Erie Life Insurance Calculator: Find Your Perfect Coverage

Have you ever wondered how much life insurance you need? It’s a question that many of us face, and finding the right answer is crucial for the financial security of our loved ones. Enter the Erie Life Insurance Calculator – a simple, user-friendly tool designed to take the guesswork out of this important decision.

With just a few clicks, you can get a clear picture of how much coverage is right for you, tailored to your unique life circumstances. Whether you’re a new parent, a business owner, or just planning for the future, this calculator is the first step in securing peace of mind. Let’s explore how this handy tool can make understanding your life insurance needs easier and more accurate than ever!

What is Erie Term Life Insurance?

One kind of life insurance the reputable Erie Insurance provides is Erie Term Life Insurance. This insurance aims to offer financial security for a predetermined amount of time or term. Here is a summary of the benefits of Erie Term Life Insurance:

- Term-Based Coverage: As the name implies, this type of insurance offers protection for a predetermined amount of time, such as ten, fifteen, twenty, or thirty years. It differs from permanent life insurance in that it provides lifetime coverage.

- Death Benefit: Erie Term Life Insurance provides the named beneficiaries a death benefit if the policyholder passes away within the policy’s term. Beneficiaries can utilize this benefit, typically paid out as a flat sum, to finance schooling, pay off debt, or cover living expenses.

- Fixed Premiums: Erie Term Life Insurance often has fixed premiums, which means your coverage payment stays the same for the duration of the policy. It is simpler to plan and budget for the expense of insurance because of this regularity.

- Convertible and Renewable Options: When your term life insurance policy expires, Erie may allow you to renew it or convert it into a permanent life insurance policy. If your life circumstances or insurance requirements alter in the future, this may be helpful.

- Policy Riders: You may be able to add riders to your term life insurance policy through Erie. Riders are extra perks that can be added to the insurance to make it more unique. As an illustration, consider a disability or expedited death benefit rider.

- Suitability: People looking for straightforward, reasonably priced coverage can find this kind of insurance a good fit. Those who require coverage to meet a temporary financial obligation, such as paying off a mortgage or supporting a child’s education, find it especially appealing.

Most people like Erie Term Life Insurance because it is an affordable means of obtaining significant life insurance coverage for a predetermined amount of time. As with any insurance product, you should consult an insurance expert to determine if this policy fits your family’s needs and financial objectives.

Which age groups have the most affordable premiums for Erie Life Insurance?

Below is a breakdown of the average national rates of smokers and non-smokers by age group. The NAIC provided the following statistics in these tables:

Average Annual Erie Life Insurance Rates for Non-Smokers – $100,000/10-Year Term

| Non-Smoker Age, Marital Status, & Gender | Erie Life Insurance Average Annual Rates | Average Annual Rates |

| 25-Year-Old Single Female | $152 | $164.50 |

| 25-Year-Old Single Male | $175 | $183.61 |

| 35-Year-Old Married Female | $178 | $170.47 |

| 35-Year-Old Married Male | $189 | $190.40 |

| 45-Year-Old Married Female | $253 | $247.50 |

| 45-Year-Old Married Male | $295 | $274.59 |

| 55-Year-Old Married Female | $440 | $417.01 |

| 55-Year-Old Married Male | $567 | $543.23 |

| 65-Year-Old Single Female | $945 | $898.76 |

| 65-Year-Old Single Male | $1,252 | $1,308.00 |

Average Annual Erie Life Insurance Rates for Smokers – $100,000/10-Year Term

| Smoker Age, Marital Status, & Gender | Erie Life Insurance Average Annual Rates | Average Annual Rates |

