In Oregon, a state known for its beautiful forests and coasts, you’ll find some of the biggest insurance companies. These companies are big, strong friends who promise to help you when things go wrong, like if your house gets damaged or you get sick.

They offer different types of insurance, like for your car, home, or health, ensuring you’re covered in many situations. Living in Oregon means you have access to these reliable companies that can help keep you and your family safe and sound, no matter what life throws your way.

Are you searching What are the top insurance companies in Oregon, and how do they provide peace of mind to the state’s residents through their services? Let’s start to find the largest companies in Oregon.

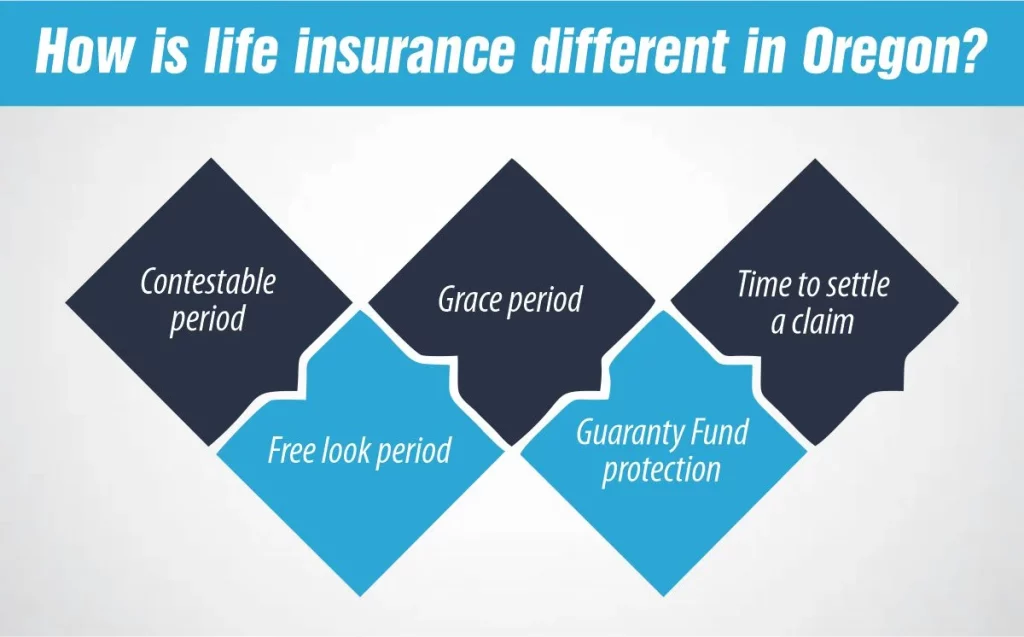

How is life insurance different in Oregon?

Some state-specific laws and regulations may impact your life insurance policy in Oregon. Before buying the Largest companies in Oregon, here are some things you should know:

Contestable period:

There is a contestable period of two years in Oregon. If you die within two years after getting a policy, the insurance company can deny your claim if it finds out you misrepresented yourself.

Free look period:

In Oregon, you have ten days to review your insurance after purchasing it or thirty days if you’re switching from another coverage. You can terminate your life insurance policy and get a complete return within this period.

Grace period:

In Oregon, there is a 30-day grace period for missing payments. If you skip a payment, interest will be added to your balance, so you’ll have to pay a little extra.

Guaranty Fund protection:

If your life insurance company goes bankrupt, Oregon’s Guaranty Association will cover up to $300,000 of your death benefits and $100,000 of your policy’s cash surrender value.

Time to settle a claim:

To avoid paying interest on your death benefit, your life insurance company must file a claim within 30 days of receiving proof of death.

Largest companies in Oregon

Many of the largest life insurance companies in the country offer policies in Oregon. Here are the 10 Largest companies in Oregon by market share.

Oregon Mutual Insurance Company

Overview: Founded in 1894, Oregon Mutual is a local insurance company headquartered in McMinnville, Oregon. It specializes in providing personal and commercial insurance solutions tailored to the needs of Oregonians.

Products: Offers auto insurance, home insurance, renters insurance, farm insurance, and business insurance.

Reason to Choose: Oregon Mutual is deeply rooted in the community and understands Oregon residents’ unique risks and challenges. They offer personalized service and quick claims processing.

The Standard:

Overview: Based in Portland, The Standard is a leading provider of employee benefits and individual disability insurance solutions. They have been serving Oregonians since 1906.

Products: Offers group disability insurance, life insurance, dental insurance, retirement plans, and more.

Reason to Choose: The Standard is known for its commitment to customer service excellence and its comprehensive range of employee benefit solutions tailored to Oregon businesses.

Regence BlueCross BlueShield of Oregon

Regence BlueCross BlueShield of Oregon

Overview: Regence BlueCross BlueShield is a nonprofit health insurance company serving Oregonians since 1941. They provide a wide range of health insurance products and services.

Products: Offers individual and family health plans, Medicare plans, dental plans, vision plans, and employer-sponsored health coverage.

Reason to Choose: Regence is dedicated to improving the health and well-being of Oregon communities. They offer access to a broad network of healthcare providers and innovative wellness programs.

Moda Health

Overview: Moda Health is a local health insurance company headquartered in Portland, Oregon. They offer a variety of health plans designed to meet the needs of individuals, families, and employers.

Products: Provides individual and family health plans, dental plans, vision plans, Medicare plans, and employer-sponsored health coverage.

Reason to Choose: Moda Health emphasizes affordability, flexibility, and personalized customer service. They have a strong presence in Oregon and a commitment to improving healthcare access and quality.

Salem Insurance Agency

Overview: Salem Insurance Agency is an independent insurance agency based in Salem, Oregon. They offer a wide range of insurance products from multiple insurance carriers to meet the diverse needs of their clients.

