Basic vs Voluntary Life Insurance : Key Differences

Last Updated on: August 27th, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

Do you live in fear of being forced to buy life insurance? Most people don’t. Although you have to admit, there are some pretty sleazy insurance salesmen out there pushing bad products onto people.

Table of Contents

ToggleBut when you hear a term like voluntary life insurance, you may be wondering, Um, isn’t all insurance voluntary?

Yes. Yes, it is. But in this case, voluntary life insurance means the kind of life insurance you can opt in or out of as an employee benefit. Cool, right? Well, we do love and recommend life insurance for most people—and you may get some good and affordable coverage as part of a benefits package. But there are also a couple of details you’ll want to dig into first, like whether the life insurance your employer offers is term life or whole life, plus a few other quirks you should know about.

Let’s find out all there is to know about basic vs voluntary life insurance.

What Is Voluntary Life Insurance?

Voluntary life insurance is one of the insurance plans that many companies provide for their employees as an extra benefit. Like any life insurance, it comes with a benefit to be paid upon the death of the employee to support the family of the employee. With voluntary life insurance, you’ll pay regular premiums, potentially at lower group rates through your employer than you would pay for on your own. The coverage amounts and the premiums depend on one’s age and health status among other factors. Voluntary life insurance allows employees to obtain additional life insurance coverage if they require it.

What’s the difference between basic vs voluntary life insurance?

Voluntary life insurance is an affordable form of term life insurance provided through employers. Unlike employer-paid life insurance policies, which typically cover an amount equivalent to one or two times your base salary, voluntary life insurance options offer additional coverage. This includes options like voluntary supplemental life insurance and voluntary whole life insurance, enhancing your voluntary life benefit.

Voluntary employee life insurance is offered to some employees as part of their employment package. This is one of the types of life insurance offered at a low cost or free. The life insurance package covers a set amount of coverage. Some companies do offer supplemental coverage to expand your policy.

– Should I get voluntary life insurance?

Think about what would happen if you weren’t around. Do you have kids or a mortgage? Would your family struggle financially? Voluntary life insurance can help cover those gaps. If you feel like the basic insurance from your job isn’t enough, getting extra coverage might make sense. But ask yourself: Can you afford the premiums, and do you need more coverage than what you already have? It’s about balancing cost and peace of mind.

How Much Does Life Isurance Cost?

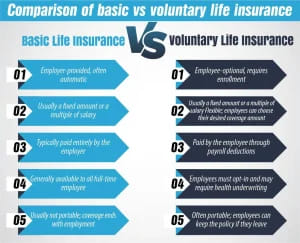

Comparison of basic vs voluntary life insurance:

When picking life insurance at work, you can go with either basic or voluntary coverage. Basic life insurance is usually free and covers a set amount. Voluntary life insurance lets you pay for more coverage if needed. Here’s a simple breakdown of basic vs voluntary life insurance:

| Feature | Basic Life Insurance | Voluntary Life Insurance |

| Coverage Type | Employer-provided, often automatic | Employee-optional, requires enrollment |

| Coverage Amount | Usually a fixed amount or a multiple of salary | Flexible; employees can choose their desired coverage amount |

| Premium Costs | Typically paid entirely by the employer | Paid by the employee through payroll deductions |

| Eligibility | Generally available to all full-time employees | Employees must opt-in and may require health underwriting |

| Portability | Usually not portable; coverage ends with employment | Often portable; employees can keep the policy if they leave |

| Beneficiary Designation | Employees designate beneficiaries, similar to voluntary | Employees designate beneficiaries |

| Additional Benefits | May include accidental death and dismemberment (AD&D) | Can include AD&D and other riders for additional cost |

While it is important to emphasize that there is free basic life insurance, it is also true that voluntary life insurance provides more possibilities and options for those people who need more options for insurance. Select the option between basic vs voluntary life insurance that is most suitable to your situation and financial needs.

Accidental Death and Dismemberment Coverage

Along with voluntary life insurance, another coverage type you’ll often hear about from employers is accidental death and dismemberment (AD&D). Avoid this trap completely! It might be offered as a rider to the main policy or as a separate policy. Either way, it’s a rip-off. Why?

Because anything voluntary life ad&d insurance is designed to cover you for—like certain kinds of accidental death or losing a limb—is already covered in other ways. Life insurance covers any kind of accidental death already. And other injuries are covered with health insurance or long-term disability insurance. Voluntary life ad&d insurance is a marketing ploy that uses fear to con you into buying extra coverage you don’t need.

