How to Switch Insurance Agents Within the Same Company

Last Updated on: June 30th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Sticking with the bad agent will make your life and insurance choices so complicated. Many people believe that when they first purchase life insurance, it’s all about finding the best rates. But over time, your priorities shift. You find out that the agent is not meeting the expectations, and this is the time to move on. Changing your agent does not mean that you are changing your policy. It simply means that you are just shifting the agent who will truly understand your needs and make the right choices for you. In this article, we will guide you on how to change the agent, when you have to change, and everything you should consider before making a move.

Table of Contents

ToggleWhy Would You Want To Switch Agents?

There are so many reason that makes your mind change the agent for your insurance policy. Here are some common reasons;

- Poor customer service

Is your agent slow to return your calls or emails? Do they promise to send quotes but never do? This will become a reason that you have to switch your agent.

- Hard to reach

You can also consider switching when they are not responding in days or weeks, and also, their working hours do not fit your schedule.

- Not a good match

Sometimes, you think you and your agent are not a good match, and working with your agent feels stressful. That’s a sign that this is the best time for a change.

- You moved

There is also a possibility that you like your agent, but you have to move to another area, so you have to change agent.

- Lack of experience

If your agent is not understanding your needs and he is not experienced enough to handle your situation so you have to move to another agent.

We all want great service, especially when it comes to something as important as insurance. If you are not getting the help or value you deserve, switching your agent will be the best step to take.

How Much Does Life Isurance Cost?

Can I Switch Insurance Agents Within the Same Company?

Yes, you can switch the agent within the same company. Most insurance companies will allow you to switch to a different agent without cancelling your policy. There is no need to start over to get a new provider. You can keep your current policy active and only work with a new agent who better understands what you want and need.

To make a switch, you just have to contact your insurance company’s customer service or visit their website. Mostly, this is a quick change, but some may ask you to fill out a form, or you have to send them a written request.

What To Expect From a Good Insurance Agent

It is important to choose the right agent when you are buying the insurance policy, and it’s also important to build a relationship. A good insurance agent always communicates well with you and cares about your needs.

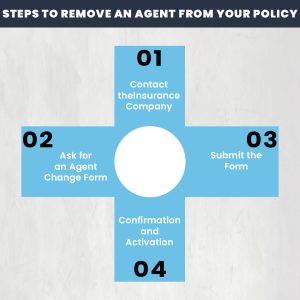

Steps to Remove an Agent from Your Policy

There are a few steps you have to take when you have decided to switch your insurance agent. Here is how it usually works;

Contact the Insurance Company

The first thing is that you have to reach out to your insurance company’s customer care service directly. They will guide you through the agent change process.

Ask for an Agent Change Form

In some companies, you may give a written request form to change the agent, but some companies need you to fill out a form called an “Agent of Record” change form, or something similar.

Submit the Form

After getting the form, you have to complete it and clearly write the name of the new agent you want. Then send it back to the insurance company.

Confirmation and Activation

The insurance company will process your request and inform you once the change is complete.

Once all this procedure is done, your old agent will no longer have access to your policy, and all future things will be handled to the new agent.

What You Need to Know Before Switching Insurance Agents

Before making the change to your insurance agent, there are a few key considerations:

1. Your Policy Stays the Same

When switching the agents, you need to know that it does not mean that you are switching the policy. Your premium, coverage limits, and terms remain the same until you make a request to change them.

2. Agent Commissions

Both old and new agents may earn commissions from your policy, but this does not impact your rates. Commissions will be built into your premiums.

3. Your Agent Relationship Matters

Insurance is about more than just a policy. It helps to have an agent who understands your needs, communicates with you, and has a good reputation.

4. Think About the Timing

If your renewal date is coming soon, that can be a good time to switch agents. but there is no need to wait; just change when you want.

Final Thoughts

Changing your insurance agent is easy and a simple thing to handle when your agent is not managing things properly. You don’t have to change your policy, just make a switch from one agent to a new one who can understand your needs well. Take a step if needed and follow the rules and paperwork of the company to quickly get the new agent. This is your policy and you have the right to change the agent and deserve the best support.

FAQs

1. Can I switch insurance agents without changing my policy?

Yes, you can switch agents in the same company without changing your policy. Your coverage, premium, and terms will stay the same.

2. Why would I want to change my insurance agent?

You have to change your insurance agent if your agent gives poor service, doesn’t answer your calls, doesn’t know much about your needs, or is hard to talk to.

3. How can I switch to a new insurance agent?

You have to contact your insurance company’s customer service and ask to change agents. Some may require a written request, and most of them will give you the form to change the agent.

4. Will switching agents affect my insurance rates?

No, changing agents does not affect your rates. Your new agent will charge commission, but it will not change your cost. The commission will be built into your premium.

5. When is the best time to switch insurance agents?

You can switch anytime, but right before your policy renewal is often a convenient moment to make the change.

Ready to Switch Your Insurance Agent?

If your current agent is not meeting your needs and expectations, don’t wait! Contact your insurance company today to start the simple process of switching to a new agent who truly understands you. Remember, you can keep your policy just the way it is while getting better service. Take control of your insurance experience now!

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.