| 25-Year-Old Single Female | $226 | $248.90 |

| 25-Year-Old Single Male | $255 | $328.31 |

| 35-Year-Old Married Female | $268 | $289.34 |

| 35-Year-Old Married Male | $298 | $366.70 |

| 45-Year-Old Married Female | $475 | $494.59 |

| 45-Year-Old Married Male | $565 | $648.16 |

| 55-Year-Old Married Female | $1,050 | $999.43 |

| 55-Year-Old Married Male | $1,435 | $1,386.70 |

| 65-Year-Old Single Female | $2,531 | $2,267.36 |

| 65-Year-Old Single Male | $3,098 | $3,333.99 |

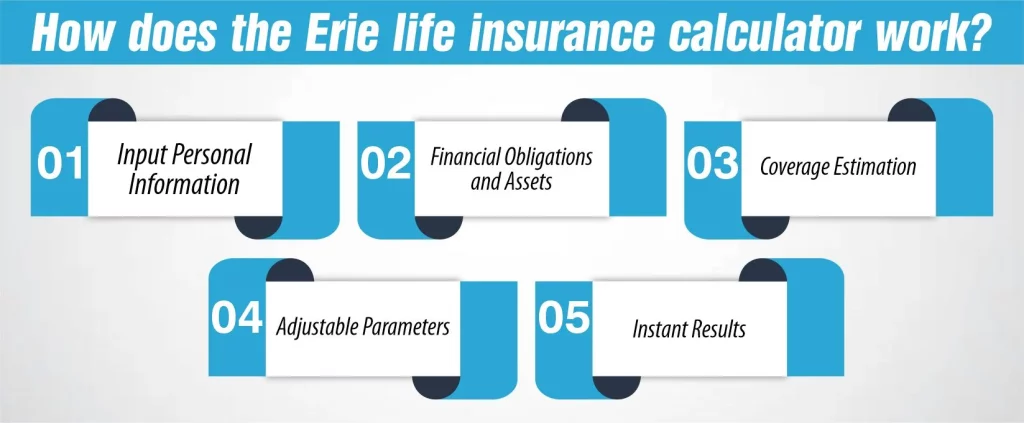

How does the Erie life insurance calculator work?

The Erie Life Insurance Calculator is a tool designed to help you estimate how much life insurance coverage you might need. Here’s a brief overview of how it works:

- Input Personal Information:

The calculator asks for basic personal information. This might include your age, income, marital status, number of dependents, and major expenses like mortgage or education costs.

- Financial Obligations and Assets:

You’ll be prompted to enter details about your financial obligations (like debts or future expenses) and assets (such as savings or existing life insurance).

- Coverage Estimation:

Based on your information, the calculator processes these details to estimate the coverage appropriate for your situation. This is to ensure that in the event of your untimely passing, your financial responsibilities can be met, and your family’s lifestyle can be maintained.

- Adjustable Parameters:

The tool allows you to adjust specific parameters, like the policy term or inflation rate, to see how different scenarios affect your insurance needs.

How Much Does Life Isurance Cost?

- Instant Results:

The Erie Life Insurance Calculator provides instant results, giving you an estimated coverage amount. It’s a quick way to get a ballpark figure for the insurance you might need without initially going through a detailed consultation process.

It’s important to remember that the calculator provides an estimate. For a more comprehensive assessment and to choose an insurance policy, it’s recommended to consult with an Erie insurance agent who can provide personalized advice based on your specific circumstances.

Why choose the Erie life insurance calculator:

Choosing the Erie Life Insurance Calculator is smart for anyone seeking clarity and simplicity in navigating life insurance options. This tool stands out for its user-friendly interface, making it easy for individuals to estimate their life insurance needs accurately without feeling overwhelmed. The calculator provides a personalized estimate of the coverage amount best suits your unique circumstances by inputting basic information about your financial situation, such as income, debts, and future expenses.

This takes the guesswork of determining how much insurance you need, ensuring you’re not underinsured or overpaying for unnecessary coverage. Moreover, the Erie Life Insurance Calculator is a stepping stone in financial planning, allowing you to make informed decisions and offering peace of mind that you and your loved ones are protected. Whether you’re a first-time buyer or reassessing your current policy, the Erie Life Insurance Calculator is an invaluable resource for making sound insurance choices tailored to your life stage and goals.

