Open Care Life Insurance: Reviews, Costs, and Options for Seniors

Last Updated on: October 3rd, 2025

Reviewed by Dylan

- Licensed Agent

- - @InsureGuardian

Life insurance is an important choice to help protect your family’s money in the future. For many older adults, final expense insurance is very helpful because it pays for funeral costs and other end-of-life expenses, so your loved ones don’t have to worry about money. One company people often talk about is Open Care Life Insurance. If you want to learn about Open Care life insurance, including reviews, costs, and rates, this guide will explain everything in a simple way to help you decide if it’s right for you.

Table of Contents

ToggleWhat is Open Care Life Insurance?

Open Care is a life insurance company that mainly helps seniors find affordable final expense insurance. Instead of selling its own policies, Open Care works like a helper or broker, connecting people with insurance from other companies. They focus on plans that are easy to get, often without needing a medical exam.

The most common plan with Open Care is final expense life insurance, that is also called burial insurance. This type of insurance will help to pay for funeral costs, medical bills, or small debts so your family doesn’t have to worry about money.

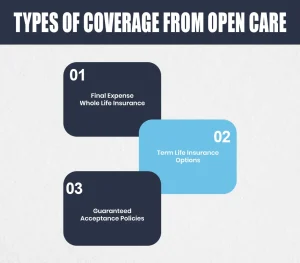

Types of Coverage from Open Care

Although the company primarily promotes final expense plans, Open Care senior life insurance generally falls into three categories:

Final Expense Whole Life Insurance

This plan is designed for seniors and provides lifelong protection. Coverage usually ranges from $2,500 to $50,000, and the premiums stay the same for your entire life. It helps ensure that your family will have money for funeral costs and other small expenses.

Term Life Insurance Options

Term life insurance options come for the set number of years so whatever is best for you like 10, 20, or 30 years you can choose. This makes it a best option for the people who want temporary protection. This plan will help to cover the specific needs during the short time and not committing for the long-term monthly premiums.

Guaranteed Acceptance Policies

These policies are available for seniors who may have health problems. No medical exam is required, making it easier to qualify. However, the premiums are usually higher, and there may be a waiting period before the full benefits are paid.

Open Care Life Insurance for Seniors

Open Care focuses on helping seniors find affordable final expense insurance. Most people who look for Open Care life insurance are between 50 and 85 years old, the ages when burial insurance is often needed. These policies are simple and easy to get. They usually don’t require a medical exam, get approved quickly, and provide smaller amounts of coverage that are enough to pay for funeral costs and other end-of-life expenses. Because the application is short and the premiums are low, many seniors find these plans very convenient.

How Much Does Life Isurance Cost?

Open Care Life Insurance Cost

One of the most common questions people ask is how much Open Care life insurance costs. Like most insurance companies, the monthly price depends on a few things. Your age when you apply, whether you are male or female, if you smoke, and the type and amount of coverage you choose all affect the cost.

Average Open Care Life Insurance Cost per Month for Seniors

For example, a healthy 60-year-old who doesn’t smoke might pay about $30 to $50 each month for a $10,000 policy. A 70-year-old who smokes could pay closer to $70 to $100 per month for the same coverage. Although ads often say coverage starts at “just $7.49 per month,” that rate is usually for very small policies or younger people. Most seniors end up paying more depending on their age and health.

Open Care Life Insurance Rates

When you are comparing the open care life insurance rates with any other provider you can find out that the Open Care life insurance rates can be competitive for some age groups, but they are not always the lowest available. Rates tend to be more attractive for healthier applicants under 65. For older seniors or those with health concerns, guaranteed issue policies can be more expensive.

When compared to other insurers, Open Care life insurance rates may be competitive for some age groups, but they are not always the lowest available. Rates tend to be more attractive for healthier applicants under 65. For older seniors or those with health concerns, guaranteed issue policies can be more expensive.

