Ever wondered Is medical insurance the same as health insurance? You’re not the only one! It’s an easy mix-up to make, but here’s the simple truth: yes, they’re basically the same. Both are there to protect you from big medical bills. But why does this even matter, and how can understanding this help you pick the right plan for your needs? Let’s dive into what these terms cover and how they can keep you from diving deep into your savings when medical needs arise. Ready to clear up the confusion and find the best coverage for you?

Is medical insurance the same as health insurance?

Yes, medical insurance is generally the same as health insurance, although the terms can sometimes be used to focus on slightly different aspects of coverage. Both are designed to protect you by covering your medical costs like doctor’s visits, hospital stays, and treatments. The term “health insurance” is more commonly used in everyday conversation and tends to cover a broader spectrum, including preventive care to keep you healthy. Meanwhile, “medical insurance” might sometimes be used to refer specifically to the treatment and diagnosis of illnesses and injuries.

Do you have any specific needs or concerns that you’re thinking about when choosing between the terms or plans?

Health insurance:

Health insurance is a type of insurance that can pay medical and surgical charges. It enables you to cover the expenses of healthcare, from habitual doctor visits to extra-critical medical processes. Think of it like a protection net: if you suddenly fall ill or get injured, health insurance looks after the hefty bills so that you’re not beaten financially.

Why is it so critical, you ask? Well, without health insurance, treating a damaged leg or getting a surgical operation may cost you thousands of dollars out of pocket. It’s no longer just about the big emergencies, although. Health insurance can also help to cover the costs of health care, like vaccinations and everyday checkups, which might be key to retaining your fitness.

Do you have a medical insurance plan that works for you, or are you in search of that one?

Let’s cover what exactly health insurance is and how it works. Let’s dive in and cover the different types:

Individual Health Insurance Plan: It’s a kind of personal fitness safety net. It’s all about masking your medical wishes, from routine checkups to sudden emergencies.

Family Floater Health Insurance Plan: Perfect for households!

With this plan, everyone’s covered under one policy. It’s like bundling up your whole family in a cozy blanket of health protection.

Group Health Insurance Plan: Strength in numbers! This plan is usually offered through your job or a group you belong to. It’s affordable and provides solid coverage for you and your colleagues or fellow members.

Critical Illness Insurance Plan: This one’s a recreation-changer. If you are hit with critical contamination like most cancers or a coronary heart attack, this plan steps in to ease the monetary strain. It’s like having a superhero in your corner in the course of tough times.

Personal Accident Insurance Plan: Life is full of surprises, but your finances do not need to go through. Whether it’s a slip, a fall, or a car accident, this plan has your back. It’s like having a parent all of a sudden.

Maternity Health Insurance Plan: From pregnancy to childbirth, this plan includes you. It looks after all the medical expenses associated with bringing a new life into the world, so you may focus on the pleasure of becoming a figure without stressing about the payments.

Now that you know the basics, which type of health insurance sounds like the right fit for you?

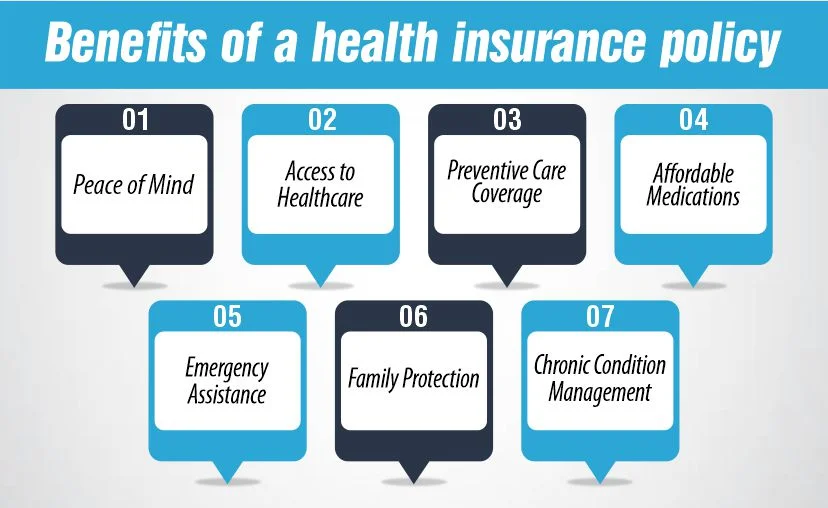

Benefits of a health insurance policy:

Benefits of a health insurance policy:

Peace of Mind:

Health coverage isn’t always preserving your health; it is also giving you peace of mind. Imagine now not having to fear about how you will pay for scientific payments in case you get ill or injured. That’s the form of safety medical health insurance presents.

