Prepaid Funeral Plans vs Life Insurance: Financial Choices

When making your final arrangements, are you struggling to decide between prepaid funeral plans and life insurance? For you and your loved ones to have financial stability and peace of mind, you must make an informed decision between these two possibilities. Prepaid funeral plans have the benefit of securing the current rates for services you may require, giving you the freedom to customize every aspect of your last goodbye to your specifications.

Conversely, life insurance shows your beneficiaries a lump payment that they might utilize to pay for burial costs or other needs they might have. But how can you determine which course of action is most appropriate for your unique situation, financial objectives, and the legacy you want to leave behind? Let’s examine the advantages and factors to assist you in making a decision consistent with your ideals and offer solace and understanding to the people you care about.

Prepaid Funeral Plans vs life insurance

While prepaid funeral plans vs life insurance are separate instruments to handle the financial fallout from death, they have distinctive functions and unique advantages.

What are pre-paid funeral plans?

An individual can plan and pay for their funeral arrangements ahead of time with a prepaid funeral plan. With this kind of plan, one can choose all the details of their funeral, including the sort of ceremony, coffin, or casket of choice, and whether they want to be buried or cremated. Prepaid funeral plans offer a significant benefit in that they fix the costs of these services at current rates, potentially saving money by preventing inflation-related price rises down the road. In a moment of grief, it also releases the remaining family members from making tough choices and meeting financial responsibilities. These plans are directly tied to the funeral service costs and usually don’t contain a payout above and above these costs.

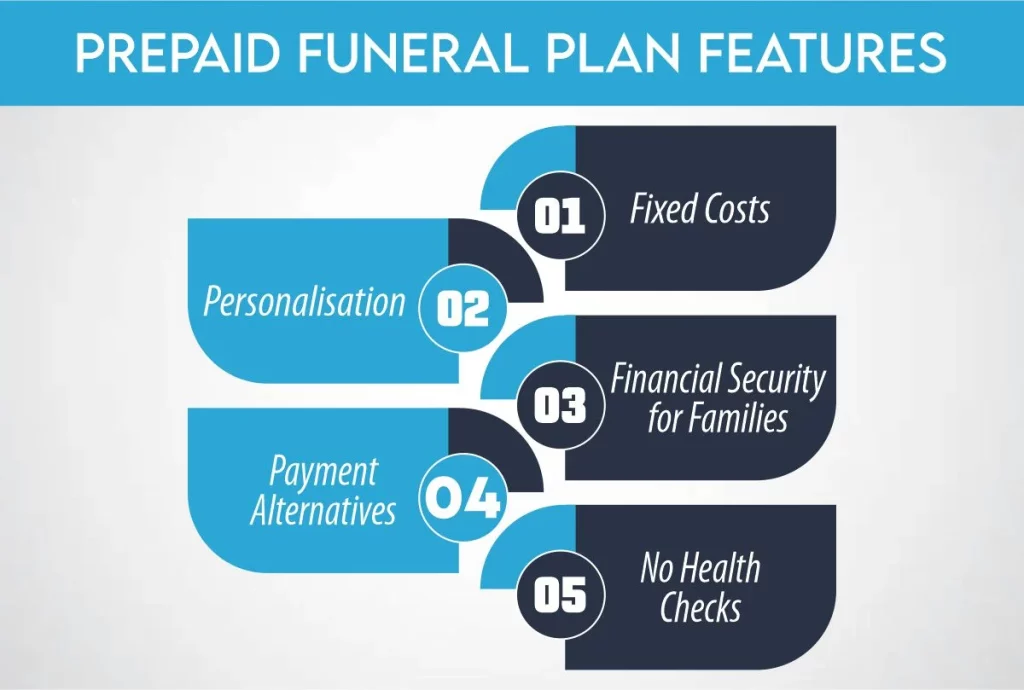

Prepaid Funeral Plan Features

Fixed Costs: By allowing you to pay for your funeral at the present rate, prepaid funeral plans help prevent future inflation and rising funeral service costs.

Personalisation: These plans frequently allow you to customize the funeral service, choosing the sort of ceremony, the casket or coffin you want, and whether you wish to be buried or cremated.

Financial Security for Families: Prepaid plans ease the financial strain on surviving family members during grief by prepaying for funeral expenses.

Payment alternatives: Many suppliers provide flexible payment alternatives, such as instalment plans or lump sum payments, which simplify adjusting to individual financial circumstances.

No Health Checks: Unlike many life insurance policies, prepaid burial plans often do not require medical exams or health questionnaires for qualifying.

What is Life Insurance?

Contrarily, life insurance is a more comprehensive financial instrument meant to give the policyholder’s beneficiaries financial stability in the event of their passing. Life insurance gives the named beneficiaries a predefined payout upon the policyholder’s death. This payment can be used for anything, such as paying for the deceased’s funeral, clearing debts, or financially supporting the deceased’s dependents. Unlike prepaid funeral plans intended only for funeral-related costs, life insurance allows flexibility in how the benefits are used. Life insurance policies come in different varieties, each with unique characteristics, advantages, and expenses, such as whole life, universal life, and term life.

How Much Does Life Isurance Cost?

Life Insurance Key Features

Financial Payout: In the event of the policyholder’s death, life insurance plans pay out a lump amount to specified beneficiaries. This money can be utilized for any reason, such as burial costs, debt repayment, or leaving a legacy.

Variety of policies: A wide range of life insurance policies are available, such as universal life, which offers variable benefits and premiums; whole life, which covers the full lifespan and includes a savings component; and term life, which is provided for a certain time.

Tax Benefits: A life insurance policy’s death benefit is often tax-free for the beneficiaries, providing a sizeable financial benefit.

Investment Potential: In addition to the death benefit, several forms of life insurance, such as whole and universal life policies, have an investment component that has the potential to increase in value over time.

Health-Based Eligibility: A policyholder’s health and life expectancy are considered when determining eligibility and premiums for life insurance. This can have an impact on the cost and scope of coverage.

What Kind of Costs is Usually Included in a Prepaid Funeral Plan?

Prepaid funeral plans allow people to plan and pay for their funeral in advance by covering the expenses and services related to end-of-life arrangements. These plans usually cover several costs, such as the funeral director’s fees, the price of the casket or coffin, the deceased’s transportation, and the body’s preparation before the funeral. Although the details might differ greatly amongst plans, many also cover the cost of a cremation or burial plot. Furthermore, specific plans may include choices for the ceremony, enabling a fully customized service regarding the location, music, and flowers. Nevertheless, it’s crucial to remember that the range of coverage varies greatly amongst providers and that some expenses, such as headstones or memorial markers and extra funeral fees, might not be covered. For this reason, you should carefully check the plan to ensure it fulfills your needs and expectations.

Differences between prepaid funeral plans vs life insurance

Making educated judgments on end-of-life financial planning requires understanding the distinctions between prepaid funeral plans vs life insurance. These are the main differences:

Purpose

Prepaid funeral plans are made expressly to pay for the expenses related to making funeral arrangements and services. They let people arrange and pay for their funeral in advance by concentrating on the specifics of the funeral itself.

Life insurance gives beneficiaries access to money in the event of the policyholder’s passing. The money is not restricted to funeral costs; it can be utilized for any purpose.

Cost-Recovery

Prepaid funeral plans pay for the funeral directly, including the cost of the casket, the burial or cremation, and the funeral service. Because these programs lock in current pricing, they can help prevent future price hikes.

After a policyholder passes away, life insurance pays out a certain amount to their beneficiaries, who may choose to use it for whatever, including burial expenses.

Payment and Premiums

Prepaid funeral plans entail making upfront payments for the funeral service, either in one large sum or via periodic installments. The price is set depending on the services chosen at the time of purchase.

Life insurance premiums are paid regularly for the duration of the policy (or until a specified age), and the policy’s terms—rather than particular funeral expenses—determine the payout amount.

Flexibility in Use of Funds:

Life insurance provides flexibility since beneficiaries can use the death benefit for any financial needs, including funeral expenses, debt repayment, or as a source of income.

Prepaid funeral plans do not allow for any flexibility in use; the funds are strictly used for the funeral services specified in the plan.

Benefits to Beneficiaries Financially

Life insurance results in a financial payout to beneficiaries, which can significantly support their financial needs after the policyholder’s death.

Prepaid Funeral Plans typically do not provide beneficiaries any direct financial benefit beyond the predetermined funeral expenses.

Here’s a comparison table based on the key features of Prepaid Funeral Plans vs Life Insurance:

| Feature | Prepaid Funeral Plans | Life Insurance |

| Cost Lock-In | Locks in current service prices, avoiding future cost increases. | Does not typically lock in costs for services, but premium rates can be fixed in term policies. |

| Personalization | Allows detailed pre-planning of funeral arrangements. | Does not cover funeral arrangements but allows for flexibility in beneficiary designation. |

| Financial Burden on Family | Reduces financial and emotional stress by pre-arranging and pre-paying for funeral costs. | Reduces financial stress by providing a death benefit but does not directly address funeral arrangements. |

| Payment Options | Often include flexible payment plans, from lump-sum payments to installments. | Premium payments can vary; term life has consistent premiums, while permanent life can have flexible premium options. |

| Health Requirements | Typically, it does not require a medical exam or health questionnaire. | It may require a medical exam or health questionnaire, especially for higher coverage amounts. |

| Cash Value | Does not include a cash value component. | Permanent policies may accumulate cash value that can be borrowed against or used in other ways. |

| Coverage Duration | N/A (not applicable as it’s service-based, not time-based). | Term life is for a specific period; permanent life is for the insured’s lifetime. |

| Beneficiary Flexibility | N/A (services are rendered to the deceased’s estate). | Policyholder can designate any individual or entity as a beneficiary. |

| Additional Features/Riders | Limited to funeral service-related options. | Can include riders like critical illness, accelerated death benefit, etc., for additional coverage. |

This table contrasts the two products on several key aspects, highlighting how Prepaid Funeral Plans are more focused on managing funeral-related specifics, while Life Insurance offers broader financial protection and flexibility for beneficiaries

Are Prepaid Funeral Expenses Tax Deductible?

Depending on the jurisdiction and particular tax regulations, pre-paid funeral expenditures may or may not be tax deductible. Since pre-paid funeral expenditures are typically considered personal expenses, they are not deductible on individual income tax returns. Nonetheless, there might be exclusions or particular situations where some of these costs qualify for tax advantages, particularly when paid for directly by an estate or in the context of estate planning. To learn about the relevant tax laws and any potential ramifications for pre-paid funeral plans, it’s crucial to speak with a local tax expert or financial counselor.

Should Funeral Bills Be Paid in Advance?

Funeral costs are a personal decision each person must make based on their values, interests, and financial circumstances. One advantage of prepaying for a funeral is that you can lock in the current service pricing, which can help you save money over time and guard against inflation. Additionally, it enables you to organize the specifics of your funeral, guaranteeing that your desires are carried out and sparing your loved ones the strain of having to make tough choices when they are grieving.

Nevertheless, there are factors to consider, like the funeral service provider’s financial standing and your potential to change your mind or relocate. Furthermore, if a plan is cancelled, its return may be incomplete. It’s critical to read contracts attentively, comprehend what is promised, investigate various payment methods, and consider how this decision fits into your overall estate and financial planning strategy. Make an educated choice that supports your objectives and gives you and your family peace of mind by speaking with financial and legal experts.

The ideal strategy is to have prepaid funeral plans vs life insurance. The decisions are often made for the survivors at a prearranged funeral. Although the work and decision-making are primarily finished, these can be altered. Pre-paid funerals frequently included choices for music, scriptures, and casket colour. Arguments and emotional overspending have disappeared.

Conclusion

Prepaid Funeral Plans vs Life Insurance serve complementary but distinct roles in financial and end-of-life planning. While Prepaid Funeral Plans provide a focused solution for managing and locking in the costs of funeral services, relieving families of financial and planning burdens, Life Insurance offers a broader financial safety net, supporting beneficiaries with a lump sum that can be used for a variety of needs, including but not limited to funeral expenses. Together, they can form a comprehensive approach to estate planning, addressing specific wishes and general financial well-being.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.