Living Life Insurance Benefits: Unlock Financial Security

Have you ever wondered if life insurance can do more than support your loved ones after you’re gone? What if it could also provide financial help while you’re still around? That’s where living benefits come in. They offer a safety net for unexpected life events, like critical illness or long-term care needs. Let’s dive into how living life insurance benefits work and why they might be a game-changer for you.

What are living life insurance benefits?

Living life insurance benefits allow the insured to access money from the policy’s death benefit while they’re still alive. These funds can be used to pay for expenses associated with terminal or chronic illness, such as medical care, hospice or nursing home care, in-home caretakers, and more. The trade-off is that accessing living benefits reduces the death benefit available to your beneficiaries when you die.

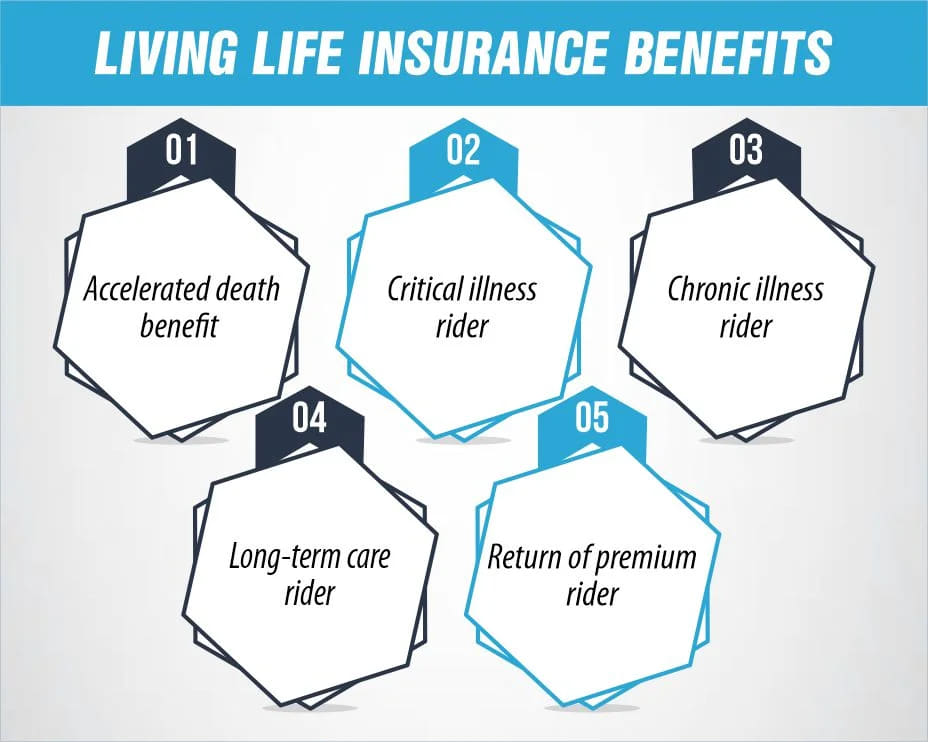

Types of living life insurance benefits:

Life insurance can help you while you’re still alive. Here are the main types:

Term Life Insurance

Term life is simple. It covers you for a set time, like 10, 20, or 30 years. If you die during this time, your family gets money. Term life policies don’t come with a cash value savings component, but insurers often offer living benefit rider options.

Permanent Life Insurance

Permanent life insurance lasts your whole life. It also has a cash value that grows over time. With cash value, insurers deposit a portion of your premium payments into an interest-bearing account. Once it reaches a certain balance or accumulates for a given number of years, you can use the cash value to pay your premiums. Insurers also often allow you to withdraw from or borrow against the cash value.

Why Get Living life insurance benefits?

Living life insurance benefits give you more options. They can help with money when you’re sick or need care. But using them might reduce what your family gets when you’re gone.

Living benefits make life insurance more useful. Whether you choose a term or permanent, they offer extra support when you need it most.

Living life insurance benefits

There are a few main types of living life insurance benefits that can be included in a life insurance policy:

Accelerated death benefit:

This enables the policyholder to receive a portion of the face value of the policy before the actual death occurs. Also referred to as a critical illness or a terminal illness rider, you can generally add an accelerated death benefit (ADB) rider to both permanent and term policies.

