What is an Overfunded Life Insurance Policy?

An Overfunded Life Insurance (OLI) strategy emphasizes amplifying cash value while minimizing the death benefit. Made higher premiums aim to quickly grow cash value, serving as power for future policy loans.Overfunding and Term Life Insurance:

Traditional term life insurance directs all payments toward the death benefit and administrative fees. With a predetermined coverage period, no benefits are paid if the policyholder passes away beyond this span.Overfunding Advantage in Permanent Life Insurance:

Contrastingly, permanent life insurance demands higher premiums, but only a fraction contributes to the death benefit and administrative fees. The surplus is funneled into an integrated savings account, known as cash-value life insurance. This comprehensive coverage spans your entire life, offering both living and death benefits.

Why Do People Choose to Overfund Life Insurance Policies?

There are many reasons why people choose to overfund life insurance policies, and because of these reasons, different people come up with different plans to achieve set financial goals about the amount of risk that one is willing to take and his or her circumstances. Here are some of the primary motivations behind the decision to overfund life insurance policies:

Tax Advantages: Overfunded policies are known to be one of the best ways of accumulating wealth and enjoying certain advantages in this regard in terms of taxes. The increase within the policy is usually compound, implying it is tax-favored since it is regarded as being tax-exempt.

Financial Security: There is a high endowment that gives society an upfront comfort since the expense will be taken care of by the death benefits of the policyholder.

Guaranteed Returns: Some of the overfunded policies include; overfunded whole life insurance policy also referred to as the overfunded cash value life insurance. With this policy, one is assured of a minimum interest rate on the cash value. This might help offer a certain degree of reliability that other investment types may lack.

Estate Planning: It is worth turning to overfunded insurance as the tool that may help to solve many problems in the field of estate planning. Generally, the death benefit is paid to the beneficiaries tax-free, it thus serves as an effective way through which wealth can be passed to the next generation or even avoiding numerous estate taxes.

Of course, it can be stated that the decision to overfund a life insurance policy requires extensive deliberation and is typically made based on the recommendation of a financial planner. This approach may not work for everyone and must be consistent with the identified financial goals and risk appetite.

Overfunded Life Insurance Policy Pros and Cons

Overfunded insurance, like any financial strategy, has both advantages and disadvantages. Here’s an overview of the advantages and disadvantages:

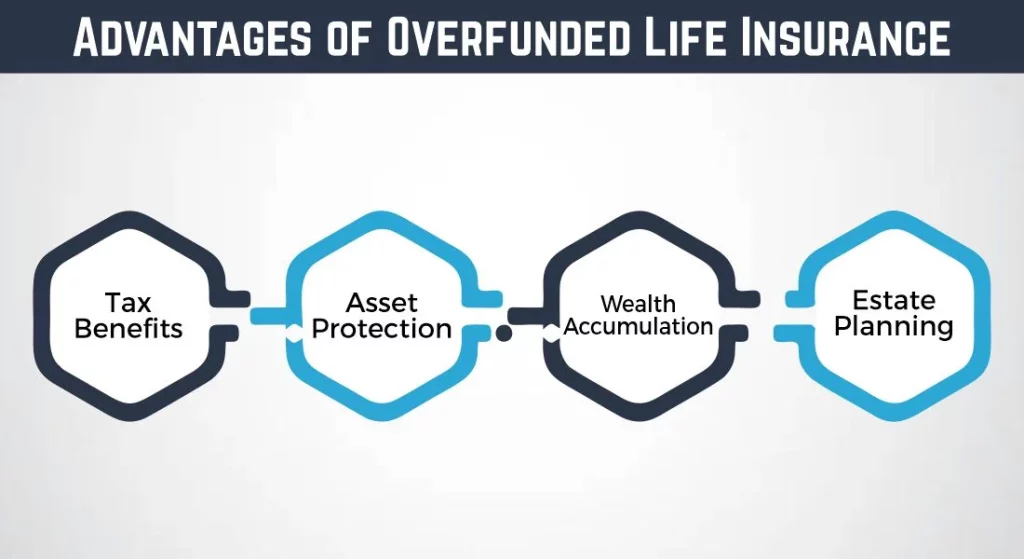

Advantages of Overfunding Life Insurance:

1- Tax Benefits

Discover how overfunded insurance policies work and how they can assist you with your taxes. The money that increases within the policy is commonly tax-favored and often, the death benefits are tax without subtraction. This can hold the greatest benefit for individuals with high levels of income, who seek to pay as little in taxes as possible.

