Insurance Agent Salaries: How Much Do They Get Paid Per Hour?

Last Updated on: October 28th, 2024

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Key Takeaways

In this blog you will learn

- Different pay structures: Hourly wages, commissions, or a mix of both.

- Hourly wage examples: Learn what top companies like Allstate, State Farm, and Liberty Mutual offer.

- Average agent salary: Find out how much agents earn per hour and annually.

- Commission structures: Understand the difference between flat and tiered commissions.

- Bonuses and incentives: See how sales performance can lead to extra income.

- Career growth: Learn how experience and the type of insurance sold affect your earning potential.

- Hourly vs. commission pay: Which is better? Explore the pros and cons.

- Tips to maximize income: Get actionable advice on increasing your earnings through networking, customer service, and more.

Insurance agents are essential for helping individuals and businesses protect the people and assets they care about most. The salaries of agents vary according to the company; nevertheless, they take a reasonable salary for their work. Usually, Insurance agents get paid hourly wages, but other companies may pay them commissions based on their salary or a combination of both. This benefits agent who take payments on a base salary plus commissions for sales they make. This structure incentivizes agents to sell more and work harder while providing a steady income.

Table of Contents

ToggleHow much do insurance agents make per hour?

Have you ever considered becoming an insurance agent? One needs to establish how the agents are treated and what are Insurance Agent Salaries — since this can differ significantly from one firm to the next or from one line of insurance to the next.

It is interesting to know that most insurance agents work on a salary and commission basis. Nonetheless, there are some companies that compensate their agents strictly on an hourly basis. You may also be wondering how much money they make in an hour. Well, that depends on the company they work for and the number of years they have been in the business.

Let’s break it down a bit about do insurance agents get paid hourly?.

However, some large-scale insurance companies that incorporate this method include Allstate, State Farm, and Liberty Mutual in which their agents work on an hourly basis. For example:

Allstate agents receive a basic wage of $15 per hour in addition to bonuses and commissions for selling insurance packages.

How Much Does Life Isurance Cost?

Of course, State Farm agents are paid $12 per hour as well as bonuses and commissions.

Liberty Mutual agents? Insurance agent salary per hour earns $16 per hour and works for the chance to earn more than that.

Sounds pretty solid, right? But that’s not the whole story.

Insurance agents have an average gross income of $36.14 per hour or roughly $75,000 a year. But there is a big range here. For the top 10 percent of agents, the income can climb up to over $100,000 per annum, while for the new entrants, they are likely to be paid $50,000 per annum.

What impacts those earnings? Experience and the type of insurance that is being sold in the market determine the outcome in such a market. For instance, agents selling life insurance policies are paid better than agents selling property and casualty insurance policies. So what do you think? property casualty insurance agent salary is not enough?

Well, how do you ensure that you will be in the higher pay bracket? It is always good to understand that before plunging into the job market, you need to determine which companies will provide you best remunerations that will help you get closer to your objectives.

Interested in a career in insurance? Well, it is all about making the right decision that will suit your personality best!

Insurance Broker vs Agent Salary

| Role | Average Salary | Income Structure | Earning Potential |

| Insurance Agent | $40,000 – $60,000 annually | Base salary + commission | Higher with more sales, often commission-based |

| Insurance Broker | $50,000 – $80,000 annually | Primarily commission-based | Unlimited potential with client base expansion |

Insurance Agent vs Adjuster Salary

| Role | Average Salary | Income Structure | Earning Potential |

| Insurance Agent | $40,000 – $60,000 annually | Base salary + commissions | Increases with sales, often commission-driven |

| Insurance Adjuster | $50,000 – $70,000 annually | Salary-based with potential bonuses | Higher for experienced adjusters handling complex claims |

What to Determine How Much Insurance Agent Salaries?

Compensation as an insurance agent depends on how many policies you sell. You earn more money the more policies you sell. The commission rates that the insurance company sets indicate how much money you make on each policy. Depending on the kind of insurance policy being sold, commission rates may change.

It is surprising, but many insurance companies have bonus programs for their agents. As we all know, when trying to increase earnings, each of these bonuses can help out!

Picture yourself earning bonus money just because you have met your sales quotas or sold more policies. Big on beers? These additional incentives do not only feel like a treat; they sum up together bringing a significant contribution to impressively high paychecks.

But that’s not all. In addition to commissions and bonuses, they may include extra remarkable privileges such as; health insurance and a retirement program. These perks can be different for every company so that is certainly something that should be considered when deciding where to apply for a job.

But what determines insurance agent earnings? It all comes down to a few key factors:

The commission’s rates are determined by your company

It is the number of policies that you sell SEO for market analysis, you can perform policy analysis for growth.

Any additional points that you build up as you make your way along.

Hence, with a little deserved attention to detail, one can earn a lot of money. Want to work as an insurance agent? Specifications are all about commission, bonuses, and benefits that are in reasonable comfort level with your lifestyle. What do you think—ready to dive in and make your mark?

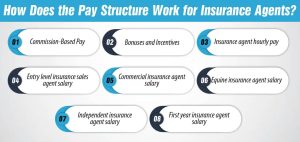

How Does the Pay Structure Work for Insurance Agents

Curious to know how much an insurance agent earns? This is a usual question for anyone willing to join this commission-based profession. Knowledge is power when it comes to your pay so that you can figure out how your money operates and how to get the most out of your check. So, to help demystify insurance agent pay, let’s take a closer look at how that compensation is normally structured.

