Life Insurance Grace Period: Understanding the Importance

Nowadays, life insurance has become an important tool for financial planning. It is famous among people as it is a critical component of financial security, providing peace of mind and a sense of security to your loved ones in the event of your passing.

However, life can be unpredictable, and there may be times when you’re unable to pay your premiums on time. This is where the life insurance grace period comes into play, offering a safety net for policyholders during challenging times.

In this comprehensive guide, we’ll explore the concept of the life insurance grace period, its importance, and how it can benefit you and your family. Let’s get started!

What is a Life Insurance Grace Period?

A grace period in the context of life insurance is a designated timeframe after the due date for a premium payment during which the policy remains in force even if the payment is late. It acts as a buffer period, typically ranging from 30 to 90 days, depending on the insurance company and the terms of the policy.

During this period, the policyholder has the opportunity to make the overdue premium payment without facing any penalties or consequences, such as the policy lapsing or losing coverage. It offers a reprieve for policyholders who may experience financial difficulties or overlook payment deadlines, allowing them to rectify the situation and maintain their life insurance coverage uninterrupted.

Importance of the Life Insurance Grace Period

The grace period in life insurance is of paramount importance for several reasons, serving as a crucial safety net for policyholders and their families:

Financial Flexibility

Life is unpredictable, and financial challenges can arise unexpectedly. The grace period offers policyholders breathing room during times of financial strain, allowing them extra time to make premium payments without risking the loss of coverage. This flexibility can be invaluable, providing peace of mind knowing that their policy remains intact even during temporary financial difficulties.

Avoiding Lapses in Coverage

A missed premium payment deadline could lead to the lapse of a life insurance policy, leaving the insured and their beneficiaries in danger. However, the grace period provides a buffer, ensuring that coverage continues even if a payment is overdue. By preventing lapses in coverage, the grace period helps safeguard the financial security of the insured’s loved ones, ensuring that they receive the intended benefits in the event of the insured’s death.

Protection for Policyholders

Life insurance companies recognize that policyholders may encounter challenges that affect their ability to make timely payments. By offering a grace period, insurers demonstrate their commitment to supporting policyholders during difficult times, thereby fulfilling their obligation to provide reliable coverage and support. This protection is particularly valuable for families who rely on the financial security provided by life insurance to meet their needs and obligations.

Overall, the grace period serves as a lifeline for policyholders, providing them with the flexibility and protection they need to navigate life’s uncertainties with confidence. By understanding and leveraging the grace period effectively, policyholders can ensure that their loved ones remain protected and secure, regardless of the challenges they may face.

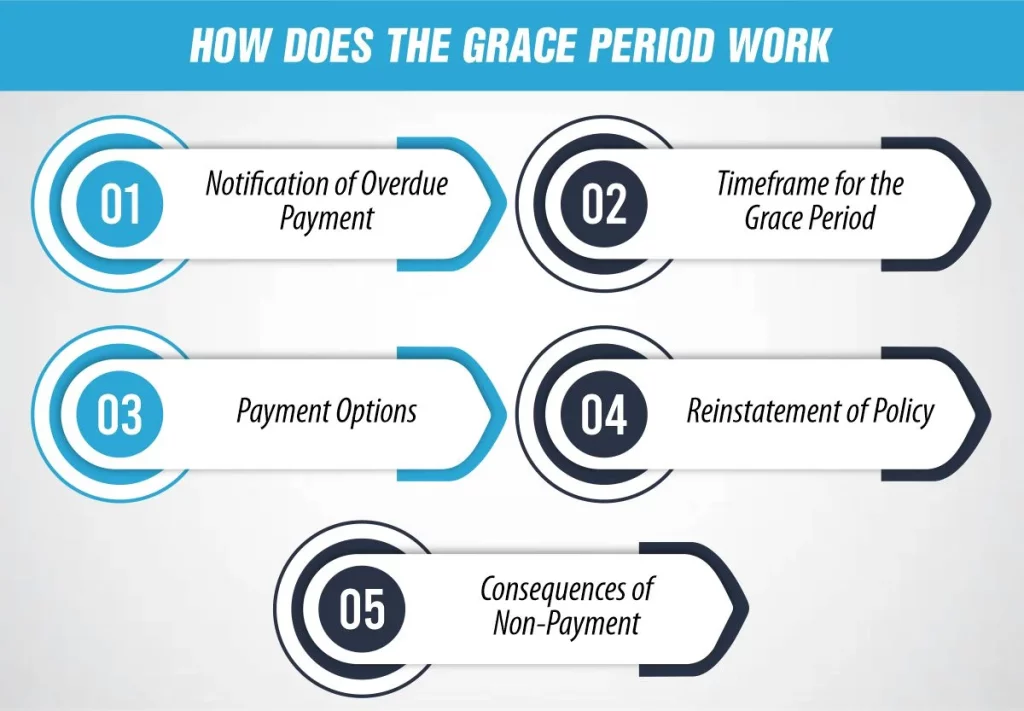

How Does the Grace Period Work?

The mechanism of the life insurance grace period is relatively straightforward, designed to offer policyholders a safety net in case of missed premium payments. Here’s how it typically works:

How Much Does Life Isurance Cost?

