Graded Premium Life Insurance: How It Works, Pros & Cons

Last Updated on: July 21st, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Planning for the future often starts with choosing the right life insurance policy. While there are a lot of plans and types of insurance policies, not all the plans are the same. There is one type that most people get confused about is called graded premium life insurance. This policy can be very helpful, but in some cases. So let’s have a look at this article and you will understand how this policy works, its good and bad sides, and also how this type of policy is different from other plans.

Table of Contents

ToggleWhat Is a Graded Premium Life Insurance Policy?

Graded life insurance is also known as graded death benefit life insurance, which is a form of whole life insurance plan. At the start, this plan only pays a small amount of money when a person dies. After a few years, the amount it pays goes up until it reaches the full amount.

Graded premium life insurance is made for people who can not qualify for the regular life insurance plan because of health problems or a risky lifestyle. It gives them a way to still get some coverage and protect their loved ones.

How does graded death benefit life insurance work?

Graded death benefit whole life insurance is a kind of life insurance. It works differently from the regular life insurance plans. Here’s how it works;

After buying the insurance policy and you will die from any illness, sickness, or old age within a few years. Then your family will not get the full amount of money right away.

But if you die in an accident like a car crash or a fall, your family will get the full payout, even if it’s early. This kind of insurance has a payment schedule. Here’s how it usually works:

- If you die in the first year, your family can only get back the money you paid for the insurance, plus a little extra money in interest.

- If you die in the second year after buying the policy, your family will get a percentage of the death benefit.

- After three years, your family will usually get the full death benefit.

On the other hand, if we are talking about the regular life insurance policies like whole, term life, or universal life insurance, these will pay your family the full amount, no matter if you die the day after you buy the policy. But to get these insurance policies, you have to do a health exam first to qualify.

Understanding the Graded Benefit Waiting Period

The graded benefit waiting period depends on the policy you pick, but usually, this is the time right after you get this policy when the money your family gets is less than the full amount. This time usually lasts for 2 or 3 years. After this waiting time of 2 -3 years end the death benefit goes up to the full amount. So if the person dies after the waiting period, their family will get the full death benefit.

How Much Does Life Isurance Cost?

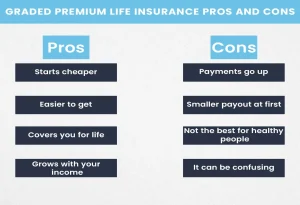

Graded Premium Life Insurance Pros and Cons

Just like other types of insurance, graded premium life insurance has some good sides and some downsides. Let’s take a look at both.

Pros

- Starts cheaper: Graded premium life insurance is a good choice if you don’t have a lot of money at the start, or you’re on a tight budget.

- Easier to get: There is no need to take a medical exam to qualify for graded premium life insurance.

- Covers you for life: As long as you keep paying the premiums, you’ll have life insurance for your whole life.

- Grows with your income: The payments slowly go up over time, which works well if you expect to earn more money in the future.

Cons

Things to watch out for with graded premium life insurance:

- Payments go up: The monthly payments can get higher as time goes on.

- Smaller payout at first: If you pass away during the waiting period, your family will get less money.

- Not the best for healthy people: If you’re in good health, a level life insurance policy might give you more value for your money.

- It can be confusing: It’s a bit harder to understand compared to regular life insurance with fixed payments.

Best Graded Premium Life Insurance Companies

If you’re thinking about getting graded premium life insurance, it’s important to pick a trusted insurance company. Here are some well-known companies that offer good graded premium life insurance plans:

1. Mutual of Omaha

- Offers whole life insurance with graded benefits

- No medical exam needed to apply

- Has a 2-year waiting period for full benefits

- If death is caused by an accident, full payout starts right away

2. AIG (American General)

- Guaranteed issue whole life insurance (you can’t be turned down)

- Graded death benefit with a 2-year waiting period

- Available for people between the ages of 50 and 80

3. Gerber Life Insurance

- Easy-to-get plans with no medical exam (some plans guarantee acceptance)

- Made especially for seniors

- Graded death benefits with affordable monthly payments

4. Colonial Penn

- Famous for $9.95 units of life insurance

- Guaranteed acceptance with graded death benefit

- Suitable for those aged 50–85

5. Globe Life

- Offers a wide range of final expense policies

- Graded benefit and level options are available

- Simple application process

What Types of Life Insurance Policies Offer a Graded Death Benefit?

Some common types of life insurance policies with a graded death benefit are:

Term Life Insurance

Term life insurance will give you coverage for a set number of years, like 10,20, or 30 years. Graded death benefit term life insurance has a short waiting period before the full benefits start.

Whole Life Insurance

This covers you for your entire life. Graded death benefit whole life insurance usually has a longer waiting time before full benefits begin than term life.

Universal Life Insurance

This is flexible and mixes features of term and whole life insurance. Its graded death benefit waiting time is usually similar to whole life insurance.

Final Thoughts

Graded premium life insurance can be a good choice for people who have health concerns and have a limited budget. This policy has higher costs over time with a waiting period of 2 or 3 years. If you learn how the policy works and look at different choices, you can pick the best plan for you. Always read all the details carefully and ask questions before you buy to make sure it’s the right one for you.

Thinking about life insurance?

Start today with a graded premium plan that fits your needs and protects your family.

FAQs

What is graded premium life insurance?

Graded premium life insurance is a kind of whole life insurance. At the beginning, it gives a smaller amount of money if you pass away. Then, after a few years, the amount of money it pays gets bigger until it reaches the full amount.

Who should consider graded premium life insurance?

This policy is good for people who can’t get regular life insurance because of health problems or risky habits. It helps them have some protection to support their family.

How does the waiting period work?

There is usually a 2 to 3-year waiting period where the death benefit is limited. If the insured dies during this time (except from an accident), the payout is less than the full amount.

Can I get full benefits right away with graded premium life insurance?

No, full benefits usually start after the waiting period of 2 or 3 years, unless death is caused by an accident, which pays the full amount immediately.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.