Life’s journey is unpredictable and filled with unexpected twists and turns. Along this path, accidents can happen suddenly, altering our lives deeply. In times of uncertainty, having the right protection in place is crucial. But in the face of such uncertainties, do you know which safety net suits you best: accidental death & dismemberment vs life insurance? These two forms of coverage may seem similar at first glance, but they serve distinct purposes. Which one is the best fit for your needs?

Join us today on a journey to unravel the mysteries of AD&D versus Life Insurance, exploring their benefits and limitations and, ultimately, empowering you to make an informed decision about your financial security.

Insurance for accidental death and dismemberment (AD&D):

In the event of an unintentional death or severe injury that results in dismemberment—such as losing limbs, eyesight, or hearing—AD&D insurance offers coverage. An additional insurance policy usually provides a lump sum payout if the insured individual dies or sustains a covered injury due to an accident.

AD&D insurance’s key characteristics are:

Coverage is limited to accidents and usually excludes death or injury from disease or natural disasters.

Benefits are typically paid on top of any other insurance the policyholder may have, such as disability or life insurance. The injury’s extent or event type determines the benefit amount. For example, one may profit more from losing both hands or eyes than losing just one.

Because the danger of accidental death or dismemberment is typically smaller than the chance of death from illness or natural causes, AD&D insurance premiums generally are lower than those for life insurance.

Life Insurance:

In the case of an insured person’s death, life insurance protects beneficiaries financially, regardless of the cause of death. Upon the insured’s passing, it distributes a certain sum of money, known as the death benefit, to the beneficiaries listed in the policy.

Important aspects of life insurance consist of the following:

The coverage encompasses death from any cause, including illness, accidents, natural causes, and other unanticipated events, and is not restricted to accidental death.

Term life insurance covers an insured person for a predetermined number of years (say, 10, 20, or 30). Permanent life insurance, such as whole life or universal life insurance, covers an insured person for their whole life as long as premiums are paid.

After the insured passes away, beneficiaries may utilize the death benefit to replace lost income, settle debts, pay for burial costs, or fulfill other financial obligations.

Because life insurance offers more comprehensive coverage and pays out regardless of the reason for death, its premiums are usually greater than those of AD&D insurance.

