National family assurance corporation scam or Legit?

Is National Family Assurance Corporation the right choice for your insurance needs or just another scam? With so many options out there, it’s important to pick a provider you can trust. Is national family assurance corporation Scam Or Legit? Let’s dig into the facts and find out what real customers are saying about their experiences. Are you ready to uncover the truth about the National Family Assurance Corporation? Let’s get started!

Who is the National Family Assurance Corporation?

Have you ever come across National Family Assurance Corporation while looking for insurance options? You’re not alone. This company offers a variety of insurance products, mainly catering to families looking to secure their financial future. But with so many insurance options out there, it’s normal to question, “Is this company legit?”

Common Concerns About Legitimacy

Is it safe? National family assurance corporation scam or legit? These are common questions potential customers might have. The worry about scams is real in the insurance world, and it’s wise to be cautious. With National Family Assurance, the key is to delve into their history, services, and customer feedback to understand their credibility.

Company Background

History of the Company: National Family Assurance Corporation hasn’t been around as long as some of the industry giants, but it has made its mark since its inception. The company has grown by offering straightforward insurance solutions to families across various states.

Services Offered: From life insurance to homeowners and auto insurance, National Family Assurance provides a spectrum of products aimed at protecting the essentials. Their services are designed to be flexible, accommodating different needs and budgets, which is a big plus for anyone looking to customize their coverage.

Understanding a company like National Family Assurance Corporation goes beyond just knowing what they offer. It’s about getting real feedback, checking their standing with insurance authorities, and comparing their services with your needs. When in doubt, do a little digging, check reviews, and talk to a representative to get the whole picture. Who knows? They might be the right fit for your insurance needs.

Potential Insurance Scams: What to Look Out For

Ever felt rushed to sign up for an insurance policy? Or stumbled upon a deal that seemed too good to be true? Navigating the insurance landscape can be tricky, especially with the risk of scams lurking around. Here’s how you can spot the red flags and steer clear of potential scams:

High-Pressure Sales Tactics

Feeling pressured? If a company is pushing hard for you to make quick decisions without giving you time to think it over or compare it with other options, take a step back. Real deal insurers know the importance of an informed decision—they won’t rush you.

Vague Policy Details

Can’t Need Help Getting the specifics? Transparency is key in insurance. If the details are murky or if getting your hands on the full policy documentation is like pulling teeth, that’s a warning sign. Legit companies lay it all out upfront, clear and simple.

Unusually Low Prices

A bargain or a trap? It’s tempting to jump on low-cost premiums, but if the price is significantly lower than similar offerings in the market, it might not be the steal it seems. These policies cover much less than you think, or worse, they could hide hefty clauses.

Lack of Physical Presence or Reliable Contact Information

Where are they? A reputable insurance provider will have a physical office and contact details that are reachable. If this basic information is hard to find or non-existent, think twice. Legitimate businesses make themselves available and easy to contact.

How Much Does Life Isurance Cost?

Requests for Personal Information Upfront

Why all the questions? If you find yourself being asked for extensive personal or financial details early on—before you’ve even seen a policy—alarm bells should ring. Scammers often collect this information for fraudulent purposes.

Stay Informed, Stay Safe

Navigating the world of insurance is not impossible. By keeping these signs in mind, you can protect yourself from potential scams and find a provider who truly has your best interests at heart. Remember, if something feels off, it’s okay to walk away and do more research. Better safe than sorry!

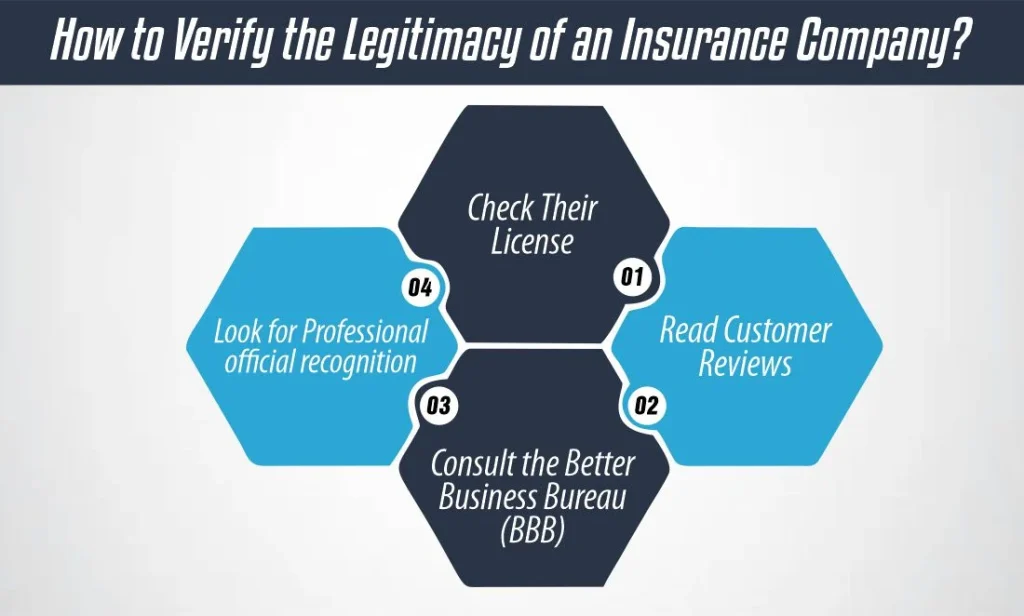

How to Verify the Legitimacy of an Insurance Company?

