In a world where money is essential for a secure future, parents are always looking for ways to ensure their children’s well-being. The Million Dollar Baby life insurance plan is a reliable financial solution that can help parents achieve this goal. It is a simple but effective way to provide a $1 million safety net for your child.

In this review, we will take a close look at the Million Dollar Baby life insurance plan. We will explain what it is, how it works, when parents should start contributing, how it compares to other long-term legacy plans, how much the monthly payments are, what benefits it offers, and where to find the best rates.

This is not about emotional appeals; it is about financial planning. Let’s examine the cold, hard facts about the Million Dollar Baby policy to help you make a practical and informed decision about your child’s financial future.

What is the Million Dollar Baby Life Insurance Plan?

The Million Dollar Baby Life Insurance Plan is a specialized financial product designed to provide a substantial life insurance benefit for a child when they reach a specified age, usually 18 or 21. This plan allows parents to secure their child’s financial future by investing in a life insurance policy with a guaranteed payout of one million dollars.

In the unfortunate event of the parent’s passing during the policy term, the child receives this million-dollar benefit, providing a significant financial cushion that can be used for various purposes, such as funding higher education, purchasing a home, or investing in their financial endeavors.

Shortly, the Million Dollar Baby policy is essentially a life insurance policy with a focus on securing the child’s financial future. It offers peace of mind to parents, knowing that they are taking steps to provide financial stability for their children, should the unexpected occur.

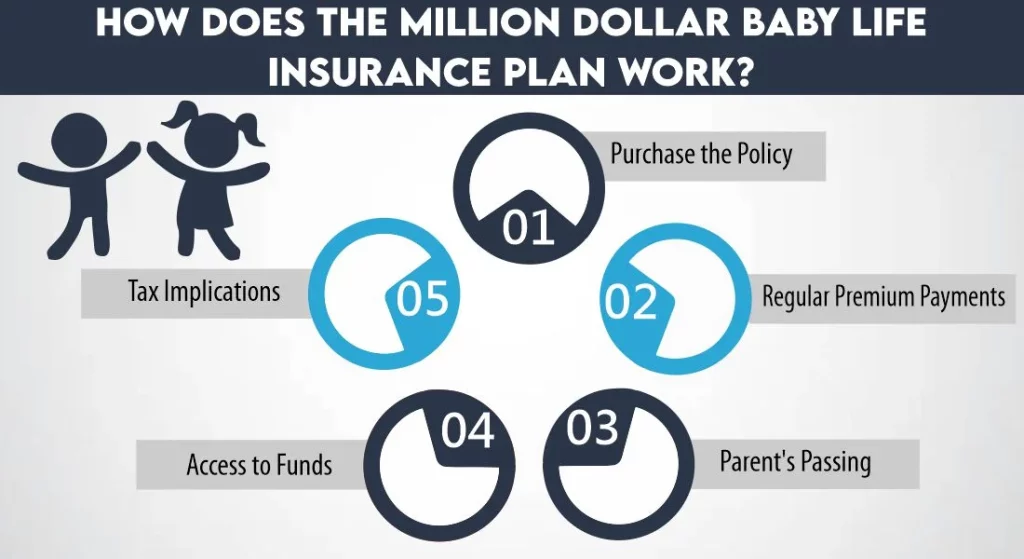

How does the Million Dollar Baby Life Insurance Plan Work?

The Million Dollar Baby Life Insurance Plan operates on a simple and structured mechanism. Here’s how it works:

Purchase the Policy:

Parents begin by purchasing a life insurance policy with a predetermined payout value, typically set at one million dollars. This policy is designed to secure their child’s financial future.

Regular Premium Payments:

To keep the policy active, parents are required to make regular premium payments. These payments can be made on a monthly or annual basis and are typically based on factors like the parent’s age, the child’s age, the desired payout amount, and the chosen insurance provider.

Parent’s Passing:

In the unfortunate event of the parent’s demise during the policy term, the child becomes the beneficiary and is entitled to receive the guaranteed payout of one million dollars.

Access to Funds:

When the child reaches a specified age, usually 18 or 21, they gain access to the policy. At this point, they can decide how to utilize the funds. The flexibility of this plan allows the child to use the money for various purposes, such as funding their higher education, buying a home, or investing in their financial future.

