How Life Insurance Empowers Families

Last Updated on: July 23rd, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Life insurance is more than just a financial product. It is a way to protect and empower your family and loved ones. When something unexpected happens, life insurance helps families stay strong in financial problems, like covering everyday expenses, and also covers home loans or any other important things to handle. When all the expenses are being handled so this thing will give you peace of mind knowing that your family will not be alone and there will be no financial struggle. In this article, we will explore how life insurance plays a powerful role in securing a family’s future and bringing comfort during life’s toughest situations.

Table of Contents

ToggleHow does life insurance for families work?

Life insurance for families helps and protects your loved ones if something happens to you. When parents get a life insurance policy, after one of the parents passes away while the policy is active, the insurance company gives money to their partner and children. This money is called the death benefit, and this will help the family to cover the daily expenses, pay off debts, and save for the future. It is a way to make sure that the family has the financial support they need if you are no longer there to provide it.

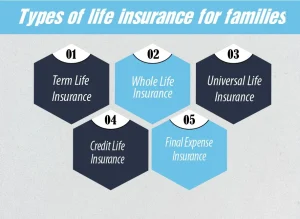

Types of Life Insurance for Families

There are a lot of insurance companies that are offering multiple insurance policies that benefit your family and loved ones. Whenever you are planning to buy an insurance policy, you must choose the right insurance policy.

Several types of insurance policies that are best for families include;

- Term Life Insurance

- Whole Life Insurance

- Universal life insurance

- Credit life insurance

- Final expense insurance

Term Life Insurance

Term life insurance is the type of life insurance you can get from the insurance companies that are affiliated with Insure Guardian. This policy covers you for a set number of years, like 10, 20, or 30. If you pass away during this set time, your family will get the money that is called a death benefit. But if you are still alive after this time, then you must start a new one to stay covered or switch to the new policy. Term life insurance is a good option if you only need protection for a certain time.

Whole Life Insurance

Whole life insurance gives you coverage for your whole life. The policy is active as long as you keep paying your premiums. In this policy, the money you pay is going into the savings, which is called the cash value. This cash value grows over time, and this is tax-free. There is also a good option for you that you can borrow these savings or money and take it out when you need it. Whole life insurance is a good option if you want to make sure your family has money after you are gone, but keep one thing in mind that it costs more than term life insurance.

Universal Life Insurance

Universal life insurance is more likely to whole life insurance. This will cover you for your entire life and also build cash value over time. But the main difference is that you can lower your premiums by reducing the death benefit. And also increase the coverage if you are willing to pay more. That’s why it makes it more flexible than whole life insurance.

Credit Life Insurance

Credit life insurance is a type of insurance that helps to pay off your loan if you die before the loan is fully paid. A loan can be for anything, like a house loan or a car loan. And if there is some loan left when you pass away. Then the insurance company will pay this loan, and your family will not have to worry about paying it.

How Much Does Life Isurance Cost?

Final Expense Insurance

Final expense life insurance is a small life insurance plan that will help your family to pay for the things in life your funeral and medical bills, after you die. This policy includes the following things

- A small payout when you pass away

- Low monthly payments

- A little savings that grows over time (called cash value)

It’s a good choice if you just want to make sure your loved ones will not be left with your final costs.

How Does Life Insurance Help Families?

Life insurance is very important because it helps families to pay the expenses and also solves financial problems that can happen when a loved one passes away. Here’s how it helps families financially:

1. Helps Pay for Funeral Costs

The final expenses, like funerals, cost a lot sometimes, between $7,000 and $15,000. Life insurance gives your family money to cover these expenses so they don’t have to worry about it during a sad and stressful time.

2. Pays Off Debts

If you have loans like a home loan, car loan, credit cards, or student debt, life insurance can help pay them off. This way, your family does not have to carry your financial burdens after you’re gone.

3. Replaces Lost Income

If you’re the main person earning money in your family, your passing could make it hard for them to pay bills or afford daily needs. Life insurance gives them money to replace their income and keep their life stable.

4. Helps Pay for Children’s Education

The most important thing life insurance can help your kids to study further and pay their college or school fees. The money also covers tuition fees, books, and other school expenses, so your children can still follow their dreams.

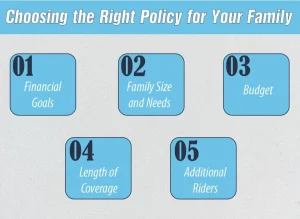

Choosing the Right Policy for Your Family

When selecting a life insurance policy, consider the following:

1. Financial Goals

Do you need coverage for a short time or your whole life? Term life insurance will cost less, and it is good for short-term needs, while whole life lasts your entire life and gives long-term benefits.

2. Family Size and Needs

A family with young kids needs different things as compared to a retired couple or a single person taking care of older parents.

3. Budget

Choose a policy with premiums that fit your current and projected future income.

4. Length of Coverage

Do you need coverage until the kids graduate from college? Or do you want a policy that lasts your entire life?

5. Additional Riders

Many life insurance policies let you add extra help, like:

- Money if you become disabled and can’t work

- Getting some money early if you get very sick

- Skipping payments if you can’t work due to illness or injury.

Final Thoughts

As we know, life insurance helps our family during tough times. If something happens to you, the policy you buy is there to protect your family so that they don’t need to worry about paying off the expenses. The one thing that you have to keep in mind is that you are choosing the right step when buying a life insurance policy. Look for prices your budget and coverage, and this will keep your family strong and feel secure.

Ready to protect your family’s future?

Protect your family’s future with the right life insurance today. Get a free quote now and ensure their financial security and peace of mind.

Your family’s safety starts with the right choice—make it today!

FAQs

1. Why is life insurance important for families?

Life insurance is very important for families because it provides financial protection for your family. It will make sure that your loved ones can handle all the expenses after you are gone

2. What types of life insurance are best for families?

There are some common life insurance plans that are best for families. These insurance policies are term life insurance, whole life insurance, universal life, credit life, and final expense insurance.

3. How does life insurance provide financial stability to the family after death?

When the person with the policy dies, the insurance company gives money to their family. This money will help the family to pay for the funeral, clear any debts, replace the money the person used to earn, and pay for the kids’ education.

4. Can life insurance help with my children’s future education?

Yes. Life insurance can provide funds to cover tuition fees, books, and other school-related costs. It helps ensure your children can continue their education.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.