Cash Out Life Insurance Policy: What You Need to Know

Last Updated on: September 22nd, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Key Takeaways

- Not all policies can be cashed out: Term life policies usually cannot be surrendered for cash unless they have special riders.

- Whole life and universal life policies offer cash value: These allow full or partial withdrawals and loans.

- Tax implications matter: Cashing out a life insurance policy can trigger taxes on gains above your premiums.

- Consider alternatives: Policy loans, partial withdrawals, or life settlements can be better than full surrender.

Table of Contents

ToggleLife insurance is all about securing your family and loved ones when you pass away. But what if you need money while you are still alive, there are so many people who ask if they get the cash out of life insurance, this is the most important thing that you have to understand when buying the policy. In this detailed guide we will explain everything you need to know about cash out life insurance policy. We will also cover the different types of policies, who can do it, the steps to take, and whether it’s a smart financial choice.

What Does It Mean to Cash Out Life Insurance Policy?

Cashing out a life insurance policy means giving your policy back to the insurance company in exchange for the cash value it has built up. This is also called a policy surrender. Not all life insurance policies have cash value. Usually, whole life and universal life policies do, but term life insurance usually does not. That’s why many people ask, “Can you cash out a term life insurance policy?” or how do i cash out a life insurance policy

The short answer is no, unless your term policy has a return of premium (ROP) feature. This feature lets you get back some of the money you paid. Term life insurance is mainly meant to give a payout to your loved ones when you pass away, not to save money for you.

Types of Life Insurance You Can Cash Out

1. Whole Life Insurance

Whole life policies are permanent insurance policy plans that provide coverage for your entire life, along with a cash value component that will grow over time. If you are considering cashing out a whole life insurance policy, You can get the following benefits

- Your cash value is guaranteed to grow.

- Your payments (premiums) stay the same.

- You might also get extra money called dividends

2. Universal Life Insurance

Universal life insurance plan will offer you flexible premiums and a cash value component that will earn interest. You can cash out a life insurance policy through withdrawals or policy loans.

3. Group Life Insurance

If you have a company-provided group life insurance, you may think that, “can I cash out my group life insurance policy?” Typically, group life policies do not accumulate cash value unless they are a permanent group plan.

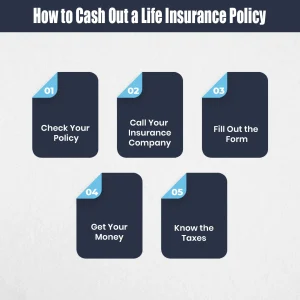

How to Cash Out a Life Insurance Policy

The process of cashing out a life insurance policy generally follows these steps:

How Much Does Life Isurance Cost?

Check Your Policy

First you have to see if you have whole life, universal, or term insurance. Look at how much cash value it has and if there are any fees for cashing out.

Call Your Insurance Company

Ask them about your options. For example, if you’re thinking, “Can I cash out my Primerica life insurance policy?” they can tell you the exact steps you have to take.

Fill Out the Form

The company will give you a form to “surrender” (cancel) your policy. You will need your policy number, ID, and bank details.

Get Your Money

Once processed, you’ll receive your cash value, minus any fees or loans you still owe on the policy.

Know the Taxes

Some or all of the money you get can be taxable, especially if it is more than what you have paid into the policy.

Tax Considerations When Cash Out Life Insurance Policy

There are so many people who are asking, “is cashing out a life insurance policy taxable?” The answer depends on the policy type and payout amount:

Non-Taxable

If the money you get is less than what you already paid in premiums, you usually don’t now have to owe taxes.

Taxable

If you get more money than you paid in premiums, the extra amount is taxed as income.

Can we Cash Out Term Life Insurance Plan

Thinking about cashing out life insurance policy if you have a term plan, The simple answer is no, you usually can not cash out a term life insurance policy. Term life is made only to give protection for a set time like for 10 years, 20, or 30 years. It does not build cash value.