Accidental death & dismemberment vs life insurance

| Coverage | Life Insurance | AD&D Insurance |

| Death From Illness | Yes | |

| Death From Disease | Yes | |

| Death From Drug Overdose | Yes | |

| Death From Homicide | Yes | Yes |

| Death From Suicide | Yes* | |

| Death From Car Crashes | Yes | Yes |

| Death From Choking | Yes | Yes |

| Death From Drowning | Yes | Yes |

| Death From Slipping | Yes | Yes |

| Death From Falling | Yes | Yes |

| Loss of Eyesight | Yes** | Yes |

| Loss of Hearing | Yes** | Yes |

| Loss of One or Multiple Limbs | Yes** | Yes |

| Loss of Speech | Yes** | Yes |

| Partial or Permanent Paralysis | Yes** | Yes |

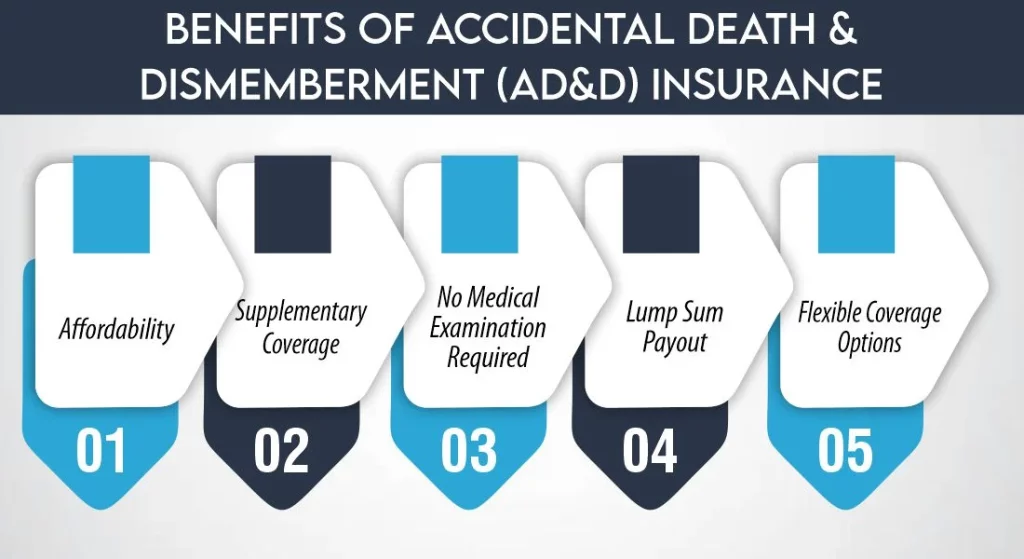

Benefits of Accidental Death and Dismemberment (AD&D) Insurance:

Affordability: AD&D insurance premiums are often lower than life insurance premiums because the coverage is limited to accidents. This affordability makes it an attractive option for individuals seeking additional protection without a significant financial commitment.

How Much Does Life Isurance Cost?

Supplementary Coverage: AD&D insurance is a supplementary policy to other insurance coverage, such as life insurance. It provides an extra layer of financial protection specifically for accidents, ensuring beneficiaries receive additional funds in the event of accidental death or severe injury.

No Medical Examination Required: Unlike many life insurance policies that may require a medical examination or health questionnaire, AD&D insurance typically does not require such assessments. This makes it easier and quicker to obtain coverage, particularly for individuals with pre-existing health conditions or those who may have difficulty qualifying for traditional life insurance.

Lump Sum Payout: AD&D insurance pays out a lump sum benefit to the designated beneficiaries in the event of accidental death or covered dismemberment. This can provide immediate financial assistance to cover medical bills, funeral costs, mortgage payments, or other financial obligations.

Flexible Coverage Options: AD&D policies often offer flexibility in coverage options, allowing policyholders to choose the level of protection based on their needs and budget. This can include options for different benefit amounts, coverage terms, and riders for additional benefits such as accidental medical expense coverage.

Benefits of Life Insurance:

Comprehensive Coverage: Life insurance covers death from any cause, including illness, natural causes, accidents, or other unforeseen circumstances. This broader coverage ensures financial protection for beneficiaries regardless of how the insured person passes away.

Income Replacement: Life insurance serves as an essential tool for income replacement, particularly for breadwinners or individuals with dependents. The death benefit can replace lost income, enabling beneficiaries to maintain their standard of living and meet ongoing financial needs, such as mortgage payments, education expenses, and daily living expenses.

Long-Term Financial Security: Permanent life insurance policies, such as whole life or universal life insurance, offer lifelong coverage as long as premiums are paid. This provides long-term financial security and peace of mind, knowing that beneficiaries will receive a death benefit whenever the insured person passes away, regardless of age or health status.

Cash Value Accumulation: Permanent life insurance policies typically have a cash value component that accumulates over time. Policyholders can access this cash value through policy loans or withdrawals to supplement retirement income, fund education expenses, or address other financial needs during their lifetime.

Estate Planning: Life insurance can be crucial in estate planning by providing liquidity to cover estate taxes, debts, and final expenses. It allows individuals to efficiently transfer wealth to their heirs and help preserve future generations’ assets.

How AD&D Insurance Works

AD&D insurance provides financial protection in the event of accidental death or certain types of severe injuries. These often include the loss of a limb, eyesight, speech, or hearing. Unlike traditional life insurance, AD&D does not offer coverage for death resulting from natural causes, illnesses, or any pre-existing medical conditions.

Accidental Death

Accidental death coverage is a core component of an AD&D insurance policy. It comes into play when the insured individual dies due to an unexpected accident, such as a vehicular collision, a fall, or other sudden events. In such cases, the beneficiary receives a lump-sum payment, typically equal to the face value of the policy. This financial payout aims to provide immediate financial relief to the beneficiary, helping to cover funeral costs, settle debts, or sustain living expenses.

