Hearing Aids: A Complete Guide to Hearing Loss Solutions

Last Updated on: February 27th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Key Takeaways

- Hearing devices will help you improve hearing ability, communication, and enhance quality of life.

- There are multiple types available for hearing devices: BTE, ITE, ITC, CIC, RIC/RITE, digital, and Bluetooth-enabled.

- Affordable and OTC options make hearing devices making it a good option for mild hearing loss.

- Holistic hearing loss management includes technology, therapy, and ongoing support.

Hearing is consider as a very important sense, and indeed it is, but there are million of people all around the world who have trouble with this sense as they can not hear properly. Hearing aids are small devices that are available to help people to hear better and making it easier for them to talk to other without any problem and enjoy their life even more. Nowadays there are so many types of hearing aids, these hearing aids are affordable and smart. In this article, we will look at what hearing aids are, the different types, their benefits, why you may need to see a specialist, and some of the best hearing devices you can get today.

Table of Contents

ToggleUnderstanding Hearing Loss and the Need for Hearing Devices

Hearing loss can occur slowly and suddenly. This is happen because of the loud noises or any medical condition and sometimes due to age and untreated haring implant. Hearing devices are small devices that are made to amplify the sounds to improve the hearing ability.

Hearing loss solutions are not limited to just amplification. There are so many modern devices that come with so many advanced and unique features, such as Bluetooth connectivity, noise reduction, and personalized sound settings, all these things making hearing aids highly effective for various types of hearing impairment.

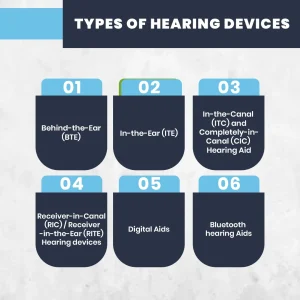

Types of Hearing Devices

There are different types of hearing devices. Each type is designed and specifically made for different levels of hearing loss, that will help you in your daily life needs. Knowing about these types will help you a lot so you can choose the hearing aid that works best for you.

1. Behind-the-Ear (BTE)

Behind the ear hearing aids are placed behind the ear and connect to the small piece that goes inside the ear. This will work for so many poople life all the ages who are suffering form the hear loss. This device is strong and it will also last for the long time and it is easy to use.

2. In-the-Ear (ITE)

These fit completely inside the outer ear. These hearing devices are smaller than BTE aids and can help with normal to severe hearing loss. They are easy to put in and take out, but they can get damaged more easily from earwax or moisture.

3. In-the-Canal (ITC) and Completely-in-Canal (CIC) Hearing Aid

These are very small and fit partly or fully inside your ear canal, so it will not be easy for others to see. They are best for people with mild to moderate hearing loss. Many people like them because they are almost invisible.

4. Receiver-in-Canal (RIC) / Receiver-in-the-Ear (RITE) Hearing devices

These devices comes up with the small speaker inside the ear and the micorphone that is outside the ear. This design will make sure to give the natural sound to the person and this is best for the people having trouble with high pitch sounds.

How Much Does Life Isurance Cost?

5. Digital Aids

These change sound into digital signals and adjust them to match your hearing needs. They give clearer sound, reduce whistling noises, and work well in noisy places.

6. Bluetooth hearing Aids

These aids can connect to the phones, tv or the other devices without any wires. So you can listen to calls and music and also videos straight through your hearings aids, these will make your life easier and more comfortable.

Hearing Aid Brands and Providers

Choosing the right hearing aid and where to buy it is very important. A good brand and provider will give you reliable products, good performance, and proper care after you buy it. Here are some common options:

Miracle Ear Aids

These are well-known for custom fitting and modern digital designs.

Hearing Aid Stores

Local shops let you try all these hearing devices , you can also talk to specialists, and get repair or cleaning services.

OTC Aids

These are sold over the counter, without a doctor’s prescription. They are best for people with mild hearing loss.