Access to Healthcare:

Think about the last time you had to see a health practitioner. With medical insurance, you’ve got more options. It’s like having a menu of healthcare carriers to choose from, ensuring you locate the one that’s right for you.

Preventive Care Coverage:

Staying wholesome is crucial, and medical health insurance permits you to do just that. It covers such things as taking a look at the United States and vaccination, making it less complicated to stay on the pinnacle of your health without breaking the bank.

Affordable Medications:

Need prescription meds? Health coverage has your lower back there, too. It’s like having a discount card in your prescriptions, so you can get the medicines you need without disturbing approximately the price.

Emergency Assistance:

Life is unpredictable. However, health insurance will let you weather the storms. Whether it is sudden contamination or harm, knowing you’re protected could make all the distinction inside the international.

Family Protection:

Your family’s health matters, too, and medical health insurance can provide coverage for them as well. It’s like having a protection net for your family’s fitness and well-being.

Chronic Condition Management:

Dealing with an extended period of fitness trouble may be challenging. However, health insurance can assist in making it more conceivable. It covers ongoing scientific desires so you can focus on residing your lifestyles to the fullest.

So, when you add it all up, the benefits of having a health insurance policy are clear. It’s about peace of mind, saving money, accessing care, and protecting yourself and your loved ones. So why wait? Get covered and enjoy the benefits today!

What is Medical Insurance?

Medical insurance is your financial backup for health-related expenses. Think of it like a safety net that catches you when medical bills threaten to sweep your wallet clean. It covers costs like doctor’s visits, hospital stays, and surgeries, easing the financial pain that often comes with health issues.

Why consider getting medical insurance? Without it, you might find yourself footing a huge bill after something as simple as an unexpected injury or a necessary surgery. It’s not all about the emergencies, though—regular checkups and preventive care are also covered, helping you stay on top of your health.

Are you currently covered or thinking about picking the right plan to safeguard your health and wallet?

There are two claims under the medical insurance policy:

1- Cashless

2- Reimbursement

Cashless Claims:

With cashless claims, you can easily cover your clinical charges without paying prematurely. It’s like having a unique bypass—just show your coverage card, and your insurance organization takes care of the bill immediately. No trouble, simply easy sailing through the healthcare gadget.

Reimbursement Claims:

Reimbursement claims paint a chunk differently. You pay your medical charges out of pocket first, then ship the bills to your coverage employer for repayment. It’s like paying for dinner with pals and then getting your money again later. It might make the effort, but you’ll ultimately get reimbursed. So, whether you like the convenience of cashless claims or are okay with expecting compensation, there’s an alternative that fits your style.

Is medical insurance the same as health insurance? Health insurance vs medical insurance

Given below are the key differences between a health insurance policy and a medical insurance policy:

| Health insurance | Medical insurance |

| Provides broad coverage for a range of health-related expenses. | Provides coverage for specific medical expenses and illnesses. |

| Typically purchased by individuals or provided by an employer (group health insurance). | Typically purchased as an add-on to a health insurance policy. |

| Covers preventive care, doctor visits, and prescription drugs. | Covers expenses related to surgery, hospitalisation, and rehabilitation. |

| May require co-payments or deductibles. | May provide a lump sum payment to cover additional expenses and income loss during recovery. |

Health Insurance Vs. Medical Insurance: Eligibility Criteria

Health Insurance Eligibility Criteria

Health insurance eligibility criteria determine who can enroll in a health insurance plan. The requirements often depend on factors such as employment status, age, and income level.

Here are some common eligibility factors for health insurance:

Employment-Based Health Insurance

- Many people get health insurance through their employers.

- Eligibility typically depends on being a full-time employee.

- Some employers offer health insurance benefits to part-time employees as well.

- There may be a waiting period before new employees become eligible for health insurance.

Government Programs

- Government programs like Medicaid and Medicare provide health insurance to eligible individuals.

- Medicaid is based on income level and other factors, providing coverage to low-income individuals and families.

- Medicare is generally available to people aged 65 and older, as well as specific younger individuals with disabilities.

Marketplace Plans

- Health insurance marketplaces, also known as exchanges, offer plans for individuals and families.

