Farm Bureau Life Insurance Calculator: Plan your Future

Are you prepared for life’s uncertainties? Farm Bureau Life Insurance understands the importance of securing your future and protecting your loved ones. Introducing our innovative tool, the Farm Bureau Life Insurance Calculator – your gateway to personalized financial planning. In today’s fast-paced world, planning for the future can seem daunting, but with our user-friendly calculator, you can gain clarity and confidence in your financial decisions.

Whether starting a family, saving for retirement, or safeguarding your legacy, our calculator empowers you to tailor your insurance coverage to your unique needs. Join the thousands who have embraced peace of mind through Farm Bureau Life Insurance. Let’s embark on a journey towards a secure and prosperous future together.

What is Farm Bureau life insurance?

Farm Bureau Life Insurance is a subsidiary of the American Farm Bureau Federation, a prominent organization that advocates for the agricultural industry and rural communities. It offers a range of life insurance products and financial services tailored to the needs of individuals and families, particularly those in rural areas.

The company aims to provide comprehensive insurance solutions that protect policyholders and their loved ones against financial uncertainties, such as unexpected illness, accidents, or death. Farm Bureau Life Insurance policies often include options for term life insurance, whole life insurance, universal life insurance, and annuities.

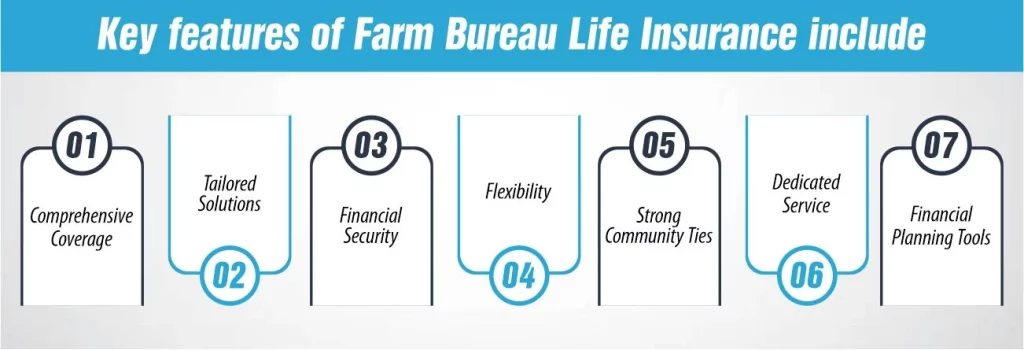

Key features of Farm Bureau Life Insurance include:

Comprehensive Coverage:

Farm Bureau Life Insurance offers a wide range of life insurance products, including term life, whole life, and universal life insurance, to meet the diverse needs of individuals and families.

Tailored Solutions:

The company provides personalized insurance solutions designed to address the specific needs and circumstances of policyholders, whether they are farmers, ranchers, or residents of rural communities.

Financial Security:

Farm Bureau, Life Insurance policies, offer financial security and peace of mind by providing coverage for unexpected events such as illness, accidents, or death, helping to protect policyholders and their loved ones from financial hardship.

Flexibility:

Policyholders can choose coverage options and benefit amounts that align with their financial goals and priorities, allowing for customization based on individual needs and preferences.

Strong Community Ties:

With its roots in the agricultural community, Farm Bureau Life Insurance understands the unique challenges faced by farmers, ranchers, and rural residents and provides tailored support and services to meet their needs.

Dedicated Service:

Farm Bureau Life Insurance is committed to providing exceptional customer service and support, with agents who are knowledgeable about the insurance products and dedicated to helping clients make informed decisions.

How Much Does Life Isurance Cost?

Financial Planning Tools:

Besides insurance products, Farm Bureau offers tools and resources, such as the Farm Bureau Life Insurance Calculator, to assist policyholders in planning for their financial future and ensuring adequate coverage.

Overall, Farm Bureau Life Insurance offers comprehensive coverage, personalized service, and a deep understanding of the needs of its policyholders, making it a trusted choice for individuals and families seeking reliable insurance protection.

Why choose Farm Bureau life insurance?

Choosing Farm Bureau Life Insurance offers several compelling reasons:

Specialized Knowledge: Farm Bureau Life Insurance has deep roots in the agricultural community, meaning they understand the unique needs and challenges faced by farmers, ranchers, and rural residents. This specialized knowledge allows them to offer tailored insurance solutions that address these needs.

Comprehensive Coverage Options: Farm Bureau Life Insurance offers a wide range of coverage options, including term life, whole life, and universal life insurance, allowing individuals to select the policy that best fits their financial goals and circumstances.

Personalized Service: With Farm Bureau Life Insurance, policyholders can expect personalized service from agents knowledgeable about the insurance products and dedicated to understanding their unique needs. This customized approach ensures that customers receive the attention and support they deserve throughout the insurance process.