This means when the term life policy plans time ends, the policy ends too, unless the person dies during the coverage period, and in this case the death benefit is paid.

Should You Cash Out Life Insurance Policy?

Cashing out your policy is a big decision. Think about these points first:

Do you need money right now?

Cashing out can give you quick money for emergencies, debts, or big expenses. So make sure you need the amount right now for your any work.

Loss of coverage

Once you cash out, your life insurance ends. Your family will not get a death benefit later.

Fees

If you cash out early, the insurance company can charge you fees that is called surrender charges.

Taxes

If you get more than you paid into the policy, the extra money can be taxed.

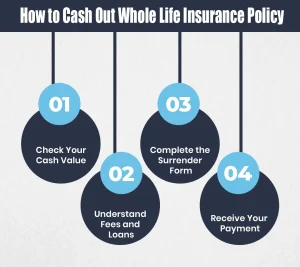

How to Cash Out Whole Life Insurance Policy

If you have a whole life policy, cashing it out is usually straightforward. Here’s how it works:

Check Your Cash Value

First you have to look at your policy statement or call your insurance company. This will show how much money (cash value) you have built up.

Understand Fees and Loans

If you have taken out loans from your policy or if there are surrender charges, these will be subtracted from your payout. So, the final amount you get may be less than the cash value shown.

Complete the Surrender Form

Contact your insurance provider and ask for the surrender paperwork. You’ll need to provide your policy number, personal details, and banking information.

Receive Your Payment

After the company processes your request, then you will receive the money, usually through direct deposit or a check sent to you. The time it takes can vary, but it often takes a few weeks.

How to Cash Out Life Insurance Policy While Alive

Yes, you can cash out life insurance policy while you are still alive, but only in the situation if you had bought a whole life or universal life policy. Because it is only possible with cashing out whole life insurance policy and universal policy. cashing out whole life insurance policy In fact, there are options to use your policy while living:

Full Surrender

You cancel the policy and get the entire cash value (minus fees or loans). But this also ends your coverage.

Partial Withdrawal

You take out just part of the cash value and keep the rest of your policy active.

Policy Loans

You borrow money against your cash value. Your policy stays active, but you’ll need to pay back the loan with interest.

Risks and Considerations

Before cashing out a life insurance policy, you have to think carefully about these things:

Loss of Death Benefit

If you cash out, your policy ends, and your family will no longer get money when you pass away.

Fees and Penalties

Insurance companies can charge you surrender fees, and any loans or debts on the policy will be taken out of your payout.

Tax Implications

If the amount you receive is more than what you have paid in premiums, the extra will be taxed.

Effect on Your Financial Plans

Cashing out could impact your retirement savings, estate planning, or long-term financial security.

Final Thoughts

Cashing out a life insurance policy can give you quick access to money, but it’s not always the best choice you can avail. Term life insurance will not be cashed out, but the whole and universal policies offer more flexibility and you can cash them out. Before making a decision, you have to make sure that you need that amount due to an emergency. Always talk to your financial advisor before making any decision.

Call Insure Guardian today or request a free consultation to learn whether cash out life insurance policy, converting, or keeping your policy is the right move for you and your family.

FAQS

What is a cash out life insurance policy?

A cash out life insurance policy is one that will let you to take money from the policy when you are still alive. This will only happen if you have whole life or the universal life insurance plans that build the cash value over time.

Can you take cash out of your life insurance policy?

Yes, but only if your policy has cash value account and that cash value grows over time. That is only possible with whole life and universal life plans.

How much will I get if I cash out my life insurance policy?

The cash out amount depends on how much cash value your policy has built up,the they minus any fees or loans. If you have paid in for many years, the cash value could be larger. If it’s early, the amount can be small.

What is the cash value of a $10,000 life insurance policy?

It depends on the type of policy. A $10,000 term life policy has no cash value. But a $10,000 whole life policy builds cash value slowly over time, usually a few hundred dollars in the first years, growing as you keep paying premiums.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.