If you buy life insurance that includes an ADB, certain qualifying events would allow you to access some of your death benefits before you pass away. Each company has its qualifying events and some include:

- Terminal Illness with short life expectancy

- Permanent disability

- Organ transplant

- Certain stages of cancer

- Paralysis

- Coma

Using accelerated death benefit riders would lower the death benefit on your policy. You could use the money when your family needs it, but any death benefits taken early will generally reduce the amount your beneficiaries receive when you pass away.

How Much Does Life Isurance Cost?

Critical illness rider:

This rider pays a fixed amount, usually between $5000 and $50000, when the policyholder contracts any of the specific critical illnesses such as cancer, heart attack, or stroke. It can be used for any purpose so many sectors and industries can make use of this software such as the educational sector, and health sector among others.

Chronic illness rider:

This rider requires the policyholder to make a payment of a portion of the death benefit, usually every month, following the policyholder’s inability to perform certain activities of daily living or supervision due to a chronic ailment. This money can also be used to finance long-term care services.

Long-term care rider:

This rider works similarly to the chronic illness rider, and provides a monthly benefit for care expenses if the policyholder needs help with ADLs. Payment often depends on the disability/impairment that the employee is eligible for, and often only when the criteria have been met.

Return of premium rider:

This rider ensures that if the insured dies from causes not covered or lives longer than the policy period, all the premiums paid will be reimbursed less the amount paid on claims. This provides some guaranteed value, But all the values are not guaranteed.

Thus, the pros and cons of living benefits life insurance give a chance to get access to the funds before death and to use them for the health crisis for payments for long-term care, or for obtaining a guaranteed refund of the premiums, if necessary. The details differ depending on the policy and the person who will be covered by the insurance policy.

Living benefits of permanent life insurance

Here are some of the key living life insurance benefits that permanent life insurance policies can provide:

Cash value accumulation

With permanent life insurance policies, there is an accumulation of cash values over the policy period, and this part grows under tax advantage. This cash value is accessible through policy loans or withdrawals, meaning the policyholder can use it while they are alive. This is especially good when someone wants to have additional income in their retirement or to cater for a certain occasion.

Loans

The permanent life insurance policies give policyholders the option to take loans against the cash value in the policy. They are normally charged at a lower interest rate and can easily be negotiated to allow for early payments. The amount of loan is predetermined based on the face value of the policy and this policy face amount is assigned as the security for the loan.

Withdrawals

Many of the permanent life policies also require the policyholder to surrender part of the accumulated cash value less any surrender fees that may be applied. These withdrawals can aid in meeting income requirements. However, there are a few drawbacks of having a cash value account such as large withdrawal reduces the death benefit.

The main advantage is that permanent life insurance offers policy owners the right to borrow or partially surrender the policy for money needs, income, or any other circumstances while they are alive, apart from the death benefit.

How much does life insurance with living benefits cost?

A nonsmoking 30-year could be charged between $23 and $30 monthly premium of a $500 000 20-year term life policy with a terminal illness rider. However, the premium amount of a life insurance policy which also features living benefits differs depending on your risk profile and policy preferences. The factors that can determine the premiums include your age, health status, the chosen type of policy, and the desired riders.

The only guaranteed way to get a clear understanding of how much your policy will be is to get in touch with a licensed agent. All our specialists at Insure Guardian are licensed in 50 states, and we can assist you with your quote comparison and policy choices.

Conclusion

So, is living life insurance benefits right for you? These features can provide peace of mind and financial flexibility when you need it most. Imagine having access to funds during a medical crisis or being able to supplement your income in retirement. Living benefits make life insurance more than just a safety net for your family—they make it a valuable resource for you, too. Why not explore your options and see how these benefits can fit into your life plan?

References:

https://www.nerdwallet.com/article/insurance/living-benefits-life-insurance

https://www.forbes.com/advisor/life-insurance/living-benefits-in-life-insurance/

https://www.policygenius.com/life-insurance/life-insurance-with-living-benefits/

https://www.bankrate.com/insurance/life-insurance/living-benefits/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.