Myths about Life Insurance: Explore the Truth

Life insurance is a topic that often comes with a lot of misconceptions and misunderstandings. In today’s fast-paced world, it’s essential to have a clear understanding of the role life insurance plays in securing your financial future and protecting your loved ones.

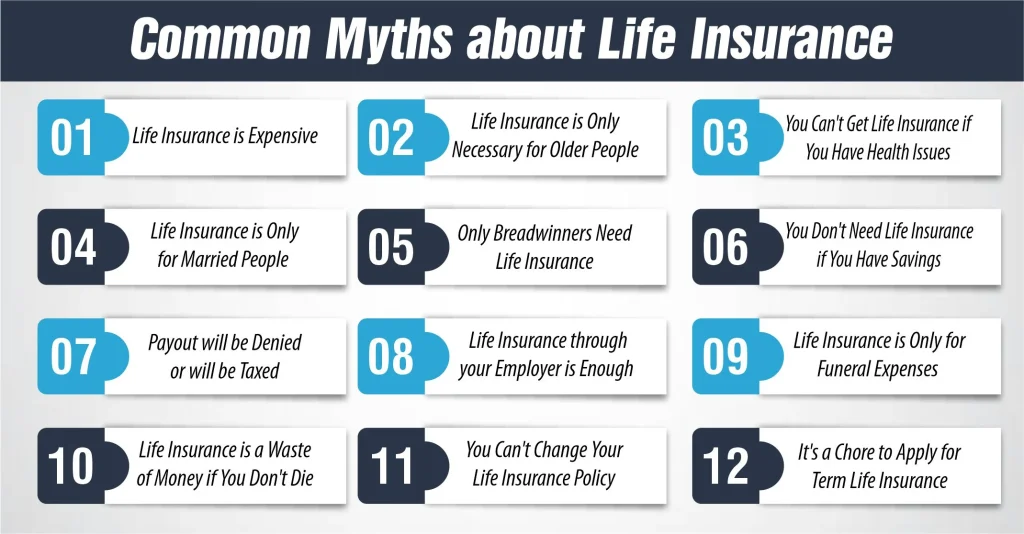

Unfortunately, many myths about life insurance can cloud judgment and prevent individuals from making informed decisions. In this blog post, we aim to debunk 12 common myths about life insurance to help you gain a better understanding of its importance and how it can benefit you and your family.

Whether you’re a young professional just starting your career or a seasoned parent planning for the future, understanding the truth behind these myths is essential for making smart financial decisions. Let’s explore together and separate fact from fiction when it comes to life insurance.

12 Common Myths about Life Insurance

Here are some of the common myths about life insurance explained:

1- Life Insurance is Expensive

Life insurance often gets a bad rap for being pricey, but the truth is, it can be surprisingly affordable. While some policies come with hefty premiums, there are plenty of options available to suit various budgets. The cost of life insurance depends on factors like your age, health, lifestyle, and coverage amount. Young, healthy individuals can typically lock in lower premiums, while those with pre-existing conditions may pay a bit more.

Additionally, term life insurance, which provides coverage for a set period, tends to be more affordable than permanent policies. By shopping around and comparing quotes from different insurers, you can find a policy that fits your financial situation. Don’t let the misconception of high costs deter you from exploring life insurance; it’s often more affordable than you think.

2- Life Insurance is Only Necessary for Older People

Life insurance is often seen as a financial tool for seniors, but the reality is that it’s beneficial for individuals of all ages. While younger individuals may not have as many financial obligations, life insurance can still provide valuable protection. For example, young parents can use life insurance to ensure their children’s future needs are met, such as education expenses.

Moreover, getting life insurance at a younger age can lock in lower premiums, saving money in the long run. Even if you’re single with no dependents, life insurance can be used to cover final expenses and any outstanding debts, sparing your loved ones from financial burdens. Regardless of your age, life insurance offers valuable protection for you and your family.

3- You Can’t Get Life Insurance if You Have Health Issues

While it’s true that health plays a role in determining life insurance eligibility and premiums, having health issues doesn’t automatically disqualify you from getting coverage. Many insurers offer policies tailored to individuals with pre-existing conditions, although the premiums may be higher.

However, some policies, such as guaranteed issue life insurance, don’t require a medical exam or health questions, making them accessible to individuals with health issues. It’s essential to shop around and compare quotes from different insurers to find a policy that meets your needs and budget. Don’t assume that your health issues make you ineligible for life insurance; speak with an insurance agent to explore your options.

4- Life Insurance is Only for Married People

Contrary to popular belief, life insurance is not exclusive to married individuals. No doubt, married couples often rely on life insurance to protect their spouses and children, single individuals can also benefit from having coverage. Life insurance can help single individuals cover final expenses, outstanding debts, and any financial obligations they may leave behind.

How Much Does Life Isurance Cost?

Aside from that, life insurance can serve as a valuable tool for leaving a legacy or supporting charitable causes. Whether you’re single, married, or in a domestic partnership, life insurance can play a crucial role in your financial planning. It’s important to consider your circumstances and financial goals when deciding if life insurance is right for you.

