Life Insurance for High Net Worth Individuals – Expert Guide

Last Updated on: June 13th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Thinking about life insurance, most people imagine protecting their family after they’re gone. But have you ever wondered what wealthy individuals do? Do they buy life insurance too, and if they do, what kinds of policies do they choose? These are the questions that often come into mind

Table of Contents

ToggleLets be clear! For people with high net worth, life insurance is more than just a way to support loved ones after passing away. It plays an important role in protecting their wealth. People having the high net worth often have unique and complex financial situations, and for them regular life insurance may not be enough.

The right insurance policy can cover estate taxes, prevent forced asset sales, and make sure that wealth passes smoothly to the next generation. In this expert guide, we’ll explore how the wealthy people get life insurance differently and what that means for anyone looking to protect their fortune and family in the smartest way possible.

What is High Net Worth Individual Insurance?

High net worth individual insurance is a kind of life insurance that is specially made for people who have a lot of money usually $5 million or more than that. High net worth insurance is different from regular life insurance because this will help with special money matters like taxes on large estates, passing on a business, giving to charity, and managing complicated investments.

Compared to normal life insurance, these policies usually offer bigger coverage amounts and are customized to fit the person’s unique financial needs. They may also include special features like ways to help pay the insurance premiums more easily.

Why Wealthy Individuals Choose Different Life Insurance

If you have built up a lot of money and assets your insurance needs are different and more detailed than most people’s. Here’s why:

Estate Tax Planning

Right now in year 2025, the government give you permission that you give away up to $12.92 million without charging you taxes. But if you have more than that, the taxes can be very big. Life insurance can help pay these taxes so you don’t have to sell your important things fast.

Wealth Transfer

Life insurance can help put money into a trust or give cash to your family. This way, your money goes to them easily and stays safe.

How Much Does Life Isurance Cost?

Business Continuity

If you own a business, life insurance wil help you out to buy a partner or keep the business running if an important person passes away.

Asset Protection

Some life insurance plans can help keep your money and things safe from people you owe or legal troubles.

Types of Life Insurance for High Net Worth Applicants

There are different types of life insurance made for people with a high net worth:

- Permanent Life Insurance

This includes whole life and universal life insurance. It covers you for your entire life and builds cash value you can use later. It’s helpful for planning your estate and reducing taxes.

- Indexed Universal Life (IUL)

This policy also lasts your whole life and builds cash value. The value can grow based on the stock market (like the S&P 500). It offers flexible payments and the chance for higher returns.

- Survivorship Life Insurance

This life insurance is also called “second-to-die” insurance. It covers two people (usually a married couple) and pays out after both have passed. It’s useful for paying estate taxes and passing wealth to children.

- Term Life Insurance

This life insurance covers you for a set number of years (like 10 or 20). It doesn’t build cash value, but it’s cheaper and can be used for short-term needs or special strategies like premium financing.

Premium Financing for High Net Worth Clients

Premium financing is one of the smart strategy that wealthy people use. This means they borrow money to pay for the life insurance instead of using their own cash. It helps them keep their money free to invest or use somewhere else, while still getting strong life insurance coverage.

Lets discuss how it works:

- A bank or lender gives a loan to pay the life insurance premiums.

- The client pays back the loan over time, sometimes using money from the policy or other investments.

- When this done properly, this strategy can lower the amount of money the client needs to pay upfront and may help grow their wealth faster.

Keep in mind Premium financing needs careful planning and is usually best for people who understand borrowing money and are okay with managing loans.

Best Health Insurance for High Net Worth Individuals

People having the high net worth always often look for the best health insurance that gives them full coverage, special personal services, also care anywhere in the world, and flexible options.

Important things to look for:

The best health insurance for wealthy individuals gives you access to top doctors and hospitals anywhere in the world, so you can get the best care no matter where you are. It also covers special or optional treatments that you might choose, like alternative medicine or elective procedures. You’ll have personalized health and wellness plans tailored just for you, helping you stay healthy and manage any medical needs. Plus, the insurance makes it easy to handle claims quickly and smoothly, whether you’re at home or traveling abroad.

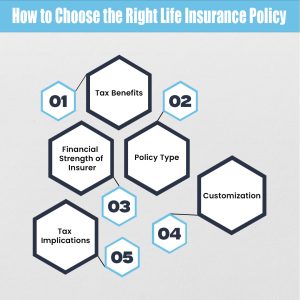

How to Choose the Right Life Insurance Policy

When choosing a life insurance policy, consider the following things that will help to choose the better option;

- Coverage Amount: Make sure the insurance amount is enough to pay estate taxes, clear debts, and support your family.

- Policy Type: make sure you choose permanent life insurance for lifelong coverage, term for short-term needs, or survivorship, which covers two people and pays out after both pass away. Pick the one that fits your goals best

- Financial Strength of Insurer: make sure to pick a trusted company with strong financial ratings.

- Customization: Look for riders and extra options that match your personal needs.

- Tax Implications: Work with a financial advisor to get the best tax savings.

It’s important to work with an advisor who understands insurance for wealthy individuals. They can help create a plan that fits your money goals and personal needs.

FAQs

1. Do I need life insurance if I have a high net worth?

Yes. Life insurance helps protect your estate from taxes, provides liquidity, funds trusts, and supports business succession planning. Even wealthy individuals benefit from tailored coverage.

2. What type of life insurance do wealthy people buy?

High net worth individuals typically purchase permanent life insurance, including whole life, universal life, or survivorship policies, depending on their estate and legacy goals.

3. What is premium financing for high-net worth clients?

Premium financing is a strategy where clients borrow money to pay insurance premiums, preserving cash flow and leveraging assets.

4. How does survivorship life insurance benefit estate planning?

Survivorship insurance pays out after the death of the second insured person, providing funds to pay estate taxes and preserve wealth for heirs.

5. What should I look for in health insurance as a wealthy individual?

Look for comprehensive global coverage, concierge medical services, wellness programs, and flexible plans that cover advanced treatments.

Summary

For people with a lot of money, life insurance is more than just protection.It’s a smart tool to help save wealth, plan for the future, and lower taxes. Knowing how special life insurance plans work, like premium financing and different policy types, helps you stay in control of what you leave behind.Working with experts who understand the needs of wealthy clients can help you choose the right policy for your personal situation and long-term goals.

Secure Your Legacy Today

Don’t leave your financial legacy to chance. Speak with a trusted advisor who specializes in high net worth insurance solutions and take control of your future today.

Contact us now for a personalized consultation.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.