1- Notification of Overdue Payment

When a premium payment is missed, the insurance company notifies the policyholder of the overdue amount and the deadline for payment. This notification serves as a reminder and prompts the policyholder to take action to avoid potential consequences.

2- Timeframe for the Grace Period

The grace period typically ranges from 30 to 90 days, depending on the insurance company and the terms of the policy. During this period, the policy remains in force, and coverage continues uninterrupted, even though the premium payment is overdue.

3- Payment Options

Policyholders have the option to make the overdue premium payment within the grace period to keep their policy active. Insurance companies usually offer multiple payment methods, including online payments, phone payments, mail-in checks, or in-person payments at a local office.

4- Reinstatement of Policy

Once the overdue premium payment is received within the grace period, the policy is reinstated, and coverage resumes as usual. It’s crucial to make the payment as soon as possible to avoid any gaps in coverage or potential complications.

5- Consequences of Non-Payment

If the policyholder fails to make the overdue payment within the grace period, the policy may lapse, and coverage will terminate. In such cases, the beneficiaries would not be eligible to receive the death benefit, leaving them financially vulnerable.

The grace period offers policyholders a second chance to rectify missed payments without facing immediate consequences. It provides flexibility and protection, ensuring that coverage remains intact even during temporary financial setbacks or oversights.

Tips for Managing Your Grace Period

Effectively managing your life insurance grace period is essential to ensure uninterrupted coverage and peace of mind for you and your loved ones. Here are some practical tips for managing your grace period effectively:

- Stay Informed: Familiarize yourself with the terms and conditions of your life insurance policy, including the specifics of the grace period. Understand the duration of the grace period, any associated fees or penalties, and the steps required to reinstate your policy if a payment is missed.

- Set Reminders: Keep track of your premium due dates and set up reminders to ensure timely payments. Use calendars, smartphone apps, or automatic reminders from your insurance company to stay on top of payment deadlines and avoid missing them.

- Budget Wisely: Prioritize your life insurance premium payments along with other essential expenses in your budget. Assign funds accordingly and plan ahead to ensure that you can afford to make timely payments without experiencing financial strain.

- Communicate with Your Insurer: If you anticipate difficulty making a premium payment on time, don’t hesitate to reach out to your insurance company. They may offer flexible payment options or assistance programs to help you maintain your coverage during challenging times.

- Consider Automatic Payments: Take advantage of automatic payment options offered by your insurer. Setting up automatic withdrawals from your bank account or credit card can streamline the payment process and reduce the risk of missed payments.

- Review Your Coverage Regularly: Periodically review your life insurance coverage to ensure that it still meets your needs and financial goals. Life changes such as marriage, the birth of a child, or career advancements may require adjustments to your coverage amount or policy type.

- Plan for the Future: Use the grace period as an opportunity to reassess your financial situation and plan for the future. Consider creating an emergency fund to cover unexpected expenses and ensure that you have a financial safety net in place.

By following these tips and staying proactive about managing your grace period, you can ensure that your life insurance coverage remains intact and continues to provide valuable protection for you and your family. Remember, timely payments and effective communication with your insurer are key to making the most of your grace period and safeguarding your financial security.

Conclusion

The life insurance grace period serves as a valuable safeguard for policyholders, providing them with the flexibility and support they need to maintain their coverage during challenging times. By understanding how the grace period works and taking proactive steps to manage it effectively, you can ensure that your loved ones remain protected and secure in the event of your passing. Remember, life insurance is more than just a financial investment; it’s a promise of security and peace of mind for you and your family.

Frequently Asked Questions (FAQs)

1- What happens if I miss the grace period for my life insurance premium payment?

If you miss the grace period and fail to make your overdue premium payment, your policy may lapse, resulting in the termination of coverage. This means your beneficiaries would not be eligible to receive the death benefit in the event of your passing.

2- Can I make partial payments during the grace period to keep my policy active?

This depends on the specific terms of your life insurance policy and the policies of your insurance company. Some insurers may accept partial payments during the grace period, while others may require the full overdue amount to be paid to reinstate the policy.

3- Is there a limit to how many times I can utilize the grace period for late payments?

Generally, there is no limit to the number of times you can use the grace period for late payments. However, frequent use of the grace period may signal financial instability to your insurer and could affect your ability to maintain coverage in the long term.

4- Will using the grace period affect my life insurance policy’s cash value or other benefits?

Using the grace period to make late premium payments typically does not affect the cash value or other benefits of permanent life insurance policies. However, it’s essential to review your policy documents or consult with your insurance agent to understand any potential implications.

5- Can I extend the grace period if I need more time to make my premium payment?

Extensions to the grace period are generally not granted by insurance companies. However, if you’re experiencing financial hardship or extenuating circumstances, it’s advisable to contact your insurer to discuss alternative payment arrangements or assistance programs that may be available.

6- Does the grace period apply to all types of life insurance policies?

Yes, the grace period is a standard feature of most life insurance policies, including term life insurance, whole life insurance, and universal life insurance. However, the specific duration of the grace period may vary depending on the policy type and insurance company.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.