Term Life Insurance vs Whole Life: Key Differences Explained

Last Updated on: January 14th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

There are only two major categories of life insurance and it is important to differentiate between Term life insurance and Whole life insurance. Each of the mentioned options has its advantages; the choice of the suitable option is determined by individual features and aims. Here are the two types of policies and getting to know them will assist you to know which one suits you best.

Table of Contents

ToggleWhat Is Whole Life Insurance vs. Term Life Insurance?

Life insurance is one of the most important financial products you may use to secure your family’s future. Among the most frequently chosen forms of life insurance, two particular forms can be reviewed: whole life insurance and term life insurance. Both offer protection to an individual’s income, however, they cannot be compared fully in terms of the period they cover, the cost incurred and the amount of benefits paid. Unraveling the differences will assist you in arriving at the right decision to select the correct policy. Let’s discuss each type more in detail.

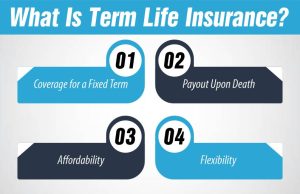

What Is Term Life Insurance?

Term life insurance is easily one of the most basic and least expensive types of life insurance out there. This one is expected to offer coverage for a certain period, and thus, a perfect plan for anyone who wants to have financial security in certain periods of his/her life.

– Coverage for a Fixed Term

It is an insurance coverage that provides the amount insured for a specific period, for instance, 10, 20, or even 30 years. This period is normally arrived at by your obligations, which in most cases include a fixed number of years to pay for such things as a house, college fees for your children, or an income that you anticipate will support your dependents. In the event of your demise during the term period, your nominee is paid the face amount of the policy free of tax.

– Payout Upon Death

Term insurance yields a cash amount called the death benefit to the personalities you have chosen. The following costs can be covered with this payout:

- Funeral and burial costs.

- Bills like credit card balances, medical bills, or other loans are taken.

- Maintenance of your family needs or coverage for your family expenses and basic needs.

- Future requirements, for example, for education or children’s maintenance for a family.

– Affordability

Term life insurance has so many benefits and the primary and the greatest is affordability. Unlike whole life, which has a savings or cash value component, and term insurance, which only covers a specific period, premiums are much lower. It makes it cheaper compared to many other insurance companies making it right for young families with children or individuals who need good coverage on a small budget.

– Flexibility

Most term life insurance contains conversion terms making it easy for you to change to a permanent type of coverage such as the whole life insurance policy before the term matures. This can prove to be beneficial if you undergo any change of fortune and you need coverage for the rest of your life.

What Is Whole Life Insurance?

Whole life insurance is a kind of life assurance that offers lifetime coverage with a savings addition. It is a financial product intended for anyone who wants more than just a lump sum payout upon his or her death.

How Much Does Life Isurance Cost?

– Lifelong Protection

Whole life insurance is one of the main kinds of insurance because it provides insurance coverage for the entire life of the policyholder provided that he pays premiums on the policy. This will make certain your beneficiaries will be in a position to be paid the death benefit regardless of the time you die making it ideal for the contract planning.

– Cash Value Component

Whole life insurance is a form of life insurance with an important element which is its cash value, which increases with time. Part of your premium goes to a savings component of the policy that offers assured returns. This cash value can:

- Be taken with interest in the form of a loan.

- Be quiet in some or most circumstances.

- Act as a source of capital in case of an emergency.

Cashing in feature located in whole life insurance puts it as not only an insuring plan but a wealth creation instrument.

– More Premiums plus Extra Services

Usually, the premium charges of whole life insurance are more expensive than those of term life insurance because of its additional options. These are lifetime policies, cash value which is assured to increase and one can borrow from the policy or use the cash value in any need as one deems fit. There is a raw sticker shock associated with investing in Real Estate, but in the long run, it is worth it, especially if one is using it for real estate purposes or building wealth.

– Predictable Premiums

Whole life insurance premiums never change throughout the whole calendar life of the policyholder. This stability makes it easier for you to have a budget in place and it also means that you won’t find yourself suddenly paying higher insurance rates as you grow older.

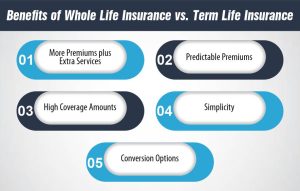

Benefits of Whole Life Insurance vs. Term Life Insurance

Whole life insurance is a kind of life assurance that offers lifetime coverage with a savings addition. It is a financial product intended for anyone who wants more than just a lump sum payout upon his or her death.

– More Premiums plus Extra Services

Usually, the premium charges of whole life insurance are more expensive than those of term life insurance because of its additional options. These are lifetime policies, cash value which is assured to increase and one can borrow from the policy or use the cash value in any need as one deems fit. There is a raw sticker shock associated with investing in Real Estate, but in the long run, it is worth it, especially if one is using it for real estate purposes or building wealth.

