Are you curious about How does risk affect insurance premiums? Insurers carefully consider the amount of risk they take when you apply for insurance, whether it be for your health, house, or vehicle. This procedure immediately affects your payment amount through an intriguing interaction of assessments, forecasts, and statistics. However, how precisely does the money you see on your bill correspond to this idea of risk? Let’s examine the workings of insurance rates and see how important risk assessment is in determining these expenses.

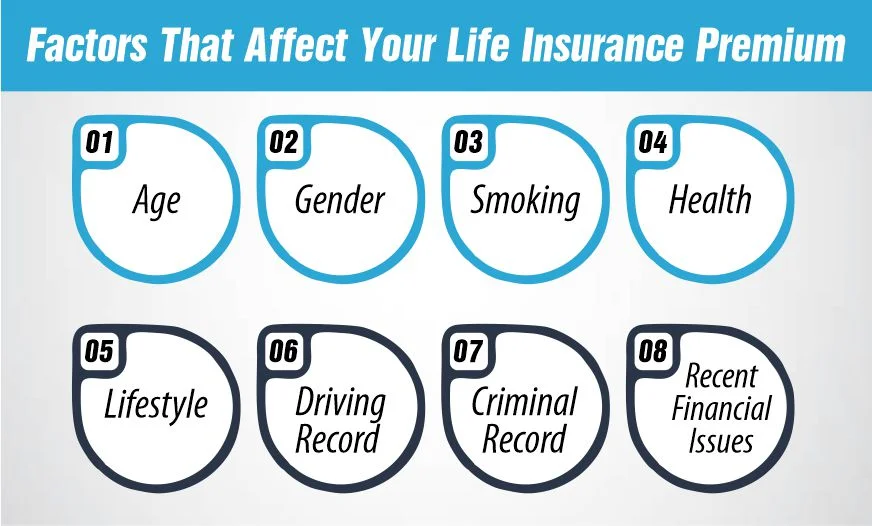

Factors That Affect Your Life Insurance Premium

Factors That Affect Your Life Insurance Premium

Understanding how does risk affect insurance premiums will help you make wise choices, when buying a policy. Here, we’ll clearly explain the major factors that insurance companies take into account when determining your prices.

Age

The main factor affecting life insurance rates is age; younger people usually pay less because there are less health risks involved. The probability of health problems rises with age, which raises premiums. To lock in lower rates, it is more economical to obtain life insurance when you are younger.

Lock in Low Rates Early: Buying life insurance young can secure lower rates.

Rate Increases: Expect premiums to rise as you age.

Gender

Insurers often consider gender because of statistically significant differences in life expectancy between genders. Typically, women may enjoy lower premiums due to their longer average lifespans. This pricing strategy reflects the varying average health trends and longevity between genders.

Women Often Pay Less: Reflecting longer average lifespans.

Gender-Based Pricing: Based on statistical data of life expectancy differences.

Smoking

Smoking is a substantial issue that affects existence coverage rates because of the high health dangers related to tobacco use. Smokers commonly face an awful lot better charges because they are more susceptible to health issues, which include heart sickness, lung cancer, and other severe conditions. If a policyholder quits smoking, they may qualify for lower charges after a specific duration, usually around 12 months of being smoke-free.

Higher Premiums for Smokers: Due to increased risk of severe health conditions.

Reduction After Quitting: Possible lower rates after cessation of smoking.

Health

Overall, health has a profound effect on lifestyle coverage rates. Insurers consider any pre-current medical conditions, like diabetes or hypertension, which could cause better expenses. Conversely, demonstrating proper health via ordinary check-united States and accessible medical records can help lessen premiums.

Impact of Pre-existing Conditions: Conditions like diabetes or heart disease increase premiums.

Benefits of Good Health: Lower premiums for those showing stable and good health.

Lifestyle

Your lifestyle choices can also affect lifestyle insurance coverage charges. High-chance behaviors, such as participating in severe sports or having a dangerous occupation, can result in higher premiums because of the extended risk of harm or demise. Leading a safe, healthful lifestyle can mitigate some of those values.

High-Risk Activities: Activities like skydiving can increase premiums.

Occupational Hazards: Jobs with greater physical risks may lead to higher premiums.

Family Medical History

A circle of relatives records of genetic or hereditary illnesses also can affect your life insurance rates. Conditions such as coronary heart disease, most cancers, and different hereditary fitness problems in your circle of relatives can cause higher premiums as those boost your chance profile.

Genetic Diseases: A history of diseases like cancer can increase premiums.

Disclosure Importance: Accurate reporting of family medical history is essential.

Driving Record

An easy-using report can result in lower lifestyle insurance premiums, while a history of site visitor violations or accidents indicates a better hazard profile, leading to accelerated fees. Maintaining a perfect riding record demonstrates duty and lowers chance.

Traffic Violations and Premiums: More violations lead to higher premiums.

Safe Driving Benefits: A clean record can lower insurance costs.

Criminal Record

A criminal history may also impact the cost of life insurance. Insurers may view people with criminal records as more risky, which could result in higher premiums depending on the type and frequency of the offenses.

Risk Assessment: Criminal activities lead to higher perceived risk.

Severity and Recency: Recent or severe offenses have a greater impact.

Recent Financial Issues

Financial stability is critical; lifestyle insurance companies may additionally consider your financial history when determining rates. Issues such as financial ruin or terrible credit can result in better premiums, as these indicate financial instability.

Credit Health: Poor credit scores can increase premiums.

Impact of Financial Stability: Demonstrating financial stability can lower premiums.

