Vital Life Wellness Insurance: Features, Pros and Cons

Do you have a health insurance plan and want to associate with vital life wellness? In the fast-paced and unpredictable journey of life, ensuring your well-being is paramount. One way to safeguard your health comprehensively is through an insurance plan – enter Vital Life Wellness Insurance.

In this blog post, we’ll explore this unique insurance offering, exploring its features, benefits, and why it’s becoming a vital choice for those who prioritize their overall well-being. But let’s start with some basic information!

What is Vital Life Wellness Insurance?

Vital Life Wellness Insurance is not your everyday health coverage – it’s a comprehensive plan designed to keep you in the best possible shape, both physically and mentally. Unlike traditional insurance that often kicks in when you’re already unwell, Vital Life takes a proactive approach. It’s all about prevention, offering regular check-ups, screenings, and vaccinations to catch potential health issues early on.

But that’s not all – this insurance goes the extra mile by prioritizing mental well-being. It covers mental health treatments, therapies, and counseling, recognizing the crucial link between mind and body. What sets Vital Life apart is its commitment to your overall wellness.

You get access to fitness classes, nutritional counseling, and stress management programs to help you live your healthiest, happiest life. With customizable policies, it tailors your coverage to fit your unique needs. In a nutshell, Vital Life Wellness is your partner in staying healthy, happy, and ahead of the curve.

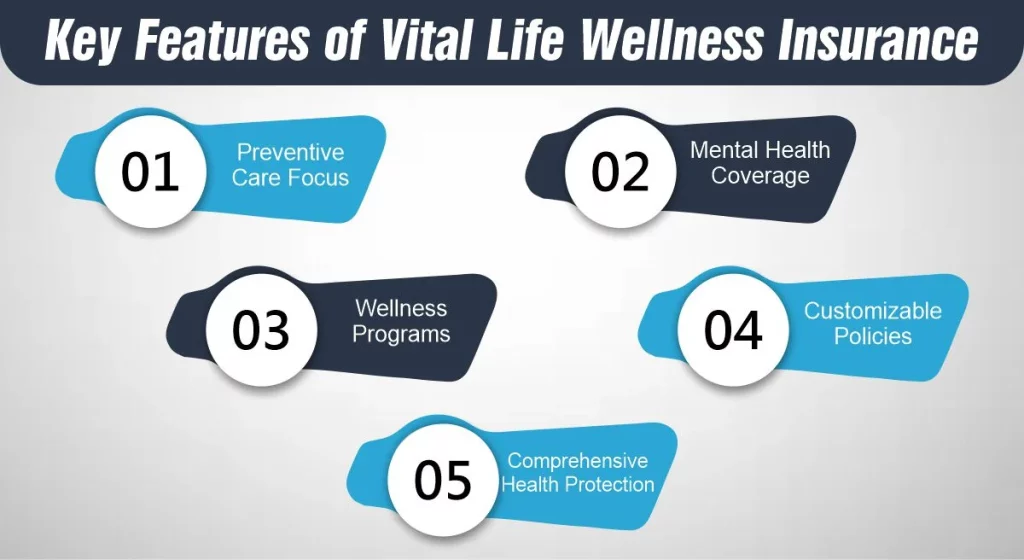

Key Features of Vital Life Wellness Insurance

Here are some of the attractive feature of Vital Life Wellness:

Preventive Care Focus

Vital Wellness Insurance takes a proactive stance on your health. It prioritzes preventive care with regular check-ups, screenings, and vaccinations to catch potential health issues before they escalate.

Mental Health Coverage

Unlike many conventional plans, Vital Life recognizes the importance of mental health. It provides extensive coverage for mental health treatments, therapies, and counseling, ensuring a holistic approach to well-being.

Wellness Programs

The plan doesn’t stop at covering illnesses – it actively promotes wellness. Vital Life offers a variety of wellness programs, including fitness classes, nutritional counseling, and stress management workshops, encouraging a healthier lifestyle.

Customizable Policies

Understanding that everyone’s health needs are unique, Vital Life Wellness allows you to tailor your coverage. This flexibility ensures that you’re investing in the services that matter most to you.

Comprehensive Health Protection

Beyond traditional medical coverage, Vital Life aims to protect your overall health. By combining preventive care, mental health coverage, and wellness programs, it offers a comprehensive approach to keeping you in peak condition.

How Much Does Life Isurance Cost?

Benefits and Drawbacks of Choosing Vital Life Wellness Insurance

Benefits

Comprehensive Coverage: Vital Life provides all-encompassing coverage, addressing not only medical expenses during illnesses but also preventive care, mental health, and wellness programs.

- Preventive Care: The plan’s focus on preventive care means early detection of potential health issues, minimizing the impact of illnesses and promoting a proactive approach to well-being.

- Mental Health Support: Unlike traditional plans, Vital Life acknowledges the significance of mental health. It offers extensive coverage for mental health treatments, therapies, and counseling, recognizing the nature of your health.

- Wellness Programs for a Healthier Lifestyle: Access to wellness programs such as fitness classes and stress management workshops encourages a healthier lifestyle, promoting overall well-being beyond just medical coverage.

- Customizable Policies: Vital Life allows policyholders to customize their coverage, ensuring that individuals pay for the specific services that align with their unique health needs.

