Variable Universal Life vs Indexed Universal Life: key Insight

Last Updated on: August 7th, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

Are you considering a variable universal life (VUL) or indexed universal life (IUL) insurance policy? It’s difficult to understand the key differences between variable universal life vs indexed universal life. choose the best one that aligns with your financial goals and risk tolerance. Let’s discuss the main points of these two universal life insurance policies, exploring their similarities, and differences, and which one may be the better choice for you. Let’s get started.

Table of Contents

ToggleWhat Is Indexed Universal Life Insurance (IUL)?

Compared to term life insurance, indexed universal life (IUL) is another form of permanent insurance with an additional cash value feature. The money in a policyholder’s cash value account can earn interest on a stock market index chosen by the insurer such as the Nasdaq 100 or the S&P 50. If you are also enrolled in the policy of a fixed-rate account, you will decide how much you would like to deposit into it.

Although the interest rate derived from the equity index account can fluctuate, the policy does offer an interest rate guarantee, which limits your losses. It also may cap your gains. These policies are more volatile than fixed universal life policies, but less risky than variable UL insurance policies because IUL does not invest in equity positions.

How does indexed universal life insurance work?

– Premiums

IUL policies are like most other insurance policies where you are required to pay premium fees on a monthly basis when you are the policy owner. The premium goes toward two things: the cost of insurance (COI), which is the price of your death benefit, and expenses that are associated with the management of your policy, and your cash value account.

IUL premiums are adjustable. In case you are unable to pay the premiums for some months or pay less than the required amount, the life insurer can use the cash value to pay your premiums. However, if you use all your cash value balance to pay your premiums, your policy may terminate which means that it will no longer provide for your beneficiaries in case of your demise.

– Interest

Most IUL policies’ cash value account corresponds to a stock or bond index of your choice depending on what carriers offer. Your insurer might also provide a fixed-rate investment as well, depending on the insurance policy that you choose. Here are a few interest-related terms worth noting:

Floor: Popularly known as the guaranteed minimum rate, the floor signifies the minimum guaranteed annual interest rate on the cash value account. If the market crashes you will have a minimum interest rate by which your account can begin to make money with the market even if it is down.

Cap: The cap is opposite to the floor in which the cash value rate won’t go over a certain percentage of the index (the cap) regardless of the high performance of the index.

Participation rate: The participation rate represents the proportion of the return of an index fund that would be given to your account. A participation rate of 100% means that your policy’s cash value will receive 100% of the investment interest, up to the policy’s interest rate. If your participation rate is 100% and your account’s index fund gains 10%, you receive 10% of that gain.

How Much Does Life Isurance Cost?

What is Variable Universal Life

There is also another type of life insurance known as variable universal life. It also has the same tax treatment as indexed universal life and allows for paying very flexible premiums and funds to the cash value in a sub account. Its major variation lies in the management of the funds in the subaccount.

Unlike an indexed account that measures an investment’s performance against an index, a sub account within a variable universal life policy provides an account that can invest in securities, stocks, and bonds. Similar to indexed universal life, Variable universal life policies do not involve participation rates, cap rates, and floor rates.

The return on a variable universal life policy cash value will reflect the actual performance of the securities, without any limits up or down. This means it is possible to get a higher return than with an indexed universal life policy but also to get a lower return as well as to lose money.

How does variable universal life work?

The main features of a variable universal life policy are a mix of those typically found in variable life and universal life policies. Based on these features let’s describe how variable universal life policy works:

– Your premiums are adjustable:

That means you can choose not to pay a particular installment or quit paying your premium totally if the cash value of the policy can meet your expenses, as pointed out by the nonprofit community Life Happens. This is similar to what happens to universal life insurance, and it may benefit you if an emergency makes you short of money.

– You have investment variety and risk:

As with a variable life policy, variable universal life lets you invest in underlying sub-accounts offering a variety of investment options. These investments are tied to financial markets, and the value of your policy may fluctuate as the value of your chosen investments goes up or down. While the reward can be great, you’re also taking on risk that can reduce your cash value, and, if by policy provisions the policy lapses, your death benefit could be lost as well, says the Insurance Information Institute. The upside? Transferring funds between investments is tax-free, so you’re not constrained by the potential tax implications, says Life Happens.

Between variable universal life vs indexed universal life with VUL policies, you choose from a few investment options for your policy’s sub-accounts. Life Happens states that you can typically invest in stocks, bonds, or a combination of the two. You can also opt to invest in a fixed account, which provides a guaranteed minimum interest. The value of your policy’s sub-accounts fluctuates based on how these investments perform. If they do well, your policy’s value increases. If the investments decrease, though, your cash value will decrease as well.

– You can increase the death benefit:

Regarding the ups and downs in people’s lives, if one day you realize that you have more diverse needs in insurance, Life Happens shares that you can always raise or lower your coverage. For example, the policy might allow you to request an increase in the death benefit or pay a large sum at once to build up cash value (though the IRS has its rules on how large that one-time payment can be), the group points out.

– You can withdraw or borrow from it:

Similar to some other forms of permanent life insurance, a variable universal life insurance policy entitles the policyholder to surrender the policy for its cash value or borrow against it. The flip side is that a withdrawal or a loan can diminish your death benefit or create a tax issue if not repaid according to the rules.