It’s important to compare rates with other well-known providers such as Mutual of Omaha, AIG, or Colonial Penn before deciding.

Open Care Final Expense Life Insurance

Final expense coverage is the flagship product marketed by Open Care. This type of policy is specifically intended to cover:

- Funeral and burial costs.

- Outstanding medical expenses.

- Minor debts left behind.

Since the average funeral cost in the U.S. is between $8,000 and $12,000, there are so many seniors choosing a $10,000 or $15,000 policy for peace of mind.

Open Care Life Insurance Reviews: Consumer Reports

Open Care does not have such things like ratings from the consumers, but you can find the helpful feedback on online sites. Overall, the ratings and opinions are mixed. There are so many seniors like that Open Care makes it easier to find a policy without dealing with multiple companies. Others think they might get lower rates by going directly to the insurance companies. If you’re thinking about using Open Care, it’s a good idea to compare different offers and read the details carefully to make sure the policy works for you.

Is Open Care Life Insurance Legit?

A question many people ask is that Open Care life insurance is legit. The short answer is yes. Open Care is a real and legitimate agency that helps people find life insurance from trusted insurance companies. However, it is not an insurance company itself, it mainly acts as a broker. Just because Open Care is legitimate doesn’t always mean it offers the best value. Some people may find better rates or clearer service by going directly to other insurance providers.

Pros and Cons of Open Care Life Insurance

Pros:

- Easy application process.

- Coverage available for seniors up to age 85.

- No medical exam for most plans.

- Quick approval process.

Cons:

- Ads can be misleading about actual costs.

- Some negative reviews about customer service.

- Premiums may be higher compared to competitors.

- Waiting periods may apply for guaranteed acceptance plans.

Who Should Consider Open Care Life Insurance?

You may want to consider Open Care if:

- You’re a senior seeking quick and simple coverage.

- You don’t want to undergo a medical exam.

- You need a small policy to cover funeral or final expenses.

Tips for Choosing the Right Policy

Compare Quotes

Don’t rely on one company. Make sure to compare the Open Care rates with other insurance providers.

Read the Fine Print

Understand waiting periods, exclusions, and coverage limits.

Check the Insurer’s Reputation

Since Open Care is a broker, find out which insurance company you’ll actually be covered by.

Calculate Your Needs

Before buying the plan you have to make sure that you have estimated funeral expenses, your unpaid loans, and other final expenses to choose the right coverage amount.

Conclusion

Choosing the right life insurance is a personal decision, especially for seniors planning for end-of-life expenses. But Open Care Life Insurance offers you easy and simple options, but it’s not the only choice. By looking at Open Care’s costs, reviews, and rates, you can decide if it is the right fit for you. If you want peace of mind and a simple process, Open Care could work. But if keeping costs low is more important, it’s a good idea to compare other options too.

Ready to find the right life insurance for you or your loved ones? Insure Guardian can help you compare plans, find affordable rates, and guide you through the process with ease.

Don’t leave your family with unexpected expenses, get started today and find the coverage that gives you peace of mind.

FAQS

Is Open Care life insurance legitimate?

Yes, Open Care is a real and legitimate company. It doesn’t sell insurance directly but helps connect people with real insurance from trusted companies.

How much is a $10,000 life insurance policy?

The cost of life insurance depends on your age, health, and if you smoke. For example, a healthy 60-year-old who doesn’t smoke will pay less each month, while a 70-year-old who smokes will pay more.

What is the cash value of a $25,000 whole life insurance policy?

Whole life insurance builds cash value over time. At first, the cash value is small, but it grows slowly as you pay your premiums on time and policy is active. Exact amounts depend on the policy and how long you have been paying for the insurance plan.

Can I withdraw money from my life insurance?

Yes you can withdraw your money from life insurance but there are some cases, like if you have a whole life insurance plan then you will be able to borrow or withdraw because the cash value build in you plan. But if you have term life plan then you will not be able to take out any money.

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.