Life Insurance Laws by State: State Insurance Regulations

Last Updated on: August 29th, 2024

- Licensed Agent

- - @InsureGuardian

You know how life insurance laws vary across different states? Understanding these state-specific regulations can be crucial when selecting a life insurance policy that best suits your needs. From policy requirements to beneficiary rights, each state has its own set of laws that can impact your coverage and financial planning. So, how do these laws affect you, and what should you know to make informed decisions? Let’s explore the intricacies of life insurance laws by state to ensure you’re fully prepared.

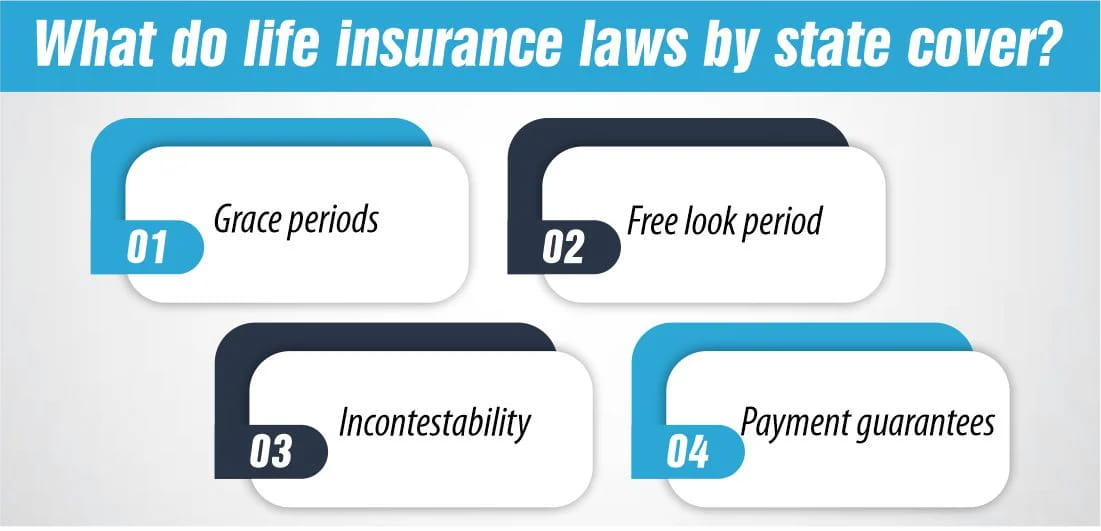

What do life insurance laws by state cover?

Generally, life insurance laws by state aim to help protect consumers by making sure life insurance companies provide adequate protection with their policies. While they vary by state, typical areas covered in life insurance rules and regulations include:

Table of Contents

Toggle– Grace periods:

This is the time between the due time of your payment and the time your policy expires. It allows you time to make a payment if for any reason you are unable to make the payment or you forget to make a payment before the due date. In most states, companies are allowed to give you about one month to pay your premium.

– Free look period:

If you choose not to continue your coverage for whatever reason, the free look period enables you to cancel and get a full reimbursement of the premium. This is usually a small period, normally 10 days or less. If you die during that period, you receive the death benefit anyway. However, if you fail to pay any of the premiums after that time, they cannot be refunded.

– Incontestability:

If your state has a contestability period, your insurance company can’t challenge a claim on your policy after you’ve owned it for a certain period. In most states, that period lasts two years.

– Payment guarantees:

It’s extremely rare for life insurance companies to go out of business, but it does happen. That’s why it’s important to work with a reputable company with a solid financial rating. If your life insurance company goes bankrupt, many states will guarantee your life insurance payout, typically up to a certain amount of your death benefit. If you have permanent life insurance, your life insurance laws by state might also guarantee a certain portion of your cash value.

Why Your Insurance Policy Will Probably Won’t Be Affected with location?

Whole life insurance policies are primarily portable. This means they can usually be transferred to another state without any issues. However, when it comes to taxes and regulation, there might be some changes involved. This is because the state mainly governs life insurance policies, and every state has policies.

Giving your new address is crucial since you wish for them to contact you and your beneficiary immediately. Your prices or the extent of your coverage may not necessarily alter if you move, though.

You might need to consider switching providers if you get whole life insurance via your employer but decide to change jobs. Your internal human resource officer can handle this. In other circumstances, you may keep your present whole life insurance plan with your previous employer.

How Much Does Life Isurance Cost?

Each state would have rules regarding policies like refunds, protection for the policyholders, late repayment grace periods, and the beneficiary if the insurance company declared bankruptcy. Even life insurance laws by state can impact the beneficiaries of life insurance death benefits.