5- Only Breadwinners Need Life Insurance

While the primary breadwinner in a family often considers life insurance a necessity, it’s not the only scenario where life insurance can be beneficial. Non-working spouses also contribute significantly to a household’s finances by providing childcare, managing the household, and more. If a non-working spouse were to pass away, the surviving spouse might need to cover these costs, which life insurance can help with.

In addition, even if you’re single or without dependents, life insurance can still serve valuable purposes, such as covering debts or leaving a financial gift to a loved one or charity. Life insurance is a versatile financial tool that can provide security and peace of mind in various life situations beyond just replacing lost income.

6- You Don’t Need Life Insurance if You Have Savings

While having savings is crucial for financial security, it’s not a substitute for life insurance. Life insurance serves a different purpose than savings. Savings are accessible funds that can be used for various purposes, while life insurance provides a financial safety net for your loved ones in the event of your death.

Life insurance can help cover immediate expenses, such as funeral costs and outstanding debts, as well as long-term financial needs, such as replacing lost income and funding future expenses like education for your children. Furthermore, life insurance can help protect your savings by preventing them from being depleted due to unexpected expenses. Having both savings and life insurance can provide comprehensive financial protection for you and your family.

7- Payout will be Denied or will be Taxed

It’s a common misconception that life insurance payouts will be denied or heavily taxed. In reality, life insurance companies have a legal obligation to pay out valid claims, provided the policyholder has met all the policy requirements. As long as the policy was in force and premiums were paid up to date, the beneficiaries should receive the full death benefit.

Furthermore, life insurance death benefits are typically not taxable at the federal level, making them an attractive option for providing financial security to loved ones. In some cases, however, there may be estate tax implications if the total value of the policy and other assets exceeds certain thresholds. It’s always wise to consult with a tax professional to understand the tax implications of your specific situation.

8- Life Insurance through your Employer is Enough

While employer-provided life insurance can be a valuable benefit, it’s often not sufficient to cover all your financial needs. Employer-sponsored life insurance policies typically have coverage limits that may not adequately provide for your family’s financial security. Additionally, if you leave your job, you may lose this coverage, leaving you unprotected. It’s important to assess your life insurance needs independently of your employer-provided coverage.

Consider factors such as your family’s financial needs, outstanding debts, and future expenses. Purchasing a separate life insurance policy ensures that you have continuous coverage, regardless of your employment status. By evaluating your coverage needs and supplementing your employer-provided insurance with an individual policy, you can ensure that you have adequate protection for yourself and your loved ones even if you lose your job.

9- Life Insurance is Only for Funeral Expenses

While life insurance can certainly help cover funeral expenses, its primary purpose is to provide financial security for your loved ones in the event of your death. Life insurance can help replace lost income, pay off debts, and cover future expenses like mortgage payments, college tuition, and everyday living expenses.

It can also provide a financial cushion for your beneficiaries, ensuring they can maintain their standard of living without facing financial hardship. Funeral expenses are an important consideration, life insurance offers much broader protection and can help secure your family’s financial future. It’s essential to consider all your financial obligations and goals when determining the amount of life insurance coverage you need.

10- Life Insurance is a Waste of Money if You Don’t Die

One common misconception about life insurance is that it’s a waste of money if you outlive your policy. However, many types of life insurance, such as whole life and universal life, offer a cash value component that can grow over time. This cash value can be accessed during your lifetime through policy loans or withdrawals, providing a source of tax-advantaged savings that can be used for a variety of purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial needs.

Even term life insurance, which does not build cash value, provides valuable protection during the term of the policy and can be a cost-effective way to ensure your loved ones are financially protected if you pass away. So, life insurance can be a valuable financial tool that offers both protection and potential savings benefits.

11- You Can’t Change Your Life Insurance Policy

Life insurance policies are not set in stone, and you can make changes to them to suit your changing needs. Many life insurance policies offer flexibility, allowing you to adjust your coverage amount, change beneficiaries, or even switch to a different type of policy. For example, if you initially purchased a term life insurance policy but later decide you want permanent coverage, you can often convert your policy to a permanent one without the need for a medical exam.

Furthermore, as your life circumstances change, such as getting married, having children, or buying a home, you may find that you need to increase your coverage to ensure your loved ones are adequately protected. It’s essential to review your life insurance policy regularly and make adjustments as needed to ensure it continues to meet your financial goals and obligations.

12- It’s a Chore to Apply for Term Life Insurance

Applying for term life insurance doesn’t have to be a hassle. Many insurers have streamlined the application process to make it quick and easy. With the rise of online applications and digital tools, you can now apply for term life insurance from the comfort of your home, often without the need for a medical exam. Many insurers offer simplified underwriting processes that use information such as your age, health history, and lifestyle habits to determine your eligibility and premium rates.

Some insurers even offer instant approval for qualified applicants, allowing you to get coverage in a matter of minutes. Along with it, many insurers offer the option to convert your term life policy to a permanent policy later on, providing added flexibility and peace of mind. Applying for term life insurance can be a straightforward and convenient process that offers valuable protection for you and your loved ones.

To Sum it up

In the end, life insurance is a valuable financial tool that provides peace of mind and financial security for you and your loved ones. By debunking these common myths about life insurance, we hope to help you make an informed decision about your life insurance needs. If you have any questions or need assistance with choosing the right life insurance policy, please don’t hesitate to us Insure Guardian. Our professional agents are always ready to help you out!

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.