Does Homeowners Insurance Cover Garage Door Replacement?

Last Updated on: August 4th, 2025

Reviewed by Dylan

- Licensed Agent

- – @InsureGuardian

We all know that home insurance is all about covering home damage. As a homeowner, you always want to make sure your home stays protected in case of unexpected damage, but have you ever thought of garage doors? What if the garage door is damaged? Are they also a part of home insurance? This is a common question that comes to homeowners’ minds. In this detailed guide, we’ll look at whether your homeowners’ insurance helps you to pay for fixing or replacing the garage door. We will also talk about what kinds of damage are usually covered and when it makes sense to file a claim. Let’s start with the basics.

Does Homeowner’s Insurance Cover Garage Door Repairs?

The answer is yes, most of the time, homeowners’ insurance will pay to fix the garage door. But there are certain situations. HO-3 policy, a common type of homeowners’ policy, covers the main parts of your home, including garage doors. It means that if your garage door is damaged by something that the policy covers, like a storm or fire, the insurance company will pay for the repair or replacement.

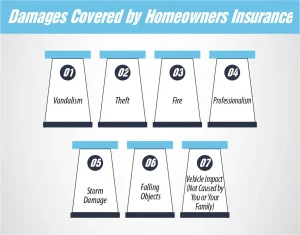

Damages Covered by Homeowners Insurance

Here are some of the examples. If these events happen, then the company will give you a garage door replacement or repair, depending on how severe it is.

- Vandalism

- Theft

- Fire

- Storm damage

- Falling objects

- Vehicle impact (not caused by you or household members)

Let’s have a look at the details of what these terms mean and how you get a repair.

1. Vandalism

Vandalism means that if someone damages your garage on purpose, like doing a spray on the garage gate or painting it, also breaking or hitting the garage gate with something heavy. Most homeowners’ insurance policies will cover the cost of fixing the door in this case.

2. Theft

Theft means that someone enters your garage and takes something. They might also break the garage door while trying to enter it. Insurance usually helps for both stolen and damaged items and also covers garage gate repair.

3. Fire

If there is a fire in your home that damages the garage door or if there is a fire in the garage, homeowners’ insurance will pay for the repairs or give a full replacement. Fire is a standard covered event in most insurance policies.

4. Storm Damage

If a storm like hail or wind damages your garage door, like dents, cracks, or even blowing. Your insurance will help pay to fix this damage.

How Much Does Life Isurance Cost?

5. Falling Objects

If a tree, branch, or something heavy falls on your garage door and your garage door is damaged, then the insurance usually helps pay to fix it. This can happen during a storm or if an old tree just falls over by itself.

6. Vehicle Impact (Not Caused by You or Your Family)

If someone from the neighbours or the delivery driver accidentally hits your garage door, your insurance will also pay for the damage. But if it’s done by someone in your family, your homeowners’ insurance will not help to make a repair or replacement. For that, you would need to use car insurance or pay for the repairs yourself.

Is It Worth It to File a Claim for Garage Door Repair?

You can use your insurance for garage door repairs, but it depends on how much the repair costs. Consider these factors while claiming a repair or replacement

Repair Cost

If the repair is less, it might be better to pay it yourself instead of using insurance.

Deductible

This is the amount you pay before your insurance helps. If your repair costs less than the deductible, insurance won’t help.

Future Insurance Price

If you make a claim, your insurance cost might go up later.

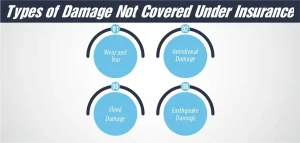

Types of Damage Not Covered Under Insurance

Homeowners’ insurance doesn’t cover everything that causes damage to your garage door. Here are the types of damage not covered under insurance:

1. Wear and Tear

If there is any damage done by old age, rust, or poor maintenance, you’ll have to pay for the repairs yourself.

2. Intentional Damage

If you or someone in your household intentionally damages the garage door, the insurance company will not help by providing the repair or any other replacement.

3. Flood Damage

Regular home insurance doesn’t cover flood damage. If water from a flood ruins your garage door, you’ll need a separate flood insurance policy to pay for it.

4. Earthquake Damage

Basic home insurance doesn’t cover earthquake damage. You’ll need extra earthquake insurance to cover problems caused by the ground shaking or moving.

Homeowners Insurance for Attached vs. Detached Garages

Your garage’s location can impact coverage. Here’s how homeowners insurance for attached vs. detached garages works:

Attached Garages

These are considered part of the home’s main structure. Any covered peril that damages the garage door is generally covered under the dwelling portion of your policy.

Detached Garages

These fall under “Other Structures” coverage. Other structures’ policy helps cover buildings that are not attached to your house.it usually covers less money than it does for parts of your house that are connected.

Damages Covered by Homeowners Insurance – Chart

Let’s summarize what damages are typically covered by standard homeowners insurance:

| Type of Damage | Covered? |

| Fire | Yes |

| Vandalism | Yes |

Storms (Wind/Hail) | Yes |

| Falling Trees/Objects | Yes |

| Theft or Break-ins | Yes |

| Vehicle Damage (not by you) | Yes |

| Wear and Tear | No |

| Flood | No |

| Earthquake | No |

| Intentional Damage | No |

Final Thoughts

Homeowners’ insurance will help you to fix your garage door, but only in cases when it is damaged by a natural disaster like fire or storm. If it is damaged because of someone in the house or if it’s old or rusted, then insurance will not cover the repair cost. Before you make a claim, think about whether the repair cost is more than your deductible and if making a claim might make your insurance cost more later. To be ready, take good care of your garage door, keep track of any repairs, and check your insurance policy often.

Ready to protect your garage door and home?

Check your insurance policy today to understand what’s covered. If you have any questions or need help with your coverage, don’t hesitate to reach us

FAQs

1. Does homeowners’ insurance cover garage door opener replacement?

No. Your insurance will only help if the garage door opener is broken because of something covered, like fire or lightning. If it is because of old age or electrical problems, insurance will not pay for it.

2. What if my car crashes into my garage door?

If you hit your garage, your auto insurance (not homeowners) may cover it under collision.If someone else hits your garage door, their car insurance should pay. If not, your home insurance will help.

3. Is there a difference in coverage between manual and automatic garage doors?

No. Coverage is based on damage source, not door type. However, electrical components may have additional limitations.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.