Coverage Length and Amount

The terms of the insurance policy, such as the length of coverage and the amount of the death benefit, directly influence rates. Opting for an extended coverage period or a better insurance quantity normally results in higher rates due to the expanded legal responsibility the insurer undertakes.

Long-Term Coverage Costs More: Longer policies are more expensive.

Higher Amounts at Higher Rates: Larger coverage amounts increase premiums.

Each of these factors plays a crucial role in determining the premiums you will pay for life insurance, affecting both the cost and the coverage you receive. Understanding these elements can help you make more informed decisions about the type and scope of life insurance you choose.

What Is the Age Limit for Life Insurance?

Life insurance is accessible to people of almost any age, but there are some guidelines and limitations you should be aware of:

Starting Point: Generally, you can purchase life insurance for children as young as a few days old.

Upper Limits: The upper age limit for initiating a new policy typically ranges between 65 and 85 years, depending on the insurer.

Considerations for Seniors: While older adults can still acquire life insurance, premiums will be significantly higher, reflecting the increased risk associated with age.

Understanding these age limits can help you plan when and how to buy life insurance, ensuring you get coverage when it’s most advantageous and cost-effective.

How Does Gender Affect Life Insurance Premiums?

Gender plays a subtle but important role in determining life insurance premiums, influenced by statistical differences in lifespan:

Life Expectancy: Historically, because women tend to live longer than men, they often enjoy lower life insurance premiums.

Statistical Data: Insurers use actuarial data to assess risk, which includes gender-specific life expectancy rates.

Changing Trends: Some countries are moving towards gender-neutral insurance policies to balance these differences, so it’s important to understand how policies may vary depending on location.

By recognizing how gender affects life insurance, you can better understand your premiums and what to expect when applying for a policy.

What’s the Best Age To Get Life Insurance?

Deciding when to buy life insurance is crucial for balancing coverage needs with cost efficiency:

Young Adults: Getting life insurance in your 20s or early 30s is often ideal because premiums are lower and health conditions are fewer.

Financial Benefits: Purchasing a policy at a younger age can lock in lower rates and provide long-term financial planning advantages.

Life Milestones: Consider buying life insurance when you reach significant life milestones such as marriage, purchasing a home, or starting a family.

Understanding the best age to get life insurance helps ensure that you’re covered when you need it most while keeping premiums manageable.

How to protect against risk factors that affect insurance premiums:

To protect against the risk factors that affect insurance premiums, consider these straightforward, effective strategies:

- Purchase insurance at a younger age to secure lower rates.

- Update your coverage as you age to maintain relevance and cost-efficiency.

- Shop around to find the best rates available for your demographic.

- Discontinue tobacco use and maintain non-smoking status to reduce premiums significantly.

- Maintain a healthy lifestyle and attend regular health check-ups to manage and improve your health metrics.

- Reduce participation in high-risk activities and consider safety courses to lower rates.

- Engage in preventive health practices and be transparent about your family’s medical history with insurers.

- Keep a clean driving record and consider defensive driving courses to enhance your driver profile and lower premiums.

- Explore legal options to expunge past offenses and demonstrate a potential period of rehabilitation.

- Work on building a better credit score and managing finances more effectively.

- Tailor your insurance coverage to fit your actual needs to avoid overpaying.

By understanding and actively managing these risk factors, you can not only protect against high premiums but also ensure that your insurance coverage aligns closely with your actual needs. This proactive approach can save money and provide peace of mind over the long term.

Bottom lines:

In conclusion, we wrap up how does risk affect insurance premiums. Life insurance is a commonplace financial tool that may offer safety for your family who depend on you. This can come with peace of thought that if you die, your beneficiaries might not face financial hardships. However, lifestyle coverage can also be a massive rate, and it’s now only sometimes best for absolutely everyone.

Familiarize yourself with extraordinary life insurance styles, including time, complete, and variable life insurance. Then, consider consulting with a financial professional to determine which life insurance is right for your situation and dreams and how you can reduce your top-rate fees.

FAQs

How does my fitness affect my lifestyle coverage chance level?

One of the primary elements affecting your lifestyle insurance risk degree is your fitness. Healthier people are considered to be at a reduced risk, which may additionally lead to less expensive insurance. Serious fitness issues or long-term illnesses might enhance your risk profile and raise your charges.

Can I decrease my existence coverage hazard stage by means of quitting smoking or dropping weight?

Yes, insurers see weight loss and smoking cessation favorably, and they could dramatically reduce your danger profile for lifestyle insurance. Over time, these modifications may result in improved health and a likely decrease in your premiums.

Can my credit score rating affect my lifestyle’s coverage hazard stage?

Indeed, as a high credit score shows consistency in finances, it might have a superb impact on your life coverage threat stage. On the other hand, because insurers agree that there may be a greater danger of non-fee or monetary instability, a low credit rating may also result in higher rates.

How frequently must I assess and update my existing insurance policy?

Reviewing and updating your life insurance policy is advised every 3 to 5 years or after a primary life occasion, like getting married, having a kid, or purchasing a property. By doing this, you can be confident that your insurance remains appropriate for your needs and scenario right now.

What happens if I offer inaccurate information on my life insurance software?

Giving fake facts in your application for existence coverage may have serious repercussions, including the coverage being cancelled, claims being denied, or criminal movement being taken. To keep legitimate insurance and prevent problems, continually publish accurate and honest records.

References:

https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/99xx/doc9924/chapter3.7.1.shtml

https://protectyourwealth.ca/understanding-life-insurance-risk-levels-comprehensive-guide/

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

Factors That Affect Your Life Insurance Premium

Factors That Affect Your Life Insurance Premium