Difference Between Burial & Funeral Life Insurance

Last Updated on: July 31st, 2024

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

When you are thinking about buying life insurance and planning end-of-life expenses. You must hear the two terms “burial insurance” and “funeral insurance. Both terms sound like they are the same, but actually, they are different. If you’re feeling confused, you’re not the only one here. Both policies help cover costs after someone passes away, so family members don’t have to pay out of pocket. But each one works in its way. In this article, we’ll explain the difference between burial insurance and funeral insurance using simple words.

Table of Contents

ToggleWhat Is Burial & Funeral Expense Insurance?

Burial and funeral expense insurance are types of final expenses. These plans are designed to help pay for expenses when someone passes away. These expenses include burial, cremation, and other funeral-related costs. However, these policies are usually small because they only cover the smaller expenses.

Purpose of These Policies

The purpose of these policies is to help in many ways after someone passes away. It can be used to pay the funeral home bills, as well as the other prices for the cremation or the purchase of the headstone or caskets. This support from the insurance companies will ease the family’s stress during a difficult time.

Is Burial Insurance the Same as Funeral Insurance?

While burial insurance and funeral insurance are similar, there are important differences between them. These differences are usually found in how the policy is set up and what it covers.

Burial Insurance

Burial life insurance is also called final expense insurance. This policy will give a lump sum of money to the person whom you choose while buying the policy. The person can use the money for anything they need, but most of the time, the money is used to pay for the burial, cremation, or other final services. The good thing about this insurance is that it gives your loved ones the freedom to use the money in a way that helps them the most.

Funeral Insurance

Funeral insurance is also called a pre-need insurance plan, and this insurance plan is connected to a specific funeral home. The money from the plan goes straight to the funeral provider to pay for the services you arranged ahead of time. It doesn’t offer much flexibility, but it helps make sure your exact funeral wishes are followed just the way you planned.

Key Difference

- Burial insurance gives the family or loved ones the freedom to decide how to spend the payout.

- Funeral insurance is typically locked into specific arrangements and service providers.

What Does Burial Insurance Cover?

Burial insurance coverage is straightforward. It provides a cash benefit to your designated beneficiary, who can then use it to manage funeral-related costs or any other outstanding expenses.

Common Costs Burial Insurance Can Cover:

- Funeral home service fees

- Burial or cremation costs

- Caskets, urns, or grave markers

- Embalming and body preparation

- Cars used for the funeral, like the hearse or a family car

Because burial insurance is not tied to one funeral home, burial insurance gives more choices to families when planning. This is so helpful during a sad and stressful time

How Much Does Life Isurance Cost?

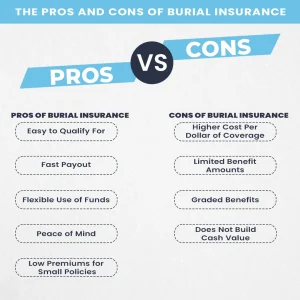

The Pros and Cons of Burial Insurance

Before you buy a policy, it’s a good idea to look at the good and bad sides of burial insurance. This will help you to decide if this is the right option for you or not.

Pros of Burial Insurance:

- Easy to Qualify For

There are insurance companies. Who provides the policies that require no medical exam.

- Fast Payout

Within one week, the beneficiaries receive the benefit.

- Flexible Use of Funds

The money can be used for any purpose, not just funeral expenses.

- Peace of Mind

It helps your loved ones pay for final expenses without worrying about money.

- Low Premiums for Small Policies

Since coverage amounts are small, premiums are generally affordable.

Cons of Burial Insurance:

- Higher Cost Per Dollar of Coverage

Premiums are expensive as compared to other policies.

- Limited Benefit Amounts

It covers up to $25,000, which may not be enough for some people.

- Graded Benefits

Some policies don’t pay the full death benefit if you die within the first two years, especially for health-compromised applicants.

- Does Not Build Cash Value

Unlike whole life insurance, some burial policies don’t accumulate savings or dividends.

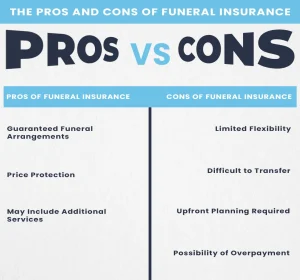

The Pros and Cons of Funeral Insurance

If you are considering a pre-need funeral insurance plan, here are the pros and cons of funeral insurance to keep in mind.

Pros of Funeral Insurance

- Guaranteed Funeral Arrangements

Lock in your desired services, casket, venue, and other details.

- Price Protection

Helps lock in today’s funeral prices, protecting against future inflation.

- May Include Additional Services

Some plans include grief support or legal assistance.

Cons of Funeral Insurance:

- Limited Flexibility

Funds are restricted to a specific funeral home or service provider.

- Difficult to Transfer

If you change your mind about the policy, it would be so difficult, costly, and complicated to transfer.

- Upfront Planning Required

Requires detailed planning in advance, which not everyone is comfortable with.

- Possibility of Overpayment

If you live for many more years, you might pay more in premiums than the services are worth.

Which One Is Right for You?

Let’s have a quick look at the comparison paper that will help you to understand which is right for you.

| Criteria | Burial Insurance | Funeral Insurance |

| Flexibility | High – Funds can be used for any purpose | Low Funds tied to specific services |

| Control Over Arrangements | Lower – Family makes decisions | High – You make decisions in advance |

| Ease of Use | Simple application, quick payout | Involves planning and coordination |

| Portability | Fully portable | Tied to a specific provider |

| Typical Use | Covering general final expenses | Locking in funeral service details |

Final Thoughts

It’s important to understand what burial and funeral expense insurance is. After knowing and understanding the meaning of both policies, you will make a better decision for your family’s peace. Both are there to help you in difficult times and cover the last funeral expenses. So make a better decision and choose the best policy that fits your budget and needs.

Protect your family from stress and unexpected costs. Choose the right insurance today.

Get a free quote now and plan with peace of mind.

FAQs

1. What Is Burial & Funeral Expense Insurance?

Burial and funeral expense insurance is a type of insurance that helps pay for things when you die, like the funeral, burial, or cremation, and other costs.

2. Is Burial Insurance the Same as Funeral Insurance?

No. Burial insurance pays a cash benefit to beneficiaries, and it’s up to the person how they spend the money.

3. Do I Need Funeral Insurance?

If you want your funeral planned and paid for ahead of time, and you don’t want your family to worry about money or making hard decisions, funeral insurance can be a good choice.

4. What Does Burial Insurance Cover?

Burial life insurance will pay for the funeral services, cremation, or moving the body, and also all the other funeral home charges.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.