Best Life Insurance for Single Parent: What You Need to Know

Are you prepared for your children’s future if something unexpected happens to you? As a single parent, your responsibilities are immense, and ensuring your children’s well-being is paramount.

Life insurance is a vital tool that can provide the financial security your family needs. But with so many options available, finding the best life insurance for single parents can be overwhelming. Don’t worry! We have got you covered!

This comprehensive guide will help you explore the different types of life insurance, understand your needs, and select the right policy to safeguard your children’s future. Let’s explore the best life insurance for single parents, so you can have peace of mind knowing your children are protected if something ever happens to you.

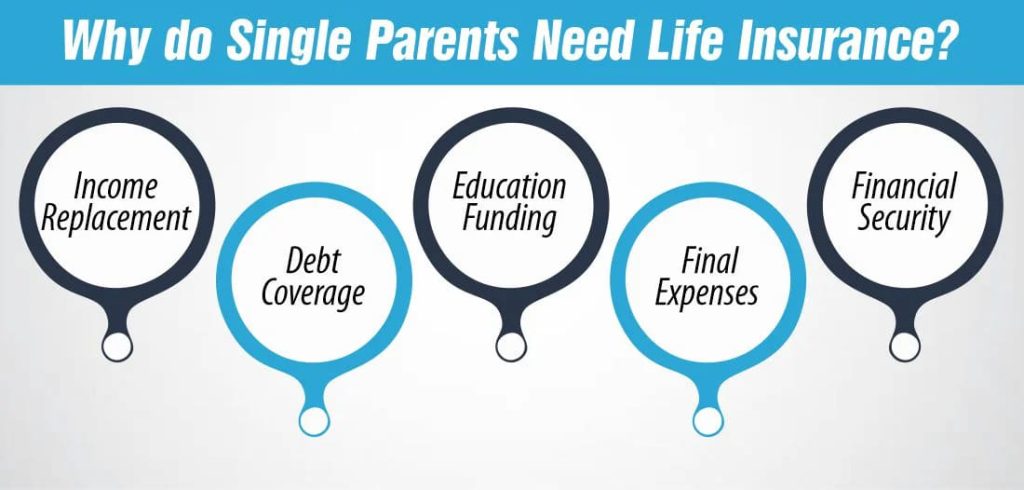

Why do Single Parents Need Life Insurance?

Life insurance is a crucial safety net for single parents, ensuring that your children’s financial future is secure even if you are no longer there to provide for them. Here are some compelling reasons why best life insurance for single parents is important:

1- Income Replacement

As a single parent, your income is the primary financial support for your household. If you were to pass away unexpectedly, life insurance can replace your lost income, ensuring your children continue to have the resources they need for daily living expenses and future aspirations.

2- Debt Coverage

Many single parents carry debts such as mortgages, car loans, or personal loans. Life insurance can help pay off these debts, preventing your children from inheriting financial burdens that could disrupt their lives and plans.

3- Education Funding

One of the most significant long-term expenses is your children’s education. Life insurance can provide the necessary funds to cover tuition and other educational costs, allowing your children to pursue their academic goals without financial constraints.

4- Final Expenses

Funeral and end-of-life expenses can be substantial. Life insurance ensures that these costs are covered, so your family doesn’t have to bear the financial stress during an already difficult time.

5- Financial Security

Life insurance provides a financial cushion that can help your children through difficult times. Whether it’s covering unexpected medical expenses, funding extracurricular activities, or simply providing a sense of stability, the financial security offered by life insurance is invaluable.

Types of Best Life Insurance for Single Parents

Choosing the right life insurance policy can be daunting, especially for single parents. Here’s a breakdown of some of the best life insurance for single parents along with their benefits:

How Much Does Life Isurance Cost?

1- Term Life Insurance

Term life insurance is one of the most popular choices for single parents due to its affordability and straightforward nature.

- Coverage Period: Provides coverage for a specific period, typically 10, 20, or 30 years.

- Death Benefit: If you pass away during the term, your beneficiaries receive the death benefit.