Tax Implications:

Depending on your location and the plan’s structure, there may be tax benefits associated with this type of insurance policy, making it a tax-efficient way to pass on wealth to the next generation.

How Much Does Life Isurance Cost?

Furthermore, carefully review the terms and conditions of the policy, as they may vary between insurance providers. By understanding the mechanics of the Million Dollar Baby plan, parents can ensure that they are taking the right steps to secure their child’s financial future, regardless of unforeseen circumstances.

How Early Should Parents Contribute to the Million Dollar Baby Plan?

Contributing to the Million Dollar Baby plan is a wise move, but the timing can vary based on individual circumstances. Typically, parents start contributing to the plan as soon as their child is born. The earlier the policy is established, the longer it has to accumulate value, potentially making it a more substantial financial resource for the child when they gain access to it.

However, some parents may choose to start later, especially if they haven’t planned for it in advance. It’s crucial to evaluate your financial situation and consult with a financial advisor to determine the best time to start contributing to the Million Dollar Baby plan.

How Does Million Dollar Baby Plan Compare to Other Kinds of Long-Term Legacy Plans?

The Million Dollar Baby plan is just one of many options available for parents seeking to secure their child’s financial future. It’s essential to compare it to other long-term legacy plans to ensure it aligns with your goals and financial capacity. Some alternative options include education savings accounts, trusts, and other life insurance policies.

One key advantage of the Million Dollar Baby plan is the guaranteed payout of one million dollars. This can be a substantial financial safety net for a child. However, it’s important to note that the primary purpose of this plan is life insurance, and it may not offer the same tax benefits or investment opportunities as other plans.

Monthly Payments for the Million Dollar Baby Life Insurance Plan

The cost of the Million Dollar Baby plan varies depending on several factors, including the parent’s age, the child’s age, the desired payout amount, and the chosen insurance provider. Monthly payments can range from a few hundred to a few thousand dollars.

Here’s a table to provide you with an idea of the typical monthly payments for the Million Dollar Baby Life Insurance Plan. Keep in mind that actual premium amounts can vary depending on factors like the parent’s age, the child’s age, and the chosen insurance provider.

| Child’s Age at Policy Inception | Parent’s Age at Policy Inception | Desired Payout Amount | Estimated Monthly Premium |