Financial Stability: Farm Bureau Life Insurance is backed by the American Farm Bureau Federation, providing policyholders with confidence in the company’s financial stability and reliability. This assurance allows individuals to trust that their insurance needs will be met, even in uncertain times.

Financial Planning Tools: Farm Bureau Life Insurance offers tools and resources, such as the Farm Bureau Life Insurance Calculator, to assist policyholders in planning for their financial future. These tools help individuals make informed decisions about their insurance coverage and ensure adequate protection for themselves and their loved ones.

Insurance Plans which farm bureau covers:

Farm Bureau helps you protect what’s important in your life with a custom array of insurance products and plans built for you – and only you. Insurance Plans that the Farm Bureau covers:

- Auto Insurance

- Home Insurance

- Farm and Ranch Insurance

- Life Insurance

- Business Insurance

- Health Insurance

Farm Bureau life insurance policies:

Farm Bureau Life Insurance offers various types of insurance policies to meet the diverse needs of individuals and families. Some of the common types of life insurance policies include:

Term Life Insurance:

This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. If the insured individual passes away during the policy term, the death benefit is paid to the beneficiaries. Term life insurance is often more affordable than permanent life insurance and is suitable for individuals looking for temporary coverage.

Whole Life Insurance:

Whole life insurance provides coverage for the entire lifetime of the insured individual as long as premiums are paid. It offers a death benefit to beneficiaries upon the insured’s death, along with a cash value component that grows over time. Policyholders can borrow against the cash value or use it to supplement retirement income.

Indexed Universal Life Insurance:

Indexed universal life insurance is a type of universal life insurance policy in which the cash value growth is tied to the performance of a stock market index, such as the S&P 500. This allows policyholders to potentially earn higher cash value returns while still providing beneficiaries with a death benefit.

Benefits of Farm Bureau Life Insurance Calculator

The Farm Bureau Life Insurance Calculator offers numerous benefits to individuals and families looking to plan their financial future effectively:

Personalized Insights: The calculator provides personalized insights into your insurance needs based on your unique circumstances, including age, income, assets, liabilities, and future financial goals. This personalized approach ensures you receive tailored recommendations aligning with your needs and objectives.

Clarity and Transparency: The calculator helps you understand your insurance needs and coverage options. It helps you understand the amount of coverage required to adequately protect your loved ones and achieve your financial goals, eliminating confusion and uncertainty in the decision-making process.

Financial Planning Guidance: The calculator is a valuable tool for financial planning, helping you assess your current financial situation and identify areas where additional insurance coverage may be necessary. It enables you to make informed decisions about your insurance needs and develop a comprehensive financial plan that addresses short-term and long-term goals.

Cost-Effective Solutions: By accurately assessing your insurance needs, the calculator helps you avoid overpaying for coverage you don’t need or underinsuring yourself and your family. It allows you to find cost-effective solutions that provide the right coverage to protect your financial security without breaking the bank.

Flexibility and Adjustability: The Farm Bureau life insurance calculator offers flexibility and adjustability. It allows you to explore different scenarios and change your inputs to see how they affect your insurance needs and coverage recommendations. This flexibility lets you fine-tune your insurance plan to suit your evolving life circumstances and financial goals.

Conclusion

In conclusion, the Farm Bureau Life Insurance Calculator is not just a tool; it’s a gateway to peace of mind and financial security. This calculator empowers individuals and families to make informed decisions about their insurance needs by offering personalized insights, clarity, and transparency. Its focus on cost-effective solutions, flexibility, and adjustability ensures that you get the right coverage to protect your loved ones without overpaying.

Furthermore, by providing access to expert advice and serving as a catalyst for meaningful discussions with Farm Bureau agents, the calculator becomes an invaluable resource on your journey toward a secure financial future. Embrace the power of planning with the Farm Bureau Life Insurance Calculator, and take control of your tomorrow today.

Do you have any questions about Financial Checkups? Talk to us:

FAQs

Is term or whole life insurance better?

The answer depends on your individual needs and financial goals. Term life insurance typically offers lower premiums and coverage for a specific period, such as 10, 20, or 30 years. It’s ideal for those looking for temporary coverage to protect against financial obligations like mortgages or education expenses. On the other hand, whole life insurance offers coverage for the entire lifetime of the insured individual and includes a cash value component that grows over time. It’s suitable for individuals seeking lifelong coverage and a vehicle for cash accumulation. Consider budget, coverage duration, and long-term financial objectives to determine which option best fits your needs.

How do you check a life insurance policy?

To check the details of your life insurance policy, start by reviewing the policy documents provided by your insurance company. These documents typically include information about your coverage, premiums, beneficiaries, and policy terms. Additionally, you can access your policy information online by logging into your insurer’s website or contacting their customer service department for assistance.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.