Can You Have More Than One Life Insurance Policy?

Last Updated on: August 6th, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

When you are so conscious about everything happening in your life, you also have to make sure that your family won’t suffer when you are not with them, and you also want to be secure against any unexpected thing in life. When it comes to securing your financial future, one life insurance policy might not always be enough for you. So you think about what if you want to buy more than one life insurance policy.

Table of Contents

ToggleYes, you can buy multiple life insurance policies. In this comprehensive guide, we’ll explore the ins and outs of holding more than one life insurance policy. We’ll answer key questions like how many life insurance policies a person can have, is it’s worth having more than one life insurance, and what are the reasons for getting multiple policies.

Basics of Life Insurance

Life insurance is defined as a contract between you and the insurance company. Then, after your death, your family will get the money from the insurance company. Buying a life insurance policy is the best way to protect your family and your loved ones’ future. It gives them support to pay for things like bills or funeral expenses when they pass away. Before getting the details of the topic of multiple policies, let’s quickly review the types of life insurance available:

Term Life Insurance

The term life insurance covers a specific period (e.g., 10, 20, or 30 years) and pays out if the policyholder dies within that time period.

Whole Life Insurance

The whole life insurance covers your entire life, giving lifetime coverage with a savings or investment component, and you can also use it while you are still alive.

Universal Life Insurance

Universal life insurance is a flexible insurance where you can adjust the amount of your payments and how much the amount your loved ones would receive when you’re gone.

Stacking Life Insurance Policies: Is It Legal and Beneficial?

Yes, you can have more than one life insurance policy, and this is completely legal and also this is very common, especially for those people who have big financial responsibilities or long-term plans.

Some common reasons to have multiple policies include:

How Much Does Life Isurance Cost?

- To cover different financial needs (e.g., mortgage, education, business loans).

- To set up term policies that end around major life milestones

- To add extra coverage on top of what their job provides.

- To adjust for changes in income, lifestyle, or family size.

So, not only can you have multiple life insurance policies, but it is also a smart way to build flexible financial safety for your loved ones.

Having Two Life Insurance Policies

Yes, you heard it right, no law restricts you from having two life insurance policies. Insurance companies do not restrict their clients from applying for coverage from multiple providers, as long as they’re honest about their existing insurance policy.

However, all insurance companies will ask if you have any other active life insurance and then they use a process called underwriting to make sure that the total amount of life insurance you’re applying for makes any sense based on your income and overall financial situation.

So, while it’s legal, it must be justified and fully disclosed.

Multiple Term Life Insurance Policies

Yes, you can have multiple-term life insurance policies, and many people do! It’s a smart way to make sure different financial needs are covered at different stages of life. For example:

- A 30-year policy to cover your mortgage.

- A 20-year policy to pay a child’s college tuition.

- A 10-year policy to handle short-term debts.

This is called laddering, and it can save money while making sure that your financial obligations are covered at the right time.

So, if you’re asking, “Can you have more than one term life insurance policy?”The answer is yes, with proper planning, it can be very effective.

Two Insurance Policies – Here’s What to Know

Yes you can have two insurance policies and not just for life insurance. It’s common in health, auto, home, and other insurance categories too. However, in each case, there are rules to avoid insurance fraud or duplicate claims.

For life insurance, having two or more policies is generally straightforward, simple and legal. For health or auto insurance, having more than one policy means the insurers work together to decide how to split the costs, which is called coordination of benefits.

So, can you have multiple insurance policies? Yes, but each type of insurance comes with its own guidelines and requirements.

2 Life Insurance Policies With the Same Company

Many insurance companies allow you to apply for extra policies if your needs change over time. But it’s a very good idea to compare the prices and benefits of the other companies because you may find better options, especially if your health or finances have improved.

Sometimes, getting a new policy from another insurer is smart because it spreads out your risk instead of putting it all with one company.

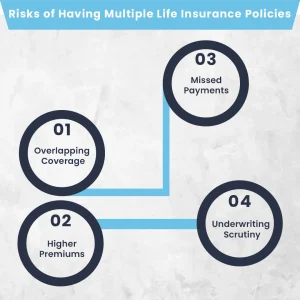

Risks of Having Multiple Life Insurance Policies

While there are many benefits of having multiple life insurance policies, there are also a few downsides and risks that you have to keep in mind:

1. Overlapping Coverage

You might pay for more insurance than you need if you’re not carefully planning how the policies work together.

2. Higher Premiums

Managing several policies may result in higher administrative costs, especially if you’re paying separate policy fees.

3. Missed Payments

More policies mean more payment dates. Missing premiums could result in policy lapses or loss of coverage.

4. Underwriting Scrutiny

If you apply for several life insurance policies at the same time, insurance companies might get concerned and look more closely at your applications.

Conclusion

You can have more than one insurance policy, even multiple-term life insurnace policies, and sometimes even with the same company. Just make sure that the policies follow the rules, and they should be in the budget and meet your financial needs. The best way to get it right is to talk with an insurance expert. They will help you find the coverage that protects your loved ones without costing more than necessary or making things confusing.

Protect What Matters Most, Speak with an Insure Guardian Expert Today! Get personalized advice from a licensed pro and find the perfect life insurance plan for your future. Don’t wait—your family’s peace of mind starts now!

FAQs

1. How many life insurance policies can a person have?

There’s no legal limit, but total coverage must be justified by your income and financial obligations.

2. Is it okay to have two insurance policies?

Yes, and it’s common. Just be aware of premium costs and ensure all policies are necessary.

3. Is it worth having more than one life insurance?

Yes, especially if you need different coverage amounts for different periods or obligations.

4. Can you have 2 life insurance policies with the same company?

Yes, many insurers allow multiple policies, but compare rates with other providers too.

5. Can you have more than one health insurance policy?

Yes, but insurers will coordinate benefits to prevent duplicate reimbursements.

6. How many insurance policies can you have on someone?

As many as needed if each policyholder has a valid insurable interest and the person being insured agrees to it.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.