– Predictable Premiums

Whole life insurance premiums never change throughout the whole calendar life of the policyholder. This stability makes it easier for you to have a budget in place and it also means that you won’t find yourself suddenly paying higher insurance rates as you grow older.

– High Coverage Amounts

In general, term life insurance is cheap because it enables the buyer to buy lots of insurance for just a small price. For instance, you may grant yourself a $1 million policy to ensure your family is well catered for if you lack and can generate income for the family.

– Simplicity

As for term life insurance, it is simple. This is not complicated by saving or investment aspects, indeed, it promises just a death benefit in case of a policyholder’s death during the term. It is recommendable for beginners in life business. This is because the cover that is offered is in simple language.

– Conversion Options

Most term policies come with the provision of conversions to cash-value products before the whole-life coverage. It enables you to be insured when your needs change or you contract illnesses that may see you locked out of getting a policy signed for later.

Whole life insurance therefore has the following advantages;

Whole life insurance is popular and it gives more than cash value for the decided amount of money if someone dies. It is a long-term financial apparatus with characteristics that can help one sustain a shield throughout his lifetime and assist in the generation of capital. Let’s explore its benefits in greater detail:

1. Lifelong Protection

Whole life insurance was designed not to expire when the agreed term reaches its expiration but to provide the policyholder with coverage for their entire lifetime provided they made payments for the policy regularly. This makes it perfect for people who wish to:

- Securing finances for their family no matter when they die.

- Pay for the Rest such as Funeral and Burial Expenses.

- Preserve wealth for children or grandchildren with a financial gift.

For instance, in as much as the policy pays up when you are 100 years old, the beneficiaries will receive the death benefit, an assurance that you cannot find anywhere.

2. Cash Value Growth

This type of life insurance contains another provision known as cash value which increases over time. Here’s how it works:

- Another part of your premium is paid out to purchase investments that earn a guaranteed interest rate.

- The non-urgent function is to accumulate, over the years, a cash balance for you to utilize.

This cash value can be:

Borrowed against: Loan can be taken against the cash value in case of need, renovation of the house, or for any other purpose.

- Withdrawn: Even those policies that give an opportunity for partial withdrawal can be useful in retirement or in an emergency.

- Left to grow: They found that if it remains unutilized, it also raises the total value of the policy which includes the cash value.

This feature turns whole life insurance into a dual-purpose tool: an emergency fund for your family and also an avenue through which you can create sustainable assets in the long run.

3. Guaranteed Payout

On the plus side, the whole concept of life insurance has its policy payout upon the death of the insured. To this end, whole life insurance is far more favorable than term life insurance because it promises money to clients’ beneficiaries regardless of when the clients die.

4. Fixed Premiums

Premiums for whole life insurance are paid in accordance throughout the whole period the policy is in force. This predictability makes it easier to budget, even in the later years in which a person’s wages, or expenses may vary. It is unwise to allow rate increases here since fixed premiums help avoid that and provide stability and a permanent source of income instead.

Cost of Whole Life Insurance vs Term

| Aspect | Term Life Insurance | Whole Life Insurance |

| Premium Costs | Lower. For example, $20-$30/month for $500,000 at age 30. | Higher. Around $300-$500/month for $500,000 at age 30. |

| Coverage Duration | Fixed period (e.g., 10, 20, or 30 years). | Lifetime coverage as long as premiums are paid. |

| Cash Value | No cash value. | Accumulates cash value over time that can be used as collateral. |

| Flexibility | Less flexible; expires after term. | Flexible; options to borrow or withdraw from cash value. |

| Renewal Options | Can renew at higher rates. | No renewal is needed; coverage is permanent. |

| Investment Component | No investment. | Acts as both insurance and a savings vehicle. |

| Premium Increases | Fixed during term, but can increase after renewal. | Premiums usually stay level for life. |

| Suitability | Ideal for temporary needs (e.g., mortgage, raising kids). | Best for long-term coverage with savings growth. |

Term vs Whole Life Insurance: Pros and Cons

Deciding which of the life insurance policies to buy means you have to compare Term Life Insurance and Whole Life Insurance. Each has its advantages and disadvantages, and this is why if you will try to understand the difference it will be easy to decide which plan is best for you and which one will let you achieve your financial objectives.

– Pros of Term Life Insurance

Lower Initial Cost

- As compared to Whole Life Insurance, Term Life Insurance costs much less – often many times less – even in the first few years of the policy. This makes it an ideal choice for any person who wants to afford a lot of coverage yet he/she lacks the deep pockets to pay dearly for the premiums.

Simple and Easy to Understand

- Term Life Insurance is easy to understand with no confusing bonus sections such as Investments. Policy premium is paid by the policyholder for a limited period (10 years, 20 years, or 30 years), and upon the policyholder’s death, the beneficiary is paid a lump sum, which is referred to as the face value of the policy. This simplicity makes it easy for people to understand or gain some appreciation of what image enhancement is all about.

Suits short-term monetary plans well

- If you have certain obligations that will not last for a lifetime such as repaying a home loan or educating your children, Term Life Insurance offers insurance coverage throughout those years instead of getting a permanent insurance policy.

– Cons of Term Life Insurance

No Savings or Cash Value

- Unlike Whole Life Insurance, Term Life Insurance has no feature of cash value accumulation. In the case that the policyholder ends up outliving the period on the policy, etc. the money paid cannot be claimed back and there are no savings or provisions to resort to.

Insurance Expires at the end of the term unless it is renewed.

- Again, the coverage will stop as soon as the term is completed, except that the policy is renewed, and this comes with costlier rates. It becomes a problem if you outlive the policy and do not again meet the requirement to be approved for a new term at such a cheap rate of insurance you may find yourself without insurance when you most need it.

– Pros of Whole Life Insurance

Builds Cash Value Over Time

- Whole Life Insurance policies not only offer a death benefit but also accumulate funds and the policyholder can borrow or redeem this cash value at any time starting today. This feature enables the policyholder to save in the policy and the future if needs money for other uses he can be offered a loan with the policy as security.

Provides Lifelong Protection

Whole Life takes care of your dependents for the entire duration of your lifetime provided you are making the agreed premium payments. This confirms that somebody, preferably a loved one, will claim the benefit upon your death no matter when it occurs.

- It can also act as an investment tool since you invest your time and money in buying the certificates.

- Second, built into the Whole Life Insurance policy is cash value which serves as an added financial resource in the policyholder’s life. The cash value may increase at a fixed rate and can also be used investment option for policyholders apart from compensating for the loss of life.

– Cons of Whole Life Insurance

Higher Premiums

- Whole Life Insurance has several disadvantages, but to name the worst one – it is comparatively more expensive than Term Life Insurance. Whole Life’s higher premiums above those of traditional Life Insurance make this form of insurance less affordable to clients who are tightening their wallets or only require insurance for a few years.

Term Life Insurance Is Far from Simple

- Whole Life Insurance is slightly more complicated because of the investment aspect and growth of the cash value. On the same note, it is a disadvantage in the sense that it makes the procedure of undertaking research on the desired policy longer for those who have no time to comprehend the complexities of the terms used in a policy.

Group Term Life Insurance vs Whole Life

Group Term Life Insurance is usually provided by companies that offer basic and temporary insurance for the employee. But one disadvantage is that it doesn’t create cash values and offers only temporary coverage for the insured. On its part, Whole Life Insurance is an individual policy with life assured and accumulative cash value from its policy period. It has higher premiums, but in return, it offers much better coverage – permanent that does not change over time—as well as the potential to utilize the accrued financial worth. Where one is interested in long-term financial protection, Whole Life is the one most suitable.

Term vs Whole Life Insurance for the Elderly

To the seniors, Whole Life Insurance is always the best because it covers all their lives thereby offering them the much-needed security for the remainder of their lives. It also pays a cash value over the years, which also has other advantages. But Term Life can also come cheaper especially if one has limited time to his plan whether preferring to pay only for the funeral and other end-of-life costs or for a certain goal. Being cheaper than Whole Life, Term Life lacks the sort of ongoing coverage or savings that can be found in Whole Life.

Conclusion: Term Life Insurance vs Whole Life

Most people find it difficult to decide that the best option is either the Term Life or the Whole Life Insurance. Term Life is cheap and provides temporary/search insurance, but has no permanent value. Whole life insurance permanently provides a payout while also accumulating cash value, and is a more expensive option, it is the better buy for those who want insurance to last for their lifetime and an investment vehicle as well. Your decision should not outdo your financial ability or even be a burden to your financial plans.

FAQs

1- Which is better, life insurance whole or term?

It depends on your needs. Whole life insurance provides lifetime savings and benefits, whereas term insurance is more cost-effective for short-term objectives.

2- What are the disadvantages of term life insurance?

The main disadvantage is that it expires after the term, and it doesn’t build cash value.

3- Can you cash out term life insurance?

No, there isn’t a cash value component to term life insurance.

4- Why do people prefer term life insurance?

People prefer term life for its affordability and simplicity, especially for short-term needs.

5- What is the age limit for term insurance?

The age limit varies by insurer but is typically between 60 and 75 years.

Resources

- https://www.mutualofomaha.com/advice/life-insurance/types-of-life-insurance/term-vs-whole-life-insurance-making-the-choice

- https://www.bankrate.com/insurance/life-insurance/term-life-vs-whole-life/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.