One good example of the significant changes in your life insurance when moving is the number of premiums you’ll pay depending on where you live. You can contact your insurance company if you’re concerned about your premiums.

Can your geographic location affect your life insurance premiums?

While life insurance companies consider some mortality risks like your medical history or your job that puts you in harm’s way in arriving at your life insurance premiums, your location does not come under this category.

Unlike other insurance companies that may increase your premiums in the event of a disaster-prone zone, this company will not charge more based on your state. While your physical location does not influence insurance premiums, each state has a legislature that governs your insurance policy.

How does local legislation impact your policy?

It is important to note that state legislatures provide the main source of regulation regarding life insurance policies and their coverage of policy owners.

During the application process for the life insurance policy, you can consult the insurance broker or agent you are dealing with regarding the following issues that may differ with the states.

– Free look period:

This is the time when policyholders can cancel the policy they have taken and get full reimbursement of the initial premium amount paid.

– Late payment grace period:

This is the period within which you need to pay the balance of your premium to cover so that your policy cannot be legally canceled.

– State Guaranty Association:

These state organizations make sure that there is always coverage and in the event of your life insurance company going bust, you receive a death benefit.

State associations coordinate through an organization named the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA). It also provides an option where you can search for your state’s guaranty association online and can check life insurance laws by state.

Laws about travel

Unlawful travel will disqualify you from purchasing life insurance regardless of where you live.

- Interstate or foreign travel is classified as unlawful if you distribute proceeds from any illegal activity, commit a crime or act of violence, or promote any illegal activity, according to the International Travel Act of 1961.

- Sometimes, even lawful travel to a location deemed high-risk by the U.S. Department of State can impact your life insurance rates.

Depending on the length, frequency, and destination of travel, it’s possible to get a higher risk classification or be disqualified from purchasing a life insurance policy altogether.

Some states have legislation in place that prohibits life insurance companies from using any planned lawful travel to determine your life insurance policy. These states are:

- Florida

- Georgia

Life insurance companies also look at your travel history as an indicator of future behavior.

The following states have legislation in place that prohibits life insurance companies from using past lawful travel as a factor in your life insurance risk classification or eligibility:

- California

- Connecticut

- Colorado

- Illinois

- Maryland

- Massachusetts

- New York

- Oklahoma

- Washington

Life insurance laws by state

Some states recognize community property laws which mean that everything you own and earn becomes community property.

This makes them own half with your spouse if you have one. Another reason why life insurance is vulnerable to community property laws is that it is a form of income replacement.

Therefore, there are nine community property states and three states that allow married couples to choose to follow the community property system. Community property laws also exist in Puerto Rico and Guam. The remaining states do not have community property and operate under the common law system.

Community property states:

- Arizona

- California*

- Idaho

- Louisiana

- Nevada*

- New Mexico

- Texas

- Washington*

- Wisconsin

Community property law generally extends to people in a registered domestic partnership in these states.

Opt-in community property states:

- Alaska

- Tennessee

- South Dakota

If you’re purchasing a life insurance policy and you live in a state with community property laws, you have to name your spouse as your life insurance beneficiary unless they sign a legal waiver that permits you to list someone else.

Before you purchase a life insurance policy, you can talk to your broker about life insurance laws by state and regulations to make sure you fully understand how your policy works.

How life insurance laws are affected by state:

– Insurance rates by gender

Most insurance service providers have a provision for adjusting insurance premium costs depending on the gender of the policyholder. For instance, young males are often given higher premiums for their auto insurance than females of the same age. However, some of the states of the United States currently prohibit insurance providers from including gender in the premiums they offer for specific insurance products.

– Refund policy

Have you ever heard about life insurance policies with something called Free Look? After a customer takes your policy, if the policy has a free look provision it means the customer has the freedom to take back his policy within a certain period and reclaim his money back. Some law of life insurance in some states compel insurance companies to give customers a free look.

– Time to process and pay a claim

In addition, how soon should your insurance company respond to your claim? State laws provide for how long the insurance company has to handle the claim and pay for it. They take different amounts of time and depend on the state, and the type of insurance, it could be homeowner, auto, or life insurance. While some states demand that payments be made without any unnecessary delays, other ones are more specific in how many days or months a company has to process the claim.

Conclusion:

Of course, the law of life insurance can change at any time, so for the most up-to-date info on how your state laws affect you and your insurance policies, contact your insurance company or agent. No matter where you live, it’s always important to read the life insurance laws by state in any insurance policy before buying it to make sure you understand what it covers, what it doesn’t cover, and what it costs. If you have any questions about a policy, be sure to ask your agent or contact the insurance company directly.

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.