How to Verify the Legitimacy of an Insurance Company?

When it comes to picking an insurance company, knowing who you can trust is key. Here’s a straightforward guide on how to check if an insurance company is legit so you can make informed choices without falling prey to scams.

Check Their License

Is it official? The first step in verifying an insurance company’s legitimacy is to check its licensing. Each state has a department of insurance that maintains records of all licensed insurers operating within its borders. Visit your state’s Department of Insurance website and look up the company. This can tell you whether they’re officially recognized and authorized to sell insurance in your area.

Read Customer Reviews

What are people saying? Customer reviews can provide invaluable insights into the reliability and customer service of an insurance company. Websites like Consumer Reports, Trustpilot, and even Google Reviews are good places to start. While it’s normal for companies to have a mix of positive and negative feedback, be cautious if you notice a consistent pattern of complaints about claims processing, customer service, or unexpected charges. These could be red flags indicating poor service or potentially dishonest practices.

Consult the Better Business Bureau (BBB)

What’s their score? The Better Business Bureau (BBB) is a trusted entity that provides ratings for businesses based on customer feedback, complaint history, and the transparency of business practices. A legitimate insurance company is likely to have a profile on the BBB’s website. Check their rating and read any complaints or official recognition information. Companies with an “A” rating generally have a proven track record of resolving customer issues and maintaining trustworthy practices.

Look for Professional official recognition

Reputable insurance companies often hold official recognitions or are members of professional associations, such as the National Association of Insurance Commissioners (NAIC) or the American Insurance Association (AIA). Membership in such organizations means the company adheres to certain industry standards and ethical practices. You can typically find this information on the company’s website or through the professional body’s member directory.

Additional Tips for Verifying an Insurance Company

Visit their office: Visiting a physical office can provide further Assurance of the company’s legitimacy.

Ask for referrals: Speak with friends or family about their experiences or ask a trusted financial advisor.

Review their financial strength: Companies like A.M. Best, Moody’s, and Standard & Poor’s rate insurance companies based on their financial health, which can indicate their ability to pay out claims.

Choosing the right insurance provider is crucial. By following these steps to verify the legitimacy of an insurance company, you’re not just protecting your investments; you’re also ensuring peace of mind for yourself and your family. Always remember doing a bit of homework before signing any contract can save you a lot of trouble down the line. So, take your time, do your research, and choose wisely. Have you checked your insurer’s credentials yet?

National Family Assurance Life Insurance Reviews & Complaints

Even though they are approved by the Better Business Bureau (BBB), the National Family Assurance Corporation faces a high number of complaints. They operate under two brand names, each with its own BBB profile, which shows significant differences in customer satisfaction:

National Family: As of May 16, 2023, this brand has a BBB rating of 1.04 out of 5 based on 146 complaints in the last three years. On Trustpilot, the rating is slightly better at 2.4 out of 5 from nine reviews.

Assurance: On the same date, Assurance has a BBB rating of 1.07 out of 5, with 290 complaints over the past three years. However, their Trustpilot score tells a different story, standing at 4.6 out of 5 from 908 reviews.

A common complaint from both policyholders and potential customers includes persistent and unwanted phone calls.

Conclusion:

So, is the National family assurance corporation scam or legit? What’s the scoop on National Family Assurance Corporation? After diving into their background, customer feedback, and industry standings, here’s the lowdown. This company is licensed and has a decent track record, according to the Better Business Bureau and other review platforms. While they’re not without complaints, what company is? —they generally seem to handle issues responsibly.

Final decision?

National Family Assurance Corporation is a legitimate option for those seeking various insurance products. However, like with any company, it’s smart to do your digging. Check out their website, call up an agent, and chat with someone who’s used them before you make your decision. Remember, the best choice is an informed one!

FAQs

How can I tell if an insurance offer from National Family Assurance is a scam?

Be cautious if you experience high-pressure sales tactics, vague policy details, or requests for extensive personal information upfront. These can be signs of a potential scam. Always read the fine print and ask questions until you feel comfortable.

What should I do if I suspect a scam from any insurance provider, including National Family Assurance?

If something feels off, it’s important to report your concerns to the Better Business Bureau (BBB) or your state’s insurance department. They can provide guidance and take action if necessary.

Can I find reviews about National Family Assurance Corporation online?

Yes, you can find customer reviews on websites like the BBB, Trustpilot, and other review platforms. These reviews give you a sense of what current and former customers think about their services and customer support.

References:

https://finalexpensebenefits.org/national-family-assurance-guide/

https://finalexpensedirect.com/national-family-life-insurance-review/

https://www.lifeant.com/faq/is-national-family-life-insurance-legit/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.

How to Verify the Legitimacy of an Insurance Company?

How to Verify the Legitimacy of an Insurance Company?