Navigating the Life Insurance Medical Exam: Everything You Need to Know

Last Updated on: March 3rd, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Life insurance plays an essential role in financial planning since it provides emotional comfort and financial security for those you love. The requirement for medical testing tends to produce feelings of anxiety combined with a sense of uncertainty in potential candidates. The complete walkthrough in this guide reveals every critical detail to help you handle your life insurance medical examination confidently.

What is a Life Insurance Medical Exam?

Life insurance medical examinations serve as a fundamental component of the underwriting procedures. A licensed medical professional who works as either a paramedic or nurse conducts this health assessment on behalf of the insurance company. The medical assessment works to determine your current health standing while evaluating potential future health risks. The evaluation enables insurance companies to accurately assess their exposure to risk before issuing policies. The exam consists of fundamental assessments including blood pressure checks, blood and urine examinations, and potentially includes electrocardiogram (ECG) testing for heart health analysis. Your complete wellness profile becomes clear to insurers through this in-depth inspection.

Why a Life Insurance Medical Exam is Important

Insurance firms base their operation on the practice of risk measurement. A medical exam functions as an essential instrument to supply crucial health information for risk analysis purposes. Your insurance provider establishes precise premiums based on the information they obtain from risk assessment of your health profile. Both the insurer and policyholders achieve mutual benefits because premiums reflect actual health risk levels accurately. Insurance companies need medical exams to evaluate health risks accurately since unknown risks would force higher premium costs for all policyholders. Risk evaluation accuracy establishes a fundamental requirement to protect both insurer fairness and policyholder equity in the insurance arrangements.

What Life Insurance Policies Require a Medical Exam?

Medical exams become necessary for both term life and whole life insurance policies, which also involve high death benefit amounts. These policies provide sizeable financial protection, which insurance companies need proper health assessments to handle their risk exposure. A death benefit size larger than average will make medical examinations more likely to be demanded by insurance providers. Insurers need this requirement to precisely determine the risks involved with delivering substantial monetary protection.

Types of Life Insurance Policies That Don’t Require a Medical Exam

For those seeking a quicker and simpler process, no-medical exam life insurance options offer an alternative. Simplified issue and guaranteed issue policies are examples of such options. However, these policies often come with higher premiums and lower coverage amounts compared to traditional policies. They are designed for individuals who may have difficulty qualifying for traditional policies due to pre-existing health conditions or other factors. While they offer convenience, it’s important to weigh the trade-offs in terms of cost and coverage.

What You Should Expect During a Life Insurance Medical Exam

The examination process remains straightforward throughout the process. You can select the appointment time at a convenient place, or the examiner can perform it at your residence or business. The examiner performs tests that include obtaining medical records from you while also measuring height and weight and analyzing blood pressure, as well as acquiring blood and urine specimens. An ECG test may be conducted by the examiner to examine your heart health. Being truthful is essential when the medical assessment occurs. The exam progresses smoothly when you give honest answers regarding your lifestyle, combined with your medical history, together with details about your family health. A complete picture of your health depends on accurate factual information when sharing details with the insurer.

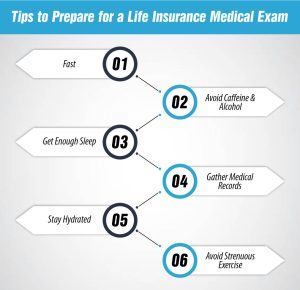

Tips to Prepare for a Life Insurance Medical Exam

Proper preparation can significantly impact your exam results. Here are some practical tips:

- Fast: Avoid eating or drinking anything other than water for 8-12 hours before the exam.

- Avoid Caffeine and Alcohol: These substances can affect your blood pressure and heart rate, leading to inaccurate readings.

- Get Enough Sleep: Adequate rest can help ensure accurate readings and reduce stress levels.

- Gather Medical Records: Have a list of your medications, medical conditions, and past treatments readily available.

- Stay Hydrated: Drinking plenty of water can make blood draws easier and improve overall circulation.

- Avoid Strenuous Exercise: strenuous activity before the exam can skew your results and affect your blood pressure.

Will the Insurer Check My Medical Records if I Apply for Life Insurance?

Insurers maintain a requirement to receive access to your medical records when they perform underwriting assessments. As part of their underwriting obligation, insurers will request authorization for them to receive your doctor’s records. Your medical record review enables the insurer to validate the application information and acquire full knowledge of your past health conditions. Transparency is key. Medical history transparency leads to problem-free underwriting because it prevents future complications.

How to “Pass” a Life Insurance Medical Exam?

During a life insurance medical exam, the traditional passing or failing system does not exist. Customers need to offer real health data and prove their ability to comprehend their medical situation. The benefits of living healthily remain constant yet they do not directly result in particular test outcomes. People with persistent health issues must show proper evidence of treatment while keeping their conditions in good control. Give the examiner both the whole truth and offer all essential facts during testing.

How Much Does Life Isurance Cost?

Can I “Fail” a Life Insurance Medical Exam?

The insurance policy rates will be affected by the exam results, yet the insurer’s decision will not be binary. The exam results will determine whether you receive standard rates, higher rates, or if your policy faces complete denial. When insurance denies your policy, you can appeal the decision and consider alternative coverage options. A company denial does not represent universal denial because insurance providers make different assessments. You should submit your application to diverse insurance providers since their underwriting policies differ from each other.

Frequently Asked Questions (FAQs)

What happens if my blood pressure is high during the exam?

Insurers recognize that the elevated blood pressure measurement could have resulted from stress conditions. Medical insurers can request that you take another blood pressure test while also requesting additional medical information from your doctor.

Can I retake the medical exam if I don’t like the results?

Under specific conditions, the examination board can allow retakes in the case of technical difficulties which occurred during the first test session.

How long are life insurance medical exam results valid?

Each insurance company determines a different time limit for results validity, which ranges from 6 to 12 months.

Does smoking affect my life insurance medical exam results?

Yes, smoking significantly impacts premiums. The assessment of nicotine content in blood tests determines whether an insured person falls into the smoking or non-smoking category.

Will my family history affect my life insurance medical exam results?

His family history is taken into account, but his current state of health remains the most crucial factor.

What medications will affect my life insurance medical exam?

All medications should be disclosed. Substances used for serious condition therapy will modify research outcomes.

How do I get a copy of my medical exam results?

Customers have the right to obtain medical records by contacting their insurance provider or examining a physician while following HIPAA requirements.

What if I have a pre-existing condition?

The evaluation process for pre-existing conditions takes place one person at a time. It doesn’t automatically mean denial.

Get a Life Insurance Quote

Ready to take the next step? Getting a life insurance quote is a simple way to explore your options. Click here to get a quote and find the right coverage for you and your family.

Conclusion

Customers need to know that the medical exam required for life insurance coverage follows standardized procedures. Your understanding of the upcoming procedure combined with proper preparation will help you handle it effectively. You should focus on giving reliable data while obtaining financial security that benefits both you and your family.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.