Health Insurance Options for College Students

Last Updated on: July 14th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Being a student, there are a lot of responsibilities in your life, but now this is the time that you can handle most of the things, until the last thing you have to worry about is getting into an accident and dealing with high medical bills. But these things are a part of life and can happen at any time. But finding the right health insurance for yourself as a college student is a must-thing you have to do. But don’t worry, we are here to help. In this article, we will share and explore the best health insurance for college students to cover medical costs, and what is good and what makes the most sense for your needs.

Table of Contents

ToggleWhy Health Insurance Matters for College Students

Many young adults think they don’t need any health insurance because they are healthy and they don’t get sick. But there are so many things that can happen at any time, like accidents, mental health issues, or some sudden illness, and this will lead to expensive medical bills. Health insurance will help you to cover these expenses, and you will be tension-free knowing that you are protected by your insurance.

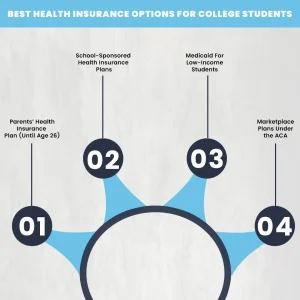

Best Health Insurance Options for College Students

There are a lot of health insurance options that are specially designed for college students. Let’s look at the most common and best health insurance choices.

1. Parents’ Health Insurance Plan (Until Age 26)

Thanks to the Affordable Care Act, students who are going to college can remain on their parents’ health plan until they turn 26. This is the easiest and most affordable option. It also offers good coverage. Staying on the parents’ policy, this would be easy for the students because they don’t need to pay extra, since they are already familiar with how the plan works. However, there is one downside to this policy that if the student is going to another state college, the plan will not cover many doctors in that state.

2. School-Sponsored Health Insurance Plans

There are so many colleges in the US that are offering their health insurance plans, just designed for their students. These plans include services from on-campus clinics and mental health counsellors. A big benefit of getting this policy is that the cost is sometimes included in tuition or student fees. However, these plans might not cover much outside of campus, and the cost can be very different depending on the college.

3. Medicaid For Low-Income Students

Medicaid is the government health insurance program that offers free or low-cost health care for people that are having low incomes. Due to the low cost, many college students can apply for this if they have a part-time job and support themselves financially. Medicaid covers doctor visits, hospital stays, and medicine. One of the best things about this health insurance is that it is usually free or very cheap. However, this policy depends on the state you live in, and in some places, there may not be many doctors who accept this.

4. Marketplace Plans Under the ACA

If any of the students is not able to get the other health insurance, they have the option to look at the federal or state marketplaces. These marketplace plans are under the ACA, and students may get help paying through income-based discounts. This will make the plan cheaper and cover many health services. There are options for the students to pick from, like silver, gold, or platinum. But students must sign up themselves, and without discounts, the plans can cost more.

How Much Does Life Isurance Cost?

Average Health Insurance Per Month for a College Student

The average health insurance for a college student costs between $150 and $400 each month, but keep in mind that the prices depend on the type of plan, where you live, and if you get any discounts or help paying for it

| Plan Type | Average Monthly Cost |

| Parent’s Plan | $0–$75 (shared premium) |

| School-Sponsored Plans | $150–$300 |

| Marketplace (with subsidy) | $100–$200 |

| Marketplace no subsidy | $300–$400+ |

| Medicaid | $0 |

What Is the Best Affordable Healthcare for College Students?

The best affordable healthcare for college students depends on personal circumstances, including income, location, and health needs. Here’s a comparison of what might work best:

| Best For | Recommended Option |

| Low-income students | Medicaid |

| Out-of-state students | Marketplace plans or school plans |

| On-campus services | School-sponsored plans |

| Staying under the parents’ plan | Family insurance |

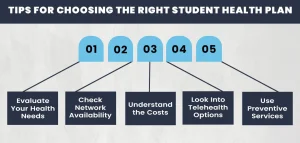

Tips for Choosing the Right Student Health Plan

- Evaluate Your Health Needs:

Do you take regular medication? Have chronic conditions? Need mental health support? - Check Network Availability:

Ensure your doctors and campus clinics are within your plan’s network. - Understand the Costs:

Consider premiums, deductibles, co-pays, and out-of-pocket maximums. - Look Into Telehealth Options:

Many plans now offer virtual visits for physical and mental health. - Use Preventive Services:

Most plans cover annual check-ups, vaccines, and screenings for free.

Final Thoughts

Health insurance is equally important for college-going students. If you are a college student and looking for health insurance, there are options to consider. You can get better coverage no matter whether it’s through the state or the private market. Just make sure that the plan you are buying fits both your budget and health needs. Having health insurance in college helps protect both your health and your money. It’s a smart move that gives you peace of mind while you focus on your studies.

FAQs

What’s the cheapest health insurance for college students?

The cheapest option for the college student is that you have to stay on your parents’ plan if you’re under 26.

Can I use my college’s health insurance?

Yes, many colleges offer their health insurance plans. These often include on-campus care and mental health services and may be added to your tuition fees.

What if I go to college in a different state?

If you’re on your parents’ plan, make sure it covers doctors in your college’s state.

Do I need health insurance if I’m healthy?

Yes, even if you are healthy, you can still get sick anytime. It’s important to get health insurance. This will help you to pay for doctor visits, hospital stays, so you will not be stuck with big medical bills.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.