Largest Companies in Hawaii: A Guide to Protection & Security

Have you ever wondered who the largest insurance players are in Hawaii? Picking the largest companies in Hawaii is important, it has beautiful beaches and a unique culture. We’re here to take a closer look at the biggest names in insurance across the Hawaiian Islands.

These are the companies that many people in Hawaii trust to protect their homes, health, and futures. They’re not just big names; they’re part of the community, understanding what living in paradise means. So, let’s dive into the insurance world in Hawaii and find out which companies are leading the way and how they make life here even more secure and worry-free.

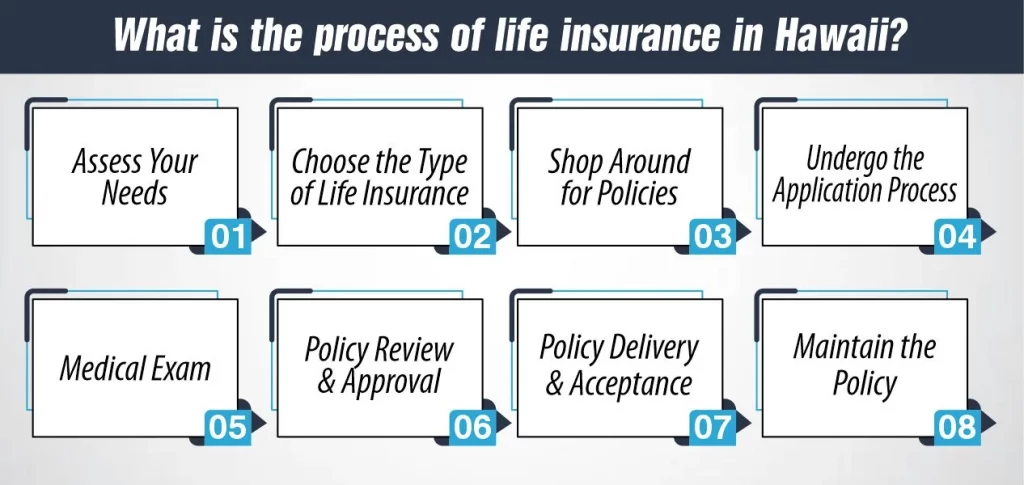

What is the process of life insurance in Hawaii?

The process of obtaining life insurance in Hawaii is similar to that in other parts of the United States. It generally involves several key steps:

- Assess Your Needs:

First, determine how much life insurance you need. This depends on your financial situation, debts, income, family responsibilities, and future goals. You might want enough coverage to pay off your mortgage, support your family’s lifestyle, cover education costs for children, and ensure your partner can retire comfortably.

- Choose the Type of Life Insurance:

Decide between term life insurance (which covers you for a set period) and permanent life insurance (like whole life or universal life, offering lifelong coverage and a cash value component). Term life is usually less expensive but temporary, while permanent life is more costly but has additional benefits.

- Shop Around for Policies:

Compare policies from different insurers. Hawaii hosts a range of insurance providers, so getting quotes from several companies is wise. Consider factors like premium costs, company reputation, policy features, and the insurer’s financial stability.

- Undergo the Application Process:

Once you choose a provider, you’ll fill out an application with questions about your age, health, lifestyle, job, and medical history. This information helps the insurer assess your risk and determine your premium rates.

- Medical Exam:

Most life insurance policies require a medical exam. The exam is typically straightforward and can be done at home or in the office. It usually involves measuring your height, weight, blood pressure, and sometimes blood and urine samples.

- Policy Review and Approval:

The insurer will review your application and medical exam results. This underwriting process can take a few weeks. They’ll then decide whether to approve your policy and at what premium rate.

- Policy Delivery and Acceptance:

You’ll receive your policy to review once approved. Make sure all the information is correct, and you understand the terms. You’ll sign the policy and pay the first premium if everything is in order.

- Maintain the Policy:

Keep your policy active by paying timely premiums. It’s also a good idea to review your insurance coverage periodically, especially after significant life events like marriage, divorce, the birth of a child, or significant changes in your financial situation.

How Much Does Life Isurance Cost?

Remember, life insurance laws and available products can vary slightly by state, so it’s a good idea to consult a local insurance professional in Hawaii who can provide tailored advice based on your specific circumstances and needs.

Market Share of largest companies in hawaii

| Rank in Hawaii | Company | Market share % in Hawaii |

|---|---|---|

| 1 | Pacific Life | 10.34 |

| 2 | New York Life | 6.18 |

| 3 | Lincoln Financial | 5.16 |

| 4 | John Hancock | 5.00 |

| 5 | Transamerica | 4.62 |

| 6 | Guardian | 4.51 |

| 7 | State Farm | 3.94 |

| 8 | Sammons Enterprises Inc. | 3.54 |

| 9 | Northwestern Mutual | 3.42 |

| 10 | Primerica | 3.42 |

Largest companies in Hawaii:

Here are 10 largest companies in Hawaii:- Pacific Life:

With over 150 years of industry experience, Pacific Life has been consistently recognized for its robust financial health and commitment to ethical business practices. They offer a wide range of products, including life insurance, annuities, and investment strategies, serving millions of customers with tailored financial solutions.

Why Choose: Customers choose Pacific Life for its strong financial foundation, comprehensive product offerings, and proven track record of fulfilling long-term commitments, making it a reliable choice for financial security and wealth management.

- New York Life:

New York Life stands as one of America’s largest mutual life insurance companies, boasting a remarkable history of over 175 years. The company is celebrated for its extensive portfolio, including term, whole, and universal life insurance, along with long-term care and retirement planning solutions.