2- Asset Protection

Currently, a majority of the states hold that the cash value of a life insurance policy is off-limits to creditors. This can indeed be a major advantage for people engaged in occupations where they stand to be sued or may have their properties attached by creditors.

3- Wealth Accumulation

The cash value within an overfunding policy can accumulate substantially over several years. This can be a source of cash savings and potential investment gains that would make you more financially agile.

4- Estate Planning

Especially when it comes to estate planning, overfunding insurance is going to be very important to you. It can be utilized to pass wealth to your heirs with less amount of estate tax which assists in making certain that your wealth is transferred to the next generation as you desire.

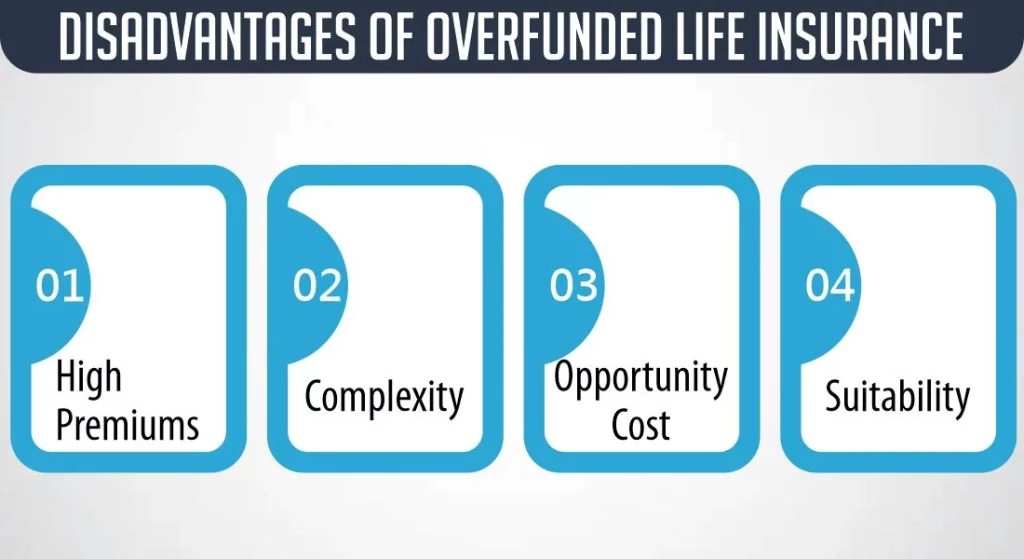

Disadvantages of Overfunding Life Insurance:

1- High Premiums

Overfunding typically requires larger premium payments than standard life insurance policies. This can strain your finances and limit your ability to allocate funds to other investments or expenses.

2- Complexity

Overfunded policies can be complex and may require ongoing management. It’s crucial to understand how the policy works and to regularly monitor its performance.

3- Opportunity Cost

Funds invested in an overfunded policy may have higher returns in other investment opportunities. You may miss out on potential gains by tying up your money in the policy.

4- Suitability

Overfunding is not a suitable strategy for everyone. It requires a clear understanding of your financial goals and risk tolerance. What works for one person may not be the right choice for another.