What Are the Pros & Cons of Erie Life Insurance?

Like any insurance product, Erie Life Insurance has pros and cons. Understanding these can help you decide whether it’s the right choice for your insurance needs.

Pros of Erie Life Insurance:

Reputation and Reliability: Erie Insurance is known for its reputation and reliability. It has a long history of providing insurance products and is well-regarded in the industry.

Personalized Customer Service: Erie Insurance is often praised for its personalized customer service. They typically offer more individual attention compared to larger, national providers.

Range of Products: Erie offers a variety of life insurance products, including term life, whole life, and universal life insurance, giving customers a range of options based on their needs.

Competitive Pricing: Many customers find Erie’s life insurance policies competitively priced, especially considering the level of coverage and service provided.

Local Agents: Erie operates through a network of local agents, which can benefit those who prefer face-to-face interactions and personalized advice.

Policy Rider Options: Erie offers various riders that can be added to policies, allowing for customization and protection tailored to individual needs.

Cons of Erie Life Insurance:

Limited Availability: Erie Insurance operates in a limited number of states, which can be a major drawback if you live outside its service area.

No Online Quote for Life Insurance: Unlike some competitors, Erie does not offer online life insurance quotes. You have to contact an agent for pricing, which might be less convenient for some customers.

Less Flexibility with Policy Changes: Some customers have reported that changing an existing Erie life insurance policy can be less flexible than other insurers.

Limited Online Resources: Erie’s digital tools and online resources may not be as robust as those offered by larger national insurers, which might be a drawback for tech-savvy customers.

Potential for Higher Premiums with Age: As with most life insurance, premiums with Erie can be higher for older applicants or those with health issues.

How can I get Erie life insurance?

To get Erie Life Insurance, you can follow these general steps:

- Research:

Research Erie Insurance to ensure their offerings align with your needs. Visit their website to understand their life insurance policies, such as term life, whole life, or universal life insurance.

- Contact an Agent:

Erie Insurance typically operates through a network of local agents. To initiate the process, you would need to contact an Erie agent. You can find an agent near you using the agent locator tool on Erie Insurance’s website. Just enter your ZIP code to provide a list of agents in your area.

- Consultation:

Schedule a consultation once you’ve found an agent. You can discuss your insurance needs, budget, and specific concerns or questions during this meeting. The agent will help you understand the different policies and options available.

- Get a Quote:

The agent will provide a quote based on the coverage amount you need, the type of policy you choose, and other factors like your age, health, lifestyle, and medical history.

- Undergo Underwriting:

If you decide to proceed, there may be an underwriting process, including filling out a detailed application and possibly undergoing a medical exam, depending on the policy.

- Review and Sign the Policy:

Once the underwriting process is complete and approved, review it carefully to ensure it meets your expectations. Ask your agent to clarify any unclear terms or conditions.

Remember, the process might vary slightly based on individual circumstances. It’s always a good idea to ask your agent about any specifics related to your situation.

Conclusion:

In conclusion, the Erie Life Insurance Calculator emerges as a vital tool for anyone looking to simplify the complex task of determining their life insurance needs. Its user-friendly interface and tailored calculations provide a personalized estimate, helping to bring clarity and confidence to the decision-making process. With a few clicks, you get a clear, personalized idea of what’s best for you and your family’s future, making life insurance planning much easier.

FAQs

Is Erie a good life insurance company?

Erie Insurance is recognized for its exceptional customer service and reliability, earning high customer satisfaction ratings. With a strong financial standing, it assures clients of its ability to pay out claims. Its range of life insurance products, coupled with the personalized service offered through its network of local agents, makes Erie a reputable choice in the insurance market.

What types of insurance policies are offered by Erie?

Erie offers term insurance, whole insurance, and guaranteed universal insurance policies.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.