Products: Offers auto insurance, home insurance, business insurance, life insurance, and specialty insurance products.

Reason to Choose: Salem Insurance Agency provides personalized insurance solutions and works closely with clients to understand their unique needs and find the best coverage options.

How Much Does Life Isurance Cost?

Bend Insurance Center

Bend Insurance Center

Overview: Bend Insurance Center is a locally owned and operated insurance agency serving the Central Oregon region. They specialize in providing insurance solutions for individuals and businesses.

Products: Offers auto insurance, home insurance, renters insurance, business insurance, and recreational vehicle insurance.

Reason to Choose: Bend Insurance Center has strong ties to the local community and offers personalized service, competitive rates, and expert advice to help clients protect what matters most.

Columbia Gorge Insurance Agency

Overview: Columbia Gorge Insurance Agency is an independent insurance agency serving the Columbia Gorge region of Oregon. They have been providing insurance solutions to individuals and businesses since 1935.

Products: Offers personal insurance, business insurance, farm insurance, life insurance, and specialty insurance products.

Reason to Choose: Columbia Gorge Insurance Agency deeply understands the insurance needs specific to the Columbia Gorge region. They offer personalized service, local expertise, and competitive rates.

Lundstrom Insurance

Lundstrom Insurance

Overview: Lundstrom Insurance is a family-owned insurance agency in Eugene, Oregon. They have served clients throughout Lane County since 1957, offering personalized insurance solutions.

Products: Provides auto insurance, home insurance, business insurance, life insurance, and specialty insurance products.

Reason to Choose: Lundstrom Insurance is committed to building long-term client relationships and providing exceptional service. They offer customized insurance packages to meet the unique needs of individuals and businesses in the area.

Fox Insurance Agency

Overview: Fox Insurance Agency is an independent insurance agency based in Beaverton, Oregon. They have been serving the Portland metro area since 2008, offering a wide range of insurance products.

Products: Offers auto insurance, home insurance, business insurance, life insurance, and specialty insurance products.

Reason to Choose: Fox Insurance Agency represents multiple insurance carriers, allowing them to compare coverage and rates to find the best options for their clients. They prioritize customer satisfaction and strive to provide expert guidance and support.

Western Pacific Insurance

Western Pacific Insurance

Overview: Western Pacific Insurance is an independent insurance agency located in Medford, Oregon. They specialize in providing insurance solutions for individuals, families, and businesses in Southern Oregon.

Products: Offers auto insurance, home insurance, business insurance, life insurance, and specialty insurance products.

Reason to Choose: Western Pacific Insurance has a team of experienced agents dedicated to helping clients protect their assets and achieve financial security. They offer personalized service, competitive rates, and trusted advice.

These Largest companies in Oregon are deeply rooted in the Oregon community and offer a wide range of insurance products tailored to the needs of residents and businesses.

Average life insurance rates in Oregon

In Oregon, a healthy 35-year-old buying a $500,000, 20-year term life insurance policy in 2024 will pay an average monthly premium of $27 ($307 per year) for women and $32 ($373 per year) for men — though your exact premium will depend on the factors that are specific to you.

| Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

| 20 | Female | $15.01 | $22.65 | $33.63 |

| Male | $19.18 | $30.20 | $47.51 | |

| 30 | Female | $15.17 | $22.98 | $36.90 |

| Male | $18.19 | $29.32 | $48.89 | |

| 40 | Female | $21.66 | $35.27 | $60.65 |

| Male | $25.39 | $42.94 | $75.24 | |

| 50 | Female | $43.92 | $78.29 | $139.50 |

| Male | $56.69 | $102.50 | $188.29 | |

| 60 | Female | $107.83 | $194.16 | $354.51 |

| Male | $149.38 | $268.09 | $499.98 |

Choosing an Insurance Company? Let InsureGuardian Help.

If you’re trying to pick the best insurance company for your needs, InsureGuardian can lend a hand. We’re here to simplify the process and help you choose. We understand that finding the right insurance can be overwhelming. With so many options, figuring out where to start takes time. That’s where InsureGuardian comes in.

We’ll guide you through the process of the Largest companies in Oregon, explaining everything in easy-to-understand terms.

Our team is dedicated to helping you find the perfect insurance company that fits your budget and provides the coverage you need. Whether you’re looking for auto, home, life, or any other type of insurance, we’ve got you covered.

With InsureGuardian, you can rest assured that you’re making an informed decision. We’ll compare quotes from top insurance companies, ensuring you get the best possible coverage at the best price. Let InsureGuardian be your guide to finding the perfect insurance company for you.

Conclusion:

In conclusion, the Largest companies in Oregon stand as pillars of its economy, driving innovation, employment, and growth across diverse sectors. Their influence and contributions underscore the state’s dynamic business landscape, shaping its present and future.

FAQs

What is the number 1 industry in Oregon?

The biggest money-making industries in Oregon are health and medical insurance, hospitals, and semiconductor and circuit manufacturing. These industries made a lot of money in 2023. Health and medical insurance brought in $23.7 billion, hospitals made $20.8 billion, and semiconductor and circuit manufacturing earned $16.7 billion.

What is the most significant industry in Oregon?

The biggest industry in Oregon is healthcare and medical services. This includes hospitals, doctors, and health insurance companies.

How many Fortune 500 companies are in Oregon?

Oregon is home to Fortune 500 companies, Nike Inc. and Precision Castparts. Precision Castparts works in metal fabrication and creates critical components for various infrastructures.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

Regence BlueCross BlueShield of Oregon

Regence BlueCross BlueShield of Oregon

Bend Insurance Center

Bend Insurance Center

Lundstrom Insurance

Lundstrom Insurance Western Pacific Insurance

Western Pacific Insurance