Why Choose: Its mutual company structure prioritizes policyholders’ interests, offering unmatched customer-centric service and customizable life insurance plans to meet diverse individual needs.

- Lincoln Financial:

Lincoln Financial Group is recognized for its innovative approach to providing a comprehensive suite of financial services, including life insurance, annuities, and retirement solutions. Their focus on empowering customers to achieve financial independence has been a cornerstone of their service.

Why Choose: Lincoln Financial is chosen for its diverse financial products, strong commitment to customer empowerment, and personalized financial planning services, making it an excellent choice for holistic financial management.

- John Hancock:

John Hancock, a long-standing leader in the insurance industry, offers a diverse range of financial products, including life insurance, investment options, and retirement plans. The company is known for integrating wellness incentives into its products and promoting healthier lifestyle choices among its clients.

Why Choose: John Hancock’s unique approach to linking insurance products with health and wellness benefits makes it attractive for health-conscious people looking for more than just financial security from their insurance provider.

- Transamerica:

Transamerica has carved out a niche in the insurance sector, focusing on life insurance policies and financial services catering to individual and business needs. The company’s reputation is built on its commitment to helping people achieve a lifetime of financial security.

Why Choose: Clients favor Transamerica for its flexibility in policy options, commitment to customer service, and a strong legacy in helping individuals and families secure their financial futures.

- Guardian:

Guardian Life Insurance Company offers various products, including life, disability, and dental insurance. It stands out for its mutual structure, prioritizing the interests and well-being of its policyholders.

Why Choose: People choose Guardian for its wide range of insurance options, its policyholder-centric approach, and its excellent track record in stability and customer satisfaction, making it a trustworthy choice for long-term insurance needs.

- State Farm:

State Farm, renowned for its significant presence in the insurance market, offers a broad spectrum of insurance products, including life, auto, and home insurance. The company is celebrated for its customer-focused service and extensive agent network.

Why Choose: State Farm is often the go-to choice for those seeking a one-stop shop for all their insurance needs, backed by exceptional local agent support and a strong emphasis on customer relationships.

- Sammons Enterprises Inc.

Sammons Enterprises, a diversified holding company, has substantial interests in multiple insurance businesses. The company is known for its financial strength and innovative product offerings in the life insurance and annuity sectors.

Why Choose: Customers are drawn to Sammons for its financial robustness, diverse insurance offerings through its subsidiaries, and commitment to integrity and customer service.

- Northwestern Mutual:

Northwestern Mutual holds a prestigious insurance and wealth management position. The company is renowned for its exceptional financial strength, a wide range of life insurance products, and personalized financial planning services.

Why Choose: Known for its customer-centric approach, Northwestern Mutual attracts clients seeking personalized, long-term financial planning and consistent top-rated customer service.

- Primerica:

Primerica is distinct in its approach, focusing primarily on term life insurance and financial services for middle-income families. They stand out for their educational approach to helping clients understand financial concepts and products.

Why Choose: Primerica is often chosen for its focus on financial literacy, making insurance and financial services accessible and understandable to a broad audience, and its commitment to serving the middle-income market.

Key features of largest companies in Hawaii

| Insurance Company | Key Features |

|---|---|

| Pacific Life | – Diverse range of life insurance and annuity products.– Strong focus on investment and retirement solutions. |

| New York Life | – Comprehensive life insurance options.– Tailored financial planning services.– Mutual company benefits. |

| Lincoln Financial | – Wide array of financial products including life insurance, annuities, and retirement plans.<br>- Innovative product solutions. |

| John Hancock | – Integrates wellness incentives into policies.<br>- Wide range of investment and insurance products. |

| Transamerica | – Flexible life insurance policies.<br>- Focus on long-term financial security. |

| Guardian | – Broad product offerings including life, disability, and dental insurance.<br>- Policyholder-centric approach. |

| State Farm | – Comprehensive insurance options: life, auto, home.<br>- Extensive agent network and personalized service. |

| Sammons Enterprises Inc. | – Financial strength and diverse insurance offerings through subsidiaries.<br>- Focus on integrity and customer service. |

| Northwestern Mutual | – Customer-focused financial planning. – Range of life insurance products.<br>- Consistent top-rated customer service. |

| Primerica | – Specializes in term life insurance.<br>- Focuses on financial literacy and middle- income market.<br>- Educational approach to insurance. |

Conclusion

In conclusion, Hawaii’s landscape of insurance options is as diverse and rich as its natural beauty. From Pacific Life’s robust financial offerings to State Farm’s deep community roots, each of these largest companies in Hawaii brings something unique. Whether you’re looking for innovative products from Lincoln Financial, personalized services from New York Life, or the middle-market focus of Primerica, there’s a provider tailored to every need and budget. Navigating these options can be much like a journey through the islands – full of variety, opportunity, and the promise of finding something that fits your life perfectly. Remember, choosing the right insurance partner in Hawaii isn’t just about policies and premiums; it’s about finding a guardian for your future in a place where it shines as brightly as the sun over the Pacific.FAQs

– Who is the largest insurance carrier in Hawaii?

As the oldest and largest property and casualty insurer headquartered in Hawaii, First Insurance Company of Hawaii, Ltd. (FICOH) has safeguarded Hawaii’s residents and businesses since 1911.– Is State Farm or Progressive bigger?

According to the National Association of Insurance Commissioners (NAIC), Progressive is the third-largest auto insurance provider in the U.S., behind State Farm and Geico. The company holds 13.7% of the market share and wrote over $35.8 billion in auto insurance premiums in 2021.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.