Affordable and Cheap Hearing Devices

These cost less but still give you the basic features you need.

Consulting a audiology & hearing aids Specialist

A hearing aid specialist that is usually an audiologist is very important. They help find out how much hearing loss you have and suggest the best solution. When you meet with an audiologist, they usually:

- Do your hearing tests to check your hearing level.

- They also recommend the right hearing devices for you.

- They fit the hearing aids so they are comfortable and work well.

- Also they give support later for cleaning, repairs, or problems.

Benefits

Investing in hearing aids will provide you a lot of benefits that will surely improve your hearing. Lets have a look at the key advantages for the better understanding:

Enhanced Communication

When you hear better and clear, it will become easy for you to talk and listen to your family and friends. So you will not have to ask people to repeat themselves as much, and conversations feel more natural.

Improved Quality of Life

Good hearing helps you feel more connected. You can join in on social activities, enjoy hobbies, and feel less lonely or left out.

Cognitive Health Support

If tyou are not treating hearing loss this can make your brain work harder and may lead to memory problems over time. Using these aids helps keep your mind active and sharp.

Access to Advanced Technology

Modern hearing devices are smart. There are so many that comes with Bluetooth, so you can connect them to your phone, TV, or computer for easier listening.

Customizable Options

Hearing devices are not come in just one size, instead they can be customized. They can be adjusted to match your level of hearing loss and your daily lifestyle, giving you the best comfort and performance.

Affordable Hearing Aids

Hearing aids can cost you so many different amounts. Some are expensive digital models, while others are cheaper. The price usually depends on the type, technology, and brand. There are so many ways to save money, lets have a look what are that:

- OTC hearing aids: Sold over the counter, good for mild hearing loss, and usually cheaper.

- Discounted packages: Some stores sell bundles that include the hearing devices,, cleaning, and accessories.

- Insurance coverage: Some health plans can also give you and help pay for hearing aids or audiologist visits.

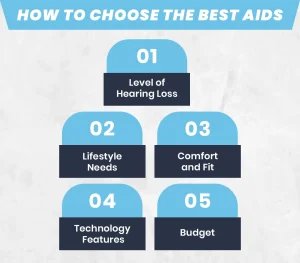

How to Choose the Best Aids

Selecting the best hearing devices involves considering several factors:

Level of Hearing Loss

You have to know that what is your level because, different devices suit mild, moderate, or severe hearing loss.

Lifestyle Needs

you have to know that what suits best for your and your lifestyle. Active users may benefit from durable, water-resistant models with Bluetooth connectivity.

Comfort and Fit

Custom fittings from a hearing aid specialist ensure comfort and long-term usability.

Technology Features

Features like noise reduction, directional microphones, and digital sound processing enhance performance.

Budget

Make sure to see what is in you budget and what you can afford. Balance affordability with the required features to find the optimal solution.

Conclusion

Hearing devices are special devices that will helo the people to hear better. These devices can make you life even better and easier. There are so many options available for the hearing devices most are bluetooth ones and even they are affordable and can fit your budget. Before buying you just have to make sure that what is best for your, what is your level of hearing loss and which device fit in your daily life, so this will make everything easier and smooth for the better hearing and you can enjoy your life the way you deserve.

Get in touch with insure guardian today to learn how our plans can cover your hearing needs and give you peace of mind.

FAQS

1. What are hearing aids?

These aids are small electronic devices that will help people to hear more natural and easily so other people do not have to repeat them.

2. How much do hearing aids cost in USA?

They usually cost $1,000–$4,000 per ear, depending on features and brand.

3. What are the top five hearing aids?

Top brands include Phonak, ReSound, Oticon, Starkey, and Signia.

4. Which type of hearing aid is best?

If you want to know the best hearing devices for your, you first have to look at the needs and your budget. But but Receiver-in-Canal (RIC) models are popular for comfort and sound quality.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.