Accidental Fuel Contamination Insurance Claim: A Comprehensive Guide

Last Updated on: September 18th, 2024

- Licensed Agent

- - @InsureGuardian

In this blog, you will learn:

- What accidental fuel contamination is and how it happens.

- The consequences of fuel contamination for vehicles and machinery.

- How accidental fuel contamination insurance coverage works.

- Steps to file an accidental fuel contamination insurance claim.

- The importance of providing detailed documentation for claims.

- Common challenges when making fuel contamination claims.

- Tips to ensure a successful insurance claim process.

- Faqs related to accidental fuel contamination insurance claim

Have you ever wondered what happens if fuel contamination damages your vehicle or machinery? Accidental fuel contamination insurance claims are becoming more and more common as the use of fuel additives increases. While fuel additives are usually there to improve your car’s performance, if you don’t handle them properly, they risk causing problems. Understand the procedure and what you can do to increase your chances of success if you have a gasoline contamination insurance claim.

Some service providers can assist you, but it’s imperative that you have a rudimentary knowledge of insurance and how to file a claim. This will help you ease the process and allow you to have the right policy.

Table of Contents

ToggleAccidental Fuel Contamination Explained

You know how aggravating it becomes when your car breaks down because of poor gas if you’ve ever experienced that. Harmful gas can cause problems, from engine knocking to stalling. And it does not only affect your car – deadly gas can ruin your whole day.

But what exactly is terrible gas? How can you tell whether you have it? Accidental fuel contamination is the term used to describe when something other than gasoline gets into your fuel tank. This can be anything from water to diesel fuel.

Contamination can happen at the gas station if your pump has been used to dispense other fuel types. A fuel leak into your automobile’s engine may also result from an outdated or broken fuel tank.

The best thing to do if your fuel gets contaminated is to have an expert examine your car. They’ll be able to identify whether you have rotten petrol and can assist you in getting rid of it.

Here are some steps you may do in the interim to try to clean your gasoline tank:

- Drain the tank and refill it with fresh gas.

- Add a fuel additive to your tank. This can help break down any contaminants and help keep your engine clean.

- Run your car for a while and see if the problem goes away. If it does, the contamination was likely minor, and your vehicle should be acceptable.

- Have your automobile checked out by a mechanic if the issue continues.

Although unpleasant, rotten petrol is hardly the end of the world. With a little effort, you can get rid of it and drive your car again.

How Much Does Life Isurance Cost?

How to File an Accidental Fuel Contamination Insurance Claim

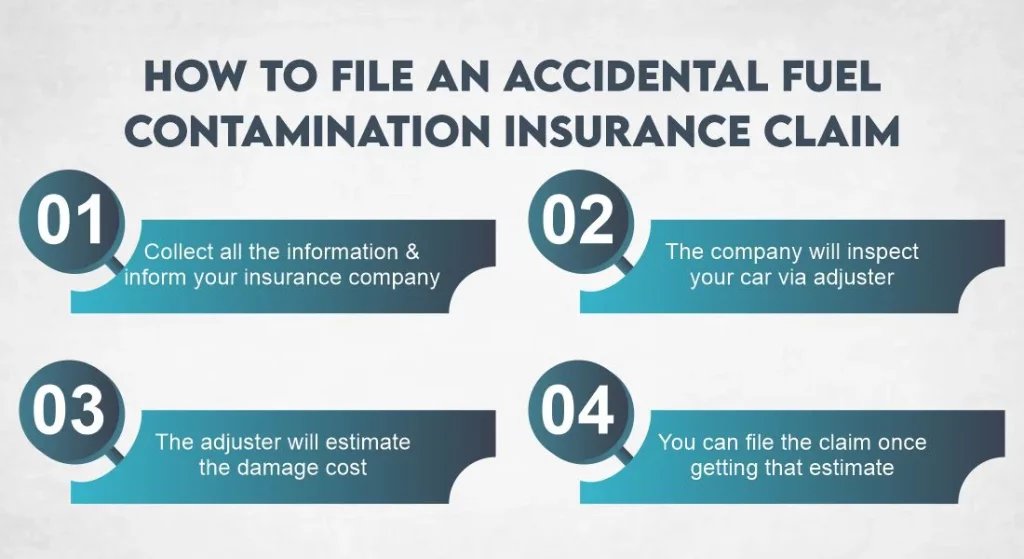

Filing a claim for accidental fuel contamination coverage is a simple process:

Collect Information and Inform Your Insurer: Note when and where the incident happened, the type of fuel contamination, and actions taken. Document everything comprehensively to support your claim.

Quickly tell your insurance company about the incident. Share the details for a smooth start to the claims process.Vehicle Inspection by Adjuster: An adjuster will check your car for damage due to fuel contamination. They’ll take pictures and gather information to determine coverage.

Estimate Damage Cost: The adjuster calculates the cost of repairs or replacements needed to restore your vehicle.

File the Claim: Once you get the estimate, formally file the claim. Submit required documents, including the adjuster’s report and incident details.

Follow these steps for a systematic approach, ensuring a smooth resolution and helping recover costs for your vehicle damage.

Overview of Accidental Contaminated Fuel Insurance Claim

The first step in filing an accidental contaminated fuel covered by insurance is to contact your insurance company. You’ll need to provide them with some basic information about what happened, such as when and what damage occurred. A list of any repairs performed to your car due to the pollution should also be kept.

Your insurance provider will send an adjuster to look at your car once you’ve contacted them. The adjuster will look for any damage that has been caused by the contamination and will also take pictures. They’ll interrogate you about the event and how it happened.

The adjuster will give you a report following their inspection of your car. This report will include a detailed breakdown of the damage found and a repair cost estimation. If you agree, you must sign the information and return it to the insurance company.

If you disagree with the report, you can elect to have your vehicle evaluated by an independent appraiser. In addition to giving you their estimate of the cost of repairs, the appraiser will search for the same damage that the adjuster did. The choice of using the insurance company’s or the appraiser’s estimate is yours.

Once you have chosen an estimate, you must contact a reliable repair company to fix your car. Finding a shop with experience with fuel contamination repairs is essential. To ensure that your vehicle is set correctly, the shop must adhere to the instructions given by the insurance provider.

You must return your car to the insurance provider when the repairs are finished so they may assess them. After that, the insurance provider will send you a cheque for the price of the repairs. It’s important to remember that it might take a few weeks.

Tip: Take clear photos, keep fuel receipts, and save all repair documents to build a rock-solid case for your insurance claim.

Types of Claims

There are two types of claims that you can make under an accidental fuel contamination insurance policy: First-party and third-party.

With a first-party claim, you claim your own insurance company. This kind of claim is typically filed to pay the expense of repairing or replacing machinery harmed by unintentional fuel pollution.

With a third-party claim, you make a claim against another party, such as the supplier of the contaminated fuel. This kind of claim is typically brought to recover losses sustained as a result of the contamination, such as the price of repairing a car that was harmed by tainted fuel.

Accidental fuel contamination insurance claim process

When your car suffers fuel contamination, it can be a costly and stressful experience. If you have fuel contamination insurance, you can make a claim to help cover the costs of repairs. You need to know here about the fuel contamination insurance claim process.

First, inform your insurance provider that you have experienced gasoline contamination. You will need to provide them with specific fundamental details, like your policy number, the occasion of the occurrence, and a succinct account of what happened.

Next, your insurance company will likely send an adjuster to inspect your car. They will evaluate the damage and estimate the cost of repairs. You may file a claim with your insurance provider once you receive an estimate.

Be sure to keep all receipts and documentation related to the incident and the repairs. To process your claim, your insurance company will require this information.

When lodged, your insurance provider will examine your claim and decide how much they will pay you in compensation. Assuming everything is in order within a few weeks, you ought to get your compensation cheque.

Contact your insurance company if you have any questions about the claims process. They will help you navigate the procedure and receive your due payment.

Things to remember…

- Adding the wrong fuel can damage the engine, so you have to release the fuel oil

- Usually, insurance does not cover misfuelling expenses

Benefits of Accidental Fuel Contamination Insurance

You want to ensure you have the finest possible defense for your car against any potential mishaps or harm. That’s why having accidental fuel contamination insurance in place is crucial if you ever need to make a claim.

There are many benefits to having this type of insurance, which include:

Cost-of-repair Coverage: If unintentional gasoline contamination causes damage to your car, your insurance will pay for the repairs. As a result, you won’t have to pay out of pocket for any necessary repairs, which may save you a significant sum of money over time.

Rental Car Expense Coverage: If your automobile needs to be repaired due to damage, your company will reimburse you for the expense of a rental car. This might save your life if you depend on your vehicle to go about it.