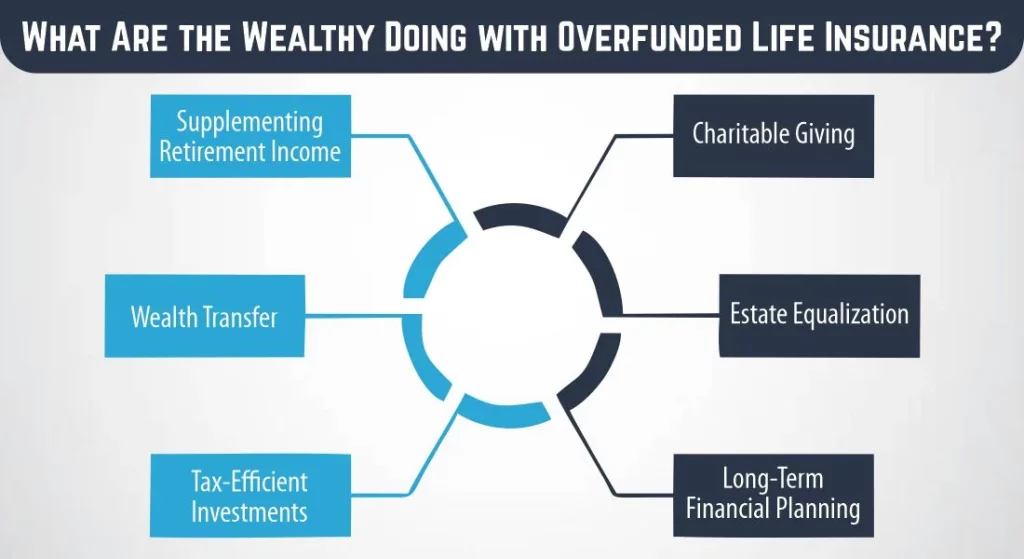

What Are the Wealthy Doing with Overfunded Life Insurance?

The wealthy often leverage overfunded insurance policies in sophisticated ways to enhance their financial strategies. Here are some of the key ways in which high-net-worth individuals utilize overfunded insurance:

Supplementing Retirement Income:

Overfunded life insurance policies can serve as a source of supplemental retirement income. Policyholders can withdraw cash values or take policy loans tax-free, allowing them to bolster their post-retirement finances.

Wealth Transfer:

Overfunded policies are employed as a tool for wealth transfer. By naming heirs as beneficiaries, high-net-worth individuals can pass on assets tax-free, reducing the impact of estate taxes and ensuring that their wealth continues to benefit future generations.

Tax-Efficient Investments:

The tax advantages of overfunded policies make them attractive to wealthier individuals. The growth within the policy is tax-deferred, and the death benefit is typically tax-free, providing a tax-efficient way to accumulate and transfer wealth.

Charitable Giving:

Wealthy individuals often use overfunded insurance to facilitate charitable giving. By naming charitable organizations as beneficiaries, they can leave a philanthropic legacy while optimizing the tax benefits associated with charitable contributions.

Estate Equalization:

In cases where high-net-worth individuals have both illiquid and liquid assets, overfunded life insurance can help equalize the inheritance among beneficiaries. Liquidating the policy’s death benefit can provide a fair distribution of assets.

Long-Term Financial Planning:

Overfunded policies are often included as a component of a broader financial plan, providing both financial security and long-term stability.

The Modified Endowment Contract (MEC)

Like many plans involving money, there are rules you must follow. The government has a say in how much you can put into an insurance policy at one time without losing the huge tax advantage it offers. If you put too much into your plan too soon, there is a risk that this change could turn into something called a modified endowment contract (MEC), for which tax laws are not helpful.

But don’t worry—there’s a way around it. The strategically designed plan, which includes a paid rider and a lifetime insurance policy, is designed to freeze your policy if you owe, if you owe, that extra thing that makes your policy pay size, and makes sure that it obeys the minimum requirements policy. Chat with your wealth advisor today to find out more.

Is Overfunded Life Insurance Right for You?

Whether overfunded life insurance is the right choice for you depends on your unique financial situation, objectives, and risk tolerance. Here are several key factors to consider when determining if overfunding a life insurance policy aligns with your needs:

Financial Goals

Clarify your financial goals. Do you aim to accumulate wealth, minimize tax liability, protect assets, or transfer wealth to heirs? Overfunded insurance can be a tool to address these objectives, but you must be clear about your priorities.

Income Level

Overfunding life insurance is often favored by high-income individuals seeking to reduce their tax burden. Assess whether you fall into this category and whether the tax advantages of overfunding make sense for your financial situation.