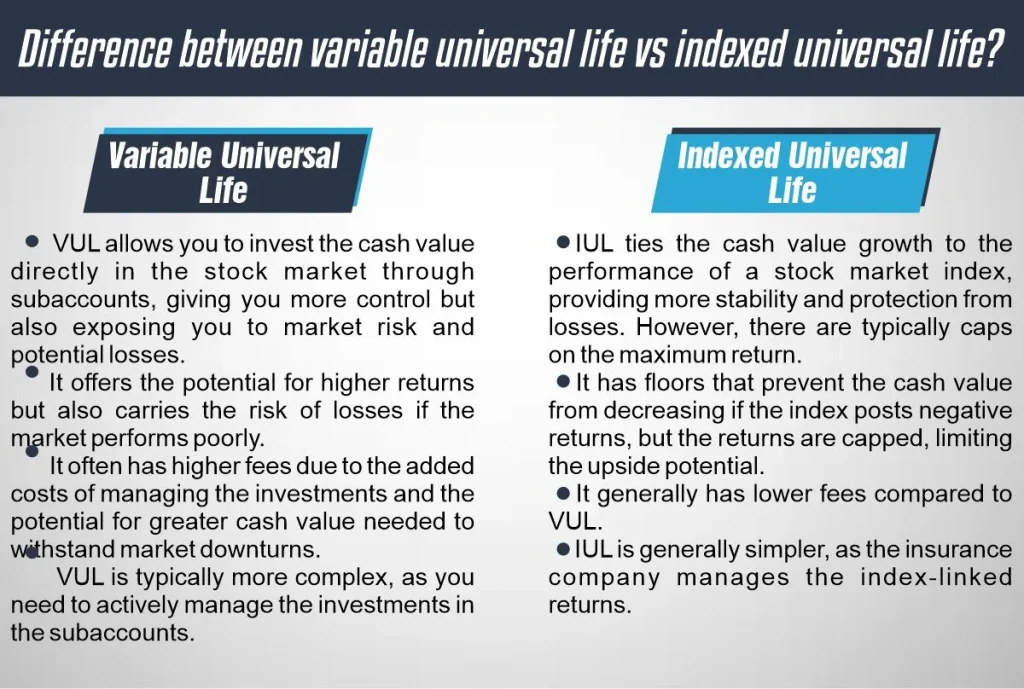

Difference between variable universal life vs indexed universal life?

The main differences between variable universal life vs indexed universal life insurance are:

– Variable universal life

- VUL allows you to invest the cash value directly in the stock market through subaccounts, giving you more control but also exposing you to market risk and potential losses.

- It offers the potential for higher returns but also carries the risk of losses if the market performs poorly.

- It often has higher fees due to the added costs of managing the investments and the potential for greater cash value needed to withstand market downturns.

- VUL is typically more complex, as you need to actively manage the investments in the subaccounts.

– Indexed universal life

- IUL ties the cash value growth to the performance of a stock market index, providing more stability and protection from losses. However, there are typically caps on the maximum return.

- It has floors that prevent the cash value from decreasing if the index posts negative returns, but the returns are capped, limiting the upside potential.

- It generally has lower fees compared to VUL.

- IUL is generally simpler, as the insurance company manages the index-linked returns.

In simple words VUL offers more investment control and potential for higher returns but also carries greater risk, while IUL provides more stability and protection from losses but with limited upside potential. The choice between the two depends on your risk tolerance and investment objectives

Which One is Better for You?

Therefore, the decision whether to invest in variable universal life vs indexed universal life is best determined by your attitude towards risk, financial objectives, and individual circumstances. if you do not mind the fluctuations in the stock market and are willing to take a little more risk VUL would be for you. But if you are the kind of investor who wants to avoid fluctuation and is more concerned about risk protection, IUL could be better for you.

One should consider one’s situation, consult with your financial advisor, and examine the peculiarities of the policy and its cost before making the final decision. Remember that VUL and IUL are both advanced financial tools and it is important to know the business risks involved and the possible returns on investment in the policy.

Conclusion

When deciding between these variable universal life vs indexed universal life, you will need to consider your tolerance to risks, the desired rate of return, interest in keeping down costs, and the extent of downside protection required. Which policy design is most logical for your financial circumstances? Please seek advice to consider these alternatives in more detail.

FAQs

1- Is a variable universal life vs indexed universal life better?

That will primarily depend on your risk tolerance and long-term financial strategy. But for the vast majority of people, an indexed universal life insurance policy is the better choice. The fees and higher risk of VUL policies don’t make sense for how volatile the stock market is becoming.

2- Can you lose money in an IUL policy?

Can you lose money with an IUL? As an investment, an IUL does include risk—so yes, you could lose money. The only exceptions would be if your IUL has a guaranteed floor for value or a minimum rate of return (a guaranteed floor just means the life insurance company promises your account won’t go below a certain amount).

References:

https://diversifiedllc.com/article/indexed-universal-life-vs-variable-universal-life/

https://www.investopedia.com/articles/insurance/09/indexed-universal-life-insurance.asp

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.