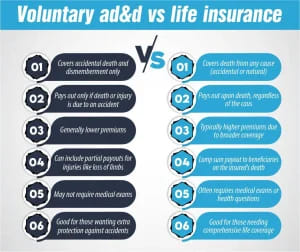

Voluntary ad&d vs Life Insurance:

Here is the Voluntary ad&d vs life insurance comparison:

| Feature | Voluntary AD&D Insurance | Life Insurance |

| Coverage | Covers accidental death and dismemberment only | Covers death from any cause (accidental or natural) |

| Payout | Pays out only if death or injury is due to an accident | Pays out upon death, regardless of the cause |

| Premium Cost | Generally lower premiums | Typically higher premiums due to broader coverage |

| Benefits | Can include partial payouts for injuries like loss of limbs | Lump sum payout to beneficiaries on the insured’s death |

| Eligibility | May not require medical exams | Often requires medical exams or health questions |

| Use Case | Good for those wanting extra protection against accidents | Good for those needing comprehensive life coverage |

Between Voluntary ad&d vs life insurance, Voluntary AD&D insurance is cheaper but only pays out for accidents, not natural causes. Life insurance costs more but covers all types of death. Choose based on your needs and the risks you want to cover.

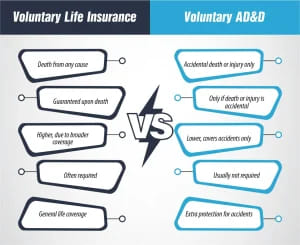

Voluntary Life Insurance vs Voluntary ad&d:

Here is is comparison tables based on key features of Voluntary life insurance vs ad&d:

| Feature | Voluntary Life Insurance | Voluntary AD&D |

| Coverage | Death from any cause | Accidental death or injury only |

| Payout | Guaranteed upon death | Only if death or injury is accidental |

| Cost | Higher, due to broader coverage | Lower, covers accidents only |

| Medical Exam | Often required | Usually not required |

| Ideal For | General life coverage | Extra protection for accidents |

This comparison between Voluntary life insurance vs ad&d shows that Life insurance covers more scenarios, while AD&D focuses on accidents. Choose based on the type of protection you need.

Other Things to Consider About Voluntary Life Insurance

Voluntary life insurance is sometimes portable. That means even if you leave your employer, you can take the coverage with you while paying for it on your own. But that’s usually only available for whole-life policies. You shouldn’t ever sign up for the whole life version. And if you did, why would you want to keep it going?

Qualifying life events can make you eligible. If an employer offers voluntary life insurance, you’ll probably be able to sign up as soon as you’re hired. But you don’t have to sign up right away. And (like with many benefits) the option will usually come back around at open enrollment time. But if voluntary life doesn’t fit your needs when you start, other life events—like marriage, divorce, or the birth or adoption of a child—could qualify you for extra chances to sign up.

Advantages of voluntary life insurance?

Some of the advantages of purchasing voluntary life insurance include.

- There is very little underwriting necessary for this type of life insurance. This makes it possible for people with health issues or lifestyles that will deem them unfit for life insurance to be able to access life insurance.

- The rates are lower by 10 to 20 percent, and that makes these life insurance policies affordable to those who would otherwise not be able to afford the policy.

- It is also common to find companies providing the option to the employee to take a policy on the spouse and children if any.

Is Voluntary life insurance worth it?

In the comparison of voluntary life insurance vs basic life insurance the question is that Is Voluntary life insurance worth it? Although it may be costly, voluntary life insurance is ideal for individuals who want to have another layer of cover to protect the family from experiencing some financial difficulties in the future after the policyholder’s demise. Voluntary life insurance can be especially appealing to those who may be declined automatic life insurance coverage based on health risks. Today’s employees are seeking additional coverage beyond the basics of health insurance. Critical illness coverage, disability income, and accident insurance are among the voluntary benefits that employees are increasingly prioritizing because such benefits often offer better value than if employees were to buy this coverage privately. These benefits provide a sense of financial security and peace of mind, contributing to higher levels of job satisfaction and loyalty in today’s fiercely competitive job market.

Conclusion

Basic vs voluntary life insurance are two distinct products, and the decision on which is best for you depends on your circumstances. When you plan for the financial goals for your family, ponder on the level of coverage that would enable your family to live comfortably without your income. The right kind of life insurance will make you relaxed when you know that your family will be well taken care of. To begin with, understanding the differences between the two is the best place to start to determine what is best for you.

FAQs

1- How Much Does Voluntary Life Insurance Cost?

Premiums are calculated according to the employer’s group, which makes it cheaper than if an individual were to purchase the insurance on their own. The lower the risk, the younger and healthier the group of patients that is applying for coverage.

2- What’s the difference between AD&D and life insurance?

AD&D insurance specifically covers accidental death and dismemberment, while life insurance provides coverage for death from any cause. AD&D is a specialized form of insurance that offers additional benefits in case of accidents.

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.