Senior Legacy Life Insurance: Secure Family’s Future

Last Updated on: September 5th, 2024

Reviewed by Joyce Espinoza

- Licensed Agent

- - @InsureGuardian

Look at the hundreds of life insurance commercials out there, and senior legacy life insurance is not even an insurance company. Isn’t that crazy?

Senior Legacy Life seems to look like a marketing company that attempts to capture your details to sell them to life insurance salespeople. If you are wondering if Senior Legacy Life is a good company or want prices, you’ve come to the right place. In this article we will go over things to know about senior legacy life insurance and if they are right for you.

Table of Contents

ToggleKey Takeaways

Senior legacy life insurance is designed to help cover final expenses, like funeral costs and debts.

It’s easy to qualify for, usually without needing a medical exam.

The coverage is typically smaller, just enough to handle end-of-life costs.

Premiums are fixed, so the payments stay the same as you get older.

What Is Senior Legacy Life insurance?

Senior legacy life insurance IS NOT an insurance company or an insurance agency.

They appear to be a lead generation website that sells your personal and private information to insurance agents.

How Much Does Life Isurance Cost?

With further research, we stumbled upon their page for professionals. It says that the Senior Legacy Life Brand connects Insurance consumers with insurance IMO (Independent Marketing Organizations) and agents.

Senior Legacy Life appears to be a direct response TV producer specializing in producing television commercials to sell consumer data to Independent Marketing Organizations selling burial insurance products.

Senior Legacy Life clearly states they will sell your information to agents to get them to talk to you for over 20 minutes and to “close” (sell you) life insurance. They indicate that 1 out of every 5 may buy insurance from their TV commercials.

They buy TV inventory to run burial insurance commercials nationally. Consumers who watch their advertisement call their 800 number and are routed to the IMOs that purchase their leads.

Is Senior Legacy Life A Real Company?

Senior Legacy Life runs TV ads and sends the seniors that call various insurance agencies. This means they are selling seniors’ information to insurance agencies who will try to sell you their insurance products.

While there is nothing illegal about this whatsoever, you should know what’s happening behind the scenes. You might get bombarded with many calls from multiple different people and companies.

Is Senior Legacy Life Insurance A Scam?

Many people feel like they have been ripped off because most of them have the impression that they are dealing with a real insurance company only for them to find out that they are with a marketing company who sells their details.

Senior Legacy is not a scam but they are NOT an insurance company and this might make people particularly feel that they have been misled by the company’s advertisements.

DO NOT be fooled into believing that some advertising companies are innocent, they sell our information.

If you’ve been searching for senior legacy life insurance, there’s no shortage of companies offering what they consider the best life insurance for seniors products.

Senior legacy life insurance products

Maybe you’ve seen the TV ad for Senior Legacy Life. They promise up to $30,000 in final expense life insurance with no medical exam, and pre-existing conditions are okay.

Or, maybe you’ve stumbled across Senior Legacy Life Insurance. If you didn’t pay much attention, you’d think these two companies are the same, but you’d be wrong.

So, who are Senior Legacy and Senior Legacy Life and what do they offer? We reviewed and compared both companies to help you decide if one would meet your needs for senior life insurance.

- Senior legacy life funeral insurance is specifically designed for customers who want to cover their costs when they die. This can include but is not limited to casket, funeral arrangements, paying off large bills, or leaving a gift to a loved one.

- Burial Insurance is another word for final expense. These policies take care of all the costs associated with a traditional burial or cremation plan. This plan eliminates the financial burden on your family when you pass.

- Whole Life is a specific type of life insurance. This plan is greatest for those on a fixed income due to its locked-in rates, and benefits that never decrease. This coverage is a very straightforward option for senior citizens.

- Term Life offers higher face values in the upward access of 100,000 or more. These life insurance policies have different provisions that can cause the payments to increase after a certain amount of years. However, the coverage with these policies is significantly higher than Whole Life.

- Mortgage Protection offers security to new homeowners or those who have purchased real estate. If the insured dies, this plan will pay for the remaining balance on the mortgage in monthly installments or one lump sum.

- Paid Up Insurance offers a higher payment than a typical life insurance policy, after a set amount of years determined in the policy, the customer is no longer required to make policy payments. This option is best for clients looking to plan for the future.

- Level Benefit ensures day-one coverage if you qualify. That means if you pass away a month later after the policy is in force, the life insurance company pays out 100% of the face value. Sounds like a great deal!

- Graded Benefit is still a great option, the benefits are graded with 30% in the first year and 70% in the second. After the full second year, the insurance company gives you the full face amount.

- Modified Benefit These plans are for candidates who the insurance company finds to be more of a risk. During the first two years of this plan, clients are offered benefits, but only with a return of premium for the first 24 months.

- Guaranteed Acceptance offers coverage without answering health questions. Regardless of any type of preexisting conditions, medications, etc. This guaranteed issue policy will require higher premiums and a two-year waiting period.

Senior Legacy Life Insurance Costs

Are you ready to find out how much life insurance costs with Senior Legacy or Senior Legacy Life?