- Eligibility for marketplace plans is based on factors such as income and household size.

- Subsidies may be available to help lower-income individuals afford coverage.

Medical Insurance Eligibility Criteria

Medical insurance eligibility criteria determine who can enroll in a medical insurance plan. Unlike health insurance, medical insurance focuses specifically on covering medical treatments and procedures. Here are some key eligibility factors for medical insurance:

Coverage for Medical Treatments

- Medical insurance provides coverage for specific medical treatments and procedures.

- Eligibility may depend on having a diagnosed medical condition or needing certain medical services.

Stand-alone plans or Add-On Coverage

- Medical insurance can be obtained as a stand-alone plan or as add-on coverage to a health insurance plan.

- Some health insurance plans offer medical insurance as an optional benefit for additional coverage.

Considerations for Eligibility

- When considering eligibility for medical insurance, it’s essential to assess your healthcare needs and budget.

- Compare the coverage options available and choose a plan that best meets your medical needs and financial situation.

Health Insurance Vs. Medical Insurance: How Does It Work?

Let’s discuss health insurance and medical insurance. They’re like two different sides of the same coin but with some important distinctions.

Health insurance is like your all-in-one package deal. It covers everything from regular checkups to big emergencies. Medical insurance, though, is more focused—it’s all about specific treatments and procedures.

When it comes to money, health insurance usually costs more because it covers a lot more ground. Think of it as the whole buffet. However, medical insurance might be cheaper upfront, though you might pay more for certain treatments later on.

Now, health insurance continues beyond doctor visits. It also covers things like dental checkups and therapy sessions. Medical insurance, on the other hand, is strictly about medical stuff—no frills.

When you sign up for health insurance, it often comes through your job or government programs. But medical insurance? You can get that separately or as part of a health insurance plan.

Is medical insurance the same as health insurance? So, how do you pick? Think about what you need. Do you want a full package or just the basics? Check out the details—like what’s covered and what you’ll pay—to find the best fit.

At the end of the day, both types of insurance are there to help you out when you need it. So, pick the one that works best for your situation.

Health Insurance Vs. Medical Insurance: What is Covered?

What a policy covers may vary according to the kind of package opted by the individual. There may be exceptions to what is covered by the policy and what is not based on this.

Let’s take a look at the scope of the health insurance policy.

- Hospital Costs for Inpatients: The policy covers hospital costs.

- Pre- and post-hospital costs: Post-hospital care includes ambulance services, initial treatment, and nursing.

- Ambulance Fees: If an ambulance is needed to transport the patient.

- Childbirth or Newborn Insurance: All pregnancy-related benefits in the hospital.

- Health Exams: Health exams are often subject to the policy.

- Daycare procedure: If you do not need to be hospitalized for more than 24 hours.

- AYUSH Benefits: All Ayush benefits are also subject to the policy.

- Mental Health Insurance: Some insurance companies also offer mental health insurance.

Let’s take a look at the scope of the policy for mediclaim.

The Mediclaim plan only covers hospitalization, accident-related treatment, and certain illnesses within the set limits.

Health Insurance Vs. Medical Insurance: How to Claim?

Understanding how to claim health insurance and medical benefits is essential for managing your healthcare expenses effectively. Here’s a step-by-step guide to help you through the process:

To claim health insurance:

- Fill out the application form completely.

- Have a doctor sign the medical certificate/form.

- Provide the original discharge report or card from the hospital.

- Gather all original receipts and invoices.

- Include prescriptions and investigation reports.

- For accidents, include a police report or Medico Legal Certificate (MLC).

And when it comes to claiming a medical Insurance:

- Organize all receipts, invoices, and medical reports.

- Request a claim form from your insurance company, which should contain policy documentation.

- Make copies of all original documents.

- Submit the documents through the appropriate TPA.

Conclusion:

Is medical insurance the same as health insurance? So, it’s clear! Medical insurance and health insurance are basically the same thing, just different names for the coverage that protects you from big medical bills. Whether you call it health insurance or medical insurance, what matters is that you have the coverage when you need it. Have you got your coverage all set, or are you still looking for the best plan? Either way, knowing this helps you make smart choices to keep yourself protected. Ready to take the next step towards peace of mind?

Refrences:

https://www.samhsa.gov/sites/default/files/health-insurance-how-do-i-get-pay-use-with-notes.pdf

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

Benefits of a health insurance policy:

Benefits of a health insurance policy: