A Pilot Applies for Life Insurance: Essential Steps and Tips

Flying high comes with its own set of challenges and thrills, but when it comes to life insurance, pilots might find themselves navigating a slightly different flight path. However, over the years, the insurance industry has come to realize that pilots tend to be less of a risk than previously assumed. As a result, pilot insurance is not as expensive as it was.

Pilots are now able to secure life insurance coverage without much hassle. So, if you are a pilot without coverage, the good news is that you can get low-cost life insurance coverage even though your job may seem risky compared to others.

Let’s explore what is the process when a pilot applies for life insurance and ensure you’re well-prepared for every step of the way.

How Does Being a Pilot Affect Life Insurance?

When a pilot applies for life insurance, the process generally mirrors what anyone else might go through when purchasing a policy. However, pilots can typically expect to face higher premiums than the average applicant. These elevated rates are due to the underwriting process, which assesses the risk each insured individual carries for dying. This evaluation includes various behaviors and factors, from smoking habits to family medical history, and notably, the applicant’s profession.

The career of a pilot introduces additional risks that are taken into account. The inherent dangers associated with plane crashes, the significant stress involved in the role, and the lifestyle of frequent travel to various locations can all impact a pilot’s life expectancy. Consequently, these factors often lead to an increase in life insurance premiums for pilots.

Do pilots need special insurance?

Despite the added risk, there is not a specialized policy specific to pilots that is widely offered. A typical life policy that anyone can purchase would suffice for pilots. However, those pilots who wish to have different terms could join a policy under the Aircraft Owners and Pilots Association. The AOPA collaborates with several companies to facilitate the provision of cheap life insurance for pilots.

The unique insurance policy that pilots regularly interact with is an aircraft policy. These policies cover the plane and the equipment on board and right from liability claims should there be an incident with passengers on board, then these policies do not guarantee the lives of the pilots.

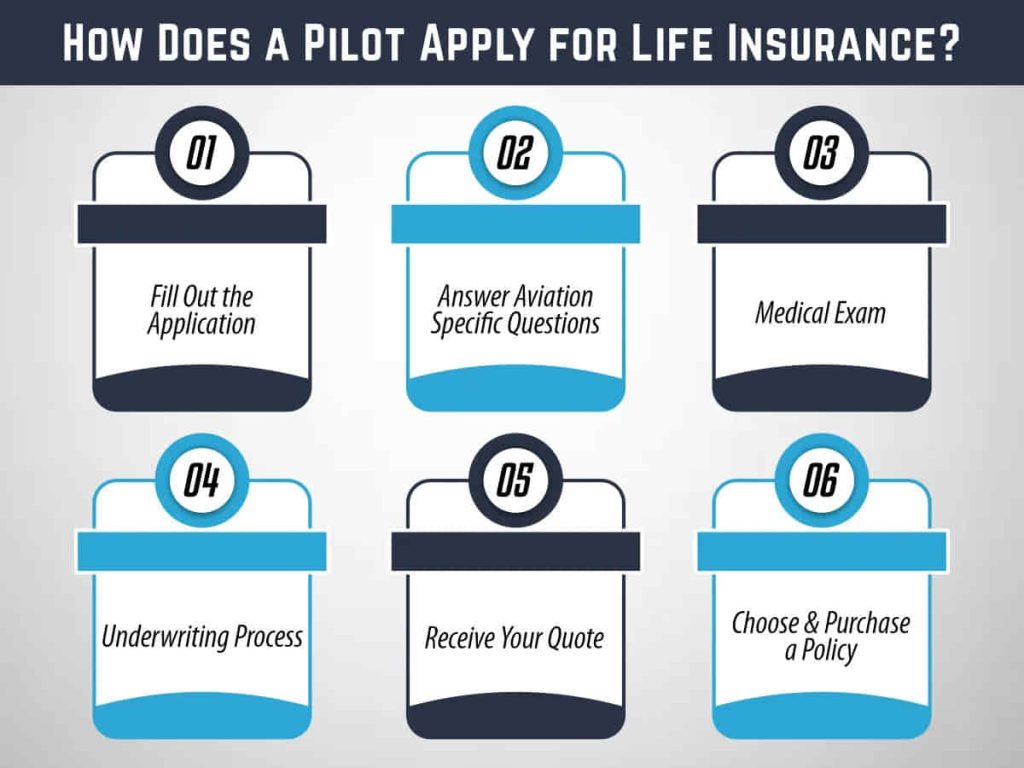

How Does a Pilot Apply for Life Insurance?

A pilot applies for life insurance isn’t much different from the usual process, but there are some extra questions you’ll need to answer. Here’s how it works:

Steps and Considerations:

– Fill Out the Application:

Start with the basic application. Provide your personal information, health history, and lifestyle details.

– Answer Aviation-Specific Questions:

- Do you fly domestically or internationally?

- Have you flown to remote locations?

- How many flight hours do you log each year?

- What’s your total number of flight hours?

- Have you had any aviation accidents or violations?

- What type of license and rating do you have?

- What type of aircraft do you fly?

– Medical Exam:

Expect a medical exam. This is standard for most life insurance applications. When A pilot applies for life insurance They’ll check your overall health and fitness.

How Much Does Life Isurance Cost?

– Underwriting Process:

The insurance company reviews your application. They’ll consider your answers about flying, health, and lifestyle.

– Receive Your Quote:

Based on your risk factors, including your flying habits, you’ll receive a quote. Pilots often face higher premiums due to the perceived risks.

– Choose and Purchase a Policy:

Review your options. Choose a policy that fits your needs and budget.

Tips:

- Be Honest: Fully disclose your flying activities. Any omissions can affect your coverage.

- Compare Rates: Different insurers may offer different rates for pilots. Shop around.

How much does life insurance cost for A pilot applies for life insurance?

The estimated price for A pilot applies for life insurance as an experienced private pilot is between $30 and $35 for a 20-year term life insurance policy with a $500,000 payout for a pilot with solo flight hours of more than 100.

However, the amount of money that you will have to spend on it depends on your qualification together with the number of flights that you usually make, your age, and your health.

How to get life insurance as a private pilot

Private pilot life insurance companies work similarly to life insurance companies for any other profession and avocation. However, there are specific questions related to your flying that you’ll likely need to answer:

Flight Locations: Are you a domestic or an international traveler?

Remote Destinations: Have you traveled, or would like to travel on a plane that goes to some far destination?

Annual Flight Hours: On average, approximately, how many flying hours do you put in in any given year?

Total Flight Hours: You have made several flights; therefore it is only proper that I ask you how many total flight hours you have.

Aviation History: Has anyone had any aviation accidents/aviation violations?

License and Rating: What kind of license and/or rating do you have?

Aircraft Type: Can I know what type of aircraft you usually fly?

The answers you make to these questions will in one way or the other determine the premiums you are going to pay on your life insurance policies. If you have a history of prior accidents, if you fly far away that no insurance company wants to cover, or if you fly a few hours a year that no insurance company will want to cover, then expect higher rates and a harder time in searching for one.

Does the type of pilot matter in underwriting?

While premiums are likely to increase if the applicant for life insurance is a pilot, the type of pilot impacts the insurance premiums differently. The pilot insurance can be rated based on the pilot type and the type of aircraft flying or using the aircraft.

– Commercial pilots

Commercial pilots can get the best rates because their professions are highly structured. The Federal Aviation Administration (FAA) strictly controls the pilot life especially those in the commercial flight business. Starting from the type of aircraft being flown to the number of working hours the pilot can work, the FAA sets certain regulations that make the environment safe for commercial pilots as well as minimize the chances of an accident.

Most insurance companies will ask commercial pilot applicants if they participate in any additional flying, whether as a helicopter pilot, flight instructor, or other variation. This extra practice is common for commercial pilots and likely won’t result in denying a life policy but may increase premiums.

– Private pilots

Private pilots are more likely to experience an accident as most of their operations are not as controlled as those of commercial pilots by the FAA. Though it is higher than commercial pilots, policy rates can vary due to one or more factors, including the type of aircraft being operated, pilot experience, and annual flying hours.

The total flight hours flown per year are an essential component when it comes to underwriting. Too few hours can result in an inexperienced pilot, and too many hours can lead to exhaustion or other adverse conditions. Either end of this spectrum can result in what is referred to as a “flat extra,” which is an additional flat fee added to the base premium policy cost.

– Helicopter pilots

Helicopter pilots are similar to private pilots in that they, too, are under consideration for a flat extra added to their premium. It is important to note that helicopter pilots can expect higher premiums when flying for commercial purposes rather than personal business or pleasure. The reason for using the helicopter also factors in, as the risk for a helicopter pilot flying for a police department is higher than flying for vacation destination tours.

– Student pilots

Although a student pilot is under continual observation by a more tenured instructor, the risk isn’t lowered. An analysis of the Aircraft Owners and Pilots Association (AOPA) statistics reveals that student pilots are slightly more exposed to accidents. This risk gives a bit higher policy premiums than the students who have done their certification to be pilots.

What is an aviation exclusion rider?

To get a better deal, insurance companies may offer you an aviation exclusion rider which means that your coverage does not cover any flying-related death.

That means that if you die flying a plane or doing any flying-related activities such as skydiving or parachuting your beneficiaries will be unable to get a payout.

While it may be dangerous to accept this type of waiver, it is the only way to minimize the amount you pay for premiums whenever you cannot access cheap plans.

FAQs

1- Can you get life insurance as a private pilot?

A private pilot can purchase life insurance. The risks of a private pilot can cause the life insurance premiums to increase, though.

2- Do pilots need special life insurance?

Pilots do not need special life insurance. However, they should consider life insurance, given the inherent risks from their jobs.

3- What kind of insurance do pilots get?

Pilots can often purchase any kind of life insurance. However, the best fit would likely be a term life policy to make insurance premiums more affordable.

References:

https://www.policygenius.com/life-insurance/private-pilots/

https://mlifeinsurance.com/pilot-applies-for-life-insurance/

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.