- Cost-Effective: Lower premiums compared to permanent life insurance.

- Flexibility: Choose a term that aligns with key milestones, like your children reaching adulthood.

2- Whole Life Insurance

Whole life insurance offers lifelong coverage with a savings component, known as cash value.

- Lifelong Protection: Coverage lasts for your entire life, as long as premiums are paid.

- Cash Value: Part of your premium builds cash value over time, which you can borrow against.

- Stable Premiums: Premiums remain consistent throughout the policy term.

- Investment Aspect: Cash value grows at a guaranteed rate.

3- Universal Life Insurance

Universal life insurance combines lifelong coverage with the flexibility to adjust premiums and death benefits.

- Flexible Premiums: Adjust your premiums and death benefits to suit your financial situation.

- Cash Value Growth: Cash value can grow based on market performance, offering potential for higher returns.

- Lifelong Coverage: Protects your entire life, similar to whole life insurance.

- Policy Loans: Access the cash value through policy loans or withdrawals.

4- Simplified Issue Life Insurance

Simplified issue life insurance is ideal for those who need coverage quickly and without a medical exam.

- No Medical Exam: Approval is based on a health questionnaire.

- Quick Approval: Faster application process compared to traditional policies.

- Higher Premiums: Typically more expensive than medically underwritten policies due to higher risk for insurers.

- Moderate Coverage Amounts: Generally offers lower coverage amounts, making it suitable for specific needs.

5- Guaranteed Issue Life Insurance

Guaranteed-issue life insurance is an option for those who might struggle to get traditional life insurance due to health issues.

- Guaranteed Acceptance: No medical exams or health questions required.

- Higher Premiums: Premiums are higher due to the increased risk for insurers.

- Limited Benefits: Often has a waiting period before full benefits are payable.

- Lower Coverage Amounts: Usually offers lower coverage amounts, suitable for covering final expenses.

How Much Life Insurance Do Single Parents Need?

Determining the right amount of life insurance for single parents is crucial. The goal is to ensure your children are financially secure if something happens to you. Here are some key factors to consider:

Assess Your Financial Obligations

Income Replacement: Consider how many years of income your children would need to maintain their lifestyle. A common recommendation is 10-15 times your annual income. This ensures your children have sufficient funds until they become financially independent.

Debts and Liabilities: Include any outstanding debts such as a mortgage, car loans, student loans, and credit card debt. The life insurance policy should be able to cover these debts, so your children aren’t burdened with financial obligations.

Education Costs: Factor in the cost of your children’s education. This includes primary, secondary, and higher education expenses. Research the average costs of college tuition and include those in your calculations.

Childcare and Daily Expenses: Estimate the daily living expenses for your children, including food, clothing, healthcare, and extracurricular activities. These costs can add up, and the insurance policy should cover them to ensure your children’s needs are met.

Consider Future Needs and Inflation

Inflation: Account for inflation when calculating the amount of coverage. The cost of living increases over time, and your life insurance policy should be able to keep pace with these changes. Adjust your coverage amount to reflect the potential increase in expenses.

Future Financial Goals: Think about any future financial goals you have for your children, such as buying a home, starting a business, or special events like weddings. Including these in your calculations ensures they have the resources to achieve their dreams.

Use Online Calculators

Many insurance companies offer online life insurance calculators. These tools can help you estimate how much coverage you need based on your income, debts, and other financial responsibilities. They provide a convenient way to get a quick estimate tailored to your specific situation.

Consult a Financial Advisor

For a more personalized assessment, consider consulting a financial advisor. They can help you analyze your financial situation in detail and recommend the appropriate amount of coverage. This professional guidance ensures you don’t overlook any important factors and helps you make an informed decision.

Best Life Insurance for Single Parents: Explore Insurance Providers

Finding the right life insurance provider is crucial for single parents. You need a company that offers reliable coverage, affordable premiums, and excellent customer service. Here are some of the best life insurance companies tailored for single parents:

1. State Farm

State Farm is known for its personalized service and extensive range of insurance products.