- Financial Security: By reducing the financial burden of medical expenses, Vital Life provides a sense of financial security, allowing individuals to focus on their health without the constant worry of potential financial strain.

Drawbacks

- Potentially Higher Premiums: The comprehensive nature of Vital Life Wellness may result in higher premiums compared to more basic health insurance plans, which might be a drawback for those on a tight budget.

- Complexity of Customization: While the option for customization is a benefit, some individuals might find the process of tailoring their coverage complex, potentially leading to confusion about the specific services included in their policy.

- Limited Network: Depending on the location and the insurance provider, Vital Life Insurance might have a more limited network of healthcare providers compared to broader health insurance plans.

- Not Ideal for Short-Term Coverage: Vital Life Insurance is designed for individuals looking for long-term, comprehensive coverage. It may not be the most suitable option for those seeking short-term or temporary insurance solutions.

- Varied Availability: Availability of Vital Life Wellness Insurance may vary by region and insurance providers, limiting access for individuals in certain locations.

Vital Life Wellness offers a lot of benefits but potential drawbacks should also be considered based on individual preferences, budget constraints, and specific health needs. As with any insurance decision, it’s crucial to thoroughly evaluate personal circumstances and compare options before making a choice.

Why Choose Vital Life Wellness Insurance Over Traditional Plans?

Choosing Vital Life Insurance over traditional plans offers a multiple advantages that go beyond conventional health coverage. Here’s why you should consider this innovative approach to insurance for your well-being:

1- Preventive Focus

Vital Life Wellness doesn’t wait for you to get sick; it actively promotes preventive care. Regular check-ups, screenings, and wellness programs ensure potential health issues are identified early, preventing them from becoming major concerns.

2- Extensive Well-Being

Unlike traditional plans that primarily cover medical treatments, Vital Life embraces a holistic approach. It covers not only physical health but also mental well-being, recognizing the interconnected nature of mind and body.

3- Proactive Lifestyle Support

Vital Life actively supports a healthy lifestyle. With wellness programs, fitness incentives, and resources for positive behavior change, it motivates you to make choices that contribute to your overall health, going beyond just illness management.

4- Customization for Individual Needs

Recognizing that everyone’s health needs are unique, Vital Life allows you to customize your coverage. This ensures you’re not paying for services you don’t need while tailoring the plan to address your specific health concerns.

5- Innovative Digital Tools

Embracing technology, Vital Life offers innovative digital tools. From wellness tracking apps to virtual consultations, these tools enhance accessibility, making it easier for you to engage with your health on a daily basis.

6- Rewards for Healthy Living

Vital Life often introduces incentives for maintaining a healthy lifestyle. Achieving fitness goals, participating in wellness activities, and adhering to preventive care recommendations can earn you rewards, adding an extra layer of motivation.

7- Comprehensive Support Ecosystem

Beyond medical coverage, Vital Life builds a comprehensive support ecosystem. Nutritionists, fitness trainers, mental health professionals – these resources create a network that addresses various aspects of your well-being.

8- Family-Centric Approach

Vital Life extends its wellness programs to cover the entire family. By prioritizing family health, the plan ensures that every member, from children to seniors, has access to resources for a healthy and fulfilling life.

9- Alternative and Complementary Therapies

Acknowledging the importance of health, Vital Life may cover alternative and complementary therapies. This inclusion broadens the spectrum of available treatments, recognizing that health encompasses various approaches.

10- Community Engagement Initiatives

Vital Life actively engages its policyholders through community initiatives. This sense of community fosters a supportive environment, encouraging individuals to share their wellness journeys, providing inspiration and guidance.

Choosing Vital Life Insurance is not just about coverage; it’s a commitment to a proactive, personalized, and holistic approach to your health. The preventive focus, lifestyle support, and comprehensive well-being coverage make it a compelling choice for those seeking a more progressive and enriching insurance experience.

Final Thoughts

In the quest of a fulfilling and healthy life, choosing the right insurance plan is a critical decision. Vital Life Wellness Insurance stands out as a beacon of complete protection, addressing not only your physical health but also your mental well-being. With its man focus on preventive care, wellness programs, and customizable policies, it’s a compelling choice for those who prioritize a proactive approach to their health.

Frequently Asked Questions (FAQs)

1- What makes Vital Wellness Insurance different from traditional health plans?

Vital Life takes a proactive approach, emphasizing preventive care, mental health coverage, and wellness programs. It goes beyond treating illnesses, focusing on holistic well-being. These characteristics of Vital Life Wellness make it unique from traditional health plans.

2- Can I customize my Vital Wellness Insurance coverage?

Yes, absolutely! Vital Life understands that everyone’s health needs are unique. You have the flexibility to tailor your coverage to suit your specific health requirements.

3- Are there any rewards for maintaining a healthy lifestyle with Vital Life Wellness Insurance?

Yes, Vital Life often introduces incentives for healthy living. Achieving fitness goals, participating in wellness activities, and following preventive care recommendations can earn you rewards.

4- Is Vital Life Wellness Insurance suitable for short-term coverage?

No, Vital Life Wellness Insurance is designed for individuals seeking long-term, comprehensive coverage. It may not be the ideal choice for those looking for short-term or temporary insurance solutions.

5- How does Vital Life actively engage its policyholders?

Vital Life engages policyholders through community initiatives, fostering a supportive environment. This community engagement encourages individuals to share their wellness journeys and provides inspiration and guidance.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.