Risk Tolerance

Evaluate your comfort level with risk. While overfunded policies can provide stability and guaranteed returns, there are risks associated with any investment. Consider how much risk you are willing to tolerate and if overfunding aligns with your risk profile.

Liquidity Needs

Think about your current and future liquidity needs. Overfunding a policy ties up funds within the policy’s cash value component, and accessing those funds may have restrictions or tax consequences. Ensure you have other sources of readily available funds for emergencies and expenses.

Estate Planning

If estate planning is a priority, overfunded life insurance can be a valuable tool for transferring wealth to the next generation with reduced estate taxes. Assess whether this aligns with your estate planning objectives.

Personal and Financial Situation

Your age, health, family circumstances, and overall financial health play a role in determining if overfunding is a suitable strategy for you. Your financial advisor can help assess these factors.

Consult with a Financial Advisor

You should always seek the advice of a professional financial planner to review the circumstances of a particular scenario, learn the goals, and advice on whether or not overfunded life insurance is a wise decision.

Is Overfunding a Term Life Insurance Policy a Viable Strategy?

In general, overfunding a term life insurance policy is not possible or advisable. Term insurance as the name suggests is meant to offer coverage for a given term which can be 10 years, 20 years, or 30 years. Term life insurance does not have features of cash accumulation and is not an investment or savings product as permanent life insurance is undefined.

No Cash Value

Term life insurance policies do not build cash value over time. They are pure insurance coverage, and the premiums you pay go toward the cost of providing the death benefit. There is no cash value to overfund or accumulate.

Temporary Nature

Term life insurance is intended to protect for a specific term. Overfunding a temporary policy would not provide any additional financial benefits because the policy is not meant for long-term wealth accumulation or savings.

Opportunity Cost

Money directed toward an Overfunded Life Insurance Policy could be used for other investment opportunities that have the ability for higher returns. There are generally extra green methods to store and make investments with your money. If your purpose is to build wealth, collect savings, or have the right of entry to a budget at some stage in your lifetime, you must consider everlasting life insurance guidelines, such as overfunding entire life insurance or widely widespread lifestyle insurance. These guidelines incorporate cash price additives that people can overfund and make use of as an investment and wealth accumulation tool. Term existence coverage is broadly speaking selected for its affordability and the protection it offers throughout precise existence ranges or for precise economic needs, which include presenting profits as a substitute in case of untimely dying. When evaluating the existing insurance alternatives, it’s critical to healthy the type of coverage in your economic desires and needs.

Final Thoughts

Overfunded Life Insurance Policy regulations offer a unique approach to financial planning and wealth accumulation. While they have benefits, it’s important to recollect your monetary scenario, desires, and risk tolerance whilst determining if overfunding is right for you. Consult with a qualified financial consultant to make a knowledgeable choice and optimize your monetary approach.

Frequently Asked Questions (FAQs)

1- Can Overfunded Life Insurance Pay Off?

Overfunded life insurance can pay off in various ways:

- Wealth Accumulation: Progressively, the policy’s cash value increases substantially and thereby one gets an accessible financial instrument in life.

- Tax-Free Death Benefit: Death gain is paid to the beneficiary in a tax-free way making it feasible for them to have financial security upon your death.

- Asset Protection: Shelter from creditors can be considered as one of the predominant blessings of this approach especially for the ones hired in occupations that could disclose one to litigations.

- Estate Planning: Overfunded lifestyle insurance may be very critical in reaching property planning desires of passing on wealth to the next technology whilst at the same time searching for to lessen the property taxes levied with the aid of the government.

2- Do Permanent Life Insurance Policies Benefit From Overfunding?

Yes, permanent Life Insurance Policies which include the complete existence coverage policy and the typical life coverage can substantially gain from overfunding. Excess of such types of policies can similarly improve their utility from an economic perspective and also can be a useful part of one’s lengthy-term monetary making plans.

3- What do you mean by the Modified Endowment Contract?

A Modified Endowment Contract (MEC) loses tax benefits due to high premiums. Policyholders should avoid excessive payments. Policyholders should avoid excessive funding to prevent unfavorable tax implications, such as MEC classification.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.