AT&T Life Insurance: Explore the Benefits and Claim Process

There is a question you might need to ask yourself; what would happen to your loved ones if something unexpected happens? Just like health or car insurance, life insurance is very crucial in financial planning in cases of any unfortunate incident.

Fortunately, AT&T, a very famous telecommunications company, offers several life insurance plans as part of its employee benefits package to the employees. But do you know what AT&T’s life insurance covers and how you can get the most out of it? Well! Don’t worry, we are going to explain all the aspects of this life insurance in this blog post.

Let’s explore it together!

Explain the Basics of AT&T Life Insurance Policy

AT&T provides life insurance benefits for their employees as well as some retirees. However, the challenge is to figure out how much coverage you may need. Do you have a family to support without overspending on unnecessary coverage? So, it’s essential to understand your AT&T insurance options.

AT&T Life Insurance Options for Employees

If you are an employee of the company, you are eligible for the basic life insurance plan. The insurance plan is provided and paid by the company means Company Sponsored Free of Charge. Ideally, coverage should provide one year’s worth of salary for the employee.

However, if you need additional insurance coverage, you may have to enroll in the supplemental life insurance coverage, a group scheme by AT&T. It could be a very cost-effective option to get more coverage and security. The overall cost and coverage amount you can get depends on your job classification, salary, and years in service along with other factors.

AT&T Life Insurance Options for Retirees

AT&T also offers life insurance to its retirees under different options to meet their diverse needs. If you meet the Modified Rule of 75, you can get basic life insurance after retirement. Being a retiree, the benefits you can avail depend on your age, job classification, and compensation.

Retirement might also feature supplemental life insurance if the employee wants it. As with the cost and availability of this coverage, your age will play a key role alongside other factors mentioned above.

Benefits of AT&T Life Insurance Policy

AT&T life insurance offers various benefits to the insured that make it an appealing option for the company’s employees. Some of them are given below:

Financial Security for Your Loved Ones

The primary advantage of the life insurance product is its ability to offer financial security. In the case of your demise, the benefits of this policy will be able to support your family with living expenses, mortgage and even other expenses.

Flexible Coverage Options

AT&T insurance plans are very flexible and allow you to select the coverage you need for your basic requirements. Whether you want basic coverage or go for a supplement for additional protection, you are all free to choose one at any time.

How Much Does Life Isurance Cost?

No Medical Exam Required for Basic Coverage

When you go for basic coverage through a group plan, there is no need to undergo a medical exam to get an insurance plan. This feature makes it accessible to all employees regardless of the health alternatives that they may have.

Portability

Employees can freely transfer their group life insurance option through AT&T. If you ever consider quitting, don’t worry because you still have the option to transfer your group policy into an individual policy. In this way, you don’t have a risk of losing your life insurance whenever you change employers, thus, having constant cover and assurance.

How to File a Claim with AT&T Life Insurance Policy?

Filing an AT&T insurance claim is a critical process. Here’s how you can improve this process to make your transition easier.

Step 1: Notify AT&T

In case of the insured’s death, the designated beneficiary must have to inform AT&T as soon as possible. It will initiate the claim process for the policy.

Step 2: Collect Important Documents

Documentations required for the process may include a death certificate for the insured, as well as identification of the policyholder. These documents are critical to the processing of the claim.

Step 3: Complete the Claim Form

Fill out the labeled “claim form”, which is legally authorized and can be procured from AT&T. Avoid any form of inaccuracy or incomplete presentation of information since this only slows down the process.

Step 4: Submit the Claim

Enclose the completed claim form and any supporting documents according to AT&T’s insurance department’s requirements. This is usually possible using a postal system or by an online submission link.

Step 5: Await Processing

The company will forward this claim to AT&T for consideration and subsequent processing. This step may take several weeks and includes such activities as compilation of data, analytical works, and others. In this case, once the approval has been made, then the payment will be made to the beneficiary.