– Commission-Based Pay

Most Insurance Agent Salaries based on commission or percentage of their sales earned throughout the period. In other words, the bigger the number of policies, the higher the amount of money that would be generated. Well, that’s simple! But do you understand that there are two categories of commission schemes?

- Flat Commission: In this structure, you get a predetermined proportion paid on every policy you sell. For instance, if someone offered you a 10% commission, that means 10% of the total premium you earn in every sale irrespective of the number of policies you sold.

- Tiered Commission: In this model, you realize a variation in your commission rate because the commission increases as you sell more. Thus, starting with, you may receive a 10% commission for the first 10 policies but rise to 12% for the next 20 policies. This is a straightforward strategy: the more you sell, the more you make – what a great strategy, no?

Which structure you fall under depends on the company you work for, but the bottom line is: that it also means that the more you sell, the more you deserve or are likely to earn a paycheck.

– Bonuses and Incentives

Apart from commissions, most companies employ bonuses and other reward systems for the distributors. Such bonuses could well be dependent on the achievement of certain sales points or customer satisfaction, for instance. Well, there might be a little extra money in your pocket if, in addition to making a sale, you are providing excellent services.

– Insurance agent hourly pay

Again, most real estate agents are compensated based on commission, but starting jobs such as customer service reps may be hired out at an hourly wage. This is less common but could be an option if, for instance, you are testing the waters, that is you’re just starting. Your company will compensate you for the work-time you do as an hourly employee, no matter how many insurance policies you are selling. Your salary will increase by the hourly rate and number of hours you work.

The downside of hourly pay is that your earnings are limited. You can only earn as much as your hourly rate allows, no matter how many policies you sell. The upside of hourly pay is that it provides a guaranteed income. Every week you’ll know exactly what Insurance Agent Salaries will be, no matter how well you sell.

– Entry level insurance sales agent salary

Starting out as an entry-level insurance sales agent? Wondering how much you’ll make? While salaries can vary, most entry-level agents earn a base pay ranging from $30,000 to $40,000 annually, with the opportunity to boost earnings through commissions. Ready to see how quickly you can grow entry level insurance agent salary?

– Commercial insurance agent salary

Wondering what a commercial insurance agent can earn? The pay can be quite rewarding, especially as you gain experience. On average, commercial insurance agents earn between $60,000 and $80,000 per year, but that’s just the beginning. Top agents, particularly those who build strong client relationships and sell high-value policies, can see their earnings soar well into six figures.

What makes it even better? Many agents enjoy a commission-based structure, meaning the more they sell, the more they take home. For those who excel at understanding business needs and providing tailored insurance solutions, the earning potential in commercial insurance is huge.

– Equine insurance agent salary

Starting as an entry-level insurance sales agent? Expect an annual salary between $30,000 and $40,000, with the exciting opportunity to earn even more through commissions. The more policies you sell, the higher your paycheck grows. Ready to kickstart your career in insurance and watch your income climb? The potential is right in front of you!

– Independent insurance agent salary

Curious about how much independent insurance agents make? These agents have the flexibility to control their income, with average earnings ranging from $50,000 to $100,000 annually. The best part? Since they work on commissions, the more they sell, the more they earn—so the potential is limitless! Ready to take charge of your own financial future as an independent agent?

– First year insurance agent salary

Wondering what you can earn in your first year as an insurance agent? Most new agents start with a base salary between $30,000 and $50,000, but commissions can quickly boost that number. Your earning potential grows with every policy sold, so the harder you work, the more you make. With dedication, your first year can set the foundation for a thriving career.

Therefore, no matter whether you operate on a commission basis or are just receiving hourly wages, insurance has more than one way of rewarding your efforts. Ready to start earning? Well, it is all about identifying the type that suits you most!

What are the Advantages and Disadvantages of Working as an Insurance Agent on an Hourly Basis?

You can make money if you’re an insurance agent. The primary factor determining how much income you get is the number of hours that you want to work. Your payment may change weekly or monthly if you get paid per hour. Depending upon your financial situation, this may have a positive or negative effect. In parallel, the fact that you receive an amount of compensation per hour provides flexibility enabling you to work as well or even less than you wish. If you’re willing to work part-time without worrying about your salary or bonus, this may be easy. For parents or persons who are going to live in residence, this may be an excellent way of supplementing their income. On the downside, your income can be very unpredictable. If you have a slow week, your paycheck will reflect that. It becomes difficult to Planning and saves for the future. Furthermore, you might work a more extended period to make ends meet at times of great demand.How Can Insurance Agents Maximize Their Income

Your income is directly linked to your ability to offer insurance policies as an agent. The more you’re selling policies, the greater your profits. But how can you maximize your income and sell as many policies as possible? Here are five tips that will help you do just that:- Become an expert on your products

- Build a strong network

- Use technology to your advantage

- Provide exceptional customer service

- Stay motivated

Conclusion

How much can insurance agents really earn? Or what are the Insurance Agent Salaries? It all depends on several variables such as experience, size of the agency or firm, and the method they use in paying their employees.Did you know most agents are independent working with insurance on a commission basis? That means they are paid based on the number of products that they are able to sell. However, not all the agents are paid an hourly wage; rather it depends on the particular job description or company they work for most of the time.But it’s not only about the financial … but about how you get your money. Advantages in this field include your experience, understanding of the customers, and service delivery. The best way to earn big in this industry is by being more informed about the industry and being able to relate with the clients.So, whether you’re chasing commissions or starting with hourly pay, remember: in the insurance business, success is not about achieving financial goals or targets; it involves the kind of relationship you have and the type of knowledge you bring in. Ready to make your mark?References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.