|---|---|---|---|

| Newborn | 30-35 | $1,000,000 | $100 – $150 |

| 1 year old | 30-35 | $1,000,000 | $120 – $160 |

| 5 year old | 30-35 | $1,000,000 | $150 – $200 |

| Newborn | 40-45 | $1,000,000 | $130 – $180 |

| 1 year old | 40-45 | $1,000,000 | $150 – $200 |

| 5 year old | 40-45 | $1,000,000 | $180 – $240 |

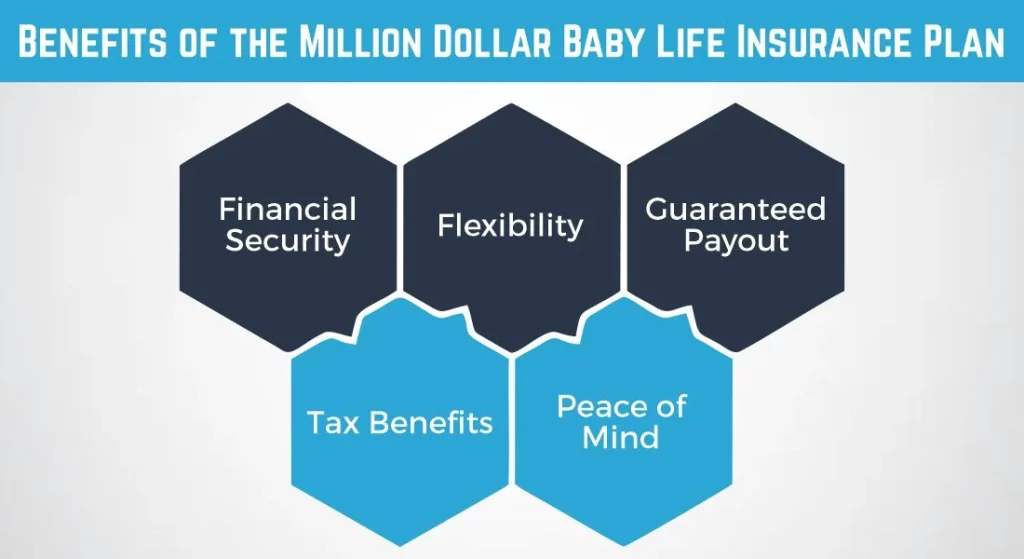

Benefits of the Million Dollar Baby Life Insurance Plan

The Million Dollar Baby Life Insurance Plan offers several benefits that make it an attractive choice for parents seeking to secure their child’s financial future. Here are the key advantages:

1- Financial Security

The plan provides a substantial financial safety net for your child. In the unfortunate event of the parent’s passing during the policy term, the child receives a guaranteed one million dollar payout. This financial cushion can help cover expenses such as higher education, home purchase, or investment in their future.

2- Flexibility

When the child reaches the specified age, typically 18 or 21, they gain access to the policy’s funds. They can use the million-dollar benefit in ways that best suit their needs and goals. This flexibility allows them to make financial decisions that align with their circumstances.

3- Guaranteed Payout

Unlike some investment-based plans, the Million Dollar Baby plan offers a guaranteed payout. This means that regardless of market fluctuations or investment performance, the child is assured of receiving one million dollars, providing a level of financial certainty.

4- Tax Benefits

Depending on your location and the specific structure of the plan, there may be tax benefits associated with this type of life insurance policy. These benefits can make it a tax-efficient way to transfer wealth to the next generation.

5- Peace of Mind

Knowing that you have taken steps to secure your child’s financial future can provide parents with invaluable peace of mind. The Million Dollar Baby plan offers a straightforward and dependable means of ensuring your child’s financial well-being.

By understanding and leveraging these benefits, parents can make a well-informed decision to protect their child’s financial future through the Million Dollar Baby Insurance policy.

How to get Competitive Rates for Million-Dollar Baby Life Insurance Plans?

Finding the most competitive rates for Million-Dollar Baby Life Insurance Plans is essential to ensure that you get the best value for your investment. Here are some steps to help you find competitive rates:

1- Compare Multiple Providers

Start by obtaining quotes from various insurance providers. Different companies may offer different rates for similar coverage. By comparing multiple quotes, you can identify the most competitive options.

2- Assess Your Financial Situation

Consider your own financial situation and what premium amount you can comfortably afford. The cost of the plan can vary based on factors like the parent’s age, the child’s age, the desired payout amount, and the chosen insurance provider. Ensure that the plan aligns with your budget.

3- Seek Recommendations

Reach out to friends, family, or colleagues who have purchased similar insurance plans. They can provide insights into their experiences and help you find reputable insurance providers.

4- Research Online

Utilize online resources to research insurance companies and their products. Look for customer reviews and ratings to gauge the satisfaction of policyholders. A well-regarded company is more likely to offer competitive rates.

5- Consult with an Independent Insurance Agent

Independent insurance agents can provide you with personalized guidance and help you navigate the complexities of insurance policies. They can often access quotes from multiple providers, simplifying your search for competitive rates.

6- Consider Policy Term and Coverage

Assess the duration of the policy and the coverage offered. Some policies may have longer terms, while others may have additional benefits. Understanding your needs and preferences can help you find a plan that matches your requirements.

7- Review the Conditions

Pay close attention to the terms and conditions of the policy, including any exclusions or limitations. Understand what the policy covers and what it doesn’t to avoid surprises in the future.

8- Financial Stability of the Provider

Investigate the financial stability and reputation of the insurance provider. A company with a strong financial track record is more likely to honor its commitments and provide competitive rates.

By following these steps and conducting thorough research, you can identify the insurance provider and policy that offer the most competitive rates for the Million-Dollar Baby Life Insurance Plan while meeting your specific financial goals and requirements.

Conclusion

Consequently, the Million Dollar Baby life insurance plan is a valuable financial tool for parents looking to secure their child’s future. Understand contributions, timing, and comparisons for an informed decision matching your family’s goals and finances.. Consult a financial advisor, compare insurers for the best rates and terms in any financial decision.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.