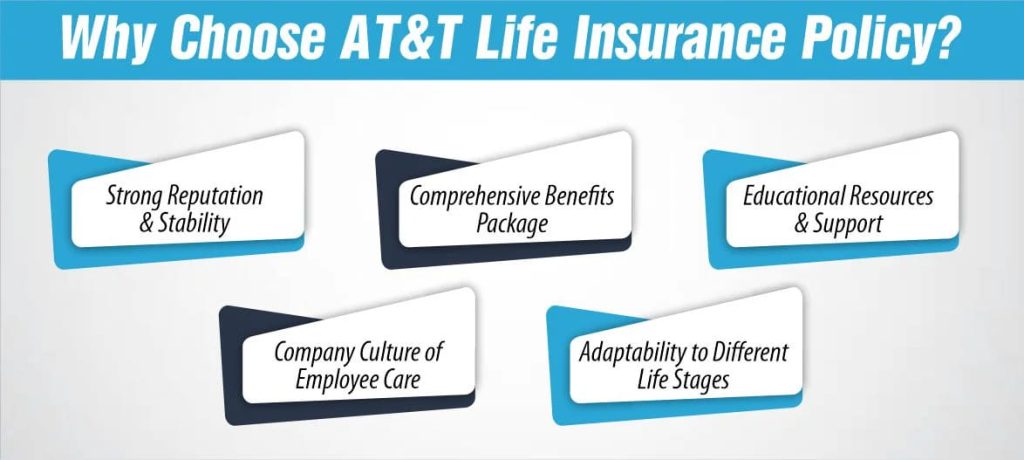

Why Choose AT&T Life Insurance Policy?

Choosing AT&T’s life insurance policy is a wise decision for many reasons. Here are some of the compelling reasons that make AT&T insurance trustworthy:

1- Strong Reputation and Stability

Purchasing a life insurance policy from the AT&T Company has many advantages because you will work with a reputable and stable company that has experience in providing security to its clients.

2- Comprehensive Benefits Package

Note that AT&T’s life insurance is not offered as a stand-alone policy; rather, it comes with the major groups of benefits. In this way, all of your benefits can be administered in one place. Moreover, the comprehensive package comprises other priceless employee benefits making the value of working at AT&T righteous more worthwhile.

3- Educational Resources and Support

It gives access to the benefits advisors to get further help and support. The company also provides information regarding the life insurance policy that can assist the employees in building up adequate knowledge of the life insurance policy.

4- Company Culture of Employee Care

The organizational culture contributes to the fact that AT&T takes good care of the people who work with the company. As a result, the policies for life insurance are made after extensive consideration of the requirements of its employees.

5- Adaptability to Different Life Stages

It is very important to choose a plan that can be flexible to cater for different career stages and thus avail life insurance solutions that are friendly to every age. AT&T insurance offers you adaptability to different life stages as the policies also evolve with your changing circumstances while ensuring continuous long-term relevance.

How to choose and manage Beneficiaries for AT&T life insurance?

Choosing and managing beneficiaries for your AT&T life insurance policy involves a few important steps:

Identify Your Beneficiaries

Start with identifying your dependents and naming those you financially rely on, such as your spouse, children, and other family members, if any. Think about the family members or dependents who will require your support financially if you are not available.

Decide on Primary and Contingent Beneficiaries

Primary beneficiaries are the priority recipients as it is their right to be compensated first in case of any financial exploitations. Contingent beneficiaries are known to be the alternatives if the primary ones aren’t available. This helps to ensure that these benefits go to a deserving person, especially in cases where somebody you know is struggling with their bills.

Allocate Shares

Choose how you want to split the payout amount between the beneficiaries in your Will. There are two options: the company can divide them equally and give them an equal number of shares, or it can allocate them in proportion to their requirements

Provide Accurate Information

It is also important that you provide the full names and telephone numbers of every beneficiary and your relationship with the beneficiary. Such accuracy contributes to avoiding problems when handling claims.

Review Regularly

Review your beneficiaries, more frequently after major life events such as marriage, divorce, having a child or the death of a beneficiary. If nothing is altering, then it must be nice to have the hope of an annual review, mustn’t it?

Update as Needed

If you want to change beneficiaries, contact the HR office or fill in an online form if provided by the organization. Updates might also contain information that calls for supporting documents, such as a marriage certificate or divorce papers.

Communicate Your Choices

Let your beneficiaries know they’ve made it, and more importantly, how you want them to utilise the benefits. This will help you to clarify your intentions and avoid misunderstandings.

Final Thoughts

AT&T life insurance provides a convenient way to secure your family’s future financially. With various plans for employees and retirees, the company offers a comprehensive plan that gives you great coverage according to your needs. Selecting AT&T insurance means enjoying the professional services of the insurance company, the possibility of convenient policy management, and the professional assistance required to choose the necessary option.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.