Last Updated on: September 29th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Planning before in your life is not just about saving the money. Its all about making sure that your loved ones are financially protected when they need it the most. For so many people, life insurance feels like that it is out of their budget. The good news? Affordable term life insurance policies make dependable protection possible without straining your budget.

Table of Contents

ToggleTerm life is not like the other permanent insurance plans, which builds cash value and comes with higher premiums, a term plan provides straightforward coverage at the lowest cost. In this guide, we’ll explore how the most affordable term life insurance works, who benefits from it, and how to find the best option for your situation, no matter if you’re a parent, homeowner, senior, or smoker.

What Makes a Term Life Insurance Policy Affordable?

A term life insurance policy provides fixed coverage for a set length of time that is commonly 10 years, 20, or 30 years. If the person who bought the policy passes away during that period, the policy will pay out a death benefit to loved ones or chosen family members.

When we talk about an affordable term life insurance policy, it usually refers to:

- Lower monthly payments compared to permanent coverage

- Flexible term lengths that fit financial goals

- Coverage amounts that align with a realistic budget

Why Term Life Coverage Costs Less

The biggest and the main reason affordable term life insurance quotes are so attractive is because they are simple. Other types of life insurance, like whole life or universal life, also act like savings plans and can last your whole life. But term life is different, it’s only about protection, nothing more.

Here’s why it costs less:

- There is no saving part in the plan you’re not paying for investment or cash value growth.

- These plans only covers for the set time. The insurance only protects you for the number of years you choose.

- The plans come with the simple design because there are fewer extras, it’s cheaper for the company to run.

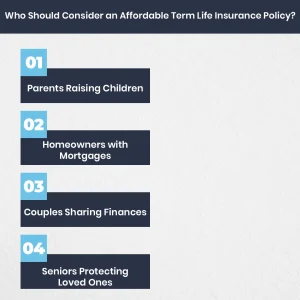

Who Should Consider an Affordable Term Life Insurance Policy?

The right insurance coverage depends on your situation of life and financial responsibilities. An affordable term life insurance prices can be a smart choice for many situations, including:

Parents Raising Children

If you are raising kids, term life can make sure their daily needs, schooling, and even college expenses are covered if something unexpected happens.

How Much Does Life Isurance Cost?

Homeowners with Mortgages

If you have a home loan, this coverage can help pay off the mortgage so your family doesn’t risk losing the house.

Couples Sharing Finances

For partners depending on each other’s income, term life can protect the household and keep the surviving spouse from financial hardship.

Seniors Protecting Loved Ones

Affordable term life insurance for seniors is still possible in your 50s or 60s. These can help cover medical charges, funeral expenses, or leave a small gift for family without charging the high monthly premiums.

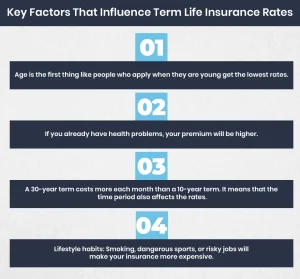

Key Factors That Influence Term Life Insurance Rates

Key Factors That Influence Term Life Insurance Rates

There are some things that can affect how much you will have to pay for your policy:

- Age is the first thing like people who apply when they are young get the lowest rates.

- If you already have health problems, your premium will be higher.

- A 30-year term costs more each month than a 10-year term. It means that the time period also affects the rates.

- Lifestyle habits: Smoking, dangerous sports, or risky jobs will make your insurance more expensive.

Affordable Options for Seniors

Many older adults assume life insurance becomes unaffordable after a certain age, but that’s not the case. Companies now offer specialized affordable term life insurance for seniors, even for applicants in their 60s.

These policies are particularly useful for:

- Covering funeral and burial expenses

- Paying off lingering medical debt or loans

- Leaving financial support for children or grandchildren

Coverage for Smokers and No-Exam Alternatives

Smokers

Smokers usually pay higher premiums, often double what non-smokers pay but term insurance remains the cheapest option available. Comparing multiple affordable term life insurance quotes can help find the least expensive plan that still offers meaningful protection.

No-Exam Policies

Another rising trend is no-exam term life insurance, which allows applicants to skip medical exams. Instead, companies rely on health questionnaires, prescription checks, and digital applications. These policies cost slightly more but offer convenience, especially for those who want quick approval.

Advantages and Drawbacks of Low-Cost Term Coverage

Like any financial product, affordable term life has both strengths and limitations.

Advantages

- Lowest-cost way to buy life insurance

- Flexible coverage periods from 10–30 years

- High death benefits for low premiums

- Available options for seniors and smokers

- Quick application with no-exam alternatives

Drawbacks

- No cash value growth

- Coverage ends when the term expires

- Renewal costs increase significantly

- Premiums based on age and health status

- Not designed for lifetime protection

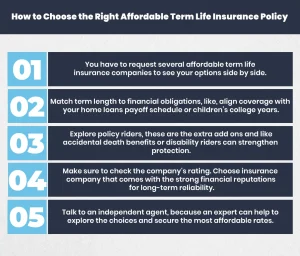

How to Choose the Right Affordable Term Life Insurance Policy

Finding the best life insurance plan is not always about getting the cheapest plan. It’s about balancing the prices, features and protection. Here’s how you can get the best plan

- You have to request several affordable term life insurance companies to see your options side by side.

- Match term length to financial obligations, like, align coverage with your home loans payoff schedule or children’s college years.

- Explore policy riders, these are the extra add ons and like accidental death benefits or disability riders can strengthen protection.

- Make sure to check the company’s rating. Choose insurance company that comes with the strong financial reputations for long-term reliability.

- Talk to an independent agent, because an expert can help to explore the choices and secure the most affordable rates.

Protect Your Loved Ones Today – Get a free quote from Insure Guardian and find the most affordable term life insurance that fits your budget.

Final words

At the end of the day the affordable term life insurance not only provides your protection but it also give you peace of mind knowing that you and your family is protected and one thing that you have to careful of is the prices, like you have to compare the prices form the different insurance companies to get the best rate that is under your budget, so you can lock in protection that keeps your family safe without over paying.

No matter if you’re a young parent, or you are about to retire, or even you are a smoker and you are looking for realistic coverage, there is an option that fits your needs. Start by gathering affordable term life insurance process today and secure a policy that balances protection and affordability.

FAQs

What is a reasonable amount to pay for term life insurance?

The cost for any plan is not fixed; it depends on age, health, and the term length. For healthy younger people, monthly premiums can range between $20 and $50 per month, making it an affordable way to provide financial protection for loved ones.

How much does a $1,000,000 term life insurance policy cost?

The cost of the $1,000,000 term life insurance policy depends on your age, health, and duration of the plan. Like if you are a young healthy man you have to pay less as compared to the senior who have some health issues..

Who does Dave Ramsey recommend for term life insurance?

Dave Ramsey recommends buying 15- to 20-year level term life insurance through independent agents who can compare multiple companies. He advises avoiding whole life insurance, focusing instead on affordable term policies to cover debts and income replacement.

At what age should you stop term life insurance?

There are so many people who end their term life insurance when they feel that they don’t need it anymore. This is usually after big bills are paid, like the house loans or kids’ college fees. Some people also stop when they have enough money and savings for the final expenses.

Key Factors That Influence Term Life Insurance Rates

Key Factors That Influence Term Life Insurance Rates