AD&D policies often list conditions and exclusions that can affect the payout. For instance, deaths resulting from high-risk activities like paragliding or bungee jumping may not be covered. Similarly, deaths due to substance abuse or occurring under the influence of alcohol are generally excluded. Some policies also have time limitations, specifying that the accidental death must occur within a certain period following the accident to be eligible for the payout.

Accidental Dismemberment

Accidental dismemberment is another key feature of an AD&D policy. This coverage is activated when the insured individual experiences a severe injury that results in losing a limb, eyesight, hearing, or other vital bodily functions. Unlike the accidental death component, which usually pays out the total face value of the policy, the accidental dismemberment payout is often a percentage of that amount. The specific percentage depends on the type and severity of the loss. For example, losing one arm might result in a 50% payout, while losing both arms could trigger a 100% payout.

Exclusions often apply, such as injuries sustained while engaging in high-risk activities or those that result from substance use. Additionally, some policies specify a time frame for the loss to occur post-accident so that the payout is valid.

Which is better, accidental death & dismemberment vs life insurance

Choosing between accidental death & dismemberment vs life insurance depends on individual circumstances, financial goals, and risk tolerance.

Life insurance offers comprehensive coverage for death from any cause, providing financial security for dependents, income replacement, debt repayment, and estate planning. It is suitable for those seeking long-term financial protection and peace of mind regardless of how death occurs.

On the other hand, AD&D insurance specifically covers accidental death and serious injuries resulting in dismemberment. It provides immediate financial assistance for accidents such as car crashes, falls, or workplace injuries. AD&D insurance may be more affordable than life insurance and can benefit individuals with high-risk occupations or lifestyles.

Ultimately, the “better” option depends on your priorities and needs. Life insurance may be preferred if you prioritize broader coverage and long-term financial security. However, if you seek supplementary coverage for accidents at a lower cost, AD&D insurance could be a valuable addition to your insurance portfolio. Evaluating your circumstances and consulting with a qualified insurance professional can help you make an informed decision based on your unique situation.

Conclusion

In conclusion, both accidental death & dismemberment vs life insurance offer valuable financial protection, yet they serve different purposes. AD&D insurance provides supplementary coverage specifically for accidents, while life insurance offers comprehensive protection for death from any cause. The choice between the two depends on individual circumstances, risk factors, and financial goals.

FAQs

Do I need both AD&D and life insurance?

Yes, you may consider having both AD&D and

life insurance for comprehensive financial protection. While life insurance covers death from any cause, AD&D insurance specifically provides benefits for accidental death and serious injuries. Assessing your needs and risk factors can help determine your appropriate coverage.

Is accidental death and dismemberment insurance a good deal?

Accidental death and dismemberment insurance can be a good deal for individuals seeking affordable supplementary coverage specifically for accidents. It provides financial protection for accidental death and serious injuries, offering peace of mind at a lower cost than comprehensive life insurance policies.

Does life insurance cover accidental death?

Yes, life insurance typically covers accidental death, along with death resulting from illness, natural causes, or other unforeseen circumstances. When a policyholder passes away due to an accident, the beneficiaries named in the life insurance policy receive the death benefit payout, providing financial support to cover expenses such as funeral costs, mortgage payments, debts, and ongoing living expenses. It’s essential to review the terms and conditions of the life insurance policy to understand the specific coverage details and any exclusions related to accidental death.

What are the pros and cons of accidental death and dismemberment insurance?

You can look forward to a lower premium if you purchase accidental death insurance. You may also experience a faster application process because it has fewer requirements — you don’t need to complete a medical exam.

That said, it’s best to consider the drawbacks. For example, although your loved ones can claim your death benefit, they can only do so if you die because of an accident. Sometimes, your employer provides AD&D coverage. In that case, you may lose your coverage if you become unemployed.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.