Unfortunately, you won’t be able to find out online. You’ll have to call Senior Legacy Life because there’s no other option on their website.

Senior Legacy offers an online quote option, but once you submit your information, you’ll receive a confirmation screen thanking you for requesting a free quote, and a certified team member will respond within 48 hours.

What Happens When You Submit Your Information On The Senior Legacy Life Website?

Senior legacy life insurance claims that your phone number and other contact information will be sold to insurance companies or agents.

Such companies particularly sell your personal information to first-line insurance salespersons who independently call you on a daily basis trying to sell you a life insurance policy.

The best way to get help is through a known company such as Burial Senior Insurance not through Senior Legacy Life which is just a lead generator.

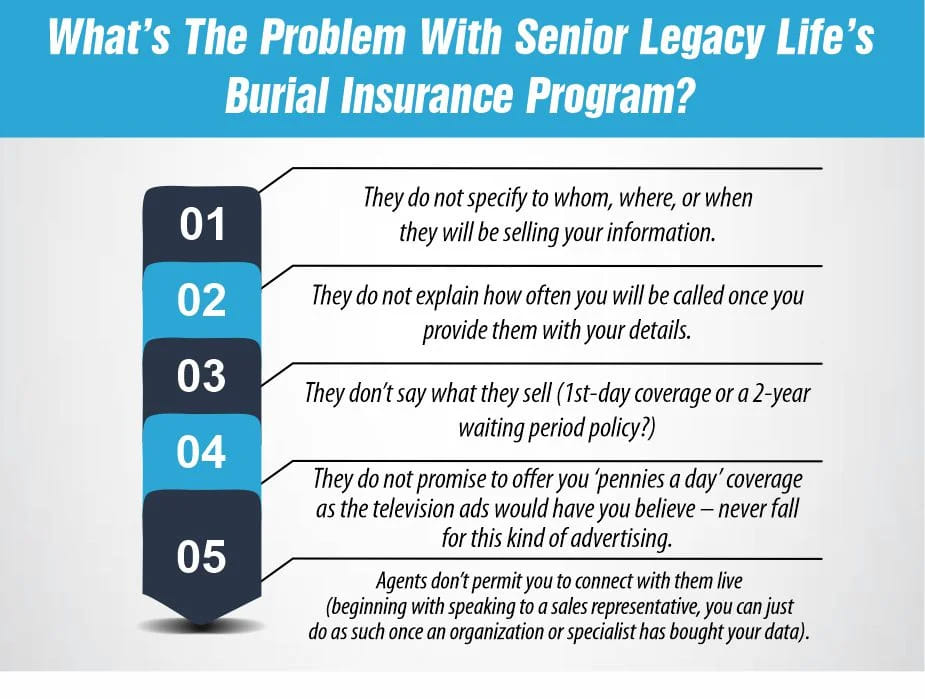

What’s The Problem With Senior Legacy Life’s Burial Insurance Program?

- They do not specify to whom, where, or when they will be selling your information.

- They do not explain how often you will be called once you provide them with your details.

- They don’t say what they sell (1st-day coverage or a 2-year waiting period policy?)

- They do not promise to offer you ‘pennies a day’ coverage as the television ads would have you believe – never fall for this kind of advertising.

- Agents don’t permit you to connect with them live (beginning with speaking to a sales representative, you can just do as such once an organization or specialist has bought your data).

Is Senior legacy life insurance Right For Me?

Unfortunately, it is really impossible to know 100% as they forward your information to other insurance companies and we are not sure which companies those may be. Sometimes you may get an experienced agent who will help you agree on what you want or at other times you will only find high-priced waiting period plans being offered to you.

The reasons that we do not recommend senior legacy life insurance are simply because you and we do not know who will be contacted, where your information is going, and whether you are getting the best deal in your state or not.

If you wish to quickly get a side-by-side comparison of all the best life insurance agencies for seniors, then simply use the quote form. Get a free consultation and no permission will be given to anyone to access your details. It doesn’t matter to us which company you choose, as long as the cost of the funeral is reasonable and your loved ones are protected. We hope you received value from senior legacy life insurance reviews and look forward to speaking with you!

FAQs

1- How does a legacy plan work?

What Is Legacy Planning? Legacy planning is a financial strategy that prepares people to bequeath their assets to a loved one or next of kin after death. These affairs are usually planned and organized by a financial advisor.

2- What are the Benefits of Senior Legacy Life?

Wealth distribution with Senior Legacy Life is very advantageous for various reasons.

- Avoid Creditors

- Avoid Probate Fees

- Protect Savings From Inflation

- Eliminate Taxes on Inheritance

- Avoid Estate Tax Liabilities & Expenses

References:

Expert Life Insurance Agent and health insurance agent

Dylan is your go-to guy for life and health insurance at InsureGuardian. He’s helped over 2,500 clients just like you figure out the best insurance plans for their needs. Before joining us, Dylan was sharing his expertise on TV with Global News and making a difference with various charities focused on health. He’s not just about selling insurance; he’s passionate about making sure you’re covered for whatever life throws your way.