Key Features:

- Local Agents: Work with local agents for tailored advice and support.

- Diverse Coverage: Options include term, whole, and universal life insurance.

- Bundling Discounts: Save by combining life insurance with other State Farm policies.

Benefits for Single Parents:

- Personal service from knowledgeable agents.

- Opportunity to save with bundling discounts.

- Reliable claims process and customer service.

2. New York Life

New York Life offers robust whole life insurance policies with a focus on long-term financial planning.

Key Features:

- Guaranteed Cash Value: Steady growth of the cash value component.

- Flexible Premiums: Options to adjust premiums and coverage.

- High Financial Ratings: Strong financial stability and excellent reputation.

Benefits for Single Parents:

- Lifelong protection with cash value accumulation.

- Flexibility to adjust policy based on changing needs.

- Access to professional financial planning services.

3. Northwestern Mutual

Northwestern Mutual provides comprehensive life insurance solutions with a focus on financial planning.

Key Features:

- Dividend Potential: Opportunity to receive dividends on whole life policies.

- Customizable Coverage: Tailor policies to fit your specific needs.

- Strong Financial Advisors: Access to expert financial advisors for holistic planning.

Benefits for Single Parents:

- Reliable dividend payments enhance policy value.

- Flexible and customizable coverage options.

- Professional financial guidance to ensure comprehensive protection.

4. Guardian Life

Guardian Life is known for its strong financial stability and extensive life insurance products.

Key Features:

- Whole and Term Policies: Offers both whole and term life insurance.

- Policy Riders: Wide range of riders to customize your policy.

- Strong Ratings: Excellent financial ratings for reliability.

Benefits for Single Parents:

- Diverse product offerings to meet various needs.

- Ability to customize with riders for additional protection.

- Dependable company with strong financial backing.

5. Prudential

Prudential offers a variety of life insurance products and is renowned for its financial strength and customer service.

Key Features:

- Flexible Coverage: Offers term, whole, and universal life insurance.

- Living Benefits: Some policies include living benefits for critical illnesses.

- Strong Financial Ratings: High ratings for financial stability.

Benefits for Single Parents:

- Flexibility to choose the right policy for your needs.

- Access to living benefits for added peace of mind.

- Reliable customer service and claims support.

Who Should Be the Beneficiary of Single-Parent Life Insurance?

Selecting the right beneficiary for your life insurance policy is a crucial decision for single parents. The beneficiary is the person or entity that will receive the death benefit when you pass away. Here are some considerations to help you choose the best beneficiary for your life insurance policy:

1- Your Children

Naming your children as beneficiaries might seem logical, but it’s important to understand the legal implications. Minors cannot directly receive life insurance proceeds. If your children are under 18, a court-appointed guardian will manage the funds, which can complicate matters and add unnecessary delays. To avoid these legal complications, consider setting up a trust for your children.

2- Trust for Your Children

Establishing a trust offers a structured method to manage the life insurance benefits for your children. A trust allows you to specify how and when the funds should be distributed, ensuring that the money is used for specific purposes such as education, housing, and daily living expenses. It also provides control and flexibility, allowing you to outline precise instructions on fund usage.

3- Legal Guardian

If you have appointed a legal guardian for your children, considering them as the beneficiary can be a practical choice. It ensures that the legal guardian has immediate access to the funds, which can be used for your children’s immediate needs and ongoing expenses. However, it is essential to ensure that the guardian is someone you trust completely to manage the funds responsibly.

4- Family Member or Close Friend

In some situations, naming a family member or close friend as the beneficiary can be beneficial. This person can manage the funds until your children reach adulthood, acting as an interim manager. It is important to choose someone who understands your wishes and is committed to acting in your children’s best interests.

Summing Up

Securing the best life insurance for single parents is a critical step in safeguarding your children’s future. By understanding the different types of policies, assessing your needs, and choosing a reputable provider, you can provide financial security for your family. Start today and ensure your children are protected no matter what the future holds.

References:

https://www.policygenius.com/life-insurance/the-single-parents-guide-to-life-insurance/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.