Towing Expense Coverage: If your car needs to be towed after damage, your insurance will pay for it. Due to the high cost of towing, doing this might help you save a lot of money.

Cost of a Replacement Vehicle Coverage: If unintentional gasoline contamination causes your car to be written off, your insurance will pay for the price of a new car. Since replacing a vehicle can be highly expensive, this might be a huge relief.

Peace of Mind: Knowing that you have insurance in place in case of accidental fuel contamination can give you peace of mind. If your car is destroyed and you don’t have insurance, the situation will relatively stress you. This information might be very reassuring.

Although unintentional gasoline contamination can be a significant issue, it’s crucial to know that you’re protected in case it ever affects you. Having insurance in place may assure you that you and your car are covered that you need.

Is contaminated fuel covered by auto insurance?

Auto coverage doesn’t mechanically cover mechanical breakdowns, but if your car meetings troubles due to infected gas, your complete coverage may also provide the wished protection. Basic legal responsibility insurance might not help in this situation, because it simplest covers damages to others in an accident, not your personal car. Crash insurance won’t apply considering your car wasn’t hit, however comprehensive insurance handles sure non-collision occasions.Comprehensive insurance usually includes robbery, fireplace, glass breakage, and vandalism, with extra conditions depending for your coverage terms. To confirm insurance, consult your insurance agent, providing information about the gasoline difficulty. Some insurers can also accept claims for infected fuel, even as others might give with policy exclusions. Be organized to share information about in which you got the gas and proof of infection.Before creating a claim, test restore expenses together with your dealer. If the prices are decrease than your deductible, it is extra low-priced now not to file a declare. Comprehensive claims typically do not impact pre-planned future costs, but in the event that they do, take into account exploring other insurers. If you can not make a complete claim, explore the possibility of a declare with the gas supplier, especially in the event that they issued a don’t forget. Most suppliers offer data on their websites about claims techniques, requiring documentation like receipts and restore payments for handling claim questions.Will Insurance Cover DEF in Diesel Tanks?

Typically no, your insurance coverage will not cover DEF in diesel tanks. The reason for this is DEF is not a cheap repair and you will be shocked when the mechanic gives you the bill. However, that massive bill will not be covered by your accidental fuel contamination insurance claim. You will have to foot the bill by yourself.Does def float or sink in diesel?

Diesel and diesel exhaust fluid (DEF) have different densities, causing diesel to float on top of DEF in the tank. It’s extremely important to note that diesel is less dense than DEF. While the physical separation occurs due to their clear densities, it’s essential to be careful as even small amounts of diesel can possibly harm the vehicle’s exhaust system. If any fluid other than DEF is accidentally introduced into the DEF tank, immediate action is necessary. Contacting the vehicle manufacturer or maintenance provider quickly is recommended, and driving the vehicle should be avoided to prevent potential damage. This underscores the importance of maintaining the purity of DEF in its designated tank to ensure the proper functioning of the vehicle’s emission control system.Conclusion

Managing an insurance claim for unintentional gasoline contamination can be challenging and frustrating. All gasoline contamination incidents and associated costs should be recorded and kept on file. When filing a claim, it’s also crucial to comprehend the insurance policy and have all the required paperwork on hand. The best outcome for an insurance claim involving unintentional gasoline contamination will get coverage by following these guidelines.FAQs

1- Is contaminated fuel covered by insurance?

The use of tainted fuel is dangerous for vehicles and leads to many expenses on the replacement of parts and time consuming. It is crucial to get acquainted with the insurance cover of contaminated fuel to find out ways to be protected by securing some financial safeguard in the event of such mishap. Some of the areas where policy terms should be reviewed include; proper care of vehicles, maintenance of the vehicles and being cautious when refueling the vehicles with fuel.2- Does car insurance cover contaminated fuel?

Damage due to mechanical breakdown is not covered under automobile insurance; however, the problem with your car is that the fuel is contaminated and therefore if you have comprehensive coverage in your car insurance policy then you can claim it.3- Does Progressive cover fuel contamination?

Like State Farm, Progressive’s comprehensive coverage generally protects against damage from contaminated fuel.4- Does insurance cover def in diesel tanks?

DEF in diesel tanks is an expensive repair and you will probably be surprised by the final bill the mechanic gives you. Many automobile insurance policies do not pay for what they refer to as ‘misfuelling.’ In other words, it makes no difference whether you fill your diesel tank with gasoline, DEF, or any other substance. You will probably have to pay for it.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.