plan, you often do.

4. Is teledermatology covered by insurance?

Yes, many insurers, including Cigna and Blue Cross, now cover virtual dermatology visits.

5. What if my dermatologist is out-of-network?

You may face higher out-of-pocket costs or no coverage at all. Always check your network first.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.