In today’s complex financial world, planning for the future is more critical than ever. Life insurance is a cornerstone of financial security, providing peace of mind for you and your loved ones. But how to choose the right option for yourself?

Navigating various options and determining the right coverage you need can be overwhelming. That’s where Allianz Life Insurance Calculator steps in to simplify the process. With this useful tool, you can get an estimate of your coverage needs within no time.

In this blog post, we will explore various aspects of the Allianz insurance calculator including its working, benefits, and many more.

What is the Allianz Life Insurance Calculator?

Allianz Insurance Calculator is a sophisticated yet user-friendly online tool designed to help individuals assess their life insurance needs accurately. It functions as a virtual financial advisor, leveraging advanced algorithms to analyze various factors such as age, income, existing assets, debts, and the desired coverage amount. By inputting this information, users receive personalized recommendations on the type and amount of life insurance coverage that best suits their specific circumstances.

Unlike generic calculators, the Allianz Life Insurance Calculator goes beyond basic calculations. It takes into account dynamic variables like inflation, interest rates, and life expectancy, ensuring that the recommendations provided are comprehensive and tailored to each user’s unique situation.

Moreover, Allianz Insurance Calculator empowers individuals to make informed decisions about their financial future, offering transparency, clarity, and peace of mind along the way. Whether you’re just starting your financial journey or reassessing your existing coverage, this powerful tool serves as a valuable resource for anyone seeking to secure their financial well-being.

How does Allianz Life Insurance Calculator Work?

Allianz Insurance Calculator operates through a simple and intuitive process, guiding users step by step to determine their optimal life insurance coverage. Here’s how it works:

1- Input Your Information

Users begin by entering basic details such as their age, income, existing assets, debts, and any specific financial goals or obligations they have.

2- Customize Your Preferences

The calculator allows users to tailor their inputs based on individual preferences and circumstances. This could include factors like desired coverage amount, preferred policy duration, and any additional riders or benefits they wish to include.

3- Analyze Your Data

Once all relevant information is provided, the calculator utilizes sophisticated algorithms to analyze the data. It takes into account various factors such as inflation rates, interest rates, and life expectancy to generate accurate projections.

4- Receive Personalized Recommendations

Based on the analysis, the calculator provides personalized recommendations for life insurance coverage. This includes details such as the type of policy (e.g., term life, whole life), the recommended coverage amount, and the estimated premium costs.

5- Review and Adjust

Users can review the recommendations provided by the calculator and make adjustments as needed. This may involve fine-tuning the coverage amount, exploring different policy options, or considering additional factors that may impact their insurance needs.

6- Make Informed Decisions

Armed with the insights provided by the calculator, users can make informed decisions about their life insurance coverage. Whether they’re looking to protect their family’s financial future, retirement plan, or reduce specific risks, the calculator permits them to navigate the complexities of insurance planning with confidence.

Overall, Allianz Insurance Calculator streamlines the process of determining life insurance needs, offering a user-friendly interface and personalized recommendations that simplify financial planning for individuals and families alike.

Allianz Life Insurance Review

Allianz Life Insurance, founded in 1896, is a well-established provider of annuities and life insurance products across the United States. The company boasts an admirable reputation for customer satisfaction, as evidenced by its low complaint index of 0.39 according to the National Association of Insurance Commissioners, significantly below the national average.

The primary life insurance offering from Allianz is the Allianz Life Pro+® Advantage, which exclusively provides fixed index universal life (FIUL) insurance. FIUL insurance is a form of permanent life insurance that offers lifelong coverage and follows cash value on a tax-deferred basis, tied to the performance of selected stock market indexes. Policyholders have the option to opt for either a fixed interest rate or an indexed interest rate that tracks market index performance.

Coverage options with Allianz range from $100,000 to $65,000,000, with premiums starting at a minimum of $25 per month. The Allianz Life Pro+® Advantage policy is available to individuals aged 0 to 80, and it offers coverage for smokers under specific risk classes. However, prospective policyholders must engage with an agent directly to apply for coverage, as Allianz does not provide online quotes for its life insurance products.

Overall, Allianz Life Insurance presents a compelling option for those seeking FIUL coverage with the backing of a reputable and customer-focused insurance provider. However, individuals interested in obtaining a policy should be prepared to engage with an Allianz agent to discuss their specific needs and obtain personalized quotes.

Allianz Life Insurance Ins and Outs

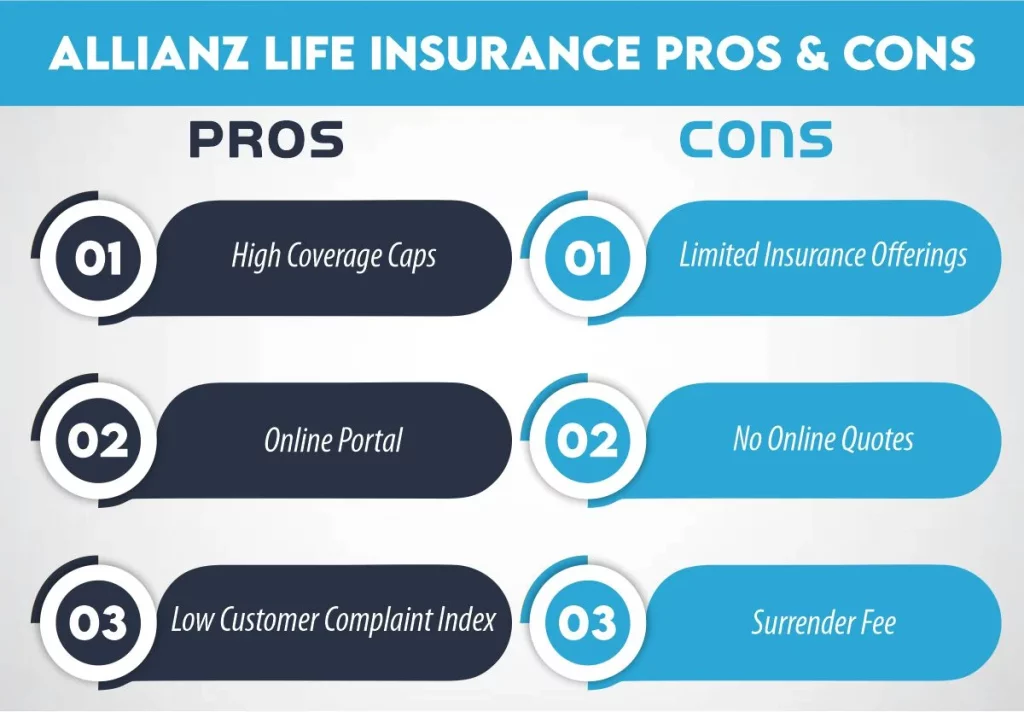

Allianz Life Insurance has several benefits and drawbacks:

Pros

- High Coverage Caps: Allianz offers high coverage limits, providing policyholders with the flexibility to obtain significant levels of protection.

- Online Portal: The company provides an online portal for policyholders, offering convenient access to manage their accounts, make payments, and access policy information.

- Low Customer Complaint Index: Allianz boasts a low customer complaint index, indicating a high level of customer satisfaction and positive experiences with the company’s services.

Cons:

- Limited Insurance Offerings: Allianz exclusively offers fixed index universal life insurance, which may not be suitable for individuals seeking other types of life insurance coverage.

- No Online Quotes: Prospective customers cannot obtain quotes online, requiring direct engagement with an agent to get personalized pricing information.

- Surrender Fee: Allianz imposes a fee if a policyholder requests a full surrender within the first 12 years of coverage, potentially resulting in financial consequences for early termination of the policy.

Is Allianz Life Insurance Right for You?

Whether Allianz is the right choice for you depends on your specific needs and preferences. Allianz’s fixed index universal life insurance policy is particularly suitable for older adults who are interested in building cash value that can be utilized for various purposes such as supplementing retirement funds or funding education expenses for children and grandchildren. Additionally, like other life insurance policies, it provides a death benefit for your family upon your passing.

However, if you’re seeking different types of life insurance coverage, such as term life insurance, Allianz may not be the ideal option as it exclusively offers fixed index universal life insurance. Moreover, if you’re operating on a budget and prefer a more short-term solution for your insurance needs, you may want to explore other alternatives.

Conclusion

In the end, the Allianz Life Insurance Calculator streamlines the complex task of determining life insurance needs. With personalized recommendations based on key financial data and consideration of dynamic variables like inflation and interest rates, it offers accuracy and ease in planning.

While Allianz Life Insurance stands out for its high coverage caps and customer satisfaction, its exclusive focus on fixed index universal life insurance and absence of online quoting may not suit all needs. For older adults seeking to build cash value for retirement or education expenses, Allianz’s offering may be ideal. However, individuals with different coverage preferences or budget constraints may need to explore some other insurers.

Frequently Asked Questions (FAQS)

1- Is using a life insurance calculator complicated?

Not at all! Allianz Life Insurance Calculator is designed to be user-friendly and intuitive. Simply input your information and preferences, and the calculator does the rest, providing personalized recommendations in minutes.

2- Will using the calculator cost me anything?

No, the Allianz Life Insurance Calculator is completely free to use. There are no hidden fees or charges associated with accessing the tool or receiving recommendations.

3- How often should I use the calculator to reassess my insurance needs?

It’s a good idea to revisit your insurance needs periodically, especially during significant life events such as marriage, the birth of a child, purchasing a home, or changing jobs. By regularly reassessing your coverage, you can ensure